10,000-Word Analysis: 7 Truths About 100 Top AI Startups

AI Startup Evolution: Lessons from the Leonis AI 100

> Special thanks to Special Agent Universe’s strategic advisor for the recommendation.

---

Overview: A Three-Year Sprint Through an Entire Market Cycle

The last three years in AI have been as transformative as three decades of traditional tech progress.

Timeline Highlights:

- Nov 2022: ChatGPT launches, igniting a wave of innovation.

- Early 2023: Thousands of AI projects emerge, but monetization lags. Skepticism rises.

- 2024: Model capabilities leap forward; paying customers arrive.

- 2025: AI products enter complex verticals (healthcare, law, finance), where compliance and workflow integration raise barriers but also strengthen competitive moats.

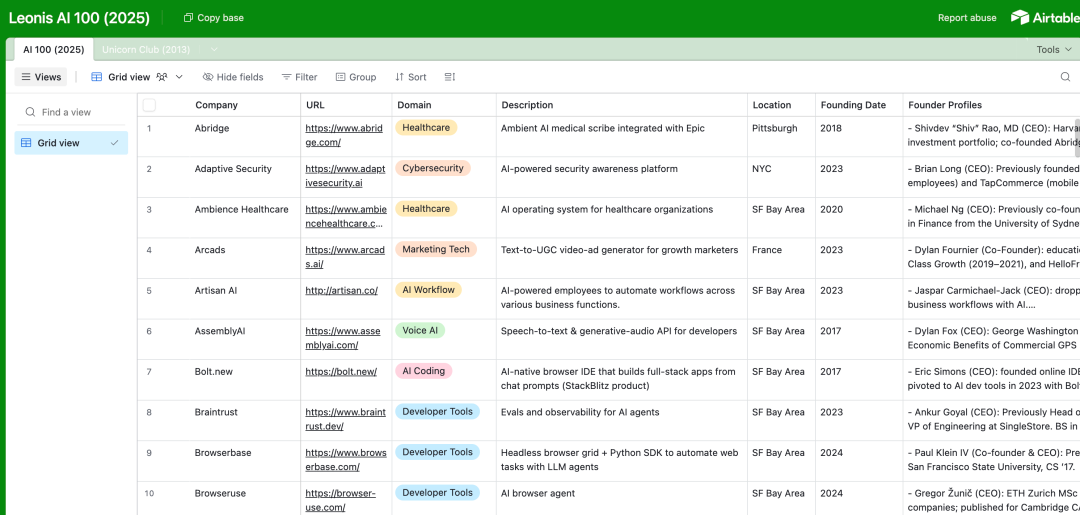

The Leonis Capital team — a VC fund founded in China in 2021 — analyzed over 10,000 startups and selected the 100 fastest-growing AI companies based on signals such as fundraising, hiring, user adoption, GitHub trends, media coverage, ProductHunt entries, and estimated ARR.

📎 Company Directory: Leonis AI 100 Airtable

---

Seven Key Insights from the Leonis AI 100

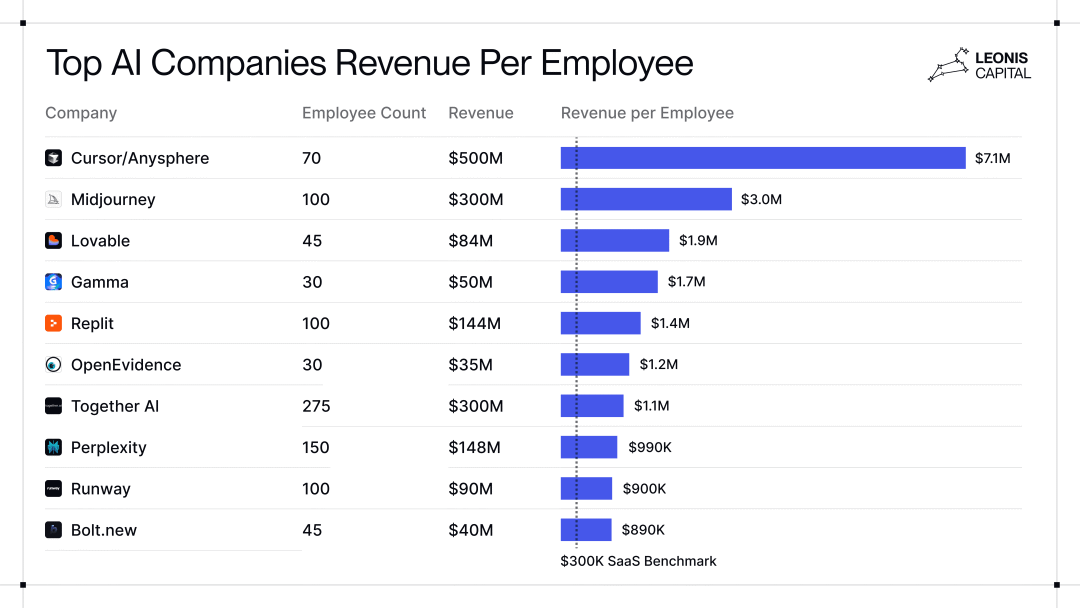

1. Smaller, Flatter Teams Deliver Massive Output

Core Observation:

AI startups achieve exceptional per-employee revenue compared to pre-IPO SaaS firms — in some cases 3–10× higher.

Examples:

- Midjourney: ~$200M ARR with 40 employees (~$5M per person).

- Lovable: ~$100M ARR with 45 employees (~$2.2M per person).

Why this works:

- Heavy use of AI for internal processes — product dev, sales outreach, customer support.

- Fewer organizational layers, more direct engagement between technical teams and customers.

- Capital allocated to compute and data rather than large teams.

- Products are highly standardized, reducing client-specific engineering costs.

Parallel Trend:

Platforms like AiToEarn官网 allow creators and small teams to publish and monetize AI-generated content widely without expanding headcount — mirroring the leverage AI startups enjoy.

---

2. Product-Led Growth Comes First, Sales Later

Pattern:

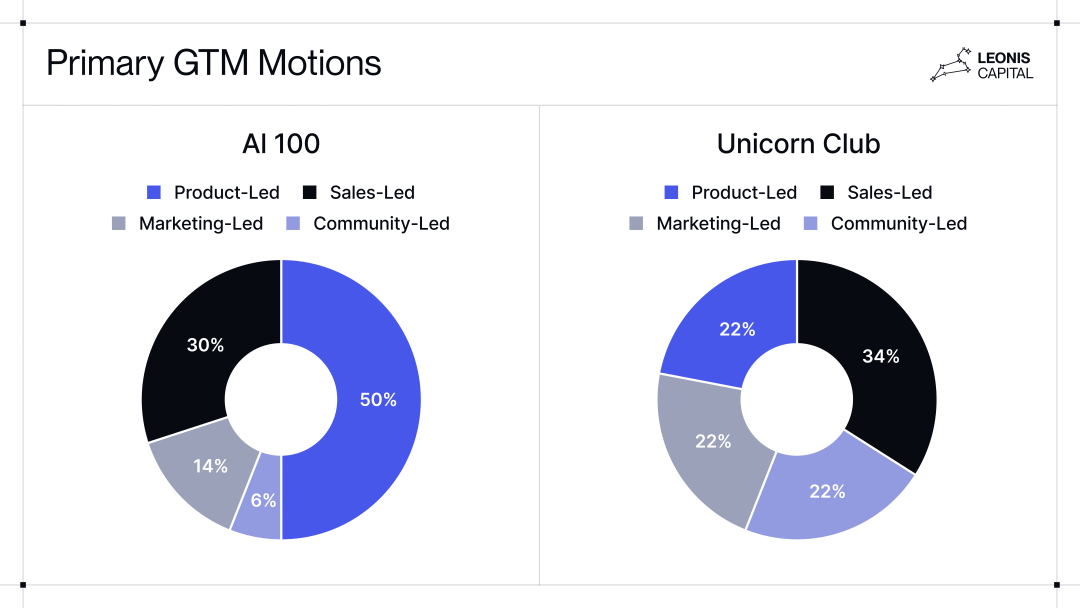

Over 80% of AI Top 100 companies start with self-service sign-up before building formal sales teams.

For horizontal products:

- Individual developers adopt tools (e.g., Cursor).

- Internal team usage grows organically.

- Sales team formalizes procurement and pricing after adoption.

For vertical products (e.g., healthcare, legal):

- Enterprise sales is necessary from day one due to compliance and integration requirements.

---

3. Multiple Winners Instead of "Winner-Takes-All"

Why:

- AI use cases are broad, enabling niche market specializations.

- Low lock-in; users mix and match tools across providers.

Examples:

- Programming: Replit, Cursor, Cognition Labs.

- Image Gen: Stability AI, Midjourney, Krea, OpenArt.

- Video Gen: Synthesia, HeyGen.

- Voice: ElevenLabs, Cartesia, Deepgram.

- Healthcare: Abridge, Freed AI.

Note: Signs of consolidation are emerging (e.g., Cursor outpacing rivals).

---

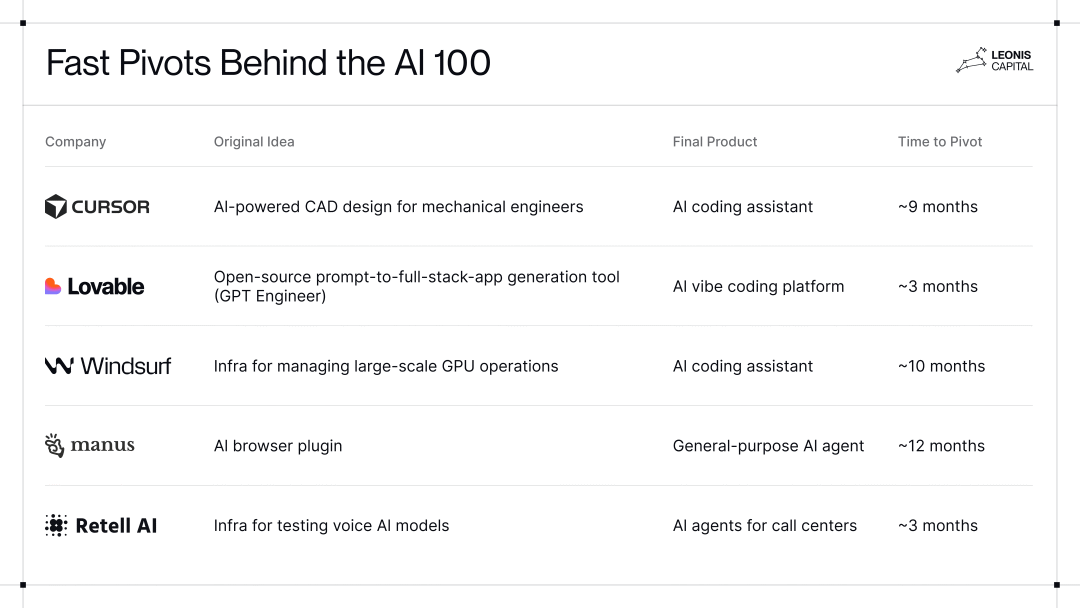

4. Rapid Pivots Are the New Norm

Key Stat:

66% of AI Top 100 companies pivoted at least once — faster than the SaaS-era Unicorn Club (54% pivot rate).

Drivers:

- Tracking foundation model advancements in real time.

- Shared infrastructure makes product reconfiguration faster and cheaper.

- Technical talent is highly transferable across domains.

Case Examples:

- Manus: From browser extension to general-purpose AI Agent.

- Cursor: From AI CAD software to programming assistant.

- Windsurf: From GPU management infra to AI programming tools.

---

5. Market Breakouts Happen in Sequence

Pattern:

- Writing & programming →

- Creative media (images, video, audio) →

- Vertical domains (healthcare, law, finance).

Trigger:

- Performance thresholds in foundational models (e.g., Claude 3.5 boosting code reliability → rise of Vibe Coding startups).

Founder Tip:

Perfect execution too early fails; enter near capability turning points for optimal growth.

---

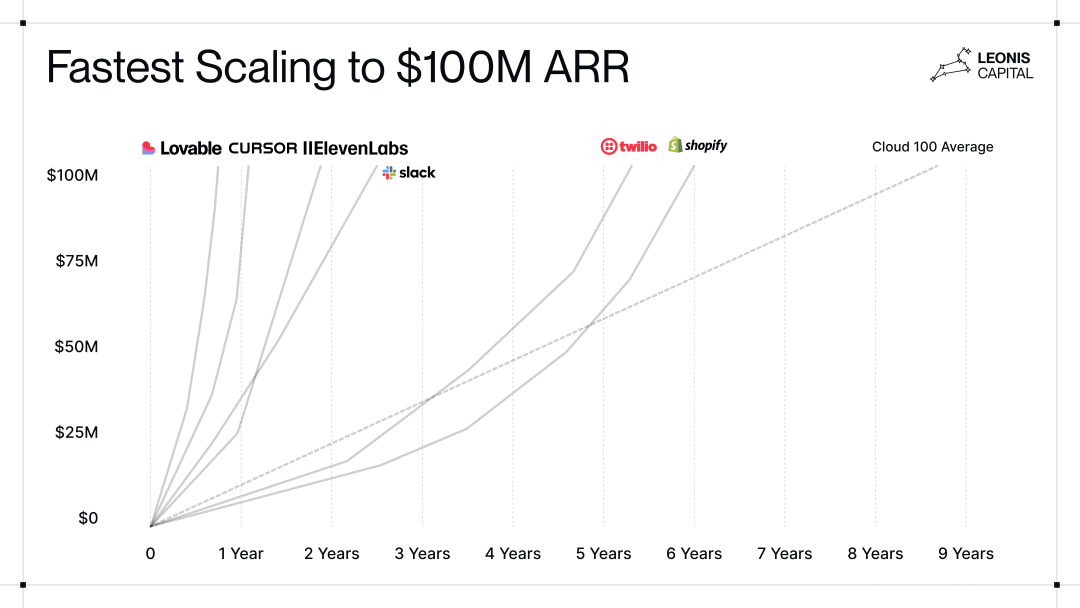

6. Revenue Surge After 2024

Shift:

Late 2024 saw an abrupt jump in revenues across AI startups:

- Cursor: $100M ARR in 12 months.

- ElevenLabs: $100M ARR in 22 months.

Drivers:

- AI replaces skilled labor, creating urgent value.

- Fast conversion to paid usage.

Cautions:

- Many companies have low gross margins due to high compute costs.

- "Vibe Revenue" (ARR from letters of intent or one-off deals) can inflate numbers.

- Sustainability requires strong NRR and retention.

---

7. Rise of Research-Driven Founders

Data:

- 82% of AI Top 100 CEOs have technical backgrounds.

- Median founder age: 29 (vs SaaS median of 34).

Advantages:

- Intimate understanding of model capabilities and limitations.

- Ability to predict tech breakthroughs.

- Technical credibility attracts talent, investors, and technical buyers.

---

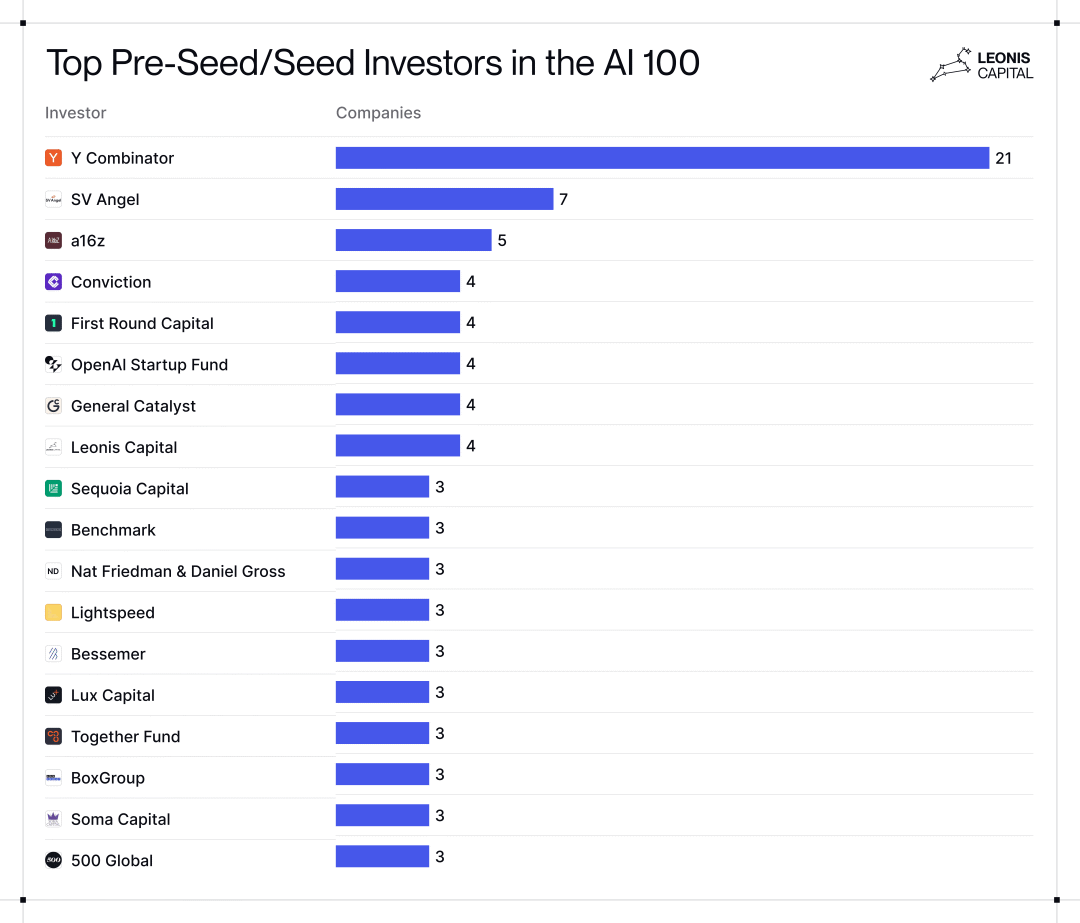

Funding Landscape Highlights

Early Stage:

- YC leads (21 companies backed).

- a16z, Sequoia Capital moving earlier into seed deals.

- Angel networks (SV Angel) and AI-native funds (Conviction, Nat Friedman/Daniel Gross) rising.

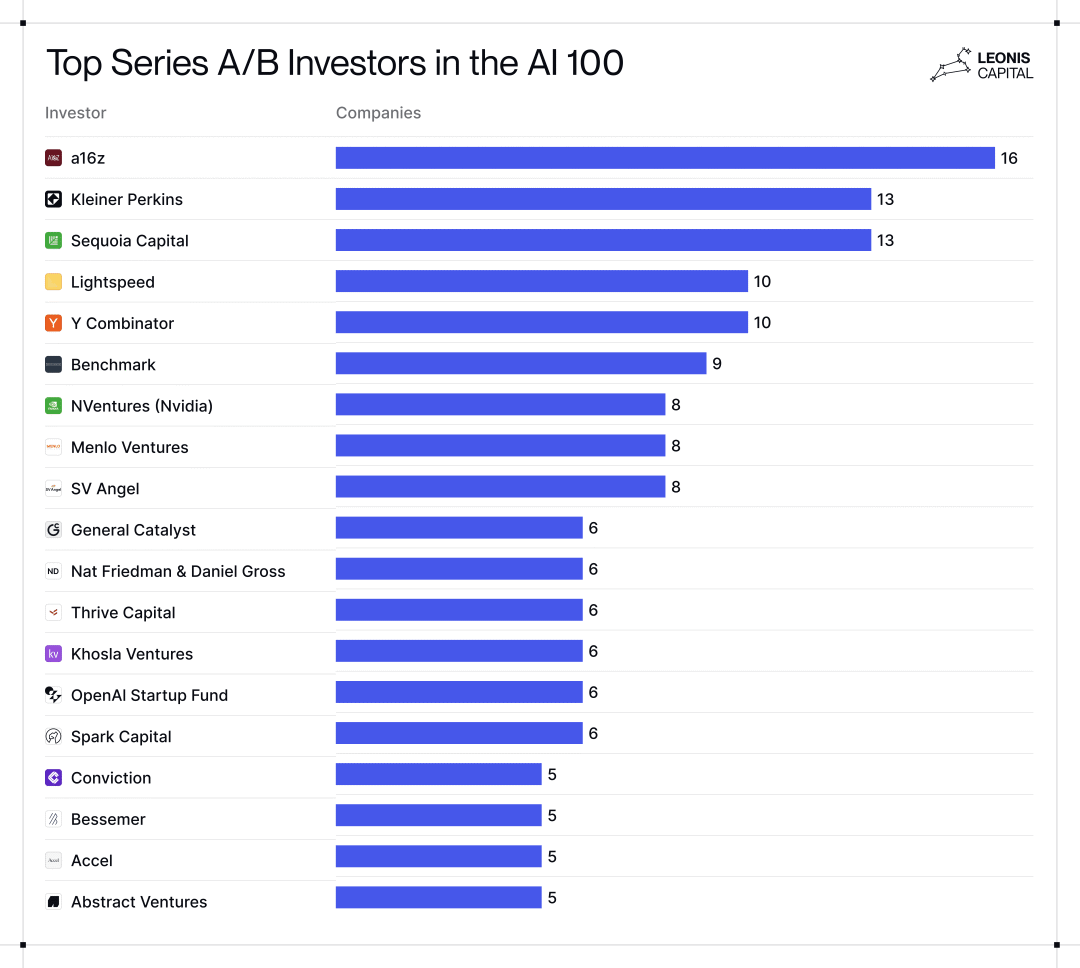

Series A & B:

- Dominated by a16z, Kleiner Perkins, Sequoia, Lightspeed, Benchmark, Menlo Ventures.

- Strategic investors like NVIDIA (NVentures) and OpenAI Startup Fund target infra and application-layer winners.

---

Key Takeaways

- Lean, tech-heavy teams achieve massive output.

- PLG-first strategies dominate early-stage user acquisition.

- AI markets currently support multiple winners.

- Rapid pivots are common and often model-driven.

- Market entry timing depends on model capability thresholds.

- Revenue acceleration post-2024 confirms customer willingness to pay — but gross margins matter.

- Technical and research-driven founders are shaping the AI startup landscape.

---

Tip for Creators & Founders:

Leverage open-source ecosystems like AiToEarn官网 to scale production, distribution, and monetization efficiently across platforms — from Douyin and Bilibili to YouTube and X (Twitter). Integrated AI generation, publishing, analytics, and model rankings can help capture market opportunities fast, especially near turning points in model capability.

---

Would you like me to also prepare a visual one-page executive summary from this rewritten content, with charts and bullet highlights? That would make it ideal for investors or founder pitch decks.