Agent Business Agreements and Building AI Economic Infrastructure: Interview with Stripe’s Head of Data and AI, Emily Glassberg Sands

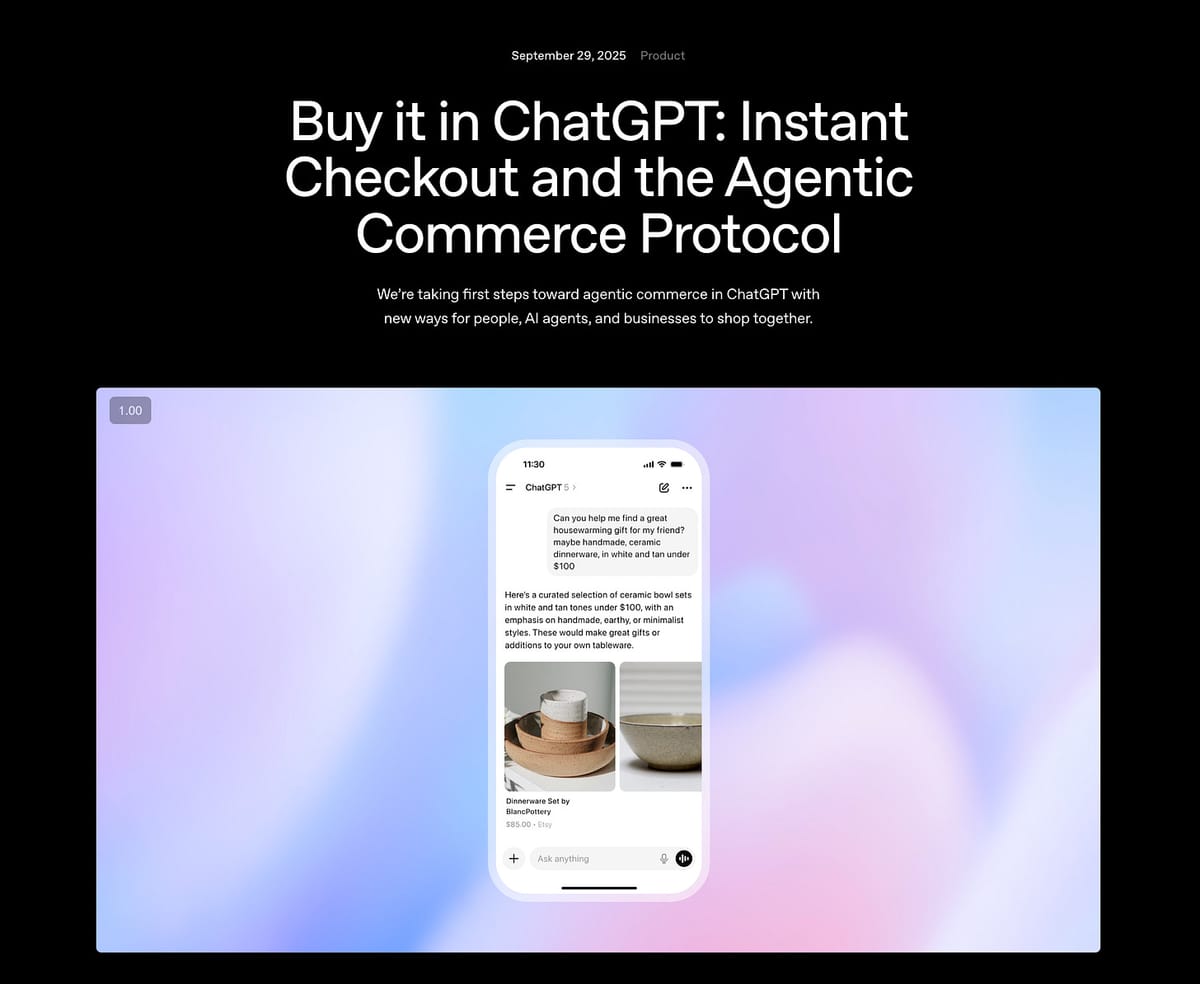

Game-Changing AI Commerce: OpenAI & Stripe Collaboration

One of the most impactful announcements this month is the partnership between OpenAI and Stripe to bring Instant Checkout to ChatGPT:

There have been various attempts to monetize agents — including x402 protocols over MCP — but the entry of two leaders in AI and payments is significant and worth close attention.

Emily Glassberg Sands, Stripe’s Head of Data & AI, shared insights on Stripe’s mission to build economic infrastructure for AI, explaining their internal AI usage and competitive edge for the next growth phase.

---

Inside ACP: Stripe’s Agent Payment Specification

The Agentic Commerce Protocol (ACP) — jointly developed by Stripe and OpenAI — powers ChatGPT Commerce and enables AI agents to discover and purchase from merchant catalogs across ecosystems.

Core Components

- Unified Discovery Layer — Catalog format to browse merchant offerings across platforms.

- Standardized Payment Interface — API flows for initiating and completing purchases in conversational contexts.

- Secure Credential Exchange — Verifies identity and payment authenticity for transactions.

- Event & State Management — Synchronizes transaction records for order management, refunds, and follow-ups.

---

AI-Native Commerce Infrastructure

This new protocol could redefine AI-driven economies — from conversational shopping to cross-platform service aggregation.

For creators exploring monetization, AiToEarn offers an open-source global platform to:

- Monetize AI-generated content.

- Connect AI tools with multi-platform publishing.

- Gain analytics and AI model rankings.

Supported platforms include Douyin, Kwai, WeChat, Bilibili, Rednote (Xiaohongshu), Facebook, Instagram, LinkedIn, Threads, YouTube, Pinterest, and X (Twitter).

---

ACP Technical Details

Catalog Schema

Includes:

- Products

- Inventory

- Pricing

- Brand constraints

Shared Payment Token (SPT)

- Scoped to business, time-limited, capped, revocable.

- No exposure of underlying credentials to agents.

- Compatible with agentic tokens from card networks like Mastercard.

- Carries Radar risk signals for fraud detection.

Integration Note: ACP works with Stripe Link (200M+ consumers) serving as wallet credentials.

---

Foundation Models for Payments

> Stripe’s machine learning for fraud detection has shifted from task-specific to transformer-based domain foundation models.

Key outcomes:

- Treat each charge as a token and behavior sequences as the context window.

- Embed payments to power multiple downstream tasks.

- Ingest tens of billions of transactions with rich features (IPs, BINs, geo, device, merchant traits).

- Focus models on “last-K” relevant events to detect patterns like card-testing.

Detection Improvements: Large merchant card-testing detection rates rose from 59% → 97%, with millisecond latency.

---

Token Billing vs Outcome Pricing

Static plans fail when model capabilities change quickly. Token Billing adapts pricing dynamically by calculating actual model token usage.

effective_price_per_unit = base_margin + (model_tokens_used * provider_unit_cost) + overheadOutcome-based Pricing Example:

Intercom charges $1 per solved support ticket (details).

---

Stripe’s Internal AI Stack

- Toolshed (MCP server) — Unified access to Slack, Drive, Git, Hubble (data catalog), query engines.

- Text-to-SQL Assistants — Both Sigma Assistant (external) and “Hubert” (internal).

- Semantic Events + Real-time Canonicals — Near-real-time feeds for dashboards, Sigma, data exports.

- Engineer Adoption — 8,500 daily users, 65–70% with AI coding assistants.

- AI-Assisted Integrations — Pan-EU payment method integration time cut from ~2 months to ~2 weeks.

---

AI Economy Insights from Stripe’s Data

- Velocity — Top 100 AI companies reach ARR milestones 2–3× faster than comparable SaaS.

- Global First — Serve 2× more countries early; median 55 countries year one.

- Retention — Slightly lower than SaaS but competitive switching common.

- Tiny Teams — High revenue per employee.

- Growth — 7× faster than S&P 500 last year.

---

Full Podcast & Resources

- 🎥 Watch on YouTube.

Timestamps:

- 00:00 — Intro & Emily’s Role

- 00:09 — AI Business Models & Fraud

- 00:16 — Token Billing & Stablecoins

- 00:23 — ACP Launch

- 00:29 — Good vs Bad Bots

- 00:40 — Designing ACP

- 00:49 — AI Adoption at Stripe

- 01:04 — Data Discovery Challenges

- 01:21 — AI Economy: Bubble or Boom?

Show Notes:

---

Key Takeaways

- ACP creates a shared, secure protocol for agent-driven commerce.

- Foundation models boost fraud detection from 59% to 97% accuracy with payment embeddings.

- Token Billing and Outcome-based Pricing align costs with actual AI model value.

- Stripe’s Internal AI Stack enables widespread adoption of AI for integrations, analytics, and operations.

- AiToEarn mirrors these principles in multi-platform AI content monetization for the creator economy.

---

Would you like me to prepare a 1-page executive summary capturing the key strategic insights for startups entering AI commerce?