AI Bubble or Infrastructure Boom? A Deep Dive from Wall Street and Silicon Valley

Silicon Valley 101 – Live Debrief

Topic: Trillion-Dollar Infrastructure – Market Opportunity or AI Bubble?

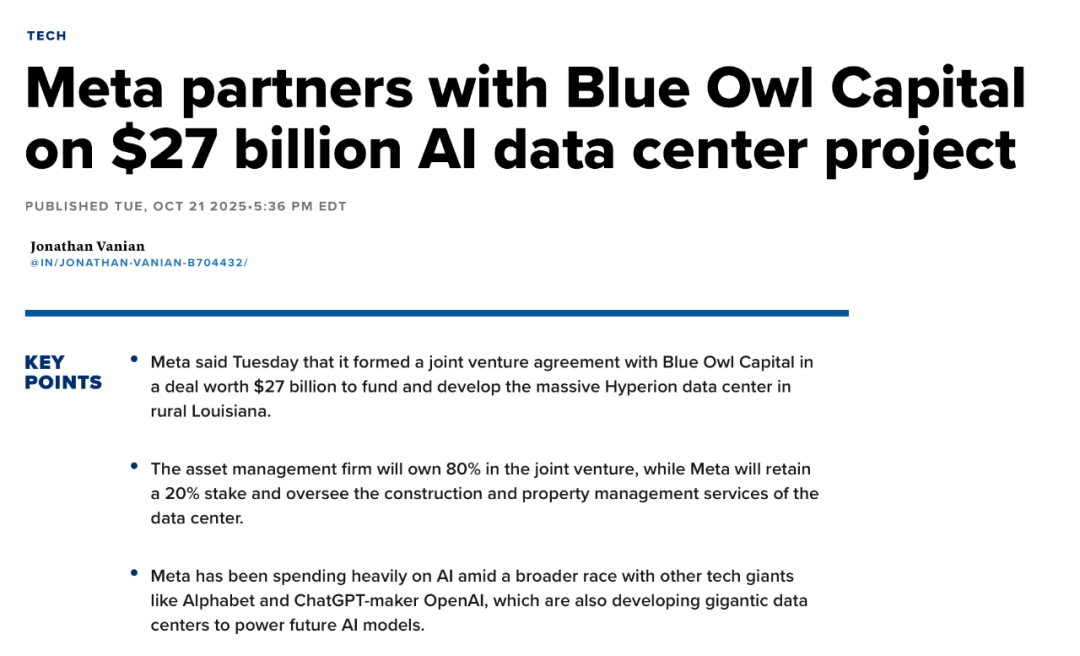

In 2025, the tech market is once again in overdrive. Giants like NVIDIA, Microsoft, Google, and Meta are pumping unprecedented Capex into AI infrastructure. Datacenters have become the new global "arms race."

At the same time, OpenAI’s trillion-scale compute plan seeks to unite global capital to build the largest AI cluster in history — sparking debates on the “AI debt cycle” and whether an AI bubble is forming.

Historically, our coverage leaned toward deep-dive video content. But production cycles couldn’t match breaking trends. Now, we’re experimenting with live broadcasts, inviting voices from technology and finance to rapidly analyze the hottest topics.

---

Live Session Recap

Date: November 15

Theme: Trillion-Dollar Infrastructure Market or AI Bubble?

Duration: 1.5 hours

Format: Live discussion with guest experts, high audience engagement

This article: Key distilled points from the session

---

Live Highlights

- Market Correction Is Healthy:

- Recent tech stock sell-offs stem from uncertain Fed rate cut expectations and saturated hedge fund positions. Healthy valuation pullback.

- AI Debt Cycle ≠ Bubble:

- The NVIDIA–OpenAI–Oracle cycle is less about speculative excess, more about mutual resource binding — securing scarce compute + ecosystem lock-ins.

- Capital Still Flows Freely:

- True internal cycles only occur when external funding dries up. Bond market appetite for AI remains strong, undermining bubble claims.

- GPU Depreciation Extension:

- Extending GPU lifespans from 4 to 6 years is strategic — redeploying older chips to inference and less latency-sensitive workloads.

- GDP “Hijack” Debate:

- AI-driven GDP growth is not inherently bad — what matters most is whether it converts to long-term productivity gains.

- AI vs. Shale Oil Analogy:

- Both cycles involve high Capex, reliance on debt, and high risk. AI is still in early build-out phase; a future correction could spark efficiency gains.

---

🎙️ Guest Panel

- Ethan Xu — Ex-Microsoft Energy Strategy Manager, Ex-Breakthrough Energy Research Director

- Bruce Liu — CEO & CIO, Esoterica Capital

- Yang Ren — Co-Founder, Esoterica Capital

- Rob Li — Managing Partner, Amont Partners (NY)

- Chen Qian — Host, Silicon Valley 101

---

01 — Is There Really an AI Bubble?

Short-Term Market Signals

- Rob Li: Fed "cold water" on Dec rate cuts dampened sentiment; hedge funds fully loaded; lacking fresh inflows.

- Bruce Liu: Valuation cooled from QQQ 28x → 26x earnings; tightening cost of capital triggered sell-offs in tech, Bitcoin, gold. Healthy adjustment.

---

Michael Burry’s Warning

- Rob Li: Burry closed funds before — not a red flag. Shorting Palantir with modest $10M puts. Impact mostly psychological.

---

Bearish Narrative Drivers

Demand side:

- OpenAI CFO flagged drop in ChatGPT DAUs due to tuning changes — still unverified.

- Doubts on ARR claims due to deep discounts and long free trials; true renewals may reveal lower enterprise willingness to pay.

Capital side:

- Hyperscalers spending own cash = low systemic risk.

- Smaller clouds (CoreWeave, Nebius) borrowing heavily. If major providers join the debt load, systemic risks could emerge — parallels to 2008 housing crash.

---

02 — The GPU Depreciation Myth

Criticism: Michael Burry says depreciation extensions “inflate” profits. Giants like Microsoft, Google, Amazon moved server/GPU lifespans from 4 → ~6 years.

Rob Li:

- Depreciation schedules are strategic levers; extending lifespan enhances accounting profit.

- Scarcity keeps even older GPUs useful; future efficiency gains may change TOC calculus.

Ethan Xu:

- Tiered utilization — top-tier GPUs for training, older for inference.

- Some 7-year-old TPUs still run at full load. Hopper prices remain stable despite Blackwell rollout.

- Major CSPs say: “If we had more capacity, revenue would be higher.”

---

03 — "AI Capital Inner Circulation"

Example: NVIDIA → GPUs to OpenAI → compute from Oracle → Oracle orders GPUs from NVIDIA. AMD offers equity to join.

Yang Ren:

- It’s ecosystem binding, not pure bubble inflation.

- Analogy: landlord invests in restaurant, restaurant rents landlord’s space, both win if customers show.

Bruce Liu:

- Test: can they raise external capital? Yes.

- “Inner cycle” only real when external funding stops — not the case today.

---

04 — Has AI “Hijacked” U.S. GDP?

Rob Li:

- AI-led GDP growth is not bad; tech has driven U.S. growth for decades.

- Critical: determine if AI-driven productivity gains will be sustained, or just short-term Capex boost.

Bruce Liu:

- Consumer spending still strong (~1% GDP contribution in H1 2025) alongside corporate investment (~1%).

- Non-AI cyclical sectors remain weak — ideal scenario is AI growth + cyclical recovery.

- Today mirrors early dot-com acceleration — growth potential huge.

---

05 — AI Infrastructure’s “Shale Oil” Moment

Bruce Liu:

- Macro backdrop favors AI as a growth engine at the top of debt cycles.

- Funding sources:

- Hyperscaler cash flow

- Public bonds

- Private credit ("shadow banking")

- Shale oil analogy: industry survived price shocks and improved efficiency; AI will need to prove monetization viability.

- OpenAI’s $1.4T plan signals a “compute arms race,” aiming for model-layer pricing power.

---

06 — Will the AI Bubble Burst?

Bruce Liu:

- Still in early, rational build-out phase.

- Historical mission in macro cycle; inevitable future “efficiency bubble” could optimize processes.

- For individuals: hedge against cash devaluation via growth-oriented assets.

Ethan Xu:

- Optimistic: current trillions in AI infra spend will prove necessary.

- Mismatches in timing between investment and returns could cause market jitters, but not a fatal bubble.

---

Closing Perspective

The session underscored AI’s dual face — a sector of vast promise paired with market volatility. Healthy corrections cleanse excess, while strategic infrastructure spend lays long-term foundation.

Whether for hyperscaler Capex or creator content monetization, the emerging theme is ecosystem integration and efficiency — aligning resources, technology, and output across platforms.

---

💡 Related Resource: AiToEarn官网 — Open-source AI content monetization and publishing ecosystem.

Enables creators to:

- Generate AI-driven content

- Publish across Douyin, Kwai, WeChat, Bilibili, Rednote, Facebook, Instagram, LinkedIn, Threads, YouTube, Pinterest, X (Twitter)

- Track analytics and AI模型排名 for optimization

---

Would you like me to also produce a visual summary infographic from this text so you can share it alongside the Markdown? That could condense these 6 sections into a reader-friendly one-pager.