AI Glasses: An Opportunity for Tech Giants or Emerging Startups?

AI Glasses: Opportunities for Startups in Niche and Vertical Markets

Market Overview

In late November 2025, Alibaba launched two series of Quark AI Glasses — S1 and G1 — covering six models. Within two days, sales exceeded 7,000 units, topping charts on JD.com, Taobao, and Douyin.

By 2025, over 40 AI glasses models have been launched by both startups and tech giants, with the release pace accelerating in the second half of the year. Major players such as Baidu, Xiaomi, and Alibaba entered aggressively, competing with startups for market share.

---

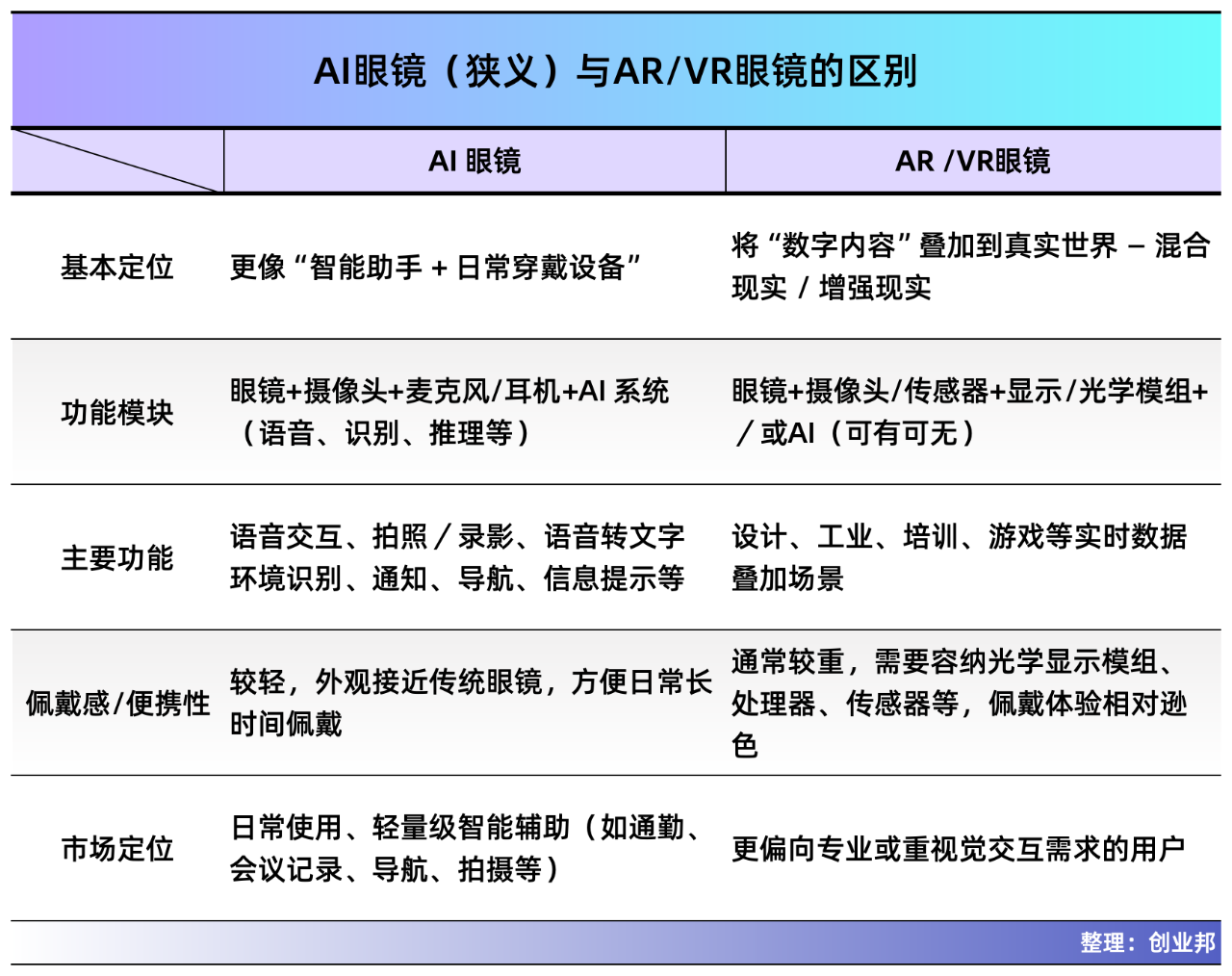

Two Main Technology Paths

AI glasses currently follow two distinct development routes:

- Lightweight, voice-driven functionality

- Features: photography, translation, voice interaction

- Favored by large corporations

- Easier to implement given mature AI models

- Avoids AR/VR display complexity, comfort issues, and high costs

- AR/VR displays

- Augmented reality overlays onto the real world

- Fully immersive virtual experiences

- Higher technical and manufacturing complexity

---

Why Big Tech Is Interested

Large companies, including Meta in collaboration with Ray-Ban, see AI glasses as the “next-generation personal mobile interface” — an extension of human vision and hearing.

Sales examples:

- Xiaomi: 200,000 orders since launch

- Price range: RMB 2,000–4,000

- Xiaomi: RMB 1,999 (entry model)

- Quark flagship: RMB 3,799

While giants explore broad consumer markets, industry insiders believe startups should focus on niche scenarios with defensible moats.

---

Lessons from Meta’s Success

Meta’s partnership with EssilorLuxottica began in 2019. They intentionally avoided expensive displays:

- Features: first-person photography, audio interaction

- Weight: under 50 g — similar to regular eyewear

- Goal solved: high “willingness to wear” factor

Product timeline:

- 2021: Ray-Ban Stories — cameras, microphones, speakers for photo/video/audio control

- 2023: Meta Smart Glasses — improved camera/microphone quality, longer recording, integrated Meta AI assistant

- 2025: Meta Ray-Ban Display — built-in display for messaging, video calls, interactive functions

By early 2025, total sales exceeded 2 million units.

---

Chinese Players Join the Race

2025 launches:

- April — Huawei AI Glasses 2 Titanium Round Frame

- June — Xiaomi AI Glasses

- November — Alibaba Quark AI Glasses

- November — Baidu’s Xiaodu AI Glasses

Startups like Rokid, originally AR/VR-focused, now leverage AI model advances to create compact devices resembling regular eyewear, weighing 39–50 g with hidden electronics.

---

Startup Opportunities in Vertical Markets

Potential niche application areas:

- Industrial operations

- Medical assistance

- Language learning

- Tourism

Dynamic interaction between AI glasses hardware and AI-assisted content ecosystems offers monetization potential. Platforms such as AiToEarn官网 enable AI content generation, publishing, and monetization across multiple platforms (Douyin, WeChat, Instagram, YouTube, X, etc.).

---

Technical Foundations

Control chips:

- Huawei: domestic “Wuqing” chip

- Others: Qualcomm AR1 for AI processing

- Xiaomi & Alibaba: dual-chip (Qualcomm AR1 + “Hengxuan” for audio)

AI software integrations:

- Huawei: Pangu large model

- Quark: Tongyi Qianwen model + Qianwen APP

- Xiaodu: domestic large model + “Super Xiaodu” assistant

- Xiaomi: in-house large AI model

- Startups like Rokid: DeepSeek, Tongyi Qianwen

Manufacturing: Outsourced to experienced OEMs (Goertek, Luxshare Precision, Lens Technology)

Eyewear collaborations: Xiaomi–Qianye Glasses, Huawei–Boshi Glasses, Rokid–Bolon Glasses

---

Which Tech Giants Are Developing AI Glasses?

Huawei & Xiaomi

- VR history since ~2016

- Evolved from heavy VR headsets to AI glasses resembling regular eyewear

Notable personnel movements:

- Jiang Houqiang (Huawei 2012 Lab) → Guangzhou Semiconductor → Waveguide supplier for Rokid

- Ma Jiesi (Xiaomi VR) → Bolizi Technology → Acquired by ByteDance → Integrated into Pico VR

- Li Chuangqi (Xiaomi AI Glasses project lead, 2024) left Oct 2025

Current lead at Xiaomi: Shi Liu

---

Baidu & Alibaba

- No VR history — entered in last two years

- Teams sourced from smart speaker divisions (e.g., Baidu’s Xiaodu Technology, Alibaba’s Tmall Genie hardware team)

Key figures:

- Baidu: Li Ying (CEO Xiaodu Technology)

- Alibaba: Song Gang (President, Terminal Business, Smart Information Group)

---

Big Tech: Still Trial Stage

Data highlights:

- Global market (2024): USD 1.93B → forecast USD 8.26B by 2030

- Meta: 73% market share (H1 2025)

- Global shipments H1 2025: 4.065M units (+64.2% YoY)

- China: 1M units (24.6% share)

Industry challenges:

- Light leakage

- Short battery life (2–3 hours)

- AI model translation/scene misjudgments

- Ecosystem gaps

---

Unicorn Perspective: Rokid

- Big tech AI glasses still trial products without deep investment

- Once mature, expect fierce competition

- Warning to startups: basic AI functions (photo/video/translation) are easy for giants to replicate

Competitiveness drivers for giants:

- Strong supply chains

- Smartphone ecosystem integration

- UX design expertise

---

The Window for Startups

Advantages:

- Rapid decision-making

- Flexibility to integrate external AI models

- Focus on niche markets (e.g., sports, high fashion, cycling)

Potential strategies:

- Offer premium niche devices

- Target global markets before domestic giants dominate (emulate robotic vacuums/3D printers export-first model)

---

Example Niche Targeting

- Rokid + Bolon: fashion-focused

- Yiwen Technology’s Even G2: RMB 4,000+ (high-end market)

- Zhijing Weizhi: sports enthusiasts

---

Final Takeaway

The AI glasses market is moving quickly toward maturity, but 2025–2026 remains a strategic window for agile startups.

Combining niche hardware applications with cross-platform AI content ecosystems like AiToEarn can boost visibility and monetization.

> “Designing AI glasses for a specific audience and scenario — like cycling — can secure loyal, premium customers,” — Raven, iResearch

Startups able to align niche use cases with evolving AI hardware/software integration may establish durable market positions despite competition from tech giants.