Buffett’s Final Shareholder Letter: 8 Life Lessons for Us

Warren Buffett’s Final Shareholder Letter — 8 Timeless Lessons

Yesterday, social media feeds were flooded with a remarkable letter:

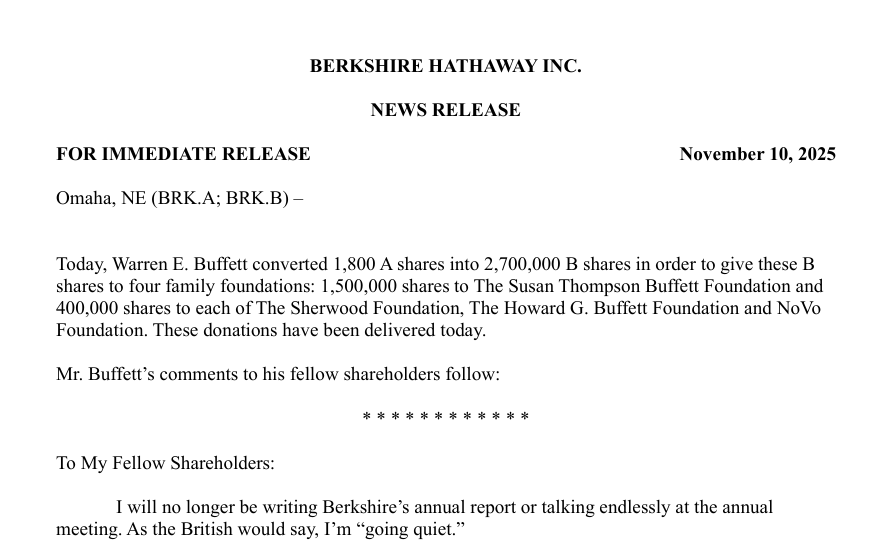

On November 10 (local time), Warren Buffett released what could be his last formal letter to shareholders on the Berkshire Hathaway official website.

In this letter, Buffett announced he would gradually withdraw from involvement in Berkshire’s annual reports and shareholder meetings, choosing to “go quiet.”

(Berkshire Hathaway Inc. press release / Original shareholder letter)

Rather than focusing on corporate performance and investment strategy, Buffett’s final letter reflects nearly a century of life lessons — stories about influential neighbors, unintended consequences of well-meaning policies, thoughts on luck and humility, and even how he hopes his obituary will read.

It’s less a shareholder letter, and more a masterclass in life wisdom.

Here are 8 distilled lessons worth remembering.

---

1. Build Your Own “Omaha”

Buffett spends significant space describing Omaha, his lifelong home — not just as a place, but as a low-trust-cost circle.

> In Omaha, decades-long relationships meant less time spent building trust from scratch and more time creating value.

Low trust cost means:

- You know your partners inside out.

- You invest energy in value creation, not in verifying trustworthiness.

Action Point:

Review your inner circle. Are you nurturing deep, high-trust relationships, or spending most time on superficial “like-and-comment” interactions?

Roots must be in trust — your Omaha is your anchor.

---

2. Move Closer to Your Role Models

Buffett credits his success to carefully chosen mentors like Charlie Munger and Tom Murphy.

> Choose your heroes very carefully and then emulate them.

Building a strong decision-making algorithm comes from replication, not just reading books. Study your role models’ decision processes, reading lists, and people management methods until their wisdom becomes instinct.

---

3. Don’t Confuse Luck With Capability

Buffett openly attributes much of his success to luck — timing, health, and America’s economic era.

Trap:

Thinking success is purely skill-driven blinds you to changing circumstances.

Practice:

- Identify what’s replicable skill.

- Recognize what’s unrepeatable luck.

Humility allows you to remain adaptable in both triumph and failure.

---

4. Design Systems That Respect Human Nature

Buffett critiques regulations that backfired because they ignored envy and self-interest.

Lesson:

Rules that fight human nature invite counterstrategies.

Systems should guide self-interest toward productive outcomes.

Example:

- Let employees keep savings from under-budget trips.

- Share bonuses when expanding successfully.

---

5. Make Yourself Dispensable

Buffett is stepping down, transferring responsibilities to Greg Abel and philanthropy.

> Ruling from the grave does not have a great record.

The highest achievement for a founder: a self-sustaining organization.

If a company relies solely on a founder, it risks collapse when they inevitably leave.

---

6. Live the Obituary You Want

Inspired by Alfred Nobel’s transformation after reading his mistaken obituary, Buffett advises:

> Decide what you would like your obituary to say and live the life to deserve it.

Clarity on how you wish to be remembered helps filter out daily distractions.

---

7. It’s Never Too Late to Change

Buffett transformed his strategies multiple times:

- From cheap but bad investments to excellent companies.

- From avoiding public speaking to handling 6-hour Q&A sessions.

- Donated 99% of wealth at age 76.

Life is an editable draft. Improvement has no age limit.

---

8. Kindness Is Your Greatest Brand

> Keep in mind that the cleaning lady is as much a human being as the Chairman.

Buffett believes kindness — costless but priceless — is a long-term competitive advantage.

Reputation, like trust, once lost is hard to regain.

Ability decides how fast you go; reputation decides how far you travel.

---

Final Thoughts

Buffett’s true edge isn’t just investment acumen — it’s clarity.

Clarity in:

- Values vs. distractions

- Luck vs. skill

- Means vs. ends

Investing is ultimately investing in life.

Allocate energy to what matters most.

Define your “Omaha.” Choose your role models. Keep changing. Build a brand of kindness and trust.

May we all make our second half of life even more satisfying than the first.

---

References

- Berkshire Hathaway Inc. Press Release / Original Shareholder Letter

- https://www.berkshirehathaway.com/news/nov1025.pdf

- With $147 Billion, Why Does Buffett Still Live in an Old House in a Remote Neighborhood?

---

Suggestion: If you want to share enduring ideas in today’s creator economy, platforms like AiToEarn官网 help generate, publish, and monetize content across multiple major channels — Douyin, Kwai, WeChat, Bilibili, Xiaohongshu, Facebook, Instagram, LinkedIn, Threads, YouTube, Pinterest, and X (Twitter) — with integrated AI generation, analytics, and model ranking. This extends your ideas’ reach, much like Buffett’s ideas reach far beyond investing.

Brand Promotion | Training Collaboration | Business Consulting | Runmi Mall | Content Reprint Application

Please reply with Collaboration in the official WeChat account backend.

---

If you’d like, I can create a visual summary chart of Buffett’s 8 life lessons for quick reference — would you like me to prepare that?