Burning Through an NVIDIA in 5 Years — Is OpenAI the Next Enron?

⚡ AI Hype vs. Physical Reality: Could OpenAI Face an Enron Moment?

Xinzhiyuan Report

Lead: While AI trumpets its promise to “change the world,” the power grid, transformers, and cash flow are already showing strain. Can the fever dream outrun the laws of physics? Time to ask: Is OpenAI’s trajectory comparable to early‑2000s Enron?

---

📉 The Enron Story — A Cautionary Benchmark

Timeline Highlight

- December 2, 2001 — Enron files for bankruptcy, the largest corporate failure in U.S. history at the time.

The Infamous "Asshole" Call

- April 17, 2001 — Enron’s quarterly earnings call.

- Analyst Richard Grubman asks why Enron refuses to publish a balance sheet alongside its earnings.

- CEO Jeffrey Skilling gives vague, evasive answers, avoiding clarity on Enron’s financial position.

- Frustrated, Grubman pushes again:

- > "You are the only company I’ve seen that won’t release a balance sheet when reporting earnings."

- Skilling loses composure:

- > "Well… thank you very much, we appreciate it… Asshole."

Recorded audio later played in court became emblematic of Enron’s collapse. Employees even turned “Ask Why” into “Ask Why, Asshole” merch — a cynical badge of defiance.

Lesson: _When a CEO chooses insults over transparency, it’s a red flag that the end may be near._

---

🤖 OpenAI’s Financial Fog — Echoes of Enron?

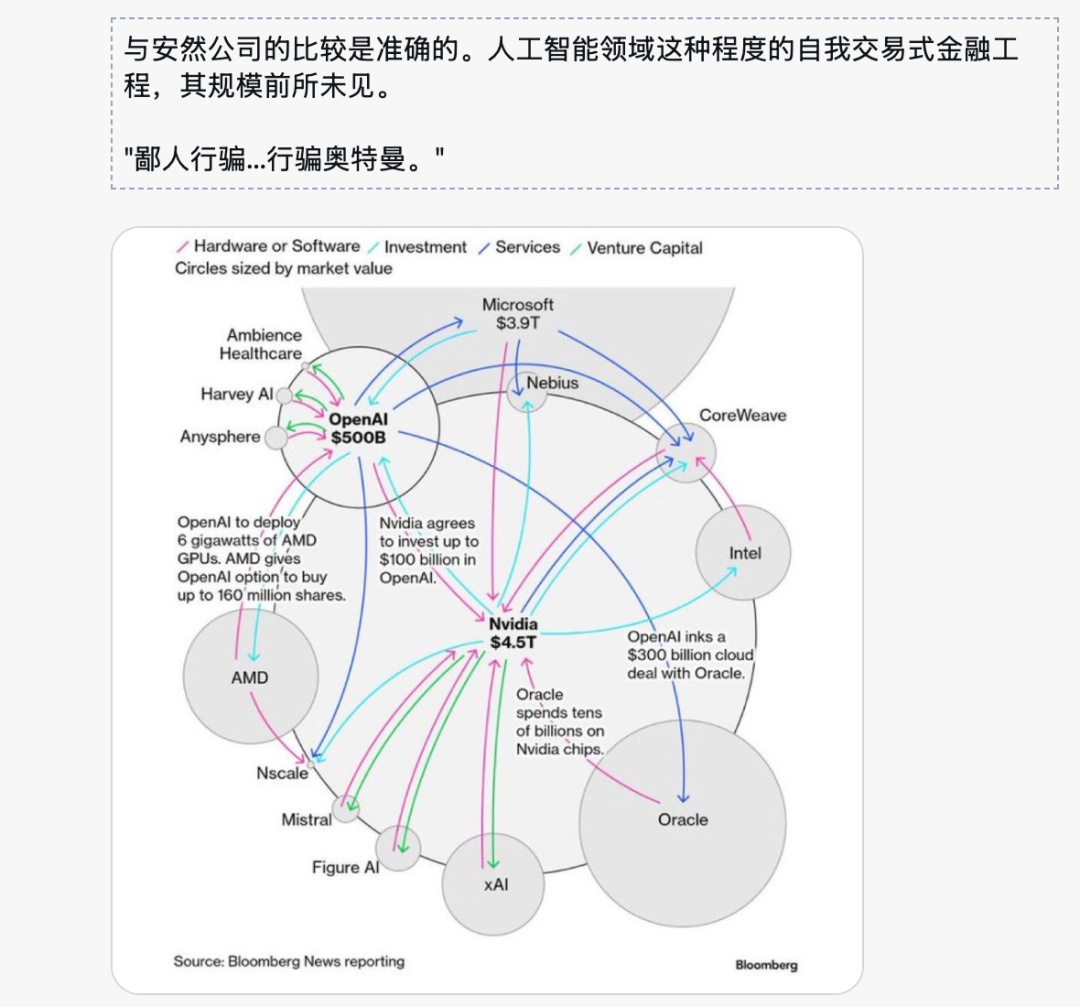

Commentator Financelot noted that parts of Sam Altman’s recent interview sounded eerily similar to that infamous earnings call.

Examples of Evasion

- "Revenue is far more than that figure" — But exactly how much? Even $30B vs. $1.4T market size leaves a massive gap.

- "If you want to sell shares, go ahead" — Highlights strong demand for OpenAI stock, but ignores the missing $1.37T revenue gap.

---

💸 The AI Cash Burn

- AI industry investment could reach $5T by 2030 — the cost of “burning an entire Nvidia.”

- For reasonable ROI, OpenAI must generate $650B new annual revenue.

- Current situation: burning cash, persistent losses, heavy dependence on equity & bonds.

---

⚖ Key Difference from Enron

- Enron: Accounting fraud, fake profits, real losses.

- OpenAI: Real products, genuine usage — but valuations may be inflated far beyond sustainable economics.

---

🏗 Physical Limits — The Real Bottleneck in the AI Gold Rush

Despite surging investment in AI data centers, physical infrastructure faces hard constraints:

United States Example

- Unlimited budgets fueling massive supercomputing buildouts.

- Demand spikes for chips, cooling systems, transformers, power plants.

- Yet production capacity of critical hardware is already booked until 2028.

Transformer Shortage — According to GE Vernova CEO Scott Strazik:

- Meeting U.S. power needs is a 10–15 year challenge, not 5.

- Delays from permits & pipeline connections exacerbate timelines.

---

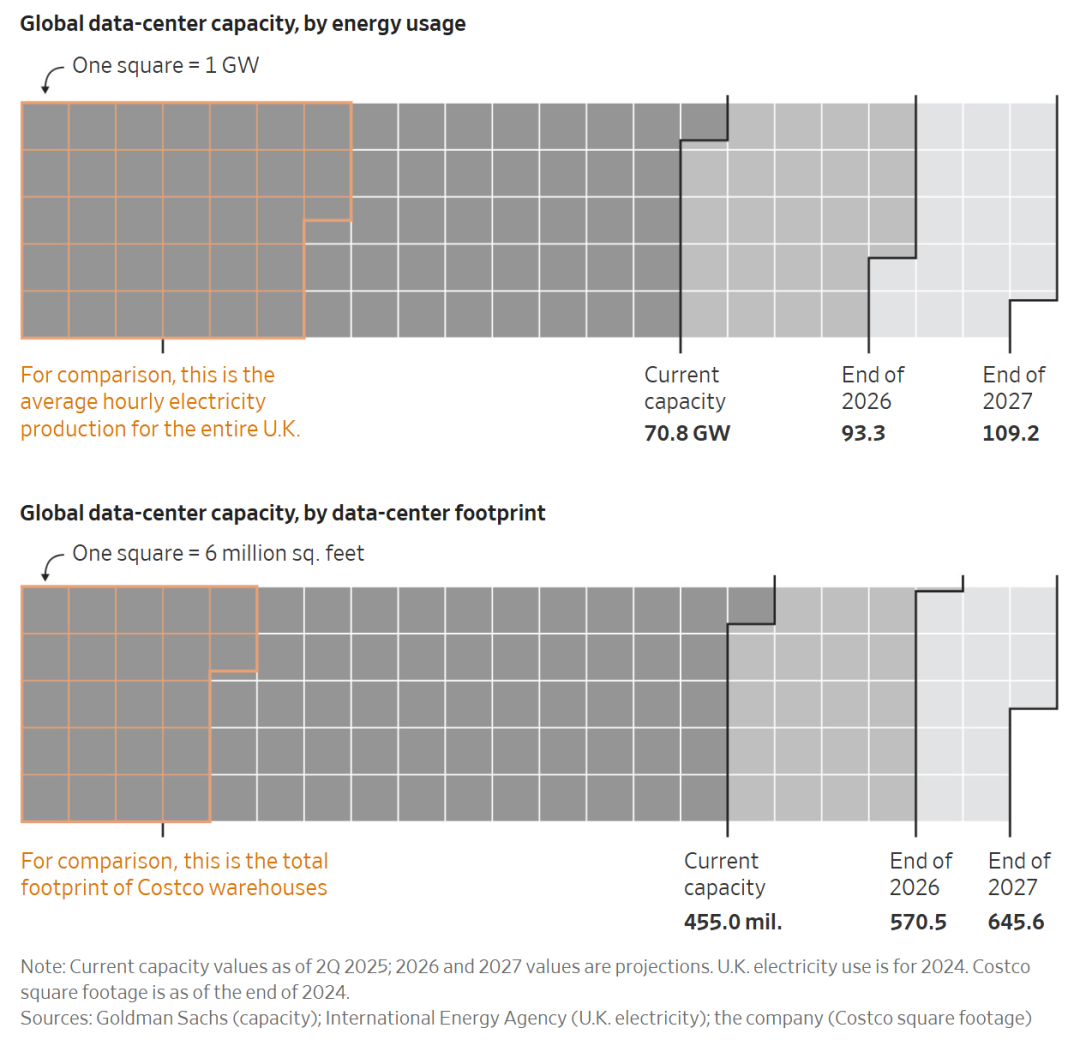

Data Center Capacity Forecasts

Global Capacity (Top: Power Consumption)

- Current: 70.8 GW → 2027 forecast: 109.2 GW

Global Capacity (Bottom: Floor Space)

- Current: 455M sq ft → 2027 forecast: 645.6M sq ft

---

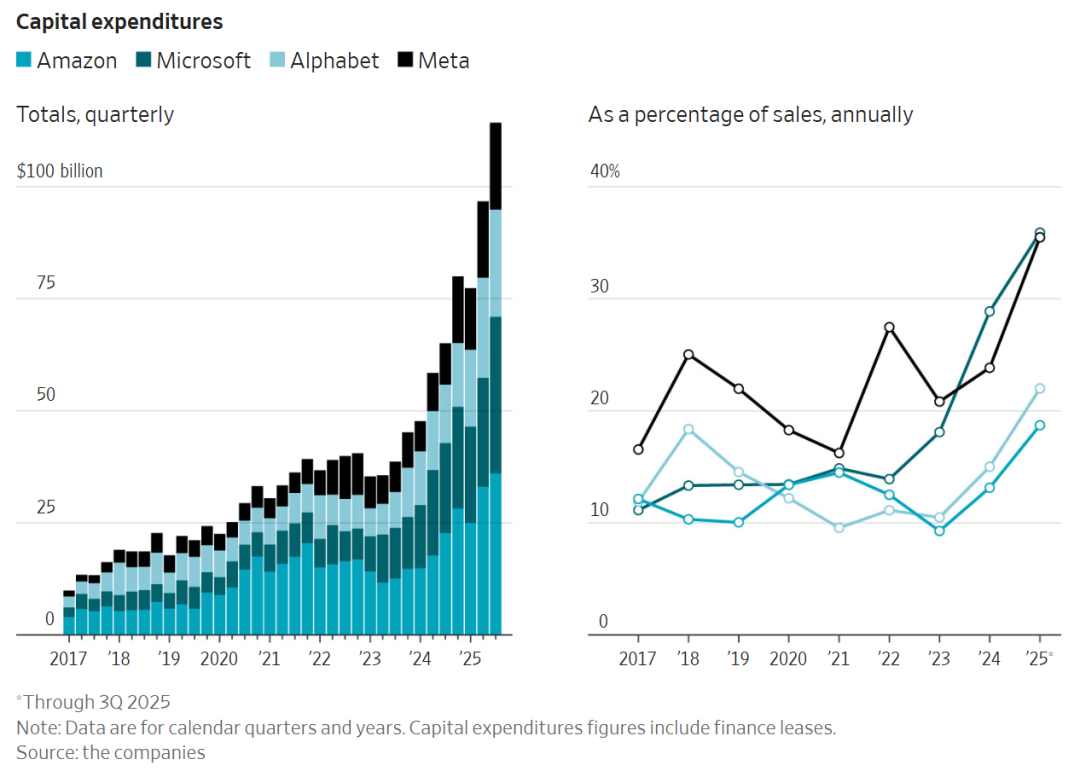

📊 Capital Expenditure Trends

Tech giants are pushing record capex — often financed by debt.

Goldman Sachs estimates OpenAI will burn $75B by 2026.

---

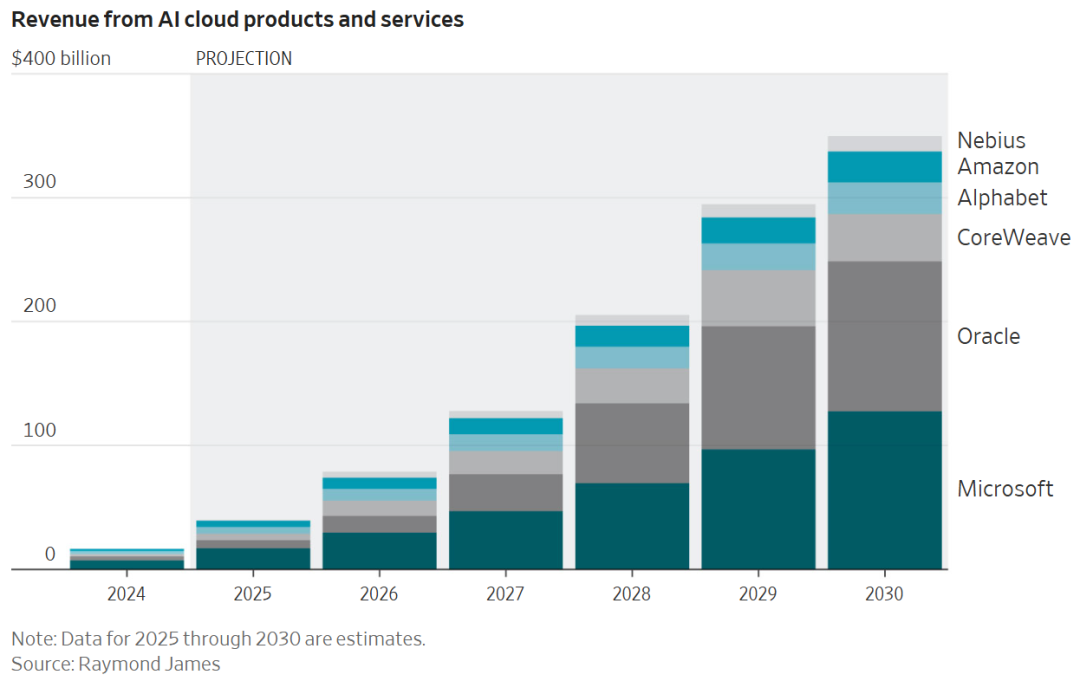

🚀 The Gamble: Massive AI Demand

Optimistic projections:

- Nearly 9× revenue growth in five years.

- Equivalent to every iPhone user spending $35/month on AI services.

Yet investment models often:

- Ignore equipment shortages.

- Assume unprecedented user demand.

---

🪙 AiToEarn — A Decentralized Alternative Path

Amid AI infrastructure uncertainty, platforms like AiToEarn官网 offer a creator-centric model:

- Open-source AI publishing & monetization.

- Multi-platform distribution: Douyin → YouTube → LinkedIn, etc.

- Integrated analytics & AI model rankings.

These tools focus on the digital layer, bypassing physical bottlenecks while enabling distributed value creation.

---

📌 Final Takeaways

- Enron: Fake profits, hidden debt.

- OpenAI: Real usage, but valuations may collide with physics & economics.

- AI’s limiters: steel, concrete, transformers, power grids.

- Market reality will decide who foots the $5T bill.

---

🥚 Easter Egg

After Enron’s collapse in 2001, NVIDIA replaced it in the S&P 500.

Today, NVIDIA is worth $5T+ — the ultimate symbol of the AI boom.

---

References:

---

💡 Editor’s Note: This rewritten version improves flow with clear headings, bold emphasis, and grouped points. Would you like me to add a comparative table highlighting Enron vs. OpenAI financial signals for quicker reference? That would make this visual, not just narrative.