Digital Gold Prices Soar, Even Lei Jun Can't Hold Out

Price Increases — A Double-Edged Sword

---

Overview

On October 24, while promoting a smartphone on Weibo, Lei Jun remarked: "Memory prices have gone up far too much recently."

The situation is stark:

- Samsung Electronics has announced a 60% price hike for memory chips.

- This directly pushes up costs for downstream electronics — phones, laptops, PCs, tablets, and other devices.

Key driver: Demand from AI giants for HBM storage, which squeezes DRAM production. AI inference growth has also reduced NAND flash supply.

Tech enthusiasts now nickname memory products “digital Moutai” or “digital gold”.

---

Impact Across the Supply Chain

At SMIC’s Q3 earnings conference:

- Storage was mentioned 38 times.

- Co-CEO Zhao Haijun reported:

- Current supply gap >5%

- Manufacturers face short-term pressure

- Expansion continues

- High prices benefit manufacturing margins

> Rule of Thumb:

> - +5% shortage → Prices may double

> - +5% surplus → Prices may be halved

---

01 — Panic, Stockpiling, and Price Inversion

Memory market cycle:

- Commoditized, highly tied to downstream demand

- Alternates between upward and downward price cycles

- A ±5% supply/demand shift can double or halve prices

Past cycles:

- 2012–2015

- 2015–2019

- 2020–2023

- 2024–present

---

New Dynamics in 2024

- OEM Production Cuts — aligned with server & AI demand

- AI Boom — drives high-end storage needs

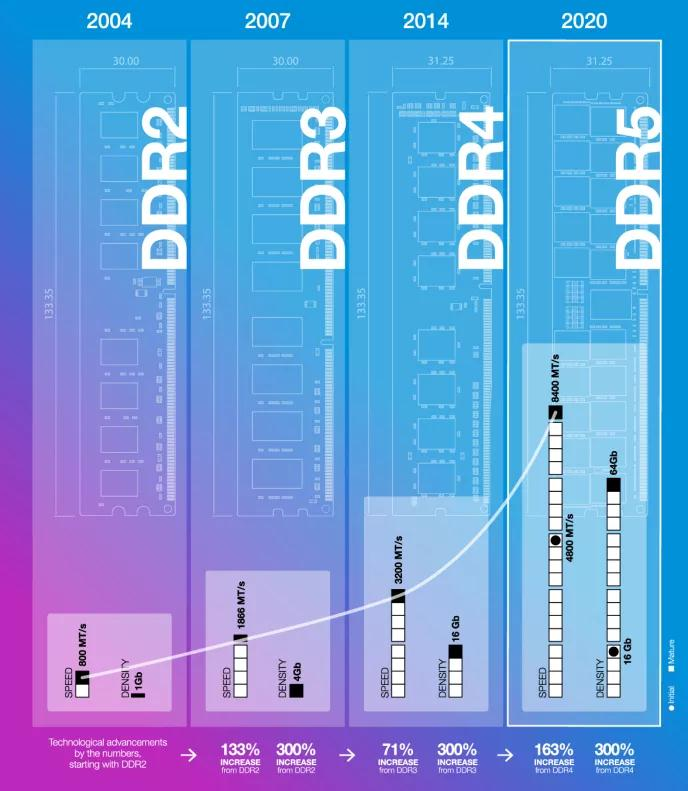

- DDR4 Phase-out — Micron & Samsung to end DDR4 production by 2025

- Production Priorities — Shift to HBM & DDR5 for higher margins

Result:

- DDR4 supply shrinks

- North American & domestic companies stockpile

- Price inversion emerges — DDR4 overtakes DDR5 prices

---

DDR technology roadmap — Micron

> Note: Transitioning to DDR5 needs CPU, motherboard, and OS upgrades — slowing immediate adoption.

Market sentiment:

- Driven by panic stockpiling, not actual end-user demand

- Seen as unhealthy and detached from realistic value

---

02 — The “Delayed” NAND/DRAM Price Spike

AI adoption has transformed NAND flash demand — once consumer-electronics-led, now AI inference–driven.

Past:

- Demand focused on HBM for model training & validation

- Low interaction rates kept NAND/DRAM demand modest

Now:

- AI penetration surges across payments, e-commerce, and enterprise

- Three-replica backup mechanisms in cloud computing triple storage needs

- AI server orders locked in through 2026 — straining supply

Inventory Snapshot:

- Normal module maker stock: ~4 months

- Current: ~2 months

- Oversupply cycles: up to 12 months

---

03 — Who Feels the Heat?

Memory cost share in hardware BOM:

- All-Flash Array Storage: 73%

- Smartphones: 18%

Trend:

- Upstream prioritizes AI server clients due to higher margins

- Top-tier phone brands meet only 80% of 2025 storage needs; second-tier ~60%

- Consumer electronics segment faces severe supply chain risk

Price Impact:

- NAND: +50%

- DRAM: +300% in 6 months

---

Industry Forecast — Morgan Stanley

- By 2026: Median gross margin ↓60%

- Median EPS ↓11% vs consensus

- Potential valuation contraction

- Vulnerable: Dell, HP, Asus, others

---

04 — The New Storage Story

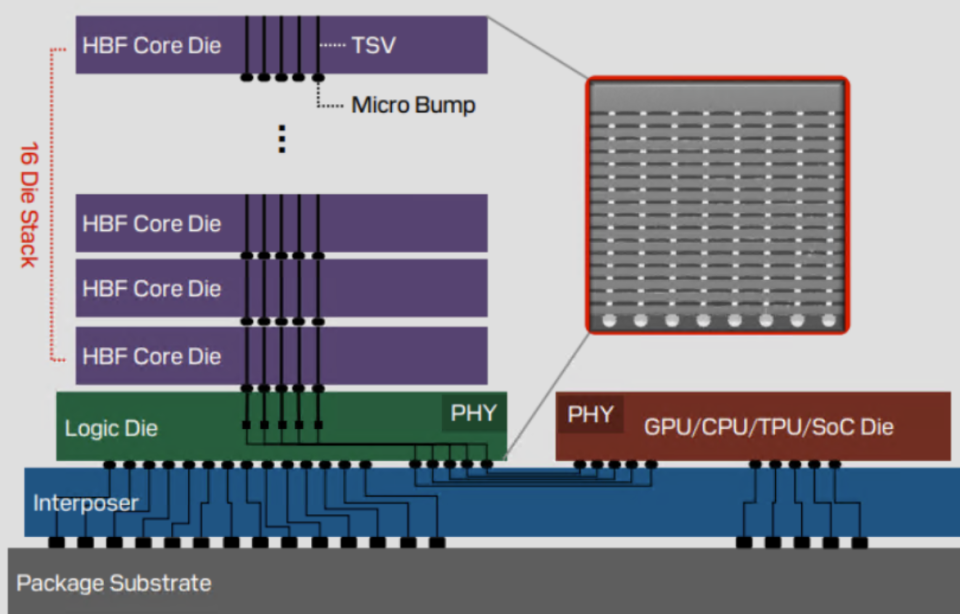

HBM: High bandwidth for AI chips, but low capacity

HBF: NAND-based innovation by Western Digital

Benefits:

- 8–16x capacity of HBM at similar cost

- Single stack up to 512GB

- Reduced GPU idle time, lower AI service costs

HBF architecture cross-section with GPU

Limitations:

- Finite NAND lifespan vs DRAM’s no-limit durability

- Operating temperature constraints (80–85°C vs 125°C for DRAM)

Likely Future: Hybrid HBM + HBF architectures for balanced performance & cost.

---

Conclusion

Price increases in memory are a double-edged sword:

- Positive: Short-term manufacturer margins, incentivizing new tech like HBF

- Negative: Supply chain instability, slower DDR5 migration, margin erosion in consumer electronics

---

Recommended Reads — "Chip Crisis" series

---

For creators and industry analysts:

AiToEarn官网 provides open-source tools to:

- AI-generate content

- Publish across Douyin, Kwai, WeChat, Bilibili, Xiaohongshu, YouTube, Instagram, X, and more

- Track model rankings (AI模型排名)

- Monetize ideas globally

---

Would you like me to also prepare a concise “Industry Impact Summary” chart from this rewrite? That would make this information faster to digest.