Best Free Competitor Research Tools in 2025: Practical Workflows and Picks

Free competitor research tools for 2025 with practical workflows for SEO and backlinks. Map markets, validate ideas, and know when an upgrade is worth it.

This guide distills a practical, free-first approach to competitor research in 2025. It focuses on clean, reproducible workflows that extract maximum signal from public data and free tiers before you commit to paid tools. Use it to map the market, prioritize opportunities, and know precisely when uncertainty makes an upgrade worth it.

Best Free Competitor Research Tools in 2025: Practical Workflows and Picks

If you’re building a market map or sharpening your go-to-market, you don’t need to start with expensive suites. The right mix of free competitor research tools can answer most of your early questions, help you prioritize, and validate hypotheses before you ever touch a credit card. This guide shows exactly what “free” can do in 2025, practical workflows to apply, and how to know when it’s time to graduate to paid plans.

What free tools can answer (and limits to expect)

Core questions you can answer with free data:

- Who your rivals are in organic search, ads, and social

- What they publish, how often, and how deep (topic clusters and intent)

- Where their links and PR coverage come from

- Directional traffic, geos, and referrers

- What ads they run and how often they refresh creatives

- Where users praise or complain (themes and language)

- How their product evolves (features, pricing, tech stack)

What “free” cannot reliably give you:

- Precise traffic or ad spend numbers

- Complete backlink exports at scale

- Share-of-voice across thousands of keywords

- Keyword volumes beyond samples

- Historic creative performance beyond what’s visible

How to use free data correctly:

- Treat it as directional, not definitive

- Triangulate at least two sources for any claim

- Account for sampling bias (free tiers often bias toward higher-traffic pages)

- Document sources and dates to make your work reproducible

- Upgrade when the cost of uncertainty is higher than the subscription

---

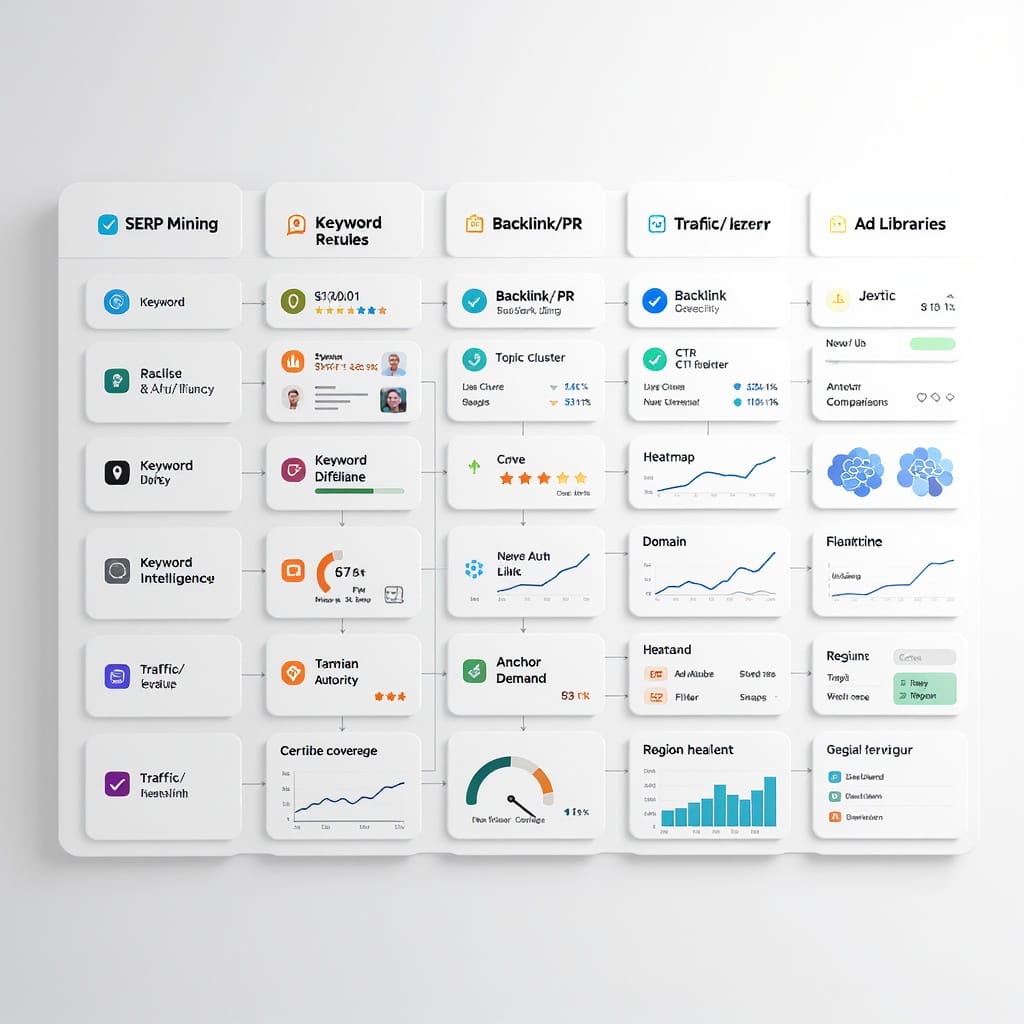

SEO and Content Intelligence Without Paid Suites

Free competitor research tools can map search intent, topic clusters, and content velocity without a full platform.

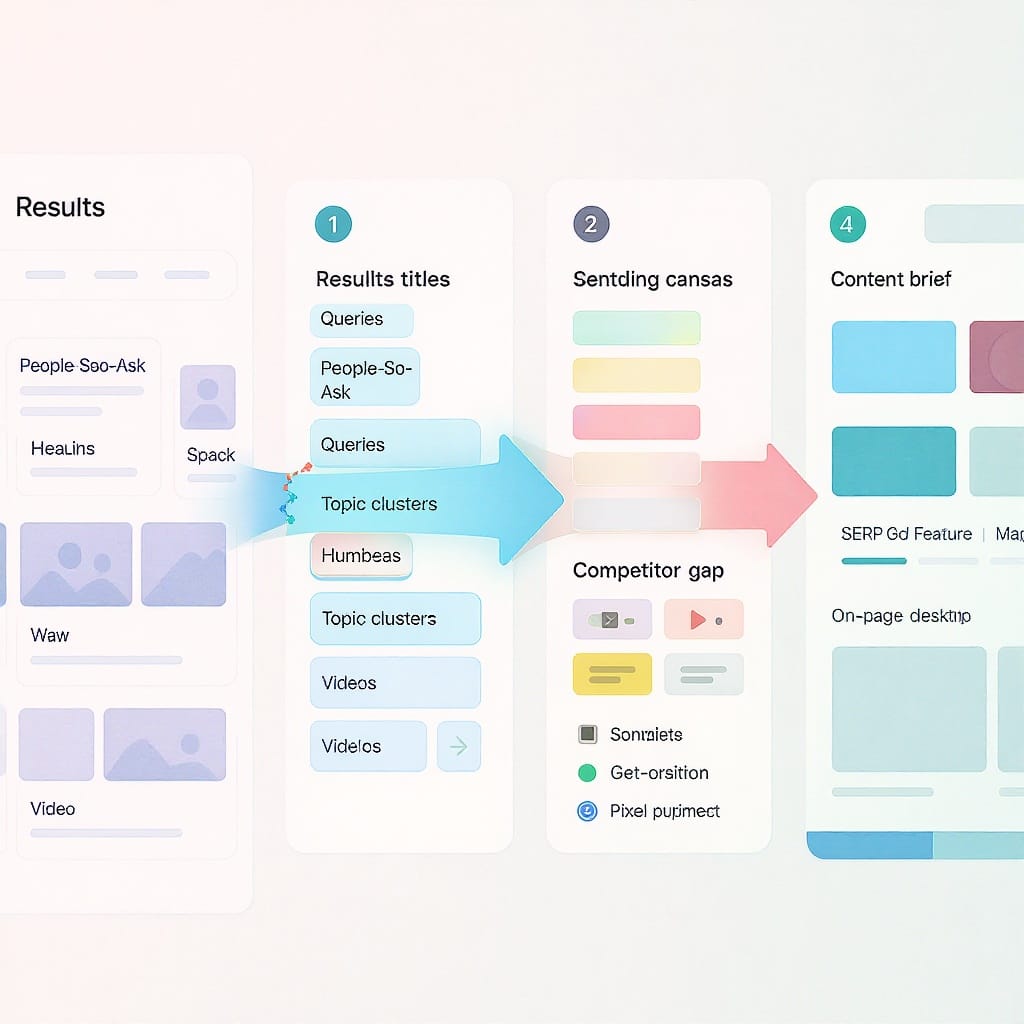

Mine Google SERPs like a pro

Use advanced search operators to inventory a competitor’s index, title patterns, and topic depth:

site:competitor.com -www subdomain:blog

site:competitor.com intitle:"guide" OR intitle:"best"

site:competitor.com inurl:/blog/ "how to"

intitle:"your topic" -site:yourdomain.com

cache:competitor.com/blog/post-slug

related:competitor.comWork the SERP:

- Scan People Also Ask and Related Searches for cluster ideas

- Note SERP features won (Featured Snippets, Top Stories, Videos, FAQs)

- Capture ranking URLs, titles, and intents (informational, commercial, transactional)

- Use cached pages to spot recent changes and update cadence

Combine lightweight free tools

- Ahrefs Free Keyword Generator: discover related topics for a seed; note parent topics

- Ahrefs Free Backlink Checker (preview): find top-linked pages for content prioritization

- Moz Link Explorer (free credits): confirm link leaders and spammy patterns

- Ubersuggest (limited reports): quick keyword ideas and page-level estimates

- AlsoAsked: visualize question clusters from PAA to inform FAQs and subheadings

Track these metrics per competitor:

- Publishing cadence (posts/month, changes to key pages)

- Word count bands (e.g., 800–1,200 vs. 2,000–3,000)

- Target intent and funnel stage

- SERP features won and schema usage (FAQ, HowTo, Product)

- Pillar vs. cluster structure and internal linking patterns (hub pages, breadcrumbs)

Quick capture template (copy into your sheet):

Date, Competitor, URL, Topic, Intent(Info/Comm/Trans), WordCount, SERPFeatures, Schema, Pillar/Cluster, LastUpdated, Notes---

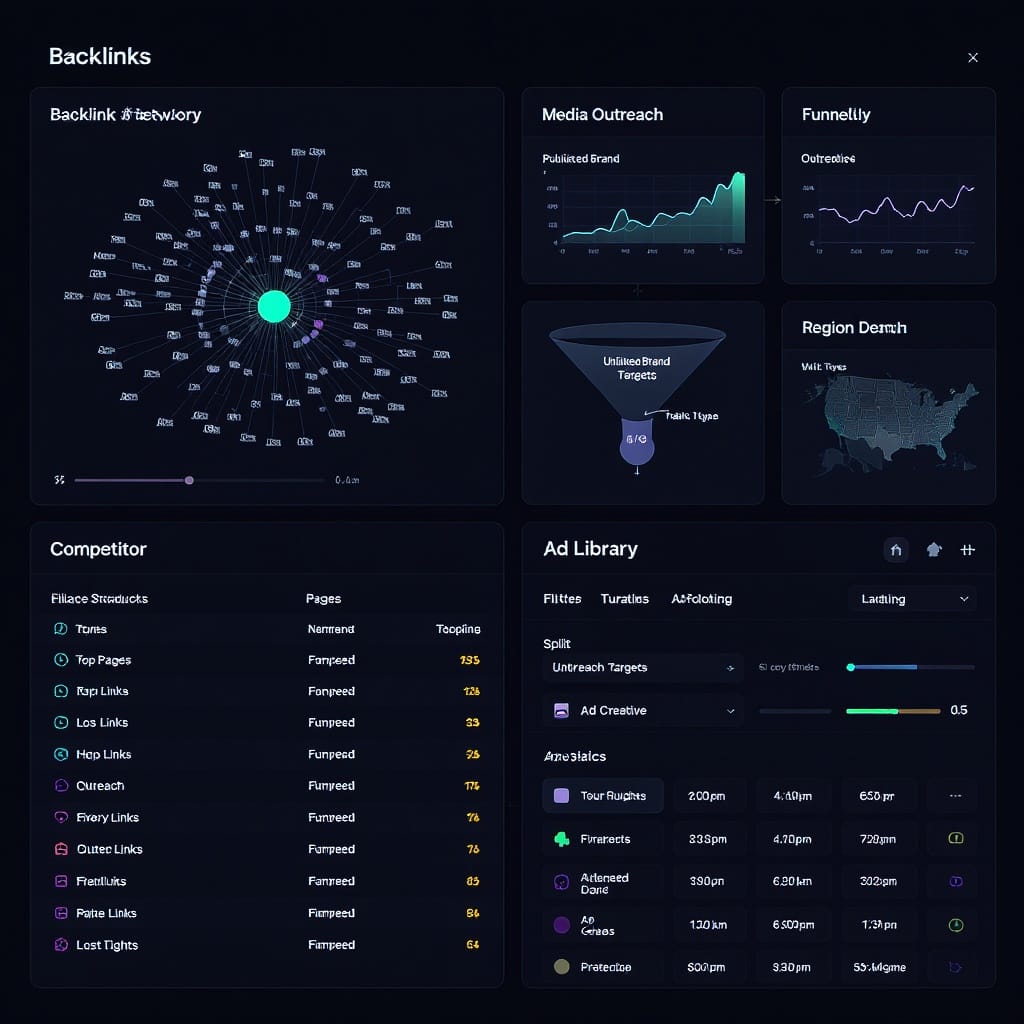

Backlink and Digital PR Reconnaissance on a Budget

You can identify link magnets and repeatable PR sources without full exports.

- Ahrefs Free Backlink Checker: list top 100 backlinks; sort by DR and recent links

- Moz Link Explorer (free): confirm unique referring domains and anchor text distribution

- Google News + advanced search:

- "competitor brand" site:newsdomain.com

- "competitor brand" press release OR announces

- Talkwalker Alerts (free tier): new mentions and coverage

- Resource pages/directories: "best [category]" "resources" site:.edu OR site:.gov

Build a target list:

- Journalists and outlets that repeatedly link to rivals

- Resource pages and curated lists that accept submissions

- Directories with dofollow links and strong moderation

- Anchor text patterns that attract links (data-led, benchmarks, templates)

- Content types that win links (original research, calculators, statistics pages)

Record for outreach:

Outlet, Journalist, Topic, Example Link, Anchor Text, Pitch Angle, Contact, Last Pitch, Status---

Traffic and Demand Signals with Free Tiers

Directional data still helps you place bets.

- Similarweb Free Domain Overview: estimated traffic trend, top countries, top pages, referrals

- Google Trends: compare brand vs. category terms; seasonality and breakouts

- Reddit and Quora: brand/category mentions and pain points; note phrasing and objections

Build a simple dashboard:

- Estimated traffic trend (directional)

- Top referrers and partner sites

- Top geographic markets

- Branded vs. non-branded interest (Trends)

- Breakout topics and Q&A threads to inform content

Example capture schema:

Month, Domain, EstTrafficTrend(Up/Flat/Down), TopCountries, TopReferrers, TopPages, BrandVsCategory(Index), BreakoutTopics, Notes---

Ad Intelligence from Public Libraries

Public ad repositories are gold for message testing and creative strategy.

- Meta Ad Library: search by advertiser; filter by active/inactive, country, platform

- TikTok Creative Center: top ads/trends in your category; see hooks and durations

- Google Ads Transparency Center: discover search/display creatives and landing pages

- YouTube Ads Library/AdBlitz: video formats, CTAs, and creative cadence

What to extract:

- Messaging angles (pain-point, ROI, social proof, comparison)

- Offers (free trial length, discounts, guarantees)

- Evergreen vs. seasonal themes

- Formats (UGC, carousel, static, motion graphics)

- CTAs and landing page types (LP vs. blog vs. comparison)

Create a swipe file taxonomy:

Advertiser, Platform, AdID, DateSeen, FunnelStage(TOFU/MOFU/BOFU), AudienceHypothesis, Angle, Offer, Format, CTA, LP_URL, Notes, RefreshCadence(days)---

Social Listening and Share of Voice (Free-First)

Get real customer language and influencer chatter.

Use X/Twitter advanced search:

from:competitor handle -filter:replies

to:competitor handle min_faves:5

"competitor brand" (scam OR bug OR broken OR slow) lang:en

url:competitor.com -from:competitor handleOther quick hits:

- Google Alerts and Talkwalker Alerts for brand, product, and executive names

- LinkedIn company pages: content cadence and engagement per follower

- Social Searcher (free): fast multi-platform scans

- Community hotspots: find recurring mentions of Slack/Discord forums on SERP, Reddit sidebars, and product docs

Track themes:

- Features praised vs. complained about

- Moments of peak engagement (releases, outages, comparisons)

- Influencers and power users who shape narratives

---

Tech Stack and Product Evolution

Spy the plumbing to infer priorities and velocity.

- BuiltWith and Wappalyzer (free lookups): CMS, analytics, A/B testing, chat, payment, CDNs

- Wayback Machine: compare pricing pages, nav, and home hero messaging over time

- robots.txt and sitemaps: discover hidden or new sections

- GitHub releases/changelogs (for dev tools): tag frequency, semantic versioning

- PageSpeed Insights/Lighthouse: performance shifts after redesigns

Useful peeks:

https://competitor.com/robots.txt

https://competitor.com/sitemap.xml

https://web.archive.org/web/*/https://competitor.com/pricingRecord:

Date, Domain, NewTech(yes/no), Tech(Added/Removed), FeatureRelease, PricingChange, OnboardingChange, PSI_Mobile, PSI_Desktop, Notes---

Pricing and Positioning Research

Compare packaging, gating, and proof elements. Use Wayback to spot historical changes. Mine G2, Capterra, Trustpilot, and app store reviews for real language, unmet needs, and perceived differentiators. Extract ICP clues from case studies and sales pages.

| Plan | Price (as listed) | Key Features | Gating (limits) | Trial/Guarantee | Proof Elements | Target ICP Signals | Notes (Wayback changes) |

|---|---|---|---|---|---|---|---|

| Free | $0 | Basic usage, limited seats | Caps on projects/exports | None | Logos, “Used by X” | Startups, solo users | Added cap from 3→2 projects in 2024 |

| Pro | $X/mo | Core features, integrations | API calls/month | 7–14 day trial | Case studies, testimonials | SaaS PMMs, SMB teams | Introduced usage-based overages 2023 |

| Enterprise | Custom | SAML, SLA, admin controls | Contracted usage | Pilot/POC | SLAs, security docs | Mid-market to enterprise | Added SOC2 Type II 2024 |

Tips:

- Look for “compare plans” fine print and per-seat vs. usage-based nuances

- Map features that are gated behind higher tiers (SSO, audit logs, export limits)

- Copy exact customer language from reviews into your messaging library

---

Monitoring and Reporting Workflow (Free Stack Template)

Stand up a lightweight, always-on monitoring system in an hour.

1) Change monitoring

- Visualping or Distill.io (free tiers): watch pricing, features, docs, careers, and status pages

- Set daily or weekly checks; trigger Slack/email alerts

2) Subscriptions

- Feedly (free): subscribe to blogs, release notes, status pages, roadmap boards (if public)

- YouTube channel + podcast alerts for launch content

3) Capture and synthesis

- Notion or Google Sheets: one dashboard to log monthly findings

- Create owners and cadence (monthly synthesis; quarterly deep-dive)

Suggested dashboard fields:

Month, Competitor, ContentVelocity(posts/mo), EstTrafficTrend, NewTopPages, NewAdsSpotted, AdRefreshCadence, TopReviewThemes, TechStackChanges, PricingChanges, NotablePR/Links, ActionItems, Owner4) Communication

- Pipe Visualping/Talkwalker/Google Alerts into Slack #market-intel

- Monthly 30-minute readout: what changed, why it matters, what we’ll do

---

Ethics, Data Quality, and When to Upgrade

Operate cleanly:

- Respect robots.txt and terms; avoid aggressive scraping, automated form fills, or paywall circumvention

- Credit sources and timestamp captures for auditability

- Don’t present directional estimates as absolutes

Triangulate:

- Cross-check Similarweb trends with Search Console (your site) and external sentiment

- Validate backlink prospects with at least two sources (Ahrefs/Moz/News)

- Confirm ad angles across multiple libraries and landing pages

Upgrade triggers:

- Need reliable keyword volumes and intent mapping at scale

- Require precise ad spend, impression share, or audience splits

- Must export full backlink profiles and run link intersect across many domains

- Want share-of-voice tracking over thousands of terms and markets

- Need continuous social listening across multiple platforms with sentiment scoring

Paid modules to consider when ROI justifies:

- Semrush or Ahrefs for comprehensive SEO/backlink analysis

- Similarweb for traffic and referral deep dives

- Brandwatch/Meltwater for social listening at scale

- Piwik PRO/Amplitude/Mixpanel for product analytics (if you own the property)

- Pudding of choice for ad intelligence (e.g., AdSpy variants where compliant)

---

Final Notes

Start with free competitor research tools to build a high-signal base: identify rivals, map intents, log tech and pricing shifts, and collect real customer language. Be disciplined about data hygiene, cross-validation, and synthesis. You’ll know it’s time to upgrade when uncertainty starts costing you more than the subscription—and by then, your free-first workflow will ensure every paid dollar drives insight you can actually use.

Summary

- Use free tools to map competitors, validate hypotheses, and prioritize opportunities with directional data you can triangulate.

- Build lightweight capture schemas, dashboards, and monitoring to keep intel current and reproducible.

- Upgrade only when the cost of uncertainty exceeds the subscription, targeting specific modules that fill proven gaps.