From No Images to Light Images: A New Race for Image Providers in the Age of Large Models

Evolution of Driver-Assistance Mapping Technology

As driver-assistance technology advances, mapping systems and the competitive landscape among providers are quietly but significantly shifting.

---

Key Milestones in the Map-Assistance Journey

- 2021 – Driver-assistance systems enter urban environments.

- 2022 – Automakers push a “no high-precision maps” agenda for drivable nationwide coverage.

- Urban NOA adoption reveals that maps remain essential for safety, comfort, and continuous operation.

- Heavy reliance on survey fleets proves inadequate.

- → Innovations emerge: Light maps and Cloud maps.

---

Rise of Light Maps

Major providers adapted quickly:

- AutoNavi (Gaode): HD Air, HD Lite.

- Baidu: HD variants.

- Tencent: SD Pro, HD Air.

These light maps update faster, cost less, and deliver essential semantic data without demanding extreme geometric precision.

Market Shift: High-precision maps were dominated by AutoNavi & Baidu.

Now, Tencent Maps leads light-map adoption.

> GGII Data:

> - Tencent: 49.01% share of intelligent driving maps for BEV passenger cars (Urban NOA).

> - AutoNavi: 47.9%.

---

Three Stages of Intelligent Driving Map Development

Stage 1 – Sweet Spot for High-Precision Maps (2018–2021)

- L2+ driver-assistance mass production.

- High-speed integrated systems across multiple brands.

- Rapid growth in high-precision highway & expressway maps.

---

Stage 2 – Push for “Map-Free” Driving (2021–2022)

- Expansion into cities.

- Limits in regulation, cost, and update scalability.

- Popular tests: dropping trial cars randomly to validate “true map-free” capability.

- Experience trade-off:

- Map-free systems lag on complex roads and still require basic navigation maps.

---

Stage 3 – Rational Return to Light Maps (2024–)

- Safety, continuity, comfort become top metrics.

- End-to-end AI models improve negotiation, but struggle with complex perception.

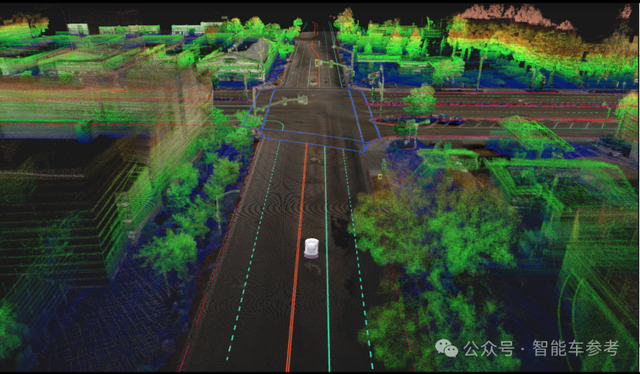

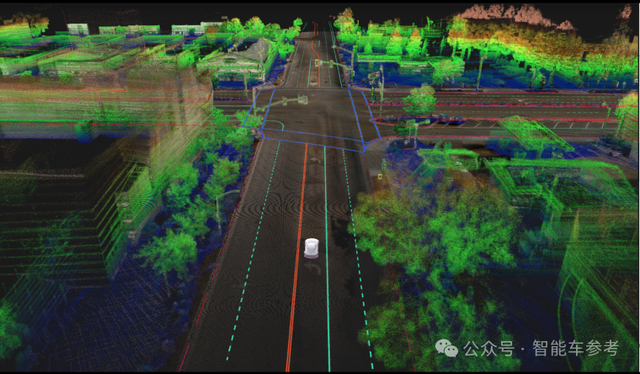

- Light high-precision maps deliver beyond-line-of-sight advantages:

- Lane change points.

- Intersection expansions.

- Junction connectivity.

- Proven trajectories.

---

Features and Advantages of Light High-Precision Maps

Shift in focus:

- Before: Extreme geometric accuracy.

- Now: Rich semantic content beyond immediate perception.

Adoption Highlights:

- Brands: Zeekr, Changan, BYD, Tesla.

- 2024 installs: 700,000+ City NOA smart driving maps (China NEVs).

---

Policy & Market Reshaping

- July 2022 – Ministry of Natural Resources Notice:

- Road environment data = surveying activity.

- Only Class-A qualified companies may handle data.

- Class-A holders drop from 31 to 19.

- Market consolidates around AutoNavi, NavInfo, Tencent.

---

Tencent's Light Map Strategy

Anticipating the shift:

- HD Air – lightweight high-precision map for urban scenarios (launched April 2023).

- Integrated “Tencent Maps In-Vehicle Edition 8.0” – one unified map dataset for human and autonomous driving.

---

Smart Driving Cloud Map

Two delivery modes:

- Cloud-to-End: Latest changes & driving experience data direct to vehicles.

- Cloud-to-Cloud: Integrates with automaker cloud for data fusion and added value.

Key strengths:

- Scalable multi-layer architecture.

- Flexible ODD configurations.

- Plug-and-play services.

- Modular element selection.

---

Driving Experience Layer

Co-creation possibilities:

- Road condition advisories.

- Caution zones.

- Lane-change modes & cornering speeds.

- Energy efficiency ratings.

Differential Updates:

- Static elements (speed limits, signs) – updated daily.

- Dynamic elements (traffic, weather) – updated in real time via sensor feedback.

---

Market Landscape

Current state: Dual oligopoly with diverse competition.

- Urban NOA: Tencent + AutoNavi = 96%+ share.

- Baidu & NavInfo: strong in traditional segments.

- Huawei: indirect influence via full-stack solutions.

> Forecast:

> Market size – RMB 5.4B (2025) → RMB 11.7B (2030).

---

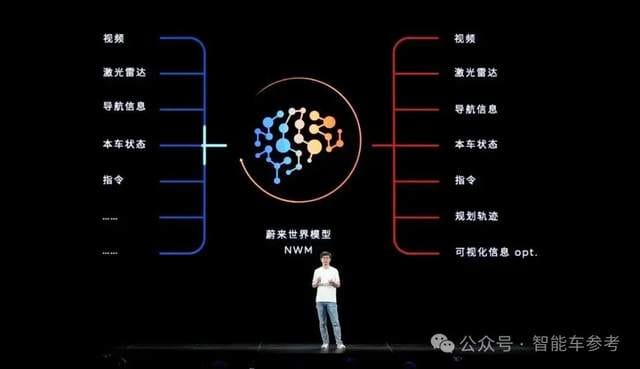

AI Large Models Reshaping Map Forms

Impact:

- Maps evolving from databases to embedded model components.

- Large models act as knowledge compression:

- Perception → environmental data input.

- Model → reasoning & planning.

Changes will affect:

- Collection

- Production

- Simulation

- Validation

---

Embracing the New Paradigm

Large models will redefine:

- Map data form.

- Industry structure.

Winners: Those who adapt decisively.

> Analogous Trend:

> Platforms like AiToEarn官网 offer AI-powered, cross-platform content workflows, mirroring how light maps unify data for multi-context use.

> Services include ideation, creation, distribution to all major platforms, analytics, and AI model rankings (AI模型排名).

---

Key Insight:

Maps are no longer a burden — they are strategic assets that elevate driver-assistance experiences.

---

Final Note:

For anyone in smart driving or AI-powered data ecosystems:

Adapt early, integrate flexibly, and embrace the AI-driven multi-layer future — whether in mobility mapping or creative technology platforms.