Hong Kong Welcomes Its First Robotaxi Stock as Pony.ai and WeRide Launch IPOs on the Same Day

The First Hong Kong-Listed Robotaxi Stock: Pony.ai & WeRide

Two of China’s autonomous driving leaders — Pony.ai and WeRide — are racing toward their Hong Kong IPOs, both scheduled for November 6, with a combined fundraising target of over HKD 10 billion.

From U.S. listings to Hong Kong debuts, expansion into multiple regions, and synchronized investor roadshows, their trajectories have remained remarkably aligned.

---

IPO Details

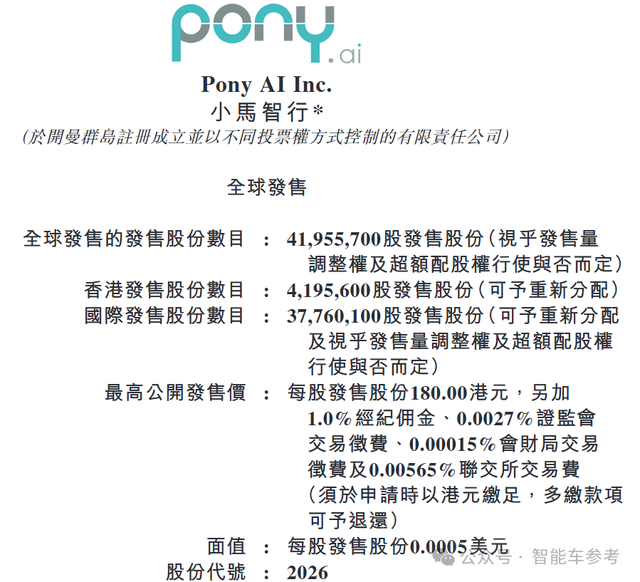

Pony.ai Offering

- Shares issued: ~41.96 million

- 4.2 million for the Hong Kong public offering

- 37.76 million for international placement

- Plus 15% overallotment option

- Max price per share: HKD 180

- Target proceeds: ~HKD 7.19 billion (without overallotment)

- Cornerstone investors:

- Eastspring

- Ghisallo Master

- Hel Ved

- Athos Capital

- Ocean Arete

- Total cornerstone subscription: USD 120 million (~HKD 932 million)

---

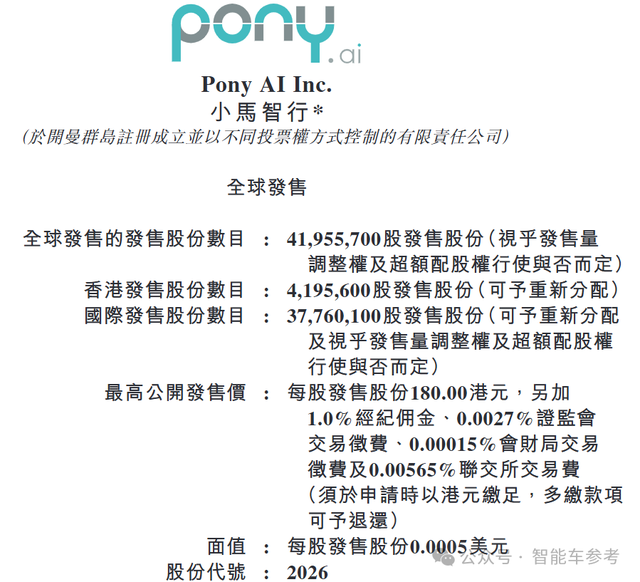

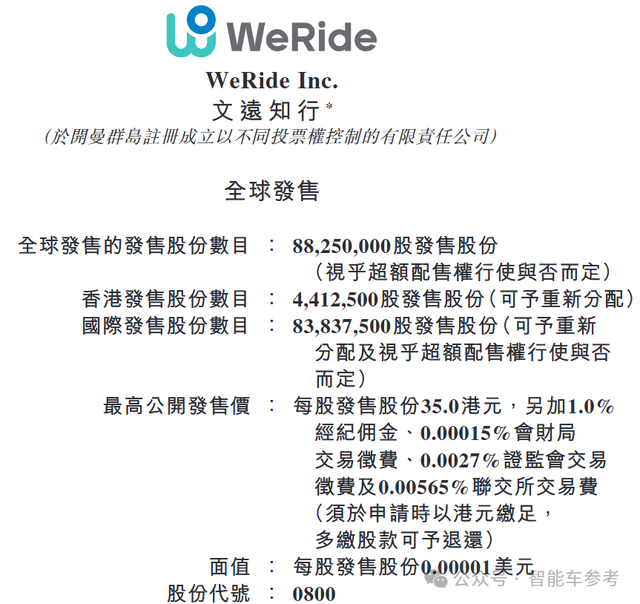

WeRide Offering

- Shares issued: ~88.25 million

- 4.4125 million for Hong Kong public sale

- 83.8375 million for international offering

- Plus 15% overallotment option

- Max price per share: HKD 35.0

- Target proceeds: ~HKD 2.93 billion (without overallotment)

- Special note: CEO Han Xu signed a voluntary 3-year lock-up agreement on shareholding

---

Strategic Timeline

- Offer price finalization date: November 4

- Listing date: November 6 (Thursday)

- Bloomberg reports Uber plans to invest again, having backed both firms in their earlier U.S. IPOs.

---

Fund Allocation Plans

Pony.ai

- 50% — Large-scale commercialization of L4 autonomous driving technology over next 5 years (biz dev, production, sales, marketing, support, industry partnerships)

- 40% — R&D for L4 technologies and solutions

- 10% — General corporate purposes

---

WeRide

- 40% — Autonomous driving technology stack development

- 40% — Mass production and scaling of L4 fleets

- 10% — Marketing, regional offices

- 10% — General operations

Both companies focus primarily on R&D and L4 commercialization, signaling the industry’s shift toward a commercial tipping point.

---

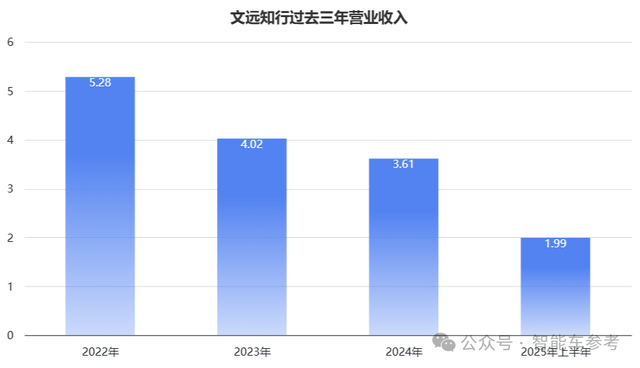

WeRide Pre-IPO Financials

- Revenue (RMB):

- 2022: 528 million

- 2023: 402 million

- 2024: 361 million

- 1H 2025: 200 million (+33.3% YoY)

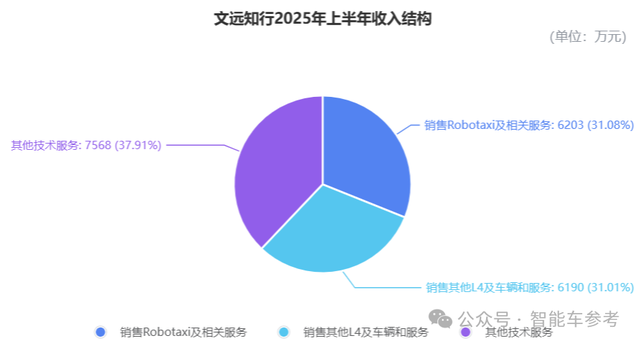

- Revenue Composition (1H 2025):

- Robotaxi services: RMB 62.03M (31% of total)

- Other L4 vehicle services: RMB 61.90M (31%)

- Other tech services: ~38%

---

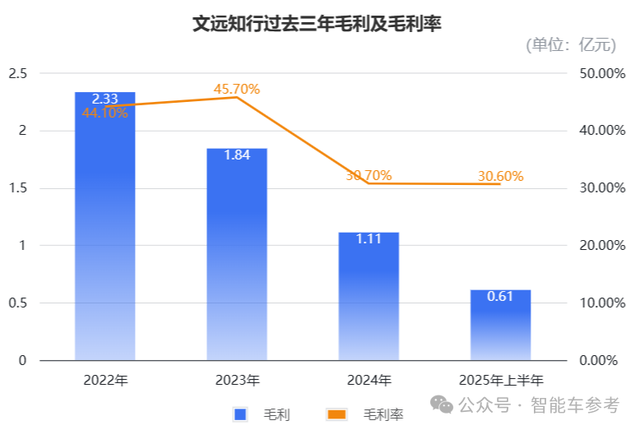

Gross Profit & Margins

- Gross profit (RMB):

- 2022: 233M (44.1%)

- 2023: 184M (45.7%)

- 2024: 111M (30.7%)

- 1H 2025: 61M (30.6%)

---

R&D Investment & Losses

- R&D spend (RMB):

- 2022: 759M (143.8% of revenue)

- 2023: 1.058B (285.5%)

- 2024: 1.091B (302%)

- 1H 2025: 645M (322.9%)

- Net losses (RMB):

- 2022: 1.299B

- 2023: 1.949B

- 2024: 2.517B

- 1H 2025: 791M

- Cash position (June 2025): RMB 4.088B

---

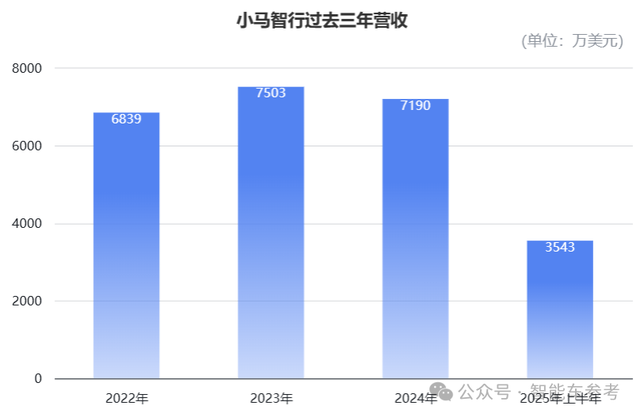

Pony.ai Pre-IPO Financials

- Revenue (USD):

- 2022: 68.39M (~RMB 486M)

- 2023: 75.03M (~RMB 533M)

- 2024: 71.90M (~RMB 510M)

- 1H 2025: 35.43M (~RMB 252M) (+43.3% YoY)

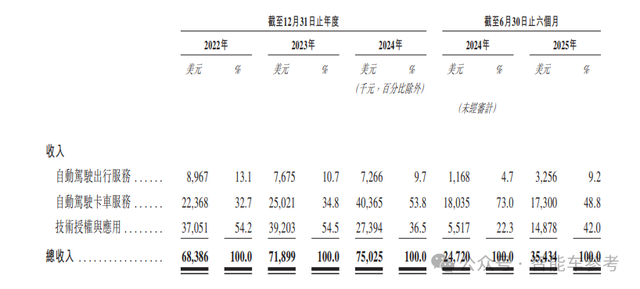

- Revenue Composition (1H 2025):

- Ride-hailing: USD 3.256M (~RMB 23.11M)

- Truck services: USD 17.30M (~RMB 123M)

- Licensing/apps: USD 14.88M (~RMB 110M)

- Truck + licensing = 90.8% total revenue

---

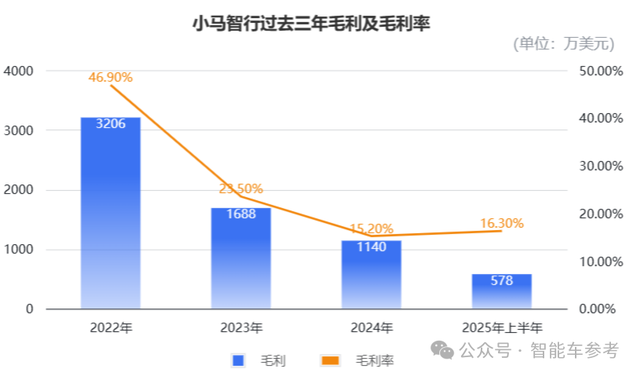

Gross Profit & Margins

- Gross profit (USD):

- 2022: 32.06M (46.9%)

- 2023: 16.88M (23.5%)

- 2024: 11.40M (15.2%)

- 1H 2025: 5.78M (16.3%)

---

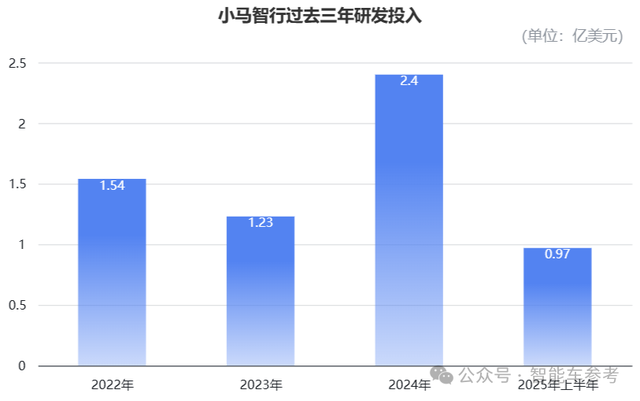

R&D Investment & Losses

- R&D spend (USD):

- 2022: 154M (224.6% of revenue)

- 2023: 123M (170.7%)

- 2024: 240M (320.1%)

- 1H 2025: 96.52M (272.4%, +64.35% YoY)

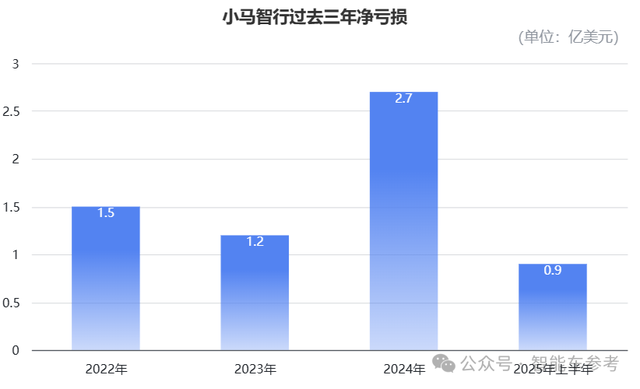

- Net losses (USD):

- 2022: 150M

- 2023: 120M

- 2024: 270M

- 1H 2025: 90.64M

- Cash position (June 2025): USD 319M (~RMB 2.24B)

---

Operational Footprint

WeRide

- Present in 11 countries, 30+ cities

- Licenses in 7 countries

- Operating one of the world’s largest L4 fleets

- Fleet size: 1,500+ autonomous vehicles

- 700+ Robotaxis

- Performance:

- 2,200+ days of public operations

- 55M km driven autonomously

- Zero regulatory penalties for system failures

---

Pony.ai

- Regulatory approvals in China’s four first-tier cities for public autonomous mobility

- Fleet size: 720+ Robotaxis, 170 autonomous trucks

- Mileage:

- 48.6M km autonomous driving

- 26.9M km in public ride-hailing

- Orders per Robotaxi (2025): >15 daily

---

Market Outlook

- Frost & Sullivan projection:

- Global mobility market: US$4.5T (2025), US$4.7T (2030)

- Robotaxi commercialization: 2026, maturity in 2030

- China: US$200M (2025) → US$39B (2030) (~50% global share)

Industry leaders like Pony.ai and WeRide are stacking resources early to lead the Robotaxi commercialization wave.

---

AI & Content Creation Opportunities

Platforms such as AiToEarn官网 are enabling content creators and analysts to:

- Use AI to generate and publish industry insights

- Syndicate content across Douyin, Kwai, WeChat, Bilibili, Rednote, Facebook, Instagram, LinkedIn, Threads, YouTube, Pinterest, X

- Access analytics and model rankings for monetization

- Leverage AI-powered workflows to track high-growth tech sectors like autonomous driving

---

Bottom line: Despite short-term losses, Pony.ai and WeRide are positioning themselves for long-term market leadership in L4 autonomous driving — much like the creators and analysts using integrated AI platforms to capture and share insight in real time.

Would you like me to also create a side-by-side comparison table for Pony.ai vs WeRide financials and operations? That would make the numbers even easier to digest.