How to Create a Social Media Listening Report Guide

Learn how to create a social media listening report by setting goals, choosing tools, tracking keywords, and analyzing sentiment and engagement.

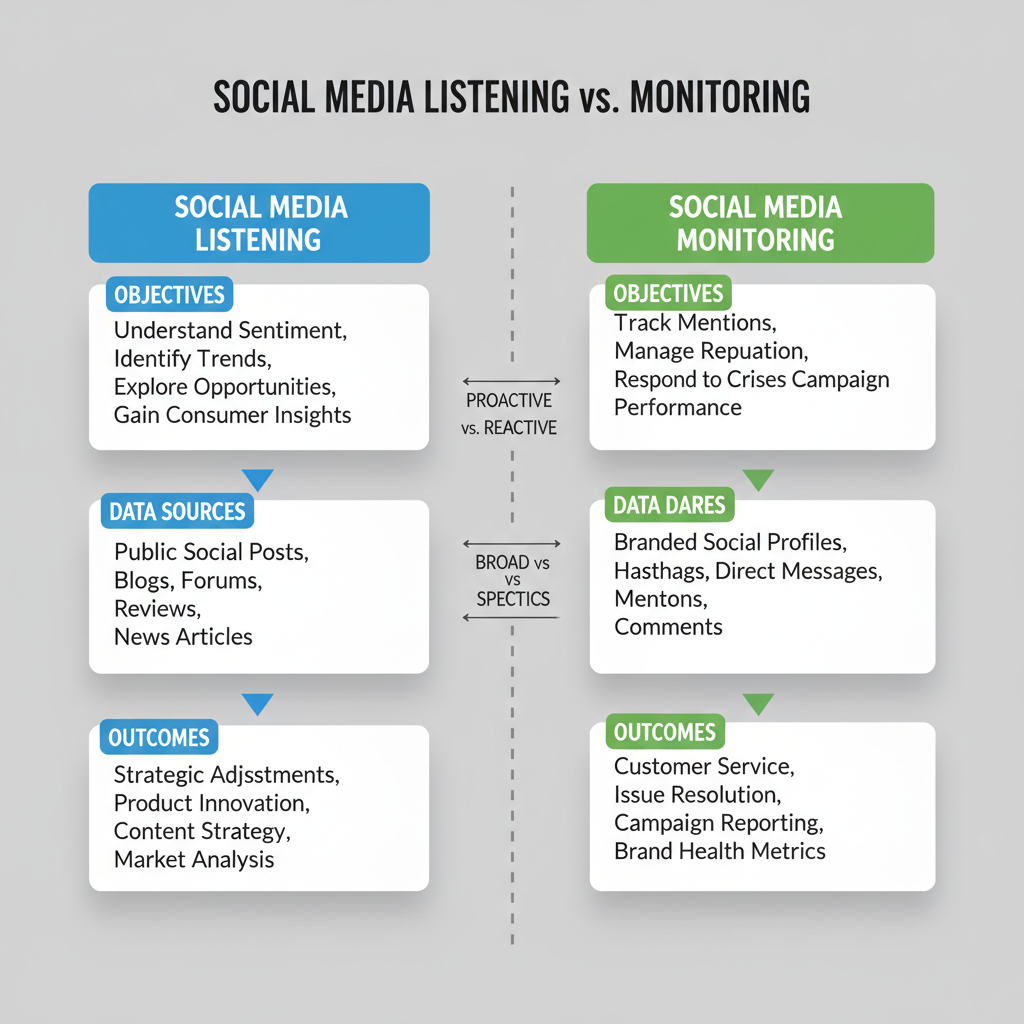

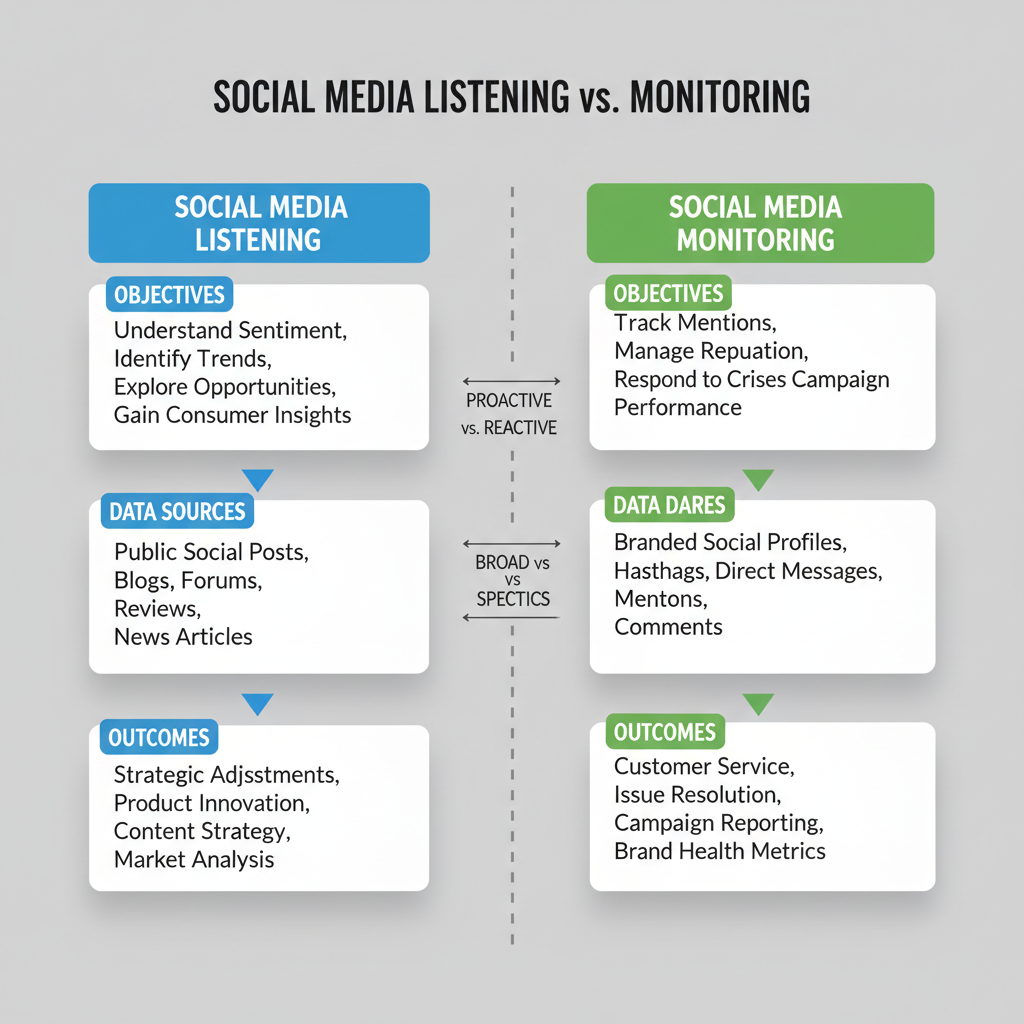

Understanding Social Media Listening vs. Social Media Monitoring

In the fast-paced world of digital marketing, knowing the difference between social media listening and social media monitoring is crucial for building effective communication strategies. Social media listening is about analyzing and understanding online conversations to reveal trends and insights, while monitoring focuses on tracking metrics and mentions in real-time. Combining these approaches helps brands respond quickly to customer needs and plan strategically for long-term growth.

Social media monitoring tracks specific metrics like mentions, likes, comments, and shares in real time. It’s reactive — enabling quick responses to customer questions or complaints.

Social media listening is proactive and analytical, examining online discussions that may not directly mention your brand. It measures sentiment, detects trends, and reveals opportunities or threats by analyzing the broader market conversation.

By integrating both listening and monitoring, businesses can both maintain responsive customer service and gather valuable intelligence for future campaigns.

---

Setting Clear Goals for Your Social Media Listening Report

Before drafting your social media listening report, define your objectives. Common goals include:

- Assessing brand sentiment — gauging audience feelings toward your brand and products.

- Spotting industry trends — identifying emerging topics, hashtags, or content formats.

- Gathering competitor intelligence — monitoring rival campaigns, customer feedback, and keyword presence.

- Evaluating campaign impact — measuring how well a marketing initiative resonates.

- Uncovering customer needs — capturing suggestions, complaints, or praise to guide improvements.

Clear, measurable goals will lead your process from data collection through to final recommendations.

---

Choosing the Right Listening Tools and Platforms

Selecting the right tools is vital for accurate data and actionable insights. Ideal solutions offer:

- Multi-platform coverage — Tracking conversations across major social networks.

- Advanced filtering — Isolating relevant keywords, excluding spam, segmenting data.

- Sentiment analysis — Automated detection of emotional tone.

- Custom reporting — Flexible dashboards and exportable formats.

- Historical data access — Reviewing past trends for context.

Popular tools include Brandwatch, Sprout Social, Hootsuite Insights, Talkwalker, Meltwater, and Mention.

---

Identifying Target Keywords, Hashtags, and Brand Mentions

The foundation of your listening report is the right data points. Build a target list that includes:

- Brand names and variations (including common misspellings)

- Key product/service names

- Campaign slogans

- Relevant industry terms

- Competitor brand names

- Branded and trending hashtags

- Event names related to launches or conferences

Update your keyword and hashtag list regularly to capture new trends and competitors.

---

Collecting Data Across Multiple Channels

Comprehensive listening means monitoring platforms where your audience is active:

- Twitter/X — High-speed trend spotting and news tracking.

- Facebook — Group discussions and community feedback analysis.

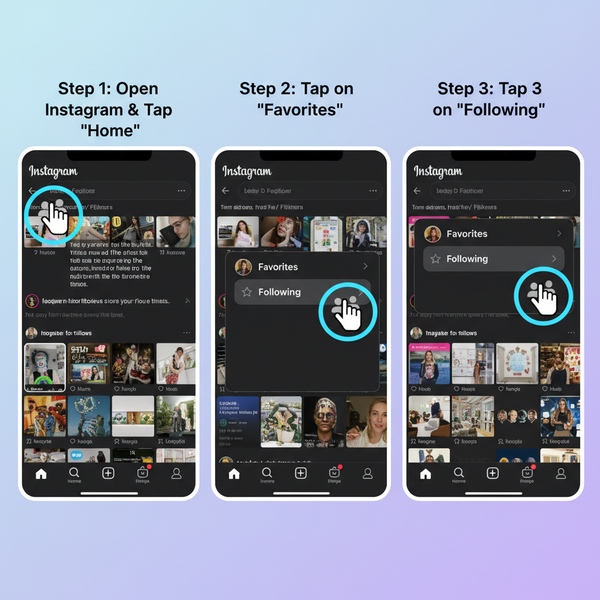

- Instagram — Visual trends and influencer campaigns.

- LinkedIn — Professional conversation sentiment for B2B insights.

- TikTok — Viral content and Gen Z engagement patterns.

- YouTube — Video comments and influencer narratives.

Choose tools that integrate with APIs for these networks to ensure breadth of coverage.

---

Analyzing Sentiment, Engagement Metrics, and Share of Voice

After collecting data, move to deep analysis. Focus on:

- Sentiment Breakdown — Positive, neutral, negative distribution.

- Engagement Rate — Likes, comments, shares, click-throughs relative to reach.

- Share of Voice (SOV) — Comparing your mentions to competitors.

Example report table:

| Metric | Brand A | Brand B | Industry Avg. |

|---|---|---|---|

| Positive Sentiment (%) | 65 | 54 | 58 |

| Negative Sentiment (%) | 12 | 20 | 15 |

| Share of Voice (%) | 38 | 42 | - |

---

Visualizing Findings with Charts, Graphs, and Word Clouds

Effective visualizations help stakeholders grasp insights quickly:

- Pie charts for sentiment distribution

- Line graphs to show trends over time

- Bar charts for engagement comparisons

- Word clouds highlighting frequent keywords

Use tools like Tableau, Power BI, or built-in visualization features for clear, compelling charts.

---

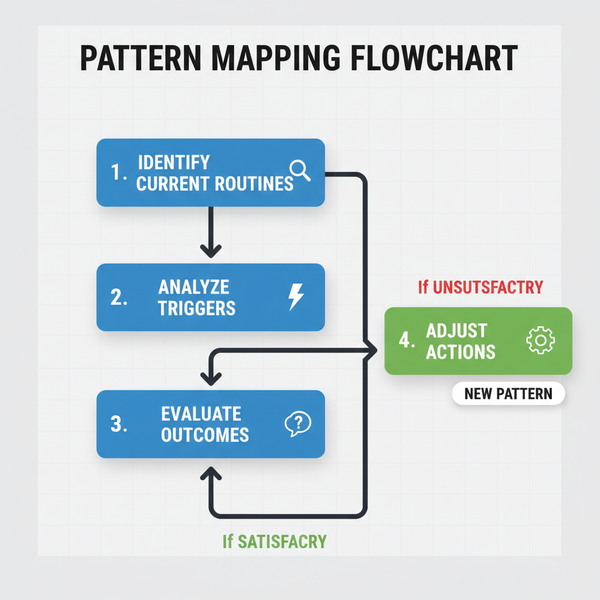

Interpreting Insights to Reveal Opportunities and Threats

Data alone is not enough. Interpretation turns raw metrics into strategy:

- Opportunities — Rising positive sentiment after a launch validates tactics; trending hashtags inspire new content.

- Threats — Increasing negative sentiment signals potential product or PR issues.

- White space — Topics untouched by competitors serve as content opportunities.

Make connections between patterns and actionable decisions.

---

Turning Insights into Actionable Recommendations

Go beyond data presentation. Recommend:

- Content themes based on popular discussions.

- PR measures to counter negative sentiment.

- Product changes informed by customer feedback.

- Competitive strategies when rivals gain share of voice.

Actionable guidance empowers teams across marketing, PR, and product.

---

Formatting the Report for Clarity

A professional report structure improves comprehension. Include:

- Executive Summary — Key findings and actions condensed to one page.

- Methodology — Tools, keywords, channels, and time frame.

- Detailed Findings — Charts, tables, and critical takeaways.

- Recommendations — Strategic and tactical next steps.

- Appendices — Raw data, keyword lists, supplementary visuals.

Proper formatting ensures your report is clear, concise, and audience-friendly.

---

Establishing a Regular Reporting Schedule and KPIs

Social conversations evolve rapidly, so create a consistent schedule (monthly, quarterly) and track key KPIs:

- Sentiment improvement rate

- Engagement growth percentage

- Share of voice changes

- Campaign-specific performance shifts

Regular reporting ensures adaptability and proactive strategy development.

---

Common Mistakes to Avoid

Avoid these pitfalls to optimize your listening report:

- Data overload without context — Overwhelms readers.

- Neglecting qualitative insights — Misses the reasons behind numbers.

- Outdated keyword lists — Fails to capture new trends.

- Irregular reporting — Misses changes over time.

- Blind reliance on automation — Risks misinterpreting tone and nuance.

---

Summary & Next Steps

A well-crafted social media listening report is a strategic asset. By setting clear objectives, selecting the right tools, monitoring target keywords, analyzing sentiment, and turning insights into actionable recommendations, brands can stay ahead in competitive markets.

Regular, structured reporting keeps teams aligned and responsive to evolving trends. Start refining your listening process today to strengthen engagement, improve reputation management, and drive informed marketing strategies.