Ilya’s Shocking Testimony: Altman’s Wrongdoing, Mira’s Drama, and OpenAI’s Near-Merger with Anthropic

Silicon Valley Drama — Altman, Musk, and Ilya

The saga of Sam Altman, Elon Musk, and Ilya Sutskever continues — Silicon Valley’s very own _“Empresses in the Palace”_, a tangled mix of ambition, rivalry, and philosophical clashes.

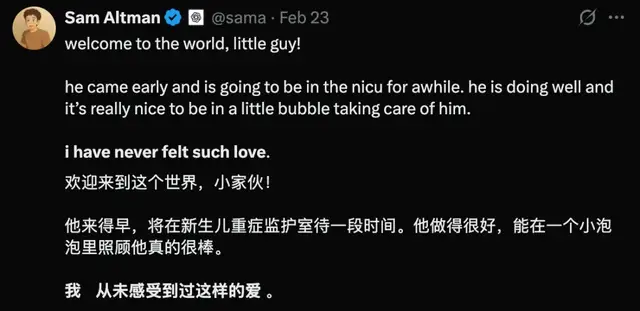

Altman Breaks Silence on His OpenAI Equity

Altman recently made a rare public comment on his zero equity stake in OpenAI:

> I really wish I had accepted equity earlier — that would have put a big dent in all the conspiracy theories.

Sharp-eyed observers have long noted that Altman holds no shares in OpenAI — something he had never explained in detail until now.

The trigger? A newly revealed 52-page testimony from Ilya, recounting the boardroom intrigue around Altman’s past ouster — testimony spurred by none other than Elon Musk.

---

The Social Media Exchange

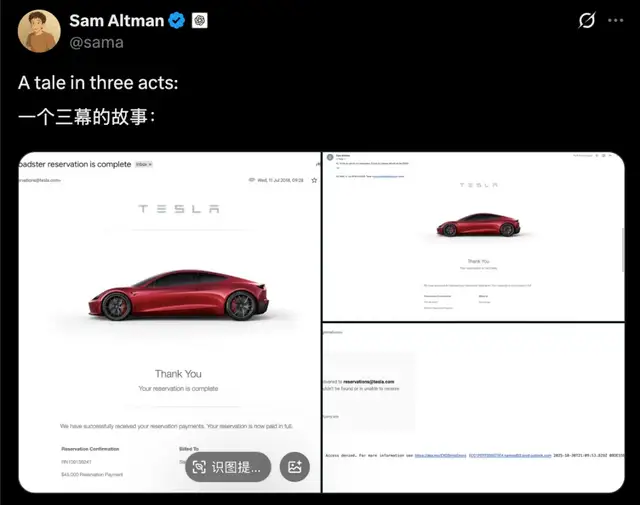

- Altman’s Tesla Refund Receipt

- Altman shared a screenshot of his Tesla order refund — seven years after purchase, with no car ever delivered.

- Musk’s Response

- Musk claimed the refund was processed within 24 hours — then accused Altman directly:

- > You stole a non-profit organization.

- Musk Escalates

- Reposting Ilya’s deposition, Musk poured fuel on the fire:

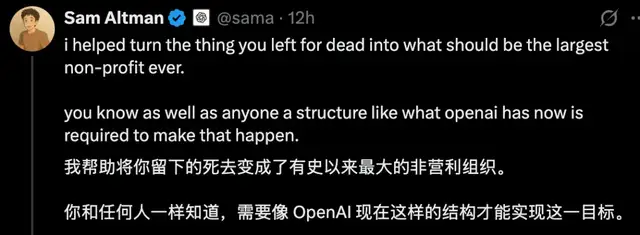

- Altman’s Counterattack

- Altman replied that he had turned Musk’s “legacy” into the world’s largest nonprofit and defended the restructuring process:

---

Regret, but Driven by Passion

Altman’s no-equity stance dates back to 2019, when OpenAI restructured into the capped-profit LP model.

At that time:

- He became CEO with no shares.

- Earned only a base salary — rare in Silicon Valley.

Even when reports suggested the board might grant him 7% equity, the official announcement once again confirmed zero holdings.

Why No Equity?

Altman has often stated:

- He’s already financially secure from ventures like Loopt, Reddit, and multiple investments.

- His motivation is love of technology — not money.

Yet in his latest statement, Altman:

- Concedes not accepting equity may have been a mistake, as it fuels speculation.

- Emphasizes his belief in shaping “the course of technology and society.”

Personal Challenges

- Calls OpenAI’s work “the most important scientific mission of our generation.”

- Admits it’s “excruciatingly painful” and he has considered quitting.

- Notes that having children has made sustaining his workload harder.

---

OpenAI’s Special Equity Rule — Power Over Profit

OpenAI’s governance ensures that non-shareholding board members can vote when the safety mission conflicts with profit motives.

This means:

- Altman’s lack of equity may actually increase his decision-making neutrality.

- He can prioritize “Safety first” over rapid commercialization — a stance investors often resist.

Still, Altman has indirect ties:

- Investments in OpenAI partners like Rain Neuromorphics.

- Past indirect holdings via Sequoia Capital.

---

The Cost of Zero Shares

OpenAI’s hybrid nonprofit–for-profit model has caused tension:

- Altman’s ouster was partly due to misalignment between mission and business.

- Conflicts with Musk spotlight these governance issues.

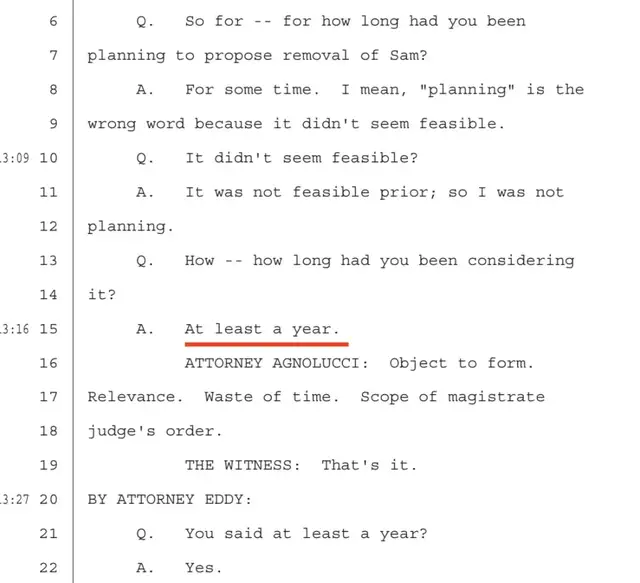

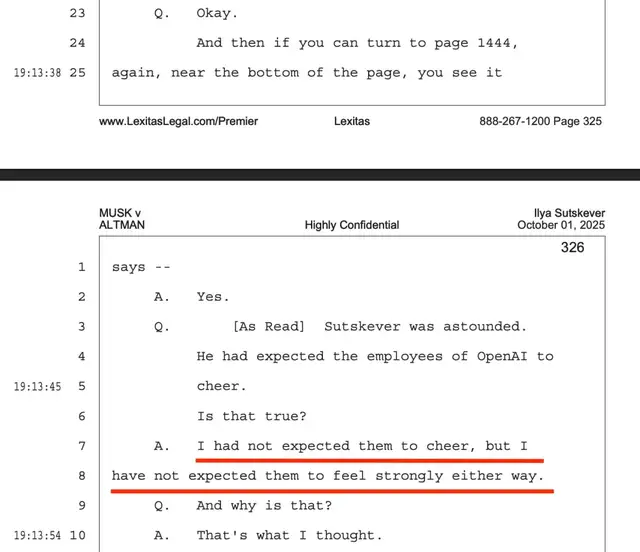

Ilya’s 52-Page Testimony

The deposition details:

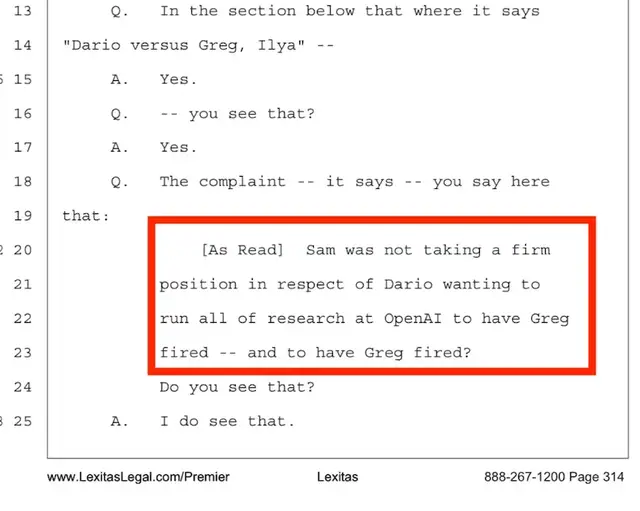

- A year-long plan by Ilya and then-CTO Mira Murati to remove Altman.

- A memo citing Altman’s alleged dishonesty and manipulation.

Examples include:

- Discrepancies over GPT-4 Turbo’s safety committee approval.

- Fostering rivalries between executives.

Ilya also claimed Mira said Altman was pushed out of Y Combinator — a statement denied publicly by co-founder Paul Graham.

Other revelations:

- Ilya documented claims of Greg Brockman’s workplace bullying.

- OpenAI once nearly merged with Anthropic.

In the end, employee backlash and threats to resign en masse led to Altman’s reinstatement.

---

Aftermath — Profit vs. Mission

Post-drama:

- Ilya left to create an AGI safety-focused company.

- Musk filed suit against Altman for “betraying” OpenAI’s nonprofit origins.

OpenAI today:

- Annual revenue exceeds $13B.

- Projected to hit $100B by 2027.

The company is reportedly mulling an IPO with a $1 trillion valuation — potentially the largest in history.

For Altman, running a nonprofit-structured company with trillion-dollar valuation may be more appealing — and powerful — than holding shares.

---

Lessons for AI Creators

In the wider AI industry:

- Balancing safety with commercial growth is crucial.

- Creators can adopt similar strategies to retain control while scaling globally.

Platforms like AiToEarn官网 exemplify this approach:

- Open-source ecosystem for AI-driven content creation & monetization.

- Supports cross-platform publishing, analytics, and AI模型排名.

- Distributes simultaneously across Douyin, Kwai, WeChat, Bilibili, Xiaohongshu, Facebook, Instagram, LinkedIn, Threads, YouTube, Pinterest, and X (Twitter).

---

References

- https://x.com/sama/status/1983941806393024762

- https://www.lesswrong.com/posts/9mp6vBwxitoZcvDmG/ilya-sutskever-deposition-transcript

- https://x.com/distributionat/status/1984924017628000296

- https://techcrunch.com/2025/11/02/sam-altman-says-enough-to-questions-about-openais-revenue/

- https://techcrunch.com/2024/12/19/sam-altman-once-owned-some-equity-in-openai-through-sequoia/

- https://www.theinformation.com/articles/openai-founder-discusses-anthropic-merger-talks-internal-beefs-deposition?rc=p2bxcy

- https://www.youtube.com/watch?v=Gnl833wXRz0

---

If you’d like, I can produce a concise timeline infographic mapping the Altman–Musk conflict, Ilya’s deposition, and OpenAI’s restructuring — this would make the events easier to follow. Would you like me to create that next?