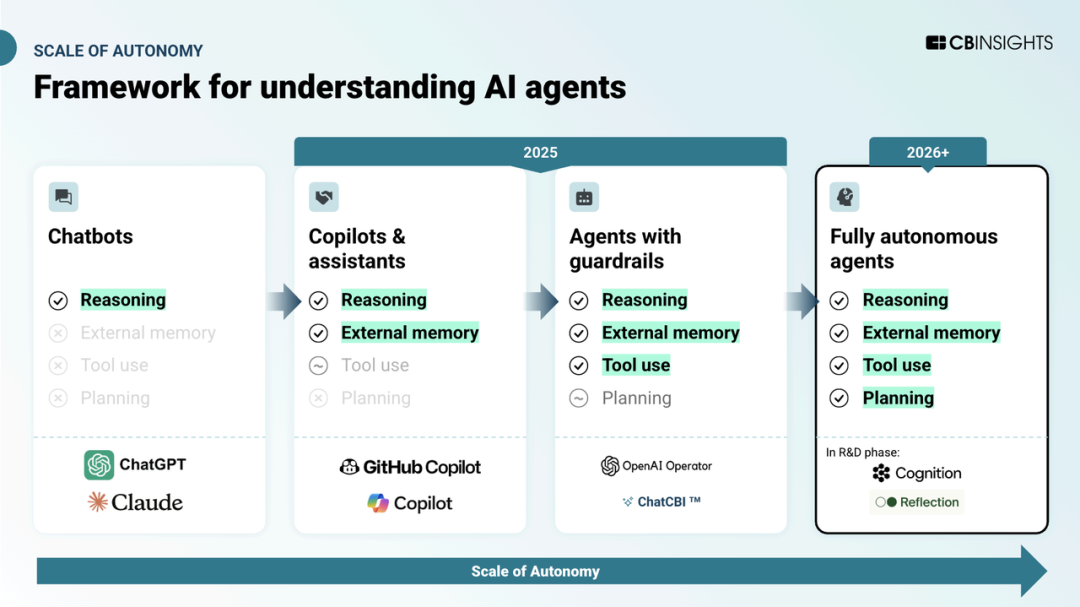

In-Depth | Key Insights from CB Insights’ 69-Page Report: Voice AI Surge and 6 Trends Shaping the New AI Battlefield

AI Agent Bible: Key Insights from CB Insights

Image source: CB Insights

This article distills the most important findings from CB Insights’ report, AI Agent Bible, which analyzes 170+ startups, big tech plays, technology stacks, and revenue trends, mapping the commercial evolution of AI Agents — from experimental prototypes to large-scale deployments.

We’ve identified four major trends reshaping business as AI Agents move toward autonomy.

---

Market Outlook: Voice AI Ignites & 6 Trends Redefine the Battlefield

> “AI Agents are evolving from ‘assistants’ to ‘autonomous agents.’ We are currently in the 2025 stage of Agents with guardrails, and will soon enter the Fully Autonomous Agents era from 2026 onwards.”

Image source: CB Insights

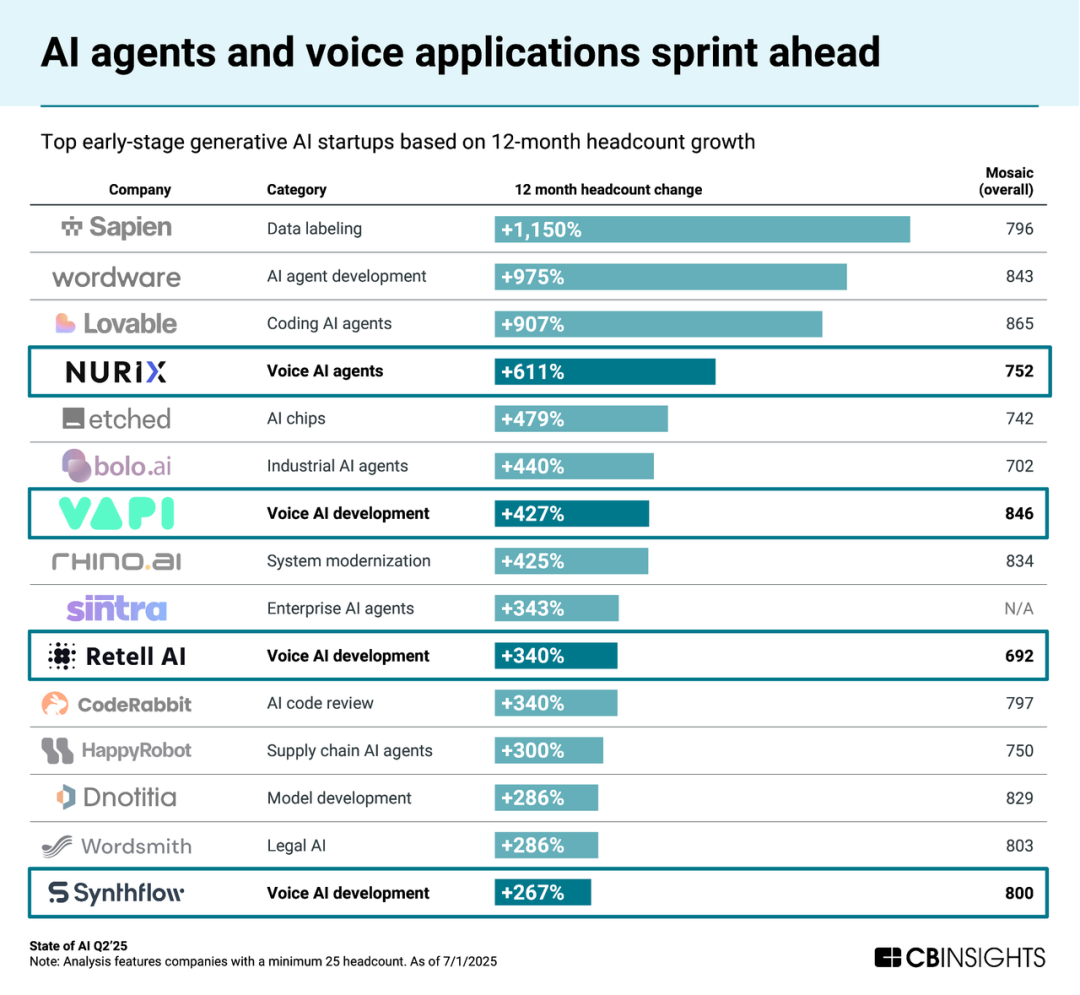

1. Voice AI Breakthrough

- Fastest-growing early-stage GenAI startups focus on voice AI.

- Meta’s 2025 acquisitions of Play AI and WaveForms AI point to rapid consolidation.

Image source: CB Insights

2. AI Agent M&A Wave

- Over 35 acquisitions in AI Agent & Copilot sectors since early 2025.

- Next likely consolidation targets: Sales, Marketing, and Coding AI companies.

3. Profit Squeeze

- Reasoning models increase output tokens by ~20×, sharply raising compute costs.

- Affects all categories — not just code generation.

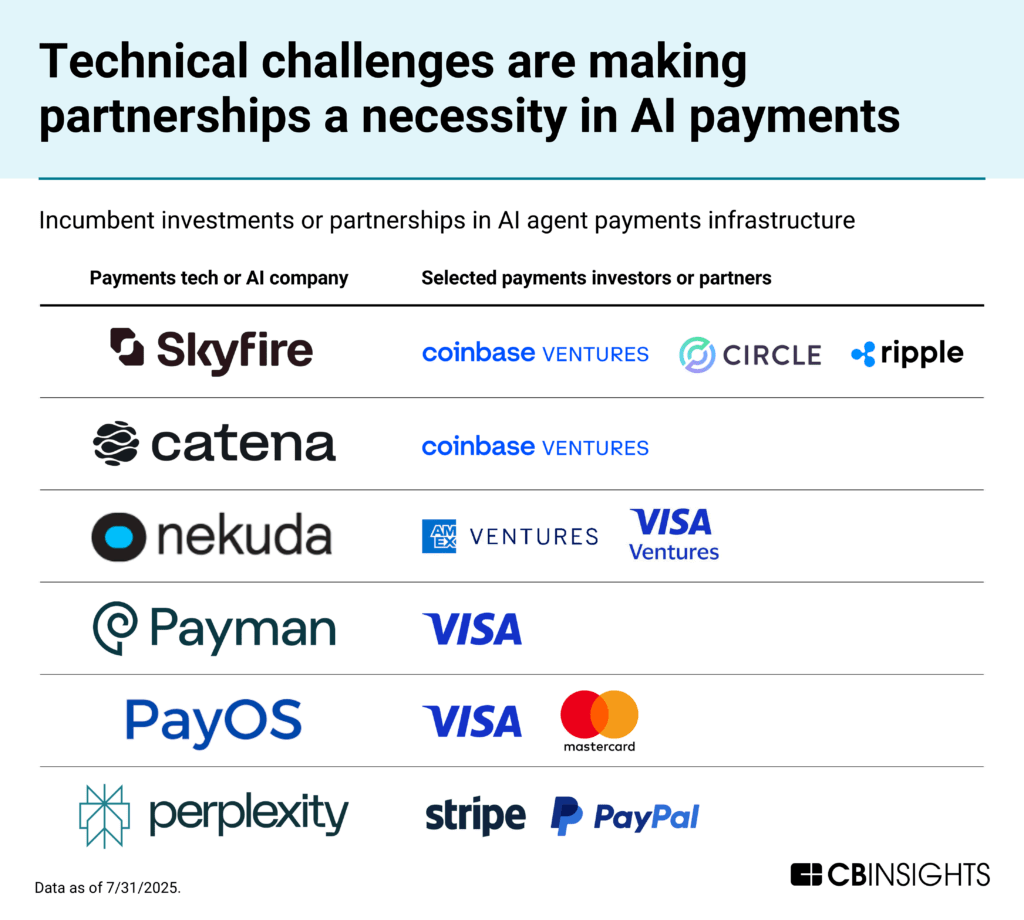

4. Agentic Commerce Accelerates

- Secure payment barriers are falling.

- “AI-native payments” emerging — Stripe launched an Agent-focused payment API in Sept 2025.

Image source: CB Insights

5. Data Moat Wars

- Software giants restrict API usage to control ecosystem data.

- Examples: Salesforce, Atlassian implementing rate limits.

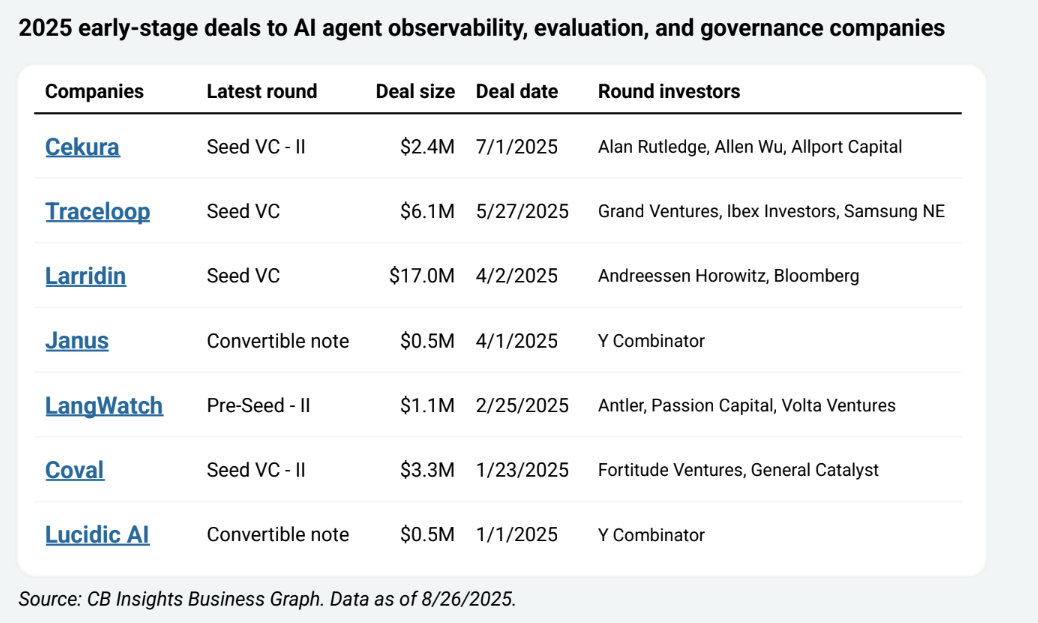

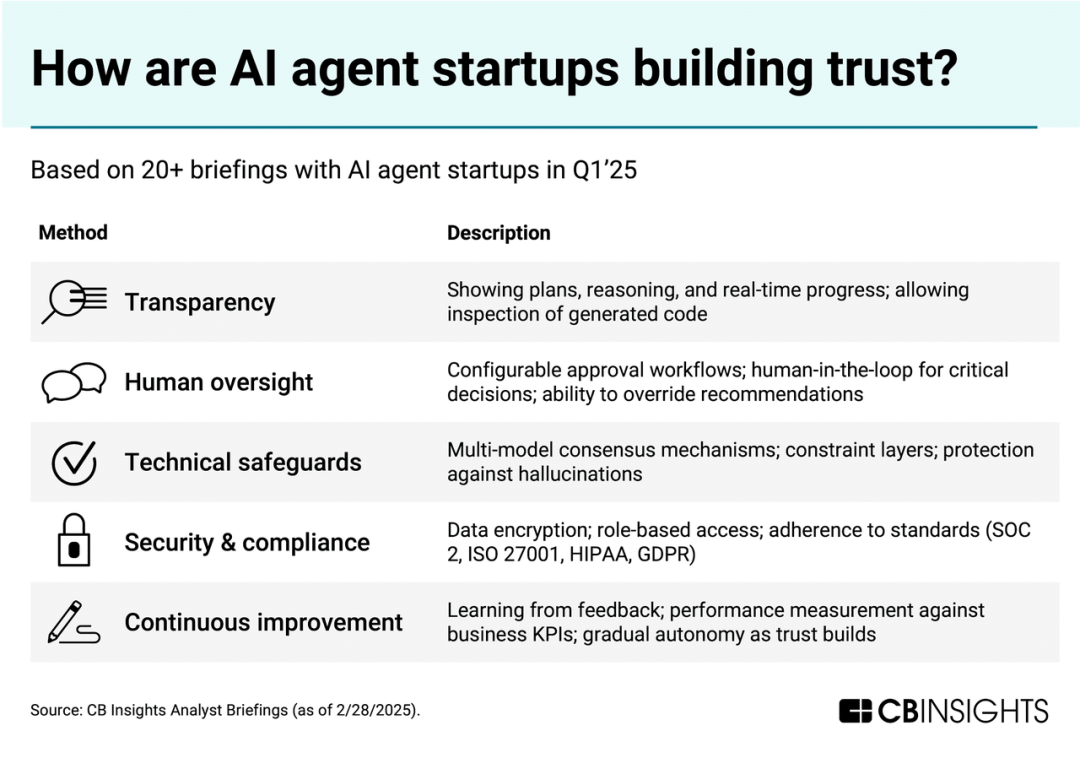

6. Oversight Tools Become Essential

- AI reliability issues (failures, hallucinations, unpredictable behavior) drive demand for monitoring & oversight tools.

Image source: CB Insights

---

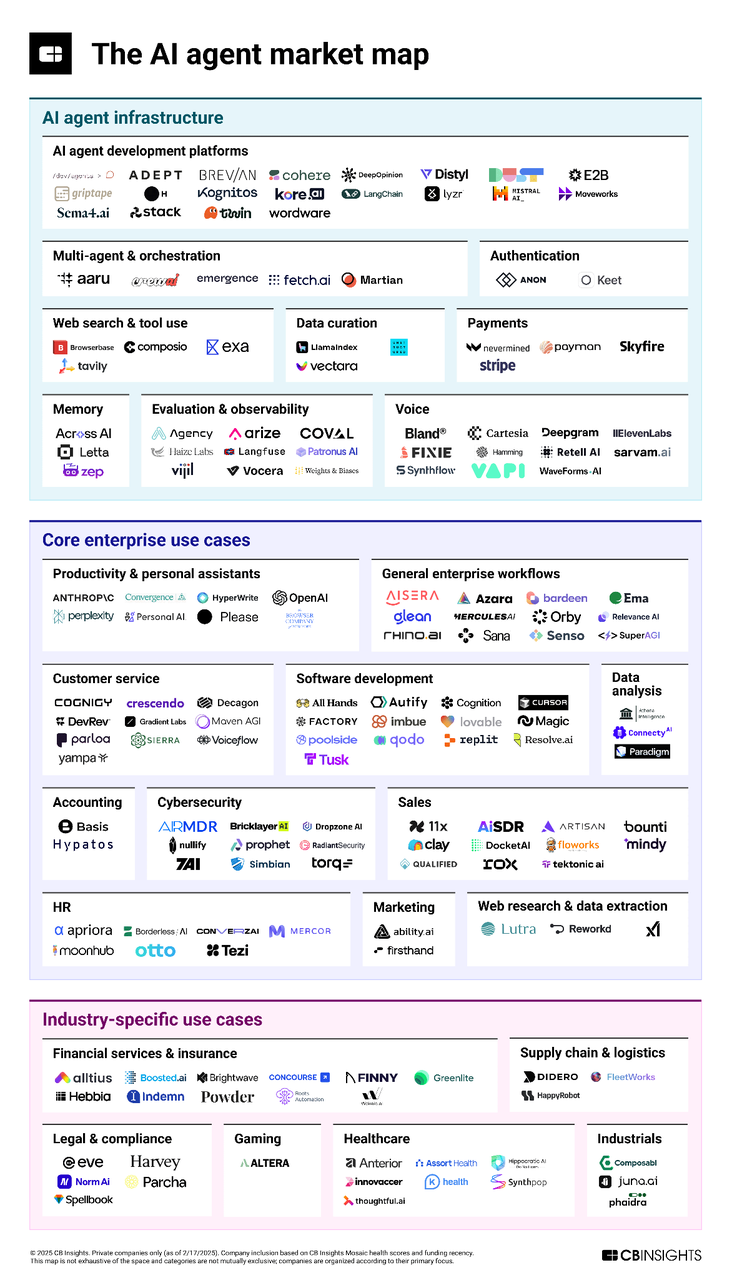

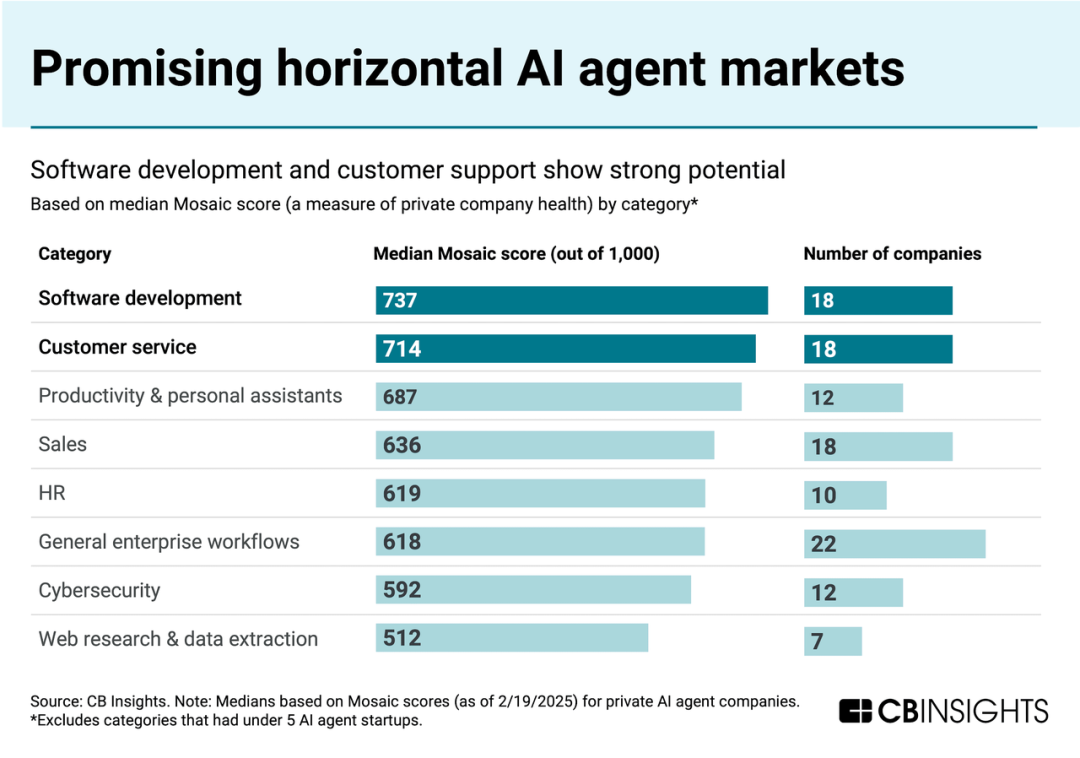

AI Agent Ecosystem: Mapping 170+ Startups & 2 Scalable Sectors

2024 saw $3.8B in funding for AI Agent startups — almost 3× 2023's total.

The shift is clear: from AI Copilots to fully autonomous decision-making agents.

Two sectors already achieving large-scale commercialization:

- Customer Service AI

- Software Development AI

Image source: CB Insights

Leading Sectors

- Software Development: Mosaic score 737

- Customer Service: Mosaic score 714

- Both thrive due to well-defined workflows and controlled test environments enabling scale.

Image source: CB Insights

---

Key Challenges & Opportunities Ahead

- Cost Control: Rising compute expenses threaten margins.

- Data Access: API restrictions limit functionality.

- Reliability: Unpredictability stalls adoption.

Platforms like AiToEarn illustrate solutions — open-source tools for AI content creation, multi-platform publishing, analytics, and monetization (AI Model Ranking).

Publishing simultaneously to Douyin, Bilibili, Instagram, X (Twitter), and more allows creators to scale without losing control over profitability.

---

Next Phase: Verticalization

Image source: CB Insights

As horizontal apps near saturation, future growth will come from industry-specific agents:

- Finance

- Healthcare

- Manufacturing

Particularly in regulated, data-sensitive sectors, vertical AI Agents will offer competitive advantage.

---

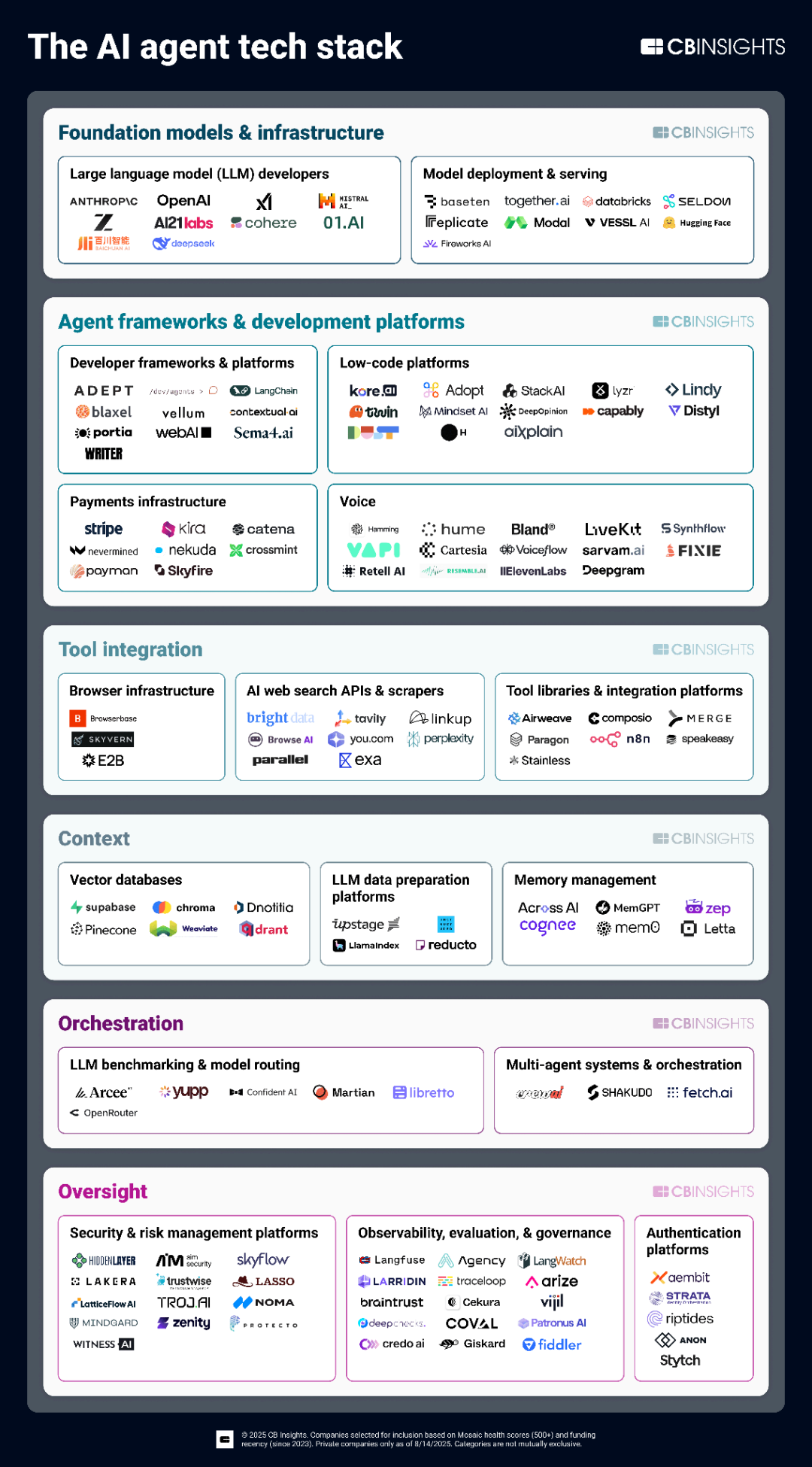

Tech Stack & $500M ARR Race

Image source: CB Insights

Revenue Leaders

- Coding AI:

- Cursor (Anysphere): $500M ARR

- Replit: $150M ARR

- Customer Service AI:

- Lower ARR but highest valuations — 219× revenue multiple vs. 80× average.

- Capital markets bet heavily on human role replacement.

Fast Scaling: These leaders reached top positions in ~3.8 years.

Infrastructure Battleground:

- Voice AI: $400M funded in 2025.

- Inter-Agent Communication Protocols:

- Anthropic (MCP)

- Google (A2A)

- IBM (ACP)

---

End of “Vibe Coding” & Rising Cost Pressures

Vibe coding = goal-based prompts (“add responsive design”), executed entirely by AI Agents.

Economic Paradox

- Growth: Reasoning models drive massive ARR boosts (Cursor: $100M → $500M in 6 months).

- Costs: Token outputs 20× higher → revenue contracts can flip from profit to loss.

- Example: $25k/year contract drops from +$22,750 to –$14,500 profit.

Result: Consolidation — 35+ acquisitions in 2025 alone as smaller startups exit.

---

Key Risks

- Reliability Failures

- Hallucination Issues

- Unpredictable Agent Actions

---

Gold Miners vs. Water Sellers

Gold Miners

- Coding AI — Revenue leader (Cursor, Replit)

- Customer Service AI — Valuation leader

New Battlefields

- Voice AI

- AI-Native Payments

- Vertical Applications (finance, healthcare, industry)

Water Sellers

- Agent Monitoring Tools — Vital for enterprise adoption

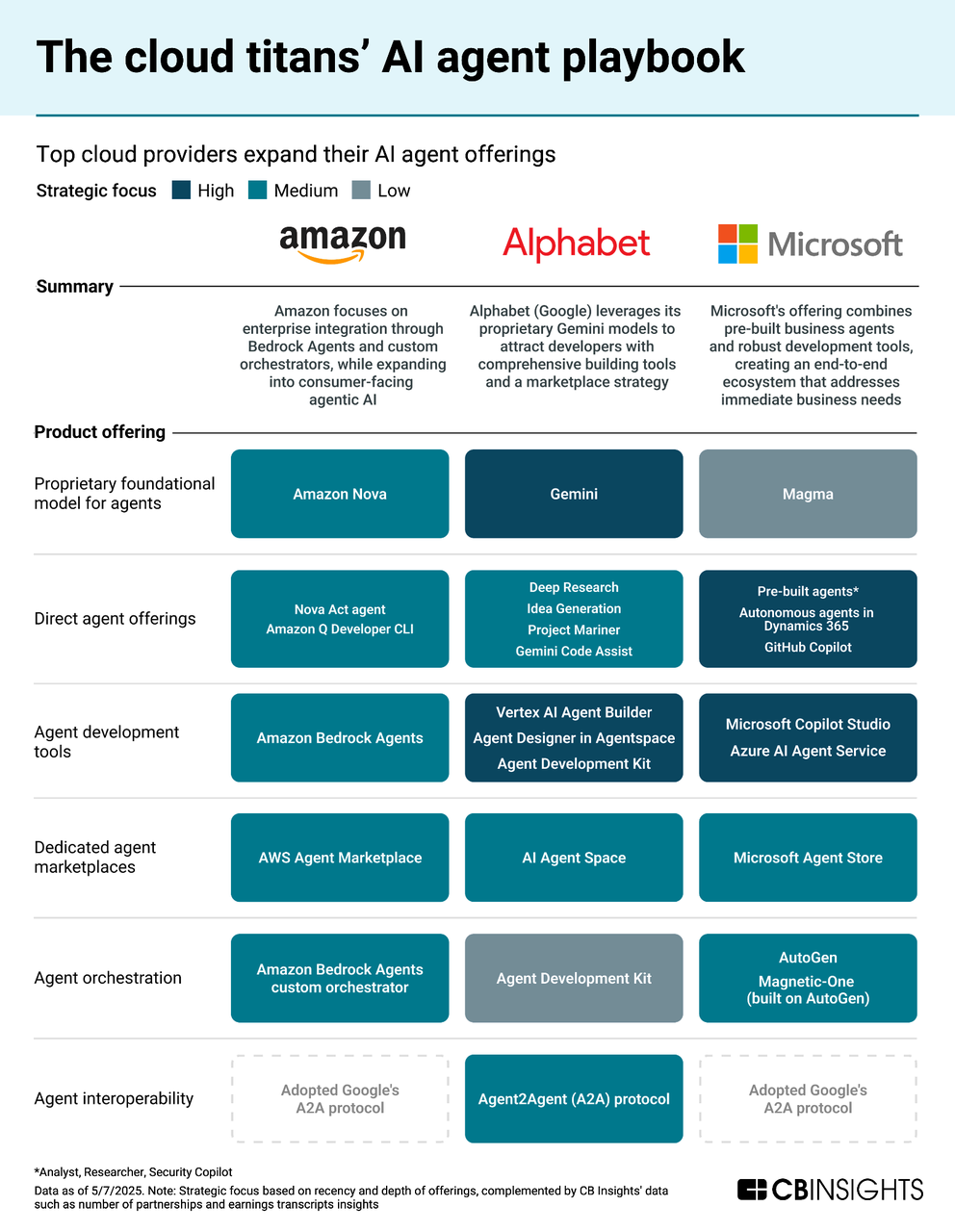

- Cloud Giants — Competing for control of the AI economy

- (Amazon, Google, Microsoft) via infrastructure, open ecosystems, and enterprise suites.

Image source: CB Insights

---

Final Takeaway

Success in the AI Agent boom demands competitive infrastructure, monetization strategies, and cost efficiency.

Open platforms like AiToEarn show how “water sellers” — infrastructure providers — can thrive by enabling generation, publishing, analytics, and ranking across major platforms from Douyin to YouTube, ensuring creativity remains scalable and profitable.

---

Original Source: CB-Insights_AI-Agent-Bible