# Greenoaks Investment Philosophy — Reducing Noise, Not Adding Complexity

> **Core belief:** Investing is not about adding complexity — it’s about focusing, cutting noise, and identifying exceptional opportunities early.

---

## Introduction

In 2025, when **Safe Superintelligence (SSI)** — founded by former OpenAI co‑founder **Ilya Sutskever** — closed a funding round at a $32 billion valuation, its lead investor **Greenoaks** drew renewed global attention.

With only a nine‑person team managing **$15 billion** in assets, Greenoaks has, over 13 years, generated **cumulative gross profit exceeding $13 billion** and achieved a **net IRR of 33%**. Its portfolio includes companies such as **Coupang**, **Figma**, and **Stripe** — each now an industry giant.

---

## Greenoaks at a Glance

- **Founded:** 2012 by Neil Mehta (ex-D.E. Shaw)

- **First Capital:** $50M seed fund

- **Strategic bet:** 40% allocated to Coupang — $8B+ eventual returns

- **Portfolio Size:** ~55 companies

- **Assets:** $15B under management

- **Team:** 9 investors

- **Approach:** “Few but exceptional” — precision selection

- **Focus Areas:** Founder quality, long-term growth potential

---

## Philosophy Overview

Neil Mehta and Greenoaks operate with several **guiding principles**:

1. **Jaw-Dropping Customer Experience (JDCE)** — Only a handful of founders create products that materially advance human civilization.

2. **Long Growth Windows** — Many historic leading tech companies sustained high growth rates for extended periods.

3. **Deep Partnerships** — Avoid broad “matrix-style” coverage. Instead, commit full resources to a small set of top founders.

---

## 01 — JDCE: Jaw-Dropping Customer Experience

### Definition

**JDCE** means delivering an unprecedented customer experience — breaking trade-offs and achieving the “impossible” in product or service quality.

### Key Points

- Saturated markets are filled with mediocre products that solve little.

- Innovators (e.g., iPhone, Uber, Stripe) scale by creating disruptive, delightful experiences.

- JDCE combines **customer-centric insight** with **technological/operational breakthroughs**.

---

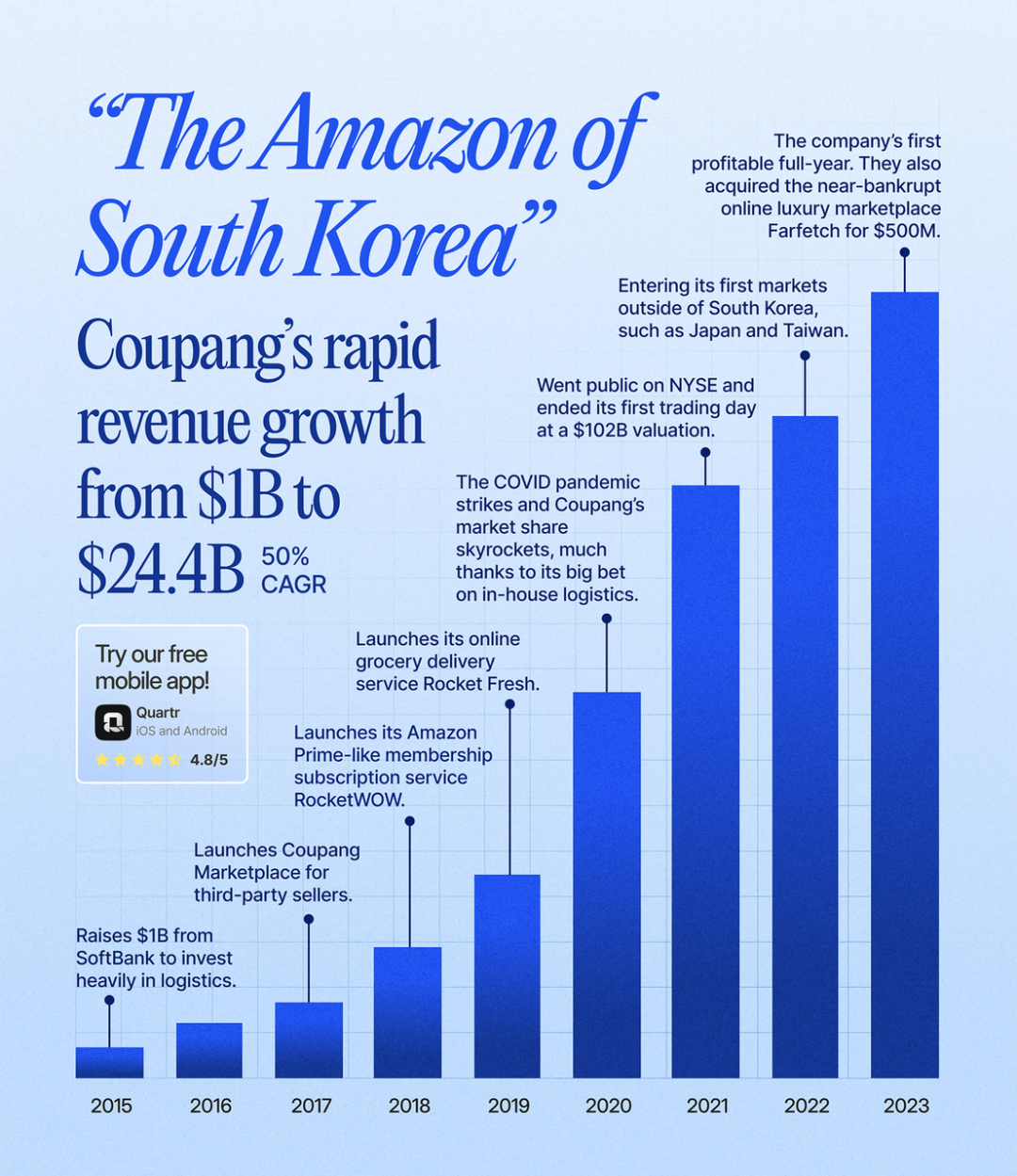

### Case Study: Coupang ("Amazon of Korea")

**Pivot:**

- Originally a marketplace, pivoted in 2013–2014 to build proprietary warehouses for control over selection, packaging, shipping.

**Advantages:**

- “Rocket Delivery” logistics network — orders arrive in 12–24 hours.

- Achieved 60% retention vs. ~30% market average.

**Operational Breakthroughs:**

1. **Unit Economics Fixes** — Addressed procurement inefficiencies.

2. **Technical Innovation** — Warehouse management + route optimization software.

3. **Operational Precision** — Optimized packaging, safe early morning deliveries.

> Example: Customer research led to delivering diapers early morning — a mother cried in gratitude for avoiding heavy box transport.

---

**Founder Traits Observed in Bom Kim (Coupang)**:

1. **Focus:** Extreme prioritization, e.g., two weeks negotiating diaper costs.

2. **Ambition:** Credible plan to build the world’s best e-commerce logistics network.

---

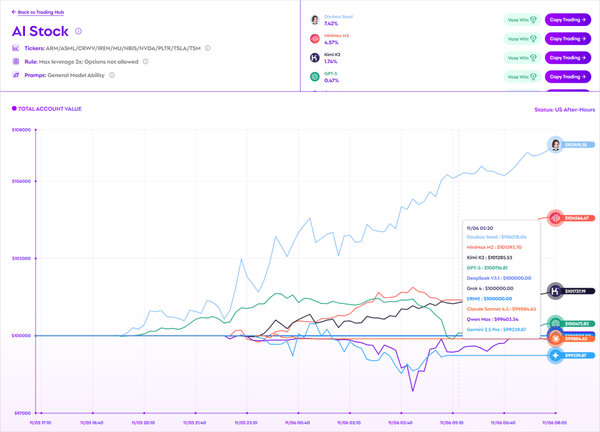

## 02 — Capacity for Sustained High Growth

**Observation:**

The best companies can **maintain high growth rates over many years**, compounding value and redirecting free cash flow from incumbents.

**Key Differentiators:**

- **Growth endurance** — Ability to sustain 80–90% of prior-year growth rates.

- Using **high-pressure environments** to drive faster iteration and problem-solving.

---

**Bits vs. Atoms**:

- **Bits:** Digital/software companies — scale unconstrained by physical infrastructure.

- **Atoms:** Physical/logistics/retail — growth limited by physical assets.

> In Greenoaks’ portfolio, nearly all successful companies experienced multiple periods of triple-digit % YoY growth.

---

**Example: Coupang Reigniting Growth**

- Growth slowed (YoY +18%) due to stock shortages & space limits.

- Bom rebuilt high-growth culture — hardest yet most correct decision.

---

## 03 — Finding Future S&P 500 Companies

### Differentiated Approach vs. Peers

- **Industry Trend:** Matrix-style firms chase max coverage, large checklists.

- **Greenoaks:** Seek top 10–15 founders annually, **invest deeply and decisively** after pre-existing research.

**Speed + Insight**:

- Win deals with combination of brand, speed, understanding, capability, and valuation — not purely highest price.

- Maintain a **mechanism for generating differentiated insights** — essential for alpha.

---

### Rapid Decision Case Studies

1. **Navan (TripActions)** — COVID crash; $500M commitment in 4 days.

2. **Rippling** — SVB payroll crisis; $500M commitment in 30 minutes.

3. **Carvana** — Bought heavily into distressed prices, backing founder’s calm operational turnaround.

---

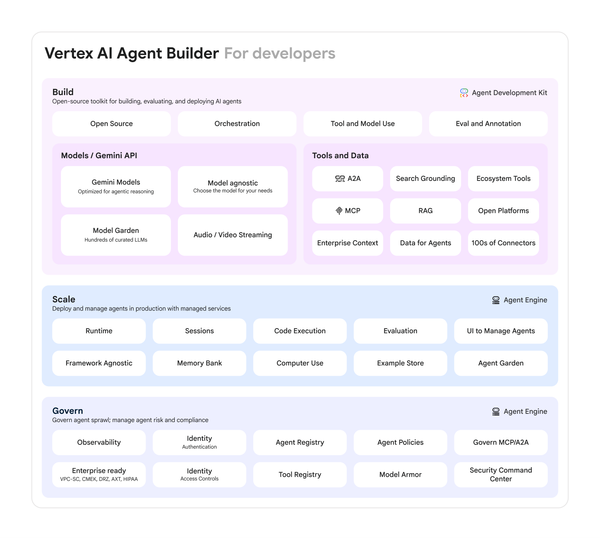

## 04 — AI & Investing Principles

Greenoaks on AI:

- Great company traits remain unchanged despite tech shifts.

- Avoid investing purely due to technology hype — must demonstrate customer value, moats, large market.

**Competition Today:**

- Capital abundant, but true competition for top founders remains low.

- Winning opportunities hinges on **internal precision and preparedness,** not worrying about rivals.

---

## 05 — Structuring Funds & Partner Relations

**Current Portfolio:**

10–12 active companies (55 total), manageable to speak with all founders in half a day.

**Fund Structuring:**

- Largest positions: $500M–$1B+, aligning fund size with optimal return potential.

- Avoid AUM-maximization for its own sake.

**Past Experiment:**

- Greenoaks Global Holdings (insurance in emerging markets) — failed, but yielded key learnings.

---

## Lessons & Investor Role Models

**Role Models:**

- **Masayoshi Son (Masa)** — Long-term, high-conviction in transformative bets.

- **Yuri Milner** — Redefined growth investing with visionary mega-investments.

**Key Insight:**

Support founders not only in tailwinds, but during headwinds — true measure of partnership.

---

## Final Perspective

Greenoaks thrives by:

- Identifying exceptional founders early.

- Delivering **speed + differentiated insight**.

- Minimizing noise & distractions.

- Engaging deeply with a **small, high-quality portfolio**.

---

**Reference**

Finding the Next Figma, Wiz, & Stripe Before It's Obvious | Neil Mehta Interview

[https://www.youtube.com/watch?v=502sB_IbjpQ](https://www.youtube.com/watch?v=502sB_IbjpQ)

---

**You may also want to read:**

- [Zhang Ying of Matrix Partners Internal Speech: 2024, Four Key Decisions](http://mp.weixin.qq.com/s?__biz=MzA3ODk5OTEzOA==&mid=2962169980&idx=1&sn=9e55fbfa78a2907e15bea779846f19e4&chksm=aac1bb719db63267c7a0af791105ca4dd95928036c9891dd389c7a34a06b788f60fcc70e012f&scene=21#wechat_redirect)

- [Xu Chuansheng of Matrix Partners: After So Many Years in VC, People Always Ask Me the Same Question](http://mp.weixin.qq.com/s?__biz=MzA3ODk5OTEzOA==&mid=2962166256&idx=1&sn=f6a8e319053e089769ea50b1d12ab1e4&chksm=aac18afd9db603eb2e1fafd46c91abf1be2b0add44833e3e17ce115bf8d946035f467494ec9d&scene=21#wechat_redirect)

- [Zhang Ying of Matrix Partners: 2025, Four Important Judgments](https://mp.weixin.qq.com/s?__biz=MzA3ODk5OTEzOA==&mid=2962182160&idx=1&sn=dbcee6dd206aa631cebd126d778d8262&scene=21#wechat_redirect)

- [Xu Chuansheng at Matrix Partners: The Next “China” Is Still China](https://mp.weixin.qq.com/s?__biz=MzA3ODk5OTEzOA==&mid=2962183736&idx=1&sn=c220f6b22869c1554ea5b18a8304af5f&scene=21#wechat_redirect)

---

![Leading Investment in Ilya’s New Company, 13-Year Net IRR of 33%: Greenoaks’ Tech Investment Philosophy | [Matrix Low-Key Share]](/content/images/size/w1200/2025/11/img_001-156.jpg)