Masayoshi Son Dumps Nvidia Again — Last Lesson Cost $250 Billion

Masayoshi Son's Bold AI Pivot: Selling All NVIDIA Shares for an OpenAI Bet

Masayoshi Son, CEO of SoftBank, has once again left the markets puzzled — and intrigued.

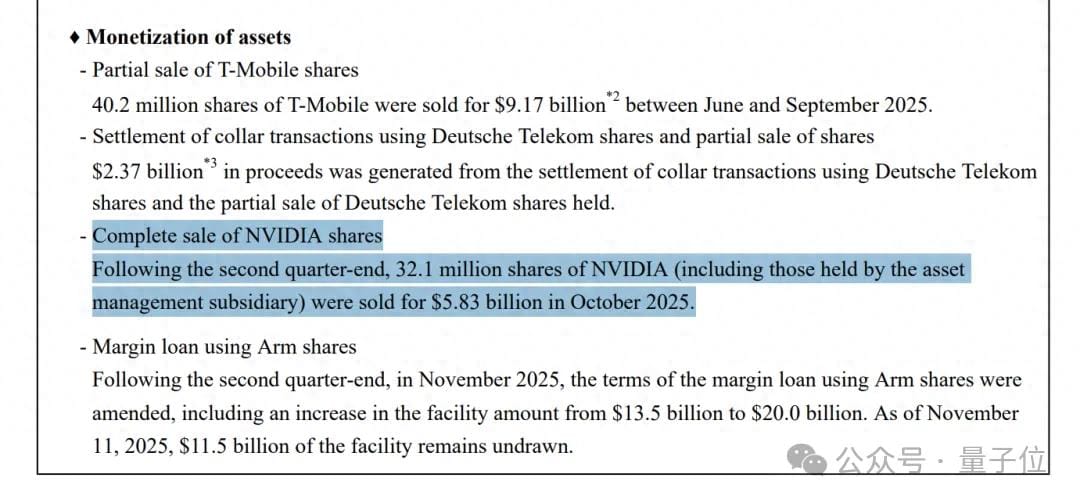

In October 2025, following the end of Q2, SoftBank sold every single one of its NVIDIA shares.

The Sale in Numbers

SoftBank's Q2 earnings report revealed:

> After the end of the second quarter, in October 2025, we sold all 32.1 million NVIDIA shares (including those held by its asset management subsidiary), cashing out USD 5.83 billion (currently about RMB 41.5 billion).

This comes at a time when NVIDIA’s market cap has surpassed USD 5 trillion — a historic milestone in tech.

Why This Is Surprising

In the AI era, NVIDIA is widely regarded as:

- The core of AI infrastructure

- The “hard currency” of computing power

Liquidating such a position seems counterintuitive.

Has Son detected an AI bubble? Or is his strategy simply shifting?

---

The Cash Destination: OpenAI Investment

SoftBank CFO Yoshimitsu Goto confirmed during the earnings briefing:

> Due to the large scale of our investment in OpenAI, we sold stocks to raise and allocate funds accordingly.

SoftBank–OpenAI Deal Breakdown

- Investment commitment: up to USD 40 billion

- Expected actual investment: USD 30 billion

- USD 10 billion allocated for co-investors

- First tranche closed in April 2025:

- USD 2.5 billion from co-investors

- USD 7.5 billion from SoftBank Vision Fund II (SVF2)

- Remaining USD 22.5 billion to be invested via SVF2, partly funded by the NVIDIA sale.

---

Analysts See a Strategic Shift

Market experts, including Morgan Stanley, interpret this move as recalibrating AI strategy, not abandoning AI:

> Masayoshi Son clearing out NVIDIA isn’t escaping AI — it’s switching seats. The AI train is still running; he just wants to be in the cockpit.

---

Upcoming SoftBank Moves

SoftBank’s latest financials outline major investments:

- Continued follow‑on investment into OpenAI (scheduled Dec 2025)

- USD 6.5B acquisition of US fabless semiconductor firm Ampere (by end of 2025)

- USD 5.4B acquisition of ABB's robotics business (mid‑to‑late 2026)

- Investment in Stargate Project (commitment up to USD 500B / 10 GW)

Conclusion: Son is moving focus from hardware to application & interaction layers.

---

> NVIDIA makes the shovels, OpenAI runs the mine, and Masayoshi Son wants to own the mine.

---

OpenAI IPO in Sight

SoftBank’s approval of the remaining USD 22.5B investment depended on OpenAI’s capital restructuring before year‑end — setting the stage for a public listing.

Last month, OpenAI completed its restructuring, making an IPO likely in the near term.

If successful, Son’s returns could be multi‑layered: capital gains, strategic positioning, and influence over AI ecosystems.

---

Déjà Vu: Son’s Past NVIDIA Exits

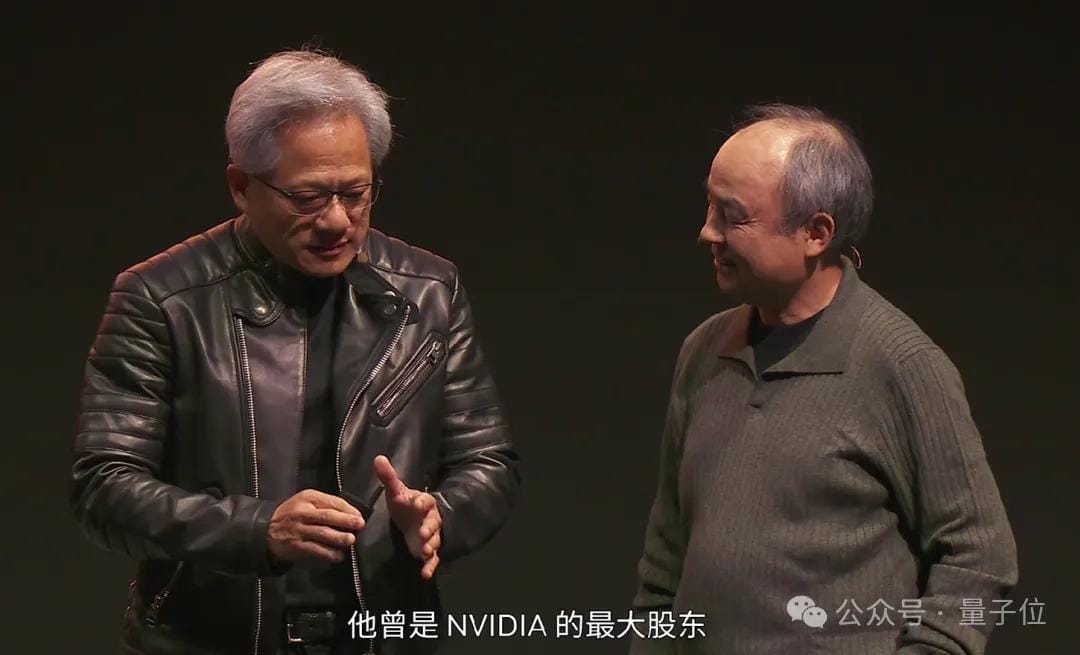

This isn’t the first time Son has sold all NVIDIA shares.

- 2017: SoftBank bought ~5% of NVIDIA for USD 4B.

- 2019: Sold entire stake for USD 3.6B amid financial strains (WeWork’s failed IPO, other losses).

(That 2019 stake would now be worth ~USD 250B — yes, $250 billion.)

---

At the NVIDIA AI Summit Tokyo, Jensen Huang teased Son about missing out on the gains, prompting a staged hug-and-laugh moment.

Son has admitted: “I really regret selling NVIDIA stock.”

---

Risk, Reward, and Son’s History

This NVIDIA–OpenAI pivot is pure Masayoshi Son:

- High risk

- High reward

- Large-scale bets

Track Record Highlights

- Alibaba (2000): Invested USD 20M after a 6-minute meeting with Jack Ma. By 2020, worth USD 150B.

- Bold bets on Uber, WeWork, and others — some failures, but always aiming at big waves in tech.

---

What’s Next?

The test now is Sam Altman and OpenAI — whether Son’s multi‑billion bet will mirror the Alibaba miracle or the WeWork misstep.

Industry trend: moving from hardware dominance toward control of models and ecosystems.

---

Similar Approach for AI‑Driven Creators

Platforms like AiToEarn官网 echo this logic:

- Connect AI generation tools with multi‑platform publishing & monetization

- Across Douyin, Kwai, WeChat, Bilibili, Rednote, Facebook, Instagram, LinkedIn, Threads, YouTube, Pinterest, and X

- Give creators the ability to own the mine in their niche, not just use the tools.

---

Final Thought:

Years from now, we’ll know if selling NVIDIA at AI’s peak was a mistake — or one of Masayoshi Son’s legendary wins.

For now, OpenAI is his cockpit seat in the AI train.

---

Would you like me to also create a timeline graphic in Markdown showing both of Son’s NVIDIA exits alongside his major AI investments? It could make the strategy shift even easier to grasp visually.