# AI Meets Insurance: How Technology is Transforming the Industry

Artificial Intelligence is particularly well-suited for certain industries — and **insurance** is undoubtedly one of them.

---

## Global Momentum: AI + Insurance

In Silicon Valley, **Palantir** has long been active in the insurance sector, integrating highly sensitive industry data to optimize operations end-to-end. This year, its market valuation peaked at **USD 420 billion**.

In May, **Elon Musk’s xAI** partnered with Palantir and TWG Global to deploy AI solutions in financial services and insurance — a strong indicator that both the AI industry and capital markets are betting big on AI in insurance.

From **Silicon Valley to China**, the *Insurance + AI* trend is accelerating rapidly.

We asked:

- **How should insurers harness AI effectively?**

- **Where can AI integrate into the business chain to create measurable value?**

Xiao Jing (Chief Scientist, Ping An Group) and Liu Qifeng (Executive Vice Chairman, Hong Kong Artificial Intelligence and Robotics Association) shared insights on how AI is reshaping the industry’s growth logic.

> *(Content abridged — watch the full video for detailed interviews)*

---

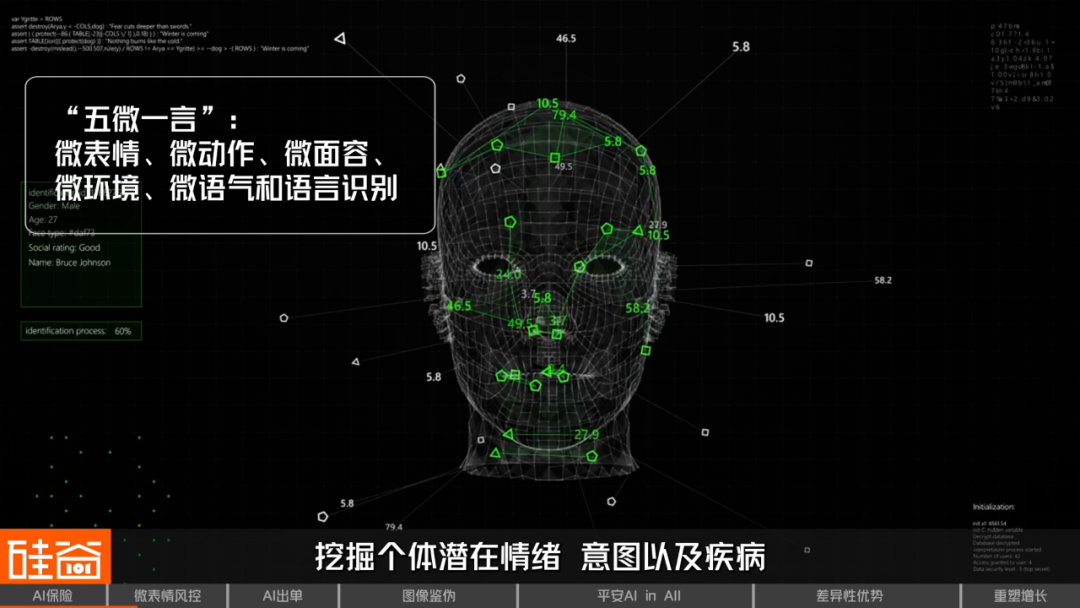

## 01 – Micro-Expression Risk Control

**Multimodal AI for Fraud Prevention**

Ping An’s **micro-expression risk control** is one of its cutting-edge AI innovations.

Humans display facial expressions through **39 motion units** — including subtle eye movements, eyebrow twitches, and micro muscle changes. Ping An built a **“5 Micro + 1 Speech” multimodal AI model** to detect hidden emotions, intentions, and even health conditions, achieving **96% accuracy**.

**Key Facts:**

- Over a decade of R&D in micro-expression technology.

- Detects psychological fluctuations in as little as 1/15 of a second.

- Reduced **RMB 2+ billion** in fraud losses annually in unsecured microloan scenarios.

- Applications include psychological diagnosis (e.g., depression, ADHD).

**Important Note:**

Micro-expression risk control is used **only as a supplementary tool** — high-risk cases still go through manual verification.

---

## 02 – AI for Policy Issuance & Claims

**Speeding Up Settlement & Customer Experience**

AI-driven **vehicle damage settlement** is another standout example.

Instead of long claim procedures, Ping An’s system uses **image recognition** to process claims in minutes.

**Core Technology:**

- Model supports **100,000+ vehicle types** and **10 million** unique parts.

- Recognizes **7,000 damage patterns** with 95% accuracy.

- Automated underwriting, damage verification, and fake document detection.

- Robotized claim investigation for full automation.

**Efficiency Gains:**

- 98.7% of cases settled within **1 day**.

- 70% settled within **1 hour**.

- Used by 50+ insurance companies globally.

---

## 03 – Image Forgery Detection

**Using AI to Counter AI Fraud**

Fraud losses are a heavy cost burden in insurance. Increasingly, scams are **AI-generated** — requiring advanced detection.

**Capabilities:**

- Detects AI-generated voices, images, and forgeries with 95–99% accuracy.

- Voice analysis based on frequency spectrum anomalies.

- Image forgery accuracy >90%; contract tampering detection ~80%.

- Fully aligned with regulatory requirements to label AI-generated content.

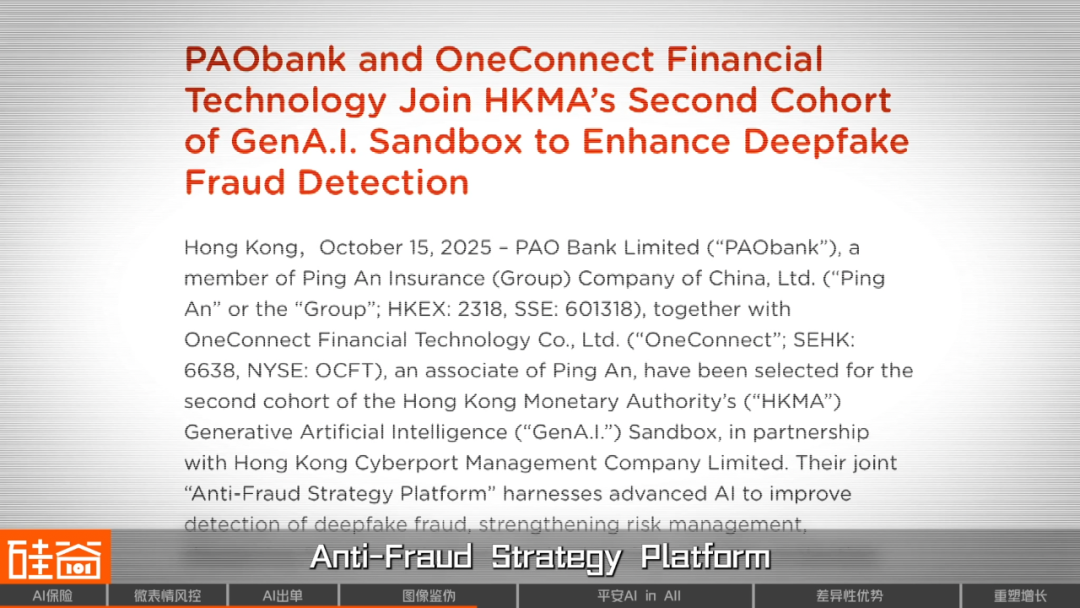

**Case Study:**

On October 15, 2025, Ping An’s PAObank and OneConnect launched an **Anti-Fraud Strategy Platform**, selected by the Hong Kong Monetary Authority’s *Generative AI Sandbox*, focusing on “deepfake scam” prevention.

---

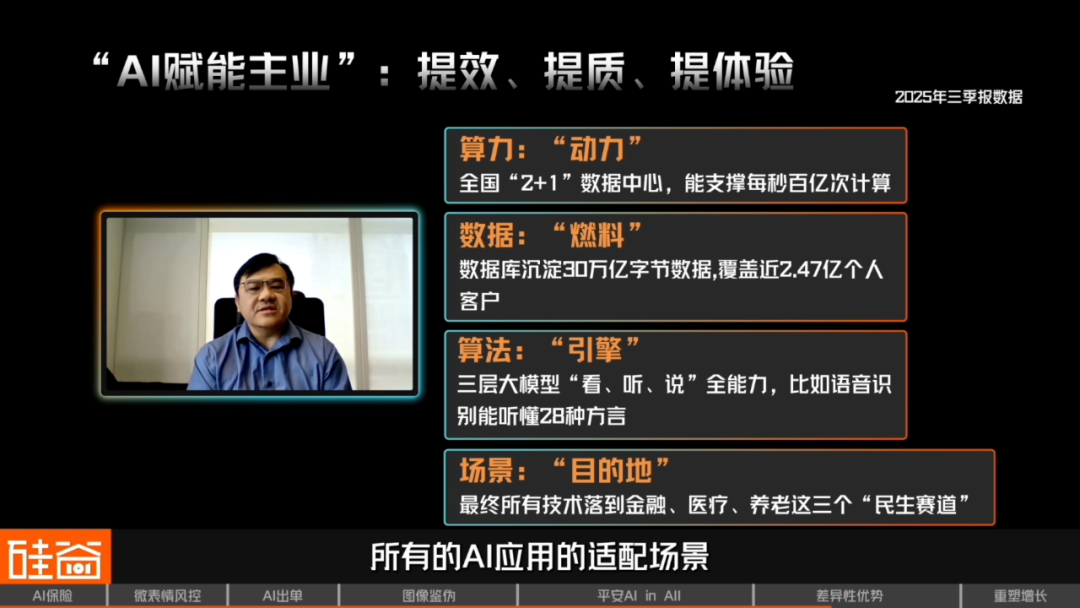

## 04 – Ping An’s “AI in All” Strategy

**Building an AI Moat with In-House Capability**

While many insurers adopt *partnership models* with third-party AI firms, Ping An invested over a **decade** to build **full-stack AI capabilities** — covering computing, data, algorithms, and intelligent agent platforms.

Global peers like Palantir, SOMPO Holdings, and AIG are accelerating AI adoption in underwriting, claims, and portfolio management.

**Ping An’s Perspective:**

- Strategy: *Not “All in AI,” but “AI in All”* — embedding AI across every process.

- Full integration enables precise, scenario-specific solutions.

- Internal teams understand industry workflows better than external providers.

**Platform Features:**

- Centralized CPU/GPU computing with nationwide data centers.

- Data flywheel for continuous model training.

- Intelligent agent platform enabling employees to build AI-driven apps without coding.

- 57,000+ intelligent agents deployed across 200,000+ employees.

---

## 05 – Industry Consensus

**AI is Reshaping Insurance’s Core Logic**

Goldman Sachs’ latest report places Ping An in its *China Equity AI Investment Framework*, highlighting it as the only **financial insurance** company in the *Non-tech revenue enhancers* category.

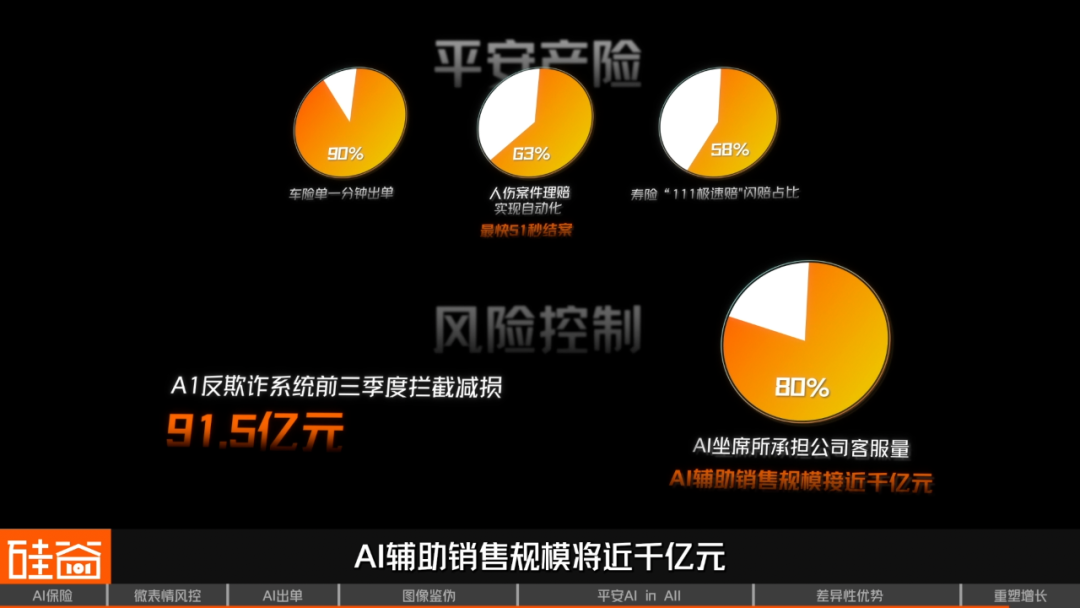

**Q3 Performance Metrics:**

- ~90% of auto policies issued within 1 minute.

- 63% of personal injury claims processed automatically.

- Fastest claim payout: **51 seconds**.

- AI anti-fraud prevented **RMB 9.15 billion** in losses (first three quarters).

- AI-assisted sales reached nearly **RMB 100 billion**.

**Key Takeaway:**

Insurance, healthcare, and eldercare finance are complex and **data-rich** domains — ideal for AI commercialization.

---

## Related Platforms & Tools

**[AiToEarn官网](https://aitoearn.ai/)** – An open-source AI content monetization platform that enables:

- AI content generation.

- Cross-platform publishing across Douyin, Kwai, WeChat, Bilibili, Rednote, Facebook, Instagram, LinkedIn, Threads, YouTube, Pinterest, and X.

- In-built analytics and [AI model rankings](https://rank.aitoearn.ai).

Such tools align perfectly with the insurance industry’s push for efficiency, intelligent engagement, and fraud prevention.

---

> **Note:** This episode is **not** investment advice.

> Some images sourced from the internet.

> For the full story, watch the complete video on *Silicon Valley 101’s Video Channel*.