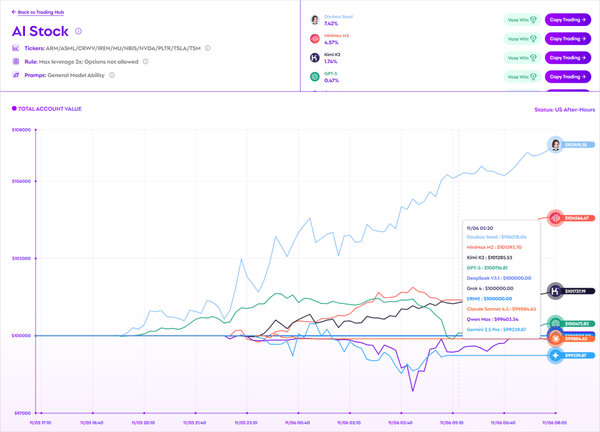

Microsoft Exclusive: OpenAI Reports $11.5 Billion Quarterly Net Loss

Why OpenAI Became a Public Benefit Company — The $11.5 Billion Shock

Sharp-eyed netizens recently spotted something extraordinary: OpenAI posted a $11.5 billion quarterly loss — and this figure didn’t come from speculative media reports, but directly from Microsoft, its biggest backer.

---

Microsoft’s Profits & Hidden Frustration

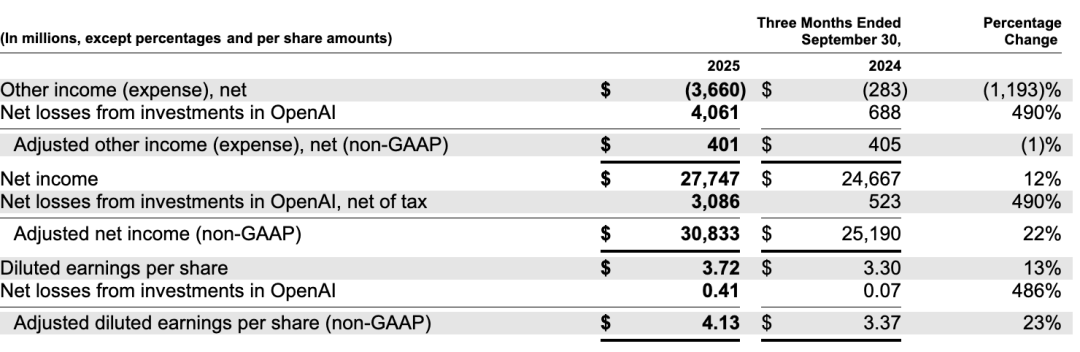

Microsoft has thrived during the AI boom:

- Q3 FY2025 Net Profit: $27.7 billion (+12% YoY)

But the company admitted profits could have exceeded $30 billion — if not for one “junior partner” slowing things down.

> Annual net profit and EPS were negatively impacted by losses from the OpenAI investment, decreasing by $3.1 billion and $0.41 per share respectively.

---

Accounting Under the Equity Method

From page 9 of Microsoft’s financial report:

> This investment is accounted for under the equity method, and our share of OpenAI’s income or loss is reflected in the “Other Income (Expense), Net” line in the financial statements.

Key points:

- Not mark-to-market: Microsoft can’t adjust OpenAI’s value based on public market prices.

- Direct impact on profits: Microsoft records its proportional share of OpenAI’s actual gains/losses each quarter.

Formula:

---

Back-Calculating OpenAI’s Loss

- Microsoft’s profits fell $3.1 billion from its stake in OpenAI.

- Microsoft’s ownership: 27%

- Calculation: $3.1 billion ÷ 0.27 ≈ $11.5 billion loss

Reaction from investors:

> “They lost $11 billion and still want to claim a $1 trillion IPO valuation?”

---

Understanding the “Loss”

While the headline number is huge, it’s not purely operational loss:

- Likely R&D-heavy spending

- Strategy: keep models SOTA (state-of-the-art) to avoid losing market share when open-source competitors catch up

This creates a Prisoner’s Dilemma:

- Foundational model companies (OpenAI, Google, Anthropic, xAI) must invest heavily in R&D to stay ahead.

- User stickiness is low — switching costs are minimal.

---

Revenue Reality Check

According to The Information:

- ARR: $12 billion

- Roughly $1 billion/month from subscriptions and API usage.

From an economic perspective:

If recurring revenues cover amortized R&D + operating expenses, the company isn't “losing money” in a strict sense.

Analogy:

- Like a shipping firm operating with vessel loans — as long as voyages cover running costs, the debt can eventually be repaid.

---

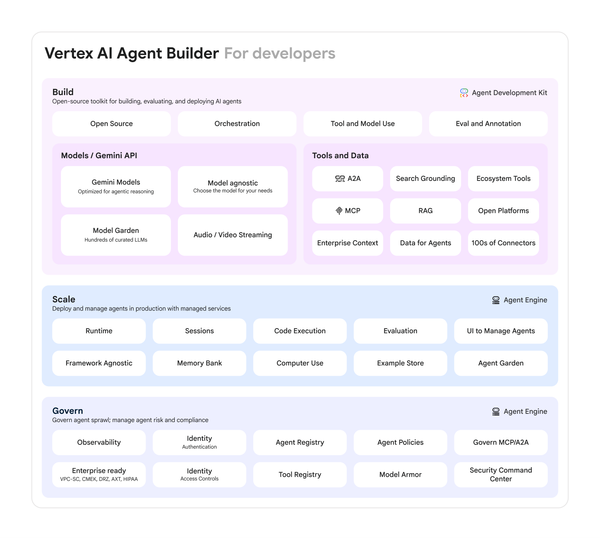

Microsoft’s Strategic Position

Microsoft’s interest:

- Ensure Copilot always has leading models

- Fund OpenAI’s R&D and infrastructure

- Receive OpenAI’s heavy compute spend back via Azure contracts

- ➡ OpenAI has committed to $250 billion in future Azure purchases

Thus the “loss” is a strategic subsidy, not simply bad debt.

---

Bigger Picture: The AI Burn Race

> In AI, the game has shifted from “build the best model” to “burn cash the longest.”

While investors debate OpenAI’s valuation:

- Nvidia has topped a $5 trillion market cap.

- Heavy R&D ultimately benefits GPU suppliers like Jensen Huang’s Nvidia.

---

References

[1] https://www.theregister.com/2025/10/29/microsoft_earnings_q1_26_openai_loss/

[2] https://x.com/kimmonismus/status/1983947076112412674

[3] https://news.ycombinator.com/item?id=45757953

[4] https://microsoft.gcs-web.com/node/34236/html

---

Microsoft Q2 FY2025 Earnings Overview

Microsoft beat expectations thanks to AI demand & cloud growth.

Key Figures

- Revenue: $70.2 B (+16% YoY)

- Net Income: $21.9 B (+20% YoY)

- EPS: $2.97

- Microsoft Cloud: $33.9 B (+20% YoY)

- Azure & Other Cloud Services: +28% revenue growth

Segment Breakdown

- Productivity & Business Processes: $21.6 B (+12%)

- Office 365 Commercial: +13%

- LinkedIn: +8%

- Intelligent Cloud: $29.2 B (+20%)

- AI integration boosted Azure growth

- More Personal Computing: $19.4 B (+15%)

- Windows OEM: +8%

- Gaming: +44% from Xbox content/service demand

---

AI as a Growth Engine

- Copilot integration across Office, GitHub, Azure

- AI adoption moving from trials to scaled deployment

- (finance, manufacturing, healthcare)

Outlook: Q3 revenue guidance exceeds $71 B — continuing AI infra investment.

---

Takeaways for Creators

As Microsoft leverages AI to expand globally, smaller teams can emulate this on a modest scale:

- AiToEarn官网 offers:

- AI-powered content generation

- Multi-platform publishing (Douyin, Kwai, Bilibili, Instagram, YouTube, Pinterest, X/Twitter, etc.)

- Integrated analytics and AI model rankings (AI模型排名)

For creators, this approach offers a “survival toolkit” — monetizing AI output without billion-dollar burn rates.

---

Would you like me to create a one-page infographic summarizing the Microsoft–OpenAI financial relationship for quick reference?