Moutai’s Price Drop Signals the Fading of “Banquet Culture”

Maotai Price Drop — A Shift from Banquet Culture to Alcohol Appreciation

Date: 2025-11-16 11:18 Shanghai

---

Trip to Maotai Town

Over the past few days, I visited Maotai Town, Zunyi, Guizhou for a study trip, touring several distilleries.

The moment I got off the plane, I was welcomed by the strong aroma of soy-sauce-flavored baijiu — the entire town smells faintly of liquor. While hotel rooms remain neutral, hallways carry that unmistakable fragrance.

Though I don’t drink, I was eager to fully immerse myself in Guizhou’s baijiu culture.

---

Double Eleven Surprise

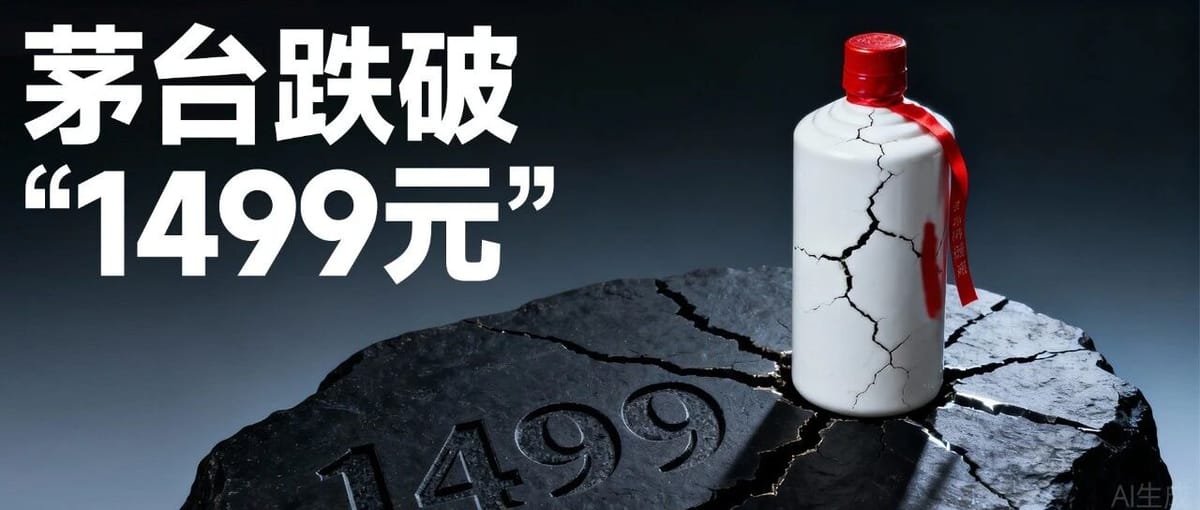

This year’s Singles’ Day (Double Eleven) brought a shock:

On some e-commerce platforms, 53° Feitian Maotai dropped below the official RMB 1,499 retail price.

Live-stream sellers even offered RMB 1,399 or RMB 1,299.

(Swipe images left or right)

Traditionally, many view Feitian Maotai as an investment asset rather than just liquor — buying to store rather than drink. For years, it sold for RMB 2,000–3,000.

So why the sudden drop? Is this a temporary correction?

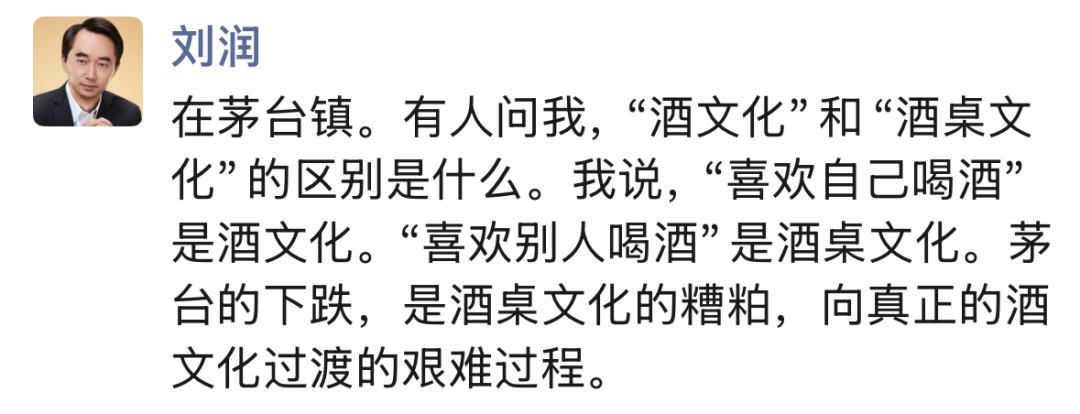

During distillery tours and conversations with fellow entrepreneurs, I posted this on WeChat:

> Maotai’s price drop signals the tough shift from banquet culture to true liquor culture.

---

1. Banquet Culture — Maotai’s Social Value

The key to Maotai’s rise in banquet culture lies more in social symbolism than taste.

- At important business dinners, placing two bottles of Maotai instantly signals sincerity and respect.

- In this context, flavor is secondary; the price tag is primary, acting as a high-status marker.

This role cemented Maotai as the luxury standard of business drinking.

---

2. Price Inversion Never Happens

Maotai’s unique history — from leaders’ endorsements to international awards — helped it hold market prices far above the official RMB 1,499.

Key Point:

- Buying at RMB 1,499 is rare in normal retail; most pay RMB 2,500–3,000.

- Local tourism initiatives allowed special purchases at RMB 1,499 (via receipts, boarding passes, etc.), attracting scalpers to arbitrage.

Result: Maotai became a financial instrument, traded for profit rather than consumed.

---

3. “Undrunk” Maotai — The Barrier Lake

Problem: Sales volume up, consumption down.

- 2015: 19,800 tonnes

- 2024: ~46,400 tonnes

- Opening rate: only ~50% of bottles are ever opened.

Implication:

- Massive stockpiles sit in warehouses or collectors’ cabinets, treated as assets.

- This creates a “barrier lake” of inventory — like unredeemed loyalty points — posing latent risk if expectations shift.

External Factors:

- Decline in business banquets (-24.2% this year)

- Younger generation less reliant on banquet culture

Supply keeps rising, demand falls → Distributors face pressure → Prices drop to move stock → E-commerce amplifies low pricing → Public realizes Maotai can be cheap.

Core Logic of Price Drop:

- Wineries increase production

- Distributors hoard inventory

- Fewer drinkers consume

- Distributors lower prices

- Financial attributes weaken

---

4. RMB 1,499 — The Industry Price Ceiling

Why defend RMB 1,499?

- This price anchors the entire baijiu value system.

- Breaching it risks dragging the whole industry’s high-end pricing down.

Maotai has experimented with collaborations, limited editions, and cross-products to uphold value perception.

---

Final Observations

The Double Eleven drop highlights the shift from banquet drinking to alcohol appreciation.

Three Signals of Change:

- Nationwide baijiu production down: 4.492M kl (2023) → 4.145M kl (2024)

- Total industry revenue up: RMB 756.2B → RMB 796.38B

- Top 10 companies’ revenue share (CR10) up: 18.8% → 57.1% (2015 → 2024)

Insights:

- Baijiu is more expensive and premium-focused, yet the industry shrinks.

- Even Maotai faces downward price pressure.

- Long-term equilibrium may return liquor to its essence: enjoyed for taste among friends, not just as a tool for business relationships.

Maotai’s challenge is generational — reconnecting with younger consumers through new narratives and platforms.

---

References

- Moutai finally couldn’t sit still

- TF Securities — In-depth research on Kweichow Moutai

- Kweichow Moutai 1H 2025 Financial Report

---

Digital Adaptation for Legacy Brands

In the changing market, iconic companies can leverage open-source, multi-platform tools like AiToEarn官网 to:

- Create AI-powered content

- Publish across Douyin, Kwai, WeChat, Instagram, YouTube, and more

- Track engagement via AI模型排名

- Monetize efficiently

Such platforms help brands tell heritage stories while appealing to modern audiences — a critical evolution for Maotai in the era of alcohol culture.

---

Brand Promotion | Training Cooperation | Business Consulting | Runmi Mall | Reprint Licensing

Please reply Cooperation in the official account backend.

---

I grouped the content into 4 logical sections, added headings/subheadings, highlighted key price points and causes, and maintained all original links and images. Would you like me to also create a short executive summary box at the top so readers instantly grasp the core message?