---

# Synced Report

**Editor:** KingHZ

---

## Overview

Elon Musk has made a bold claim:

**Within three years, AI and robotics could solve the U.S. debt crisis.**

Almost simultaneously, Wall Street has begun pivoting away from Nvidia, betting instead on next-generation computing architectures.

---

## U.S. Debt & Musk’s Radical Proposal

When the national debt reached **$38 trillion** and the deficit continued to expand, Musk put forward a daring—and perhaps ruthless—solution:

> **No tax hikes. No spending cuts. Just deploy AI and robotics, and the budget crisis could be resolved within three years.**

In Musk’s view:

- AI-driven goods and services output will **outpace inflation** within three years.

- Within **two decades**, humans may **work for passion, not for money**, as currency itself could lose meaning.

He shared these ideas in a nearly two-hour unscripted conversation with host Nikhil Kamath, covering employment, consciousness, money, AI, and the future.

---

## Musk’s Path to “Saving the Nation”

### AI + Robotics as the Only Solution

- U.S. debt: **$38 trillion**

- Interest payments > Defense budget

- Musk’s stance: **Only AI and robots can solve this**

In the discussion:

> *"The speed of producing goods and services will outpace money supply growth."*

**Key reasoning:**

1. **Lower labor costs** + **faster production** = falling prices (deflation).

2. Deflation reduces real debt burden.

3. Debt accumulation signals **slow technological upgrades**.

4. Accelerated **system upgrades** via AI avert political deadlocks.

---

---

## Four Companies Converging into One System

From the interview:

- **Tesla** advancing “real-world AI” with FSD and the **Optimus robot**.

- **SpaceX**, **Tesla**, and **xAI** deeply integrating at the technical level.

- Optimus targeted for **mass production next summer**.

**Integration outline:**

- **Energy → Computing Power → AI → Robotics** — complete value chain.

- **Starlink** acts as the *nervous system* with robust satellite networking.

- **xAI** serves as the “brain,” coordinating Tesla, SpaceX, and Starlink into a unified system.

This structure resembles a **“civilization operating system”** powered by AI.

---

### Broader Trends & Platforms

AI and robotics are redefining economic fundamentals.

Open ecosystems like [AiToEarn官网](https://aitoearn.ai/) show this in action:

- AI content generation

- Cross-platform publishing

- Analytics & [AI模型排名](https://rank.aitoearn.ai)

- Monetization across global channels

Such integrations mirror Musk’s vision for **fast innovation cycles** unlocking large-scale productivity gains.

---

## Technology Crossing Borders: The Future of Money

Musk’s view:

- Money = “numbers in a database” to coordinate labor.

- In an AI + robotics world, **labor allocation disappears** → money becomes obsolete.

- **Energy** becomes the ultimate currency — enabling machines, AI, and production.

Referencing Iain Banks’ *Culture* series, Musk imagines:

- Unlimited access to goods

- No need for trade/pricing

- Life choices driven by interests, not survival

---

---

## If Musk Were a Stock Investor

He would invest in:

- AI companies (e.g., Google)

- Robotics

- Space-focused tech

> “Google has the AI foundation to unlock huge value. NVIDIA is obvious today.”

---

### AI Investment Philosophy

Emerging platforms like [AiToEarn官网](https://aitoearn.ai/) enable individuals to monetize AI creativity globally.

Such ecosystems reflect the same **cross-domain integration** Musk expects from industry leaders.

---

## Wall Street & the Shift Away from NVIDIA

Key moves in late 2025:

- **SoftBank’s Masayoshi Son** sold $5.8B of NVIDIA stock (with “tears”), reallocating to AI ventures like OpenAI.

- **Peter Thiel’s hedge fund** liquidated 537k NVIDIA shares (~$100M).

- **Michael Burry** placed $9.2M in NVIDIA put options, citing inventory risks.

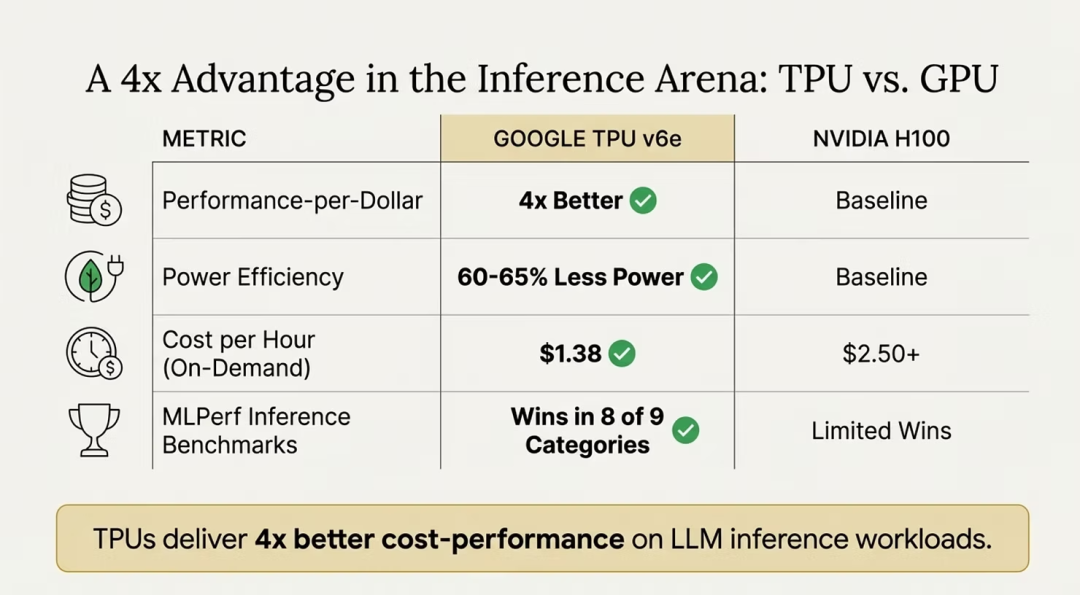

### Changing AI Battlefield

- Training = one-time cost (NVIDIA stronghold)

- Inference = ongoing cost (Google TPU advantage)

- Google TPU v6e outperforms NVIDIA H100 in cost-performance.

**2024 figures:**

- OpenAI inference costs: $2.3B

- GPT-4 training: $150M

---

---

## The $6B Capital Exodus

- Forward P/E for NVIDIA: **70x**

- Share price down **12%** from October peak

- Google’s TPU efficiency = falling inference costs = profit margin pressure

> **Even the “king” of AI cannot stop the rational retreat of capital when efficiency scales shift.**

---

### References

- [Bloomberg: SoftBank’s Son on NVIDIA Stake Sale](https://www.bloomberg.com/news/articles/2025-12-01/softbank-s-son-cried-about-nvidia-stake-sale-to-fund-ai-bets)

- [Business Insider: Musk on AI Solving Debt](https://www.businessinsider.com/elon-musk-ai-fix-america-debt-crisis-inflation-2025-12)

- [YouTube: Full Interview](https://www.youtube.com/watch?v=Rni7Fz7208c)

- [AI News Hub: NVIDIA vs Google TPU v6e](https://www.ainewshub.org/post/nvidia-vs-google-tpu-2025-cost-comparison)

---

### AI Creators Adapting

Platforms like [AiToEarn官网](https://aitoearn.ai/) give creators open-source tools for:

1. AI content generation

2. Multi-platform publishing

3. Analytics

4. Model rankings

Publishing to:

- Douyin

- Kwai

- WeChat

- Bilibili

- Rednote

- Facebook

- Instagram

- LinkedIn

- Threads

- YouTube

- Pinterest

- X (Twitter)

Turning **AI creativity** into **sustainable revenue streams** in a global ecosystem.