Musk’s Q3 Earnings Reveal Optimus Roadmap: Million-Unit Line by Year-End, Mass Production in 2026, Tesla as Real-World AI Leader

Tesla Q3 2025 Earnings Call: Accelerating the “Real‑World AI” Strategy

In Q3 2025, Tesla’s earnings call — led by Elon Musk — showcased a decisive acceleration of its “Real‑World AI” vision. Discussion ranged from:

- Large‑scale FSD and Robotaxi deployment

- Breakthrough AI 5 chip design

- Mass production plans for Optimus humanoid robots

- Expansion of the energy storage and solar business

Key takeaway: Tesla is rapidly evolving from an intelligent driving company into a leader in embodied intelligence and integrated energy systems.

---

Vision: From Driving AI to Embodied Intelligence

Musk highlighted Tesla’s move beyond transportation:

- Non‑supervised FSD: Fully driverless operation in Austin within months

- Production target: 3M annualized vehicles in 24 months

- Cybercab: Purpose‑built for autonomy

- AI 5 chip: 40× AI 4’s power, manufactured in the U.S.

Financial results hit record highs:

- Free cash flow: $4B

- Cash reserves: $41B+

- Expectation of higher CAPEX for AI, chips, and robotics

---

The Inflection Point of Real‑World AI

Musk’s Perspective

- Tesla’s AI value lies in closed‑loop learning in the physical world

- Synergy of models + data + computing power from millions of connected vehicles

- Autonomous driving without HD maps — pure vision-based real‑time learning

Structural Impact

- FSD + Robotaxi: A turning point in transportation history

- Each car as a mobile intelligence node — autonomy at scale via software updates

- Energy AI extending to grid optimization, doubling U.S. output without new plants

---

Austin: First City to Go Fully Driverless

Within months:

- Robotaxi safety drivers removed in Austin — signaling commercial Real‑World AI launch

- Proving ground for scaling autonomous operations

- Fleet milestones:

- Austin: 250K+ driverless miles

- Bay Area: 1M+ miles (regulatory driver required)

Safe‑rollout strategy for new cities:

- Validation phase

- Safety driver removal

- Rapid scale-up upon safety confirmation

---

FSD Software Roadmap

- Version 14 deployed

- 14.2: comfort improvements

- 14.3/14.4: reasoning capability

- Complex decision-making (drop‑off priorities, parking selection)

- AI evolves towards agent-like autonomy

---

Scaling Production: Cybercab Launch

Target: 3M Vehicles Annualized in 24 Months

- Requires supply chain + logistics + throughput upgrades

- Cybercab:

- No steering/pedals; designed for maximum efficiency

- Speed capped ~85–90 mph

- Optimized for safety, comfort, and cost per mile

Margin confidence: Demand expected to be “insane”.

---

AI 5 Chip: Streamlined 40× Leap

Design Philosophy

- Single‑purpose optimization for Tesla’s own workloads

- Removed extraneous GPU/ISP modules — all core logic dedicated to reasoning

- Data‑to‑wafer loop: Real‑time design feedback from global fleet

Manufacturing:

- Samsung (Texas) and TSMC (Arizona) — both in U.S.

- Overcapacity strategy to support all vehicles/robots and possible data center use

Performance Gains:

- 2–3× performance per watt

- Up to 10× performance per dollar

---

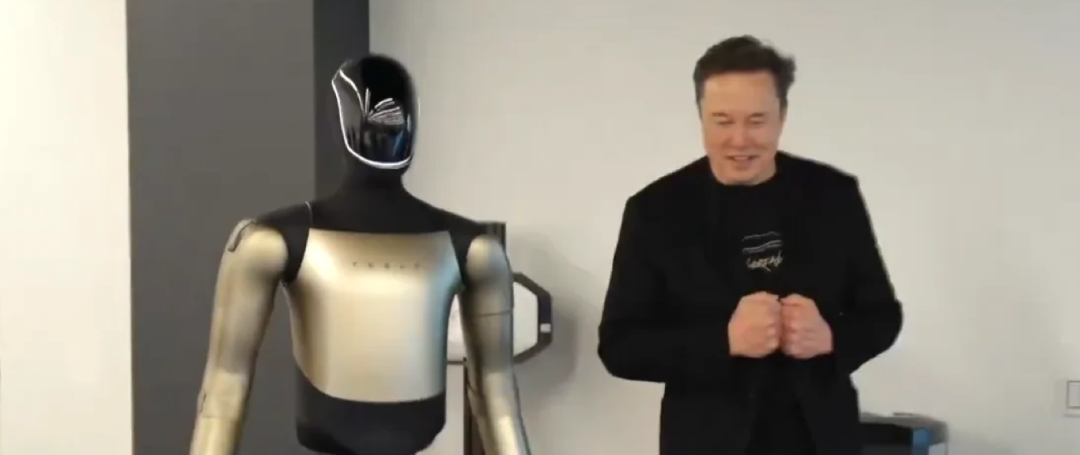

Optimus: Humanoid Robotics at Scale

Product Ambition

- “Greatest product in history”

- Integrates Tesla’s advances in perception, reasoning, actuation, manufacturing

Challenges:

- Human‑level dexterous hands: Actuator complexity concentrated in forearms

- Full vertical integration — supply chain built from scratch

Production Goals

- V3 prototype in Q1 next year

- Million‑unit capacity line by year‑end

- Long‑term: 50–100M units (V5)

Economic Potential:

- Robots working 24/7 → 5× human productivity

- Path to abundance where work becomes optional

---

Energy Systems Expansion

Battery Products:

- Mega Pack backlog into next year

- Mega Pack 4: Integrated substation output at 35 kV

- Powerwall + solar demand surging

Buffalo Plant: Producing residential PV modules — shipments Q1 next year

---

Financial Performance

Q3 records:

- Revenue & Free cash flow: $4B

- Cash & investments: $41B+

- Energy margins improved despite $400M tariff hit

2025 CAPEX: ~$9B

2026 CAPEX: Increase to support AI, chips, robotics

---

Related AI Monetization Tools

Platforms like AiToEarn官网 align with Tesla’s scale philosophy:

- Open‑source global AI content monetization

- Cross‑platform publishing (Douyin, Kwai, Facebook, Instagram, LinkedIn, YouTube, X, etc.)

- Integrated AI generation, analytics, and model ranking

---

✦ Featured Content ✦

- Jensen Huang & Sequoia US: 100M-Fold AI Factory Investment

- MatrixCube Dialogue: AI Globalization Barriers

- Cathie Wood: AI Doubling GDP

- OpenAI DevDay: Language as OS

- Jensen Huang’s Latest Insight

---

Final Note

In both Tesla’s mobility ecosystem and the AI creator economy, vertical integration and distributed intelligence networks are becoming defining advantages. Whether in autonomous fleets or global content publishing, these strategies enable rapid scaling, resilience, and monetization in the AI‑driven world.