NeurIPS 2025 | When AI Learns to "Trade Stocks": Recreating Financial Market Emergence with Thousands of Virtual Investors

Following AI Agents — 2025-11-15 · Shandong

---

AI can understand not only natural laws but also social laws; not only optimize algorithms, but also reveal human nature.

> The market is not a machine, but a crowd; not a formula, but a story. TwinMarket teaches AI to tell these stories.

---

Background: From Rule-Based Agents to Human-Like AI

In 1994, the Santa Fe Institute in the U.S. launched the Artificial Stock Market project to explore whether “electronic traders” with simple rules could recreate real-world market complexity.

While price fluctuations and collective behaviors did emerge, the experiment revealed a core problem: real humans are not rule-bound machines. Cognitive biases, emotions, and social influence often drive our actions beyond formulaic logic.

Fast-forward 30 years: Large Language Models (LLMs) now process nuanced language, simulate emotions, and display human-like biases. Could they finally serve as realistic “virtual humans” in market simulations?

Researchers from The Chinese University of Hong Kong, Shenzhen and Nanjing University have answered with TwinMarket — a large-scale LLM-powered financial market simulation platform. Their paper "TwinMarket: A Scalable Behavioral and Social Simulation for Financial Markets" was accepted at NeurIPS 2025 and won Best Paper at the ICLR 2025 Financial AI Workshop.

---

Paradigm Shift: From Rules to Cognition

Traditional simulations rely on preset rules (e.g., “if price rises by X%, sell”). This approach suffers from:

- Behavioral Homogeneity

- Overlooks diverse investor strategies — from fundamentals-driven to highly speculative.

- Lack of Social Interaction

- Ignores influence networks like social media, where rumors and thought leaders drive herd behavior.

- Opaque Decision Logic

- Outputs are seen, but reasoning — rational or emotional — remains hidden.

TwinMarket uses LLMs to create cognitively rich agents that trade, interact, and evolve in data-driven market environments.

---

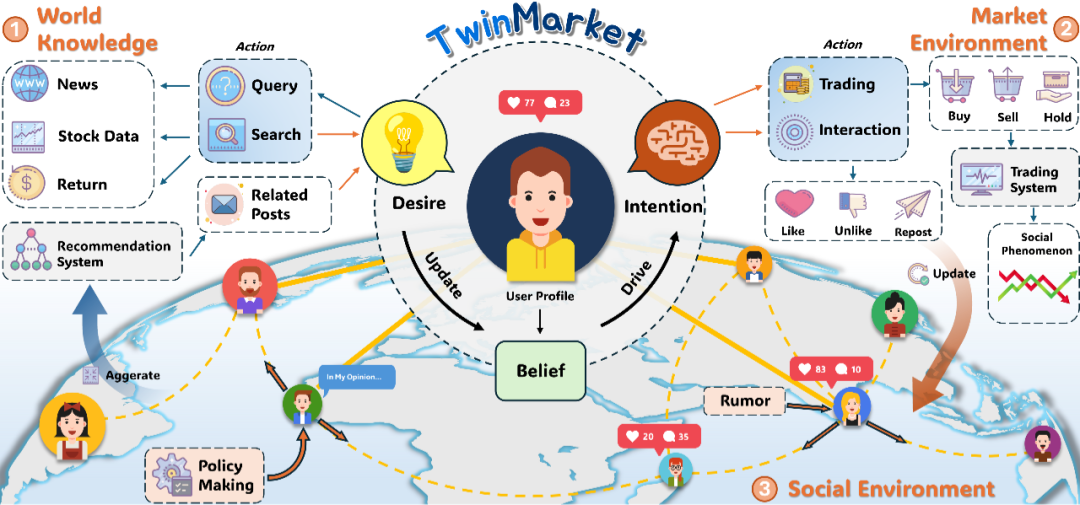

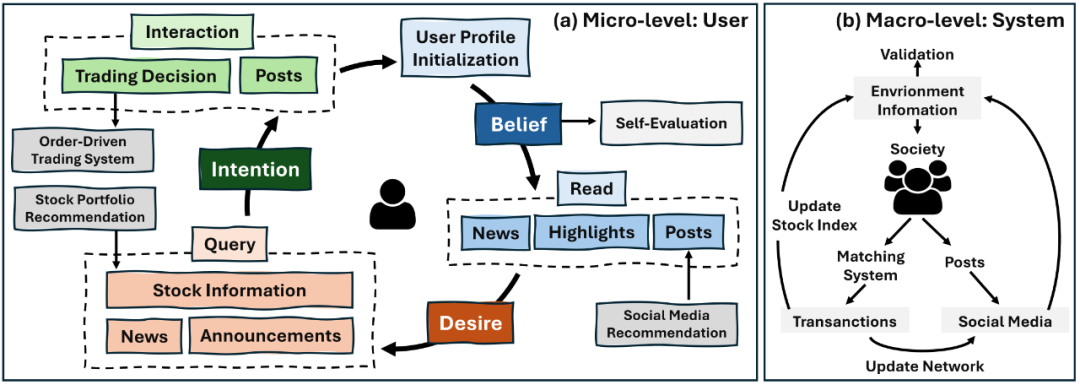

Cognitive Core: The BDI Framework

TwinMarket integrates the Belief–Desire–Intention (BDI) framework, shifting from rule matching to cognitive reasoning.

Three Layers of Reasoning

- Belief — perception of the world

- Desire — personal goals

- Intention — chosen actions

Agents self-reflect after each trade: evaluate outcomes, assess market feedback, and update beliefs. This enables adaptive behavior without retraining models.

---

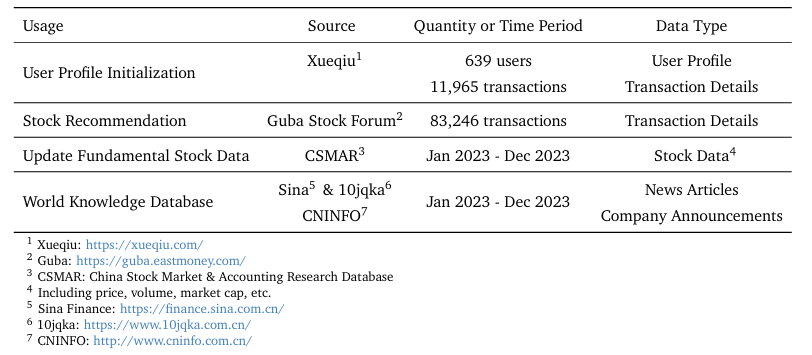

Real Data Foundations

Agents are initialized using real trading data from 639 Xueqiu platform investors (11,965 trades). Profiles capture:

- Demographics — gender, region, social influence

- Investment Style — fundamental vs. technical analysis

- Behavioral Biases — disposition effect, lottery preference, over-concentration, over-trading

Example agent profile combines attributes into custom system prompts for realistic behavior modeling.

---

Market Environment

Each simulated trading day includes:

- Economic & policy news

- Corporate announcements

- Stock market indicators

- Tailored social media excerpts

---

Trading System

Uses call auction under China A-share rules:

- Limit orders with price & quantity

- Match by price priority then time priority

- ±10% price limits

- Endogenous price formation via agent supply/demand

---

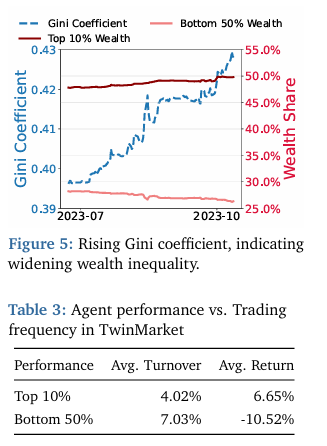

Micro-Level Results: Human-Like Patterns

Emergent findings:

- Natural Wealth Inequality — Gini coefficient rises as small differences amplify over time.

- Over-Trading Penalty — frequent traders underperform less active ones, even without transaction costs.

---

Macro-Level Validation: Stylized Facts

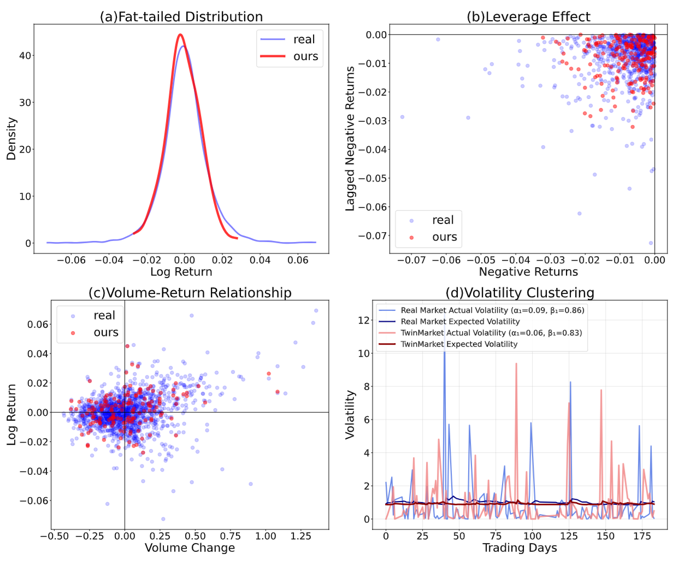

TwinMarket reproduces four market “stylized facts”:

- Fat Tails — extreme price moves occur more often than normal distribution predicts.

- Leverage Effect — price drops increase volatility.

- Price–Volume Relationship — large moves coincide with volume surges.

- Volatility Clustering — high-volatility periods persist.

---

Emergent Phenomena

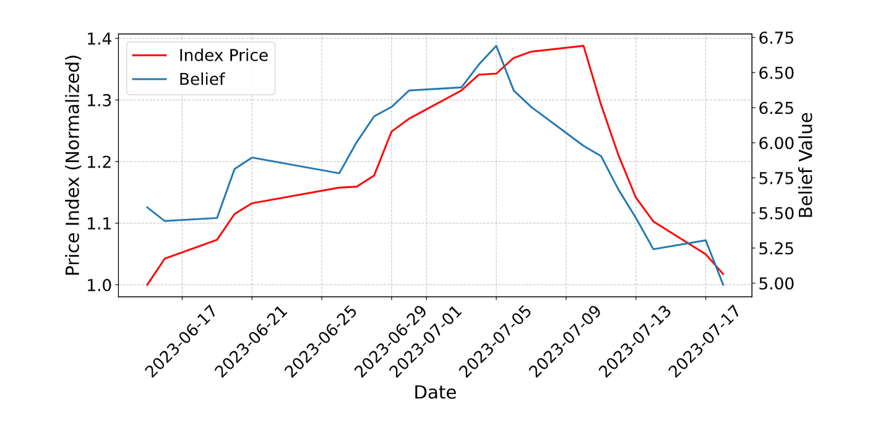

Bubble–Crash Cycle

Phases: optimism → price rise → belief reinforcement → exuberance → selling → panic → crash.

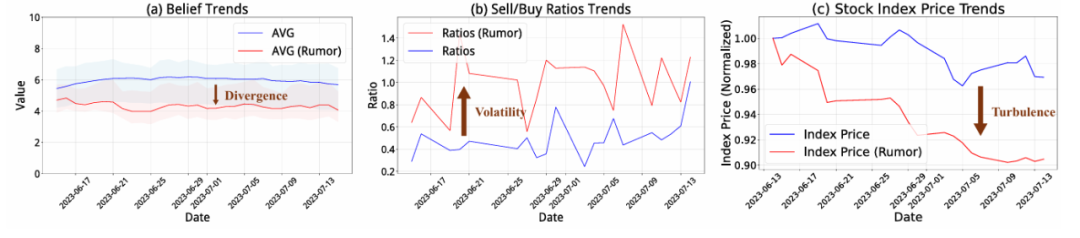

Rumor Propagation

Negative rumors among high-impact users lead to sharp market drops via opinion leader amplification, echo chambers, and polarization.

---

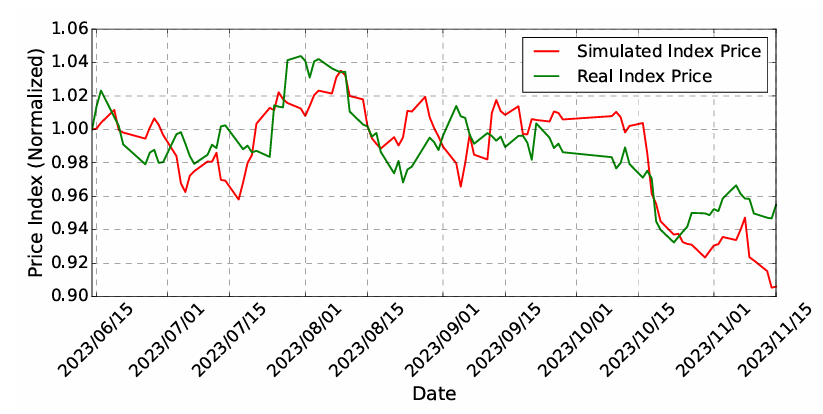

Scalability

Experiments from hundreds to thousands of agents show:

- Linear volume growth with activity rate

- Declining RMSE with larger scale

- Persistence of emergent effects at scale

---

Applications

Theory Validation

Engineers controlled experiments on social density thresholds, misinformation spread, and trading rule impacts.

Policy Evaluation

Simulate effects of regulatory adjustments (price limits, margin rules, disclosure requirements) before real-world rollout.

Risk Detection

Identify micro-signals: viewpoint polarization, false consensus, herd clustering.

Interdisciplinary Reach

BDI + LLM approach can model opinion dynamics, public health responses, and more.

---

Future Directions

- Market Expansion — continuous auctions, short-selling, multiple asset classes.

- Macro Integration — central banks and regulators as super-agents.

- Cross-Domain Evolution — apply to political and public health systems.

---

Conclusion: AI as the Microscope of Social Science

TwinMarket positions AI as a precision instrument for observing complex social systems beyond finance. It demonstrates that:

- Rationality is the start; irrationality makes simulations real.

- AI can interpret natural laws, social laws, and human nature.

---

Research Team

- Yifei Zhang — M.Sc. student, Nanjing University; expertise in Narrative Economics, Financial LLMs, Autonomous Agents. Homepage

- Minghao Wu — Ph.D. student, CUHK-Shenzhen; specialization in social simulation and medical foundation models.

---

Paper Information

Title:

TwinMarket: A Scalable Behavioral and Social Simulation for Financial Markets

Authors:

Yuzhe Yang, Yifei Zhang, Minghao Wu*, Kaidi Zhang, Yunmiao Zhang, Honghai Yu†, Yan Hu†, Benyou Wang†

Affiliations:

CUHK–Shenzhen · Nanjing University · Jiangsu Key Laboratory of Digital Finance

Project Page:

https://freedomintelligence.github.io/TwinMarket

Paper PDF:

https://arxiv.org/pdf/2502.01506

GitHub:

https://github.com/freedomintelligence/TwinMarket

---

Original WeChat Link: