NVIDIA’s AI Compute Monopoly May Be Shaken — AMD Bets It All, Altman Delighted

New Intelligence Report

---

Overview

When OpenAI and AMD signed a cooperation agreement for 6 GW of chip supply plus warrants, it struck like a strategic bomb — potentially reshaping the AI hardware ecosystem.

For AMD, this marks a shift from follower to potential core computing power player — a move filled with both risks and opportunities.

📎 Related Reading:

---

Major Announcement

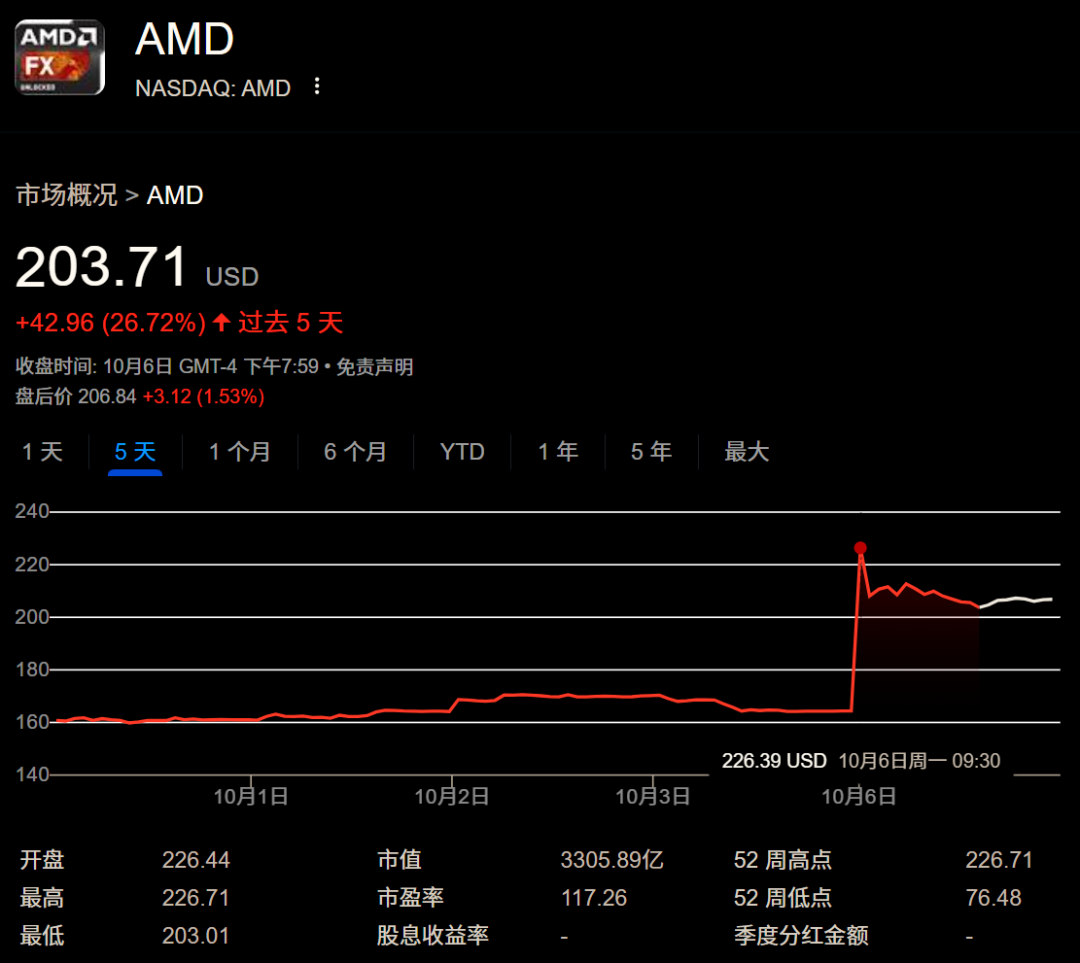

Shortly after revealing plans to deploy 10 GW of NVIDIA GPUs, OpenAI announced it will also deploy 6 GW of AMD GPUs.

Market Reaction: AMD’s share price jumped from $164.37 to $226.36 — a surge of almost 40%.

Question: Beyond market excitement, what opportunities and challenges lie ahead for AMD?

---

AMD’s Strategic Turning Point

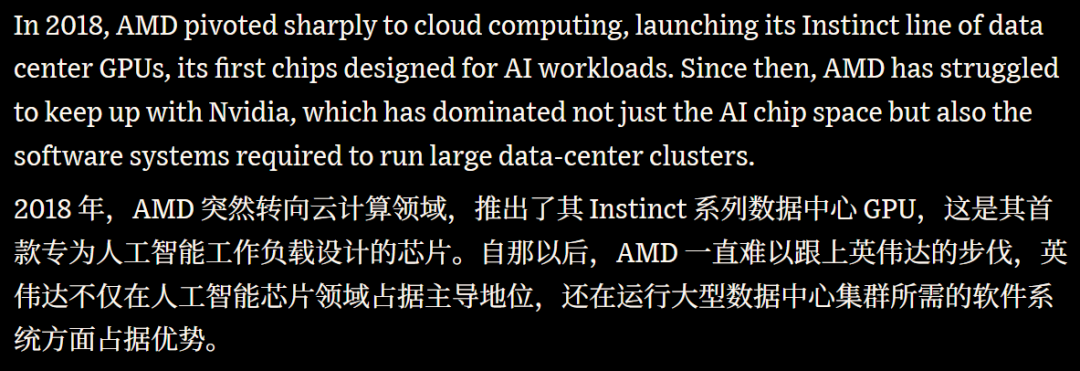

AMD has long been seen as the #2 contender in CPU and GPU markets — competing against Intel and NVIDIA.

AI Wave Catalysis

- Trend: Large-scale compute power has become a scarce resource.

- AMD’s Instinct-series GPUs target AI training and inference workloads.

- Challenge:

- Training segment has high ecosystem barriers (dominated by NVIDIA).

- Inference segment is more open but demands strict stability, efficiency, and compatibility.

Why This Deal Matters

- Beyond standard chip orders, it includes capital-binding mechanisms:

- OpenAI holds warrants to acquire up to 160 million AMD shares at $0.01/share.

- Conditions include deployment milestones, stock price levels, and other metrics.

- Full exercise could give OpenAI ~10% stake in AMD.

Strategic Benefit:

- OpenAI gains potential multi-billion-dollar equity at minimal cost.

- Rising AMD stock can fund future AMD GPU purchases.

- A mutual incentive & binding commitment — deep integration if successful.

---

Implications for the AI Hardware Ecosystem

Such alliances intertwine capital, supply chains, and platforms.

Example: Platforms like AiToEarn官网 integrate:

- AI-powered content generation

- Cross-platform publishing (Douyin, Bilibili, Instagram, YouTube, X)

- Analytics & AI模型排名

These illustrate that infrastructure diversity — whether for compute or content delivery — is key in global innovation.

---

Supply Logic and Industry Context

Compute Scarcity

- NVIDIA GPUs long dominated training/inference.

- Result: supply-demand imbalance & price hikes.

Multi-source Strategy

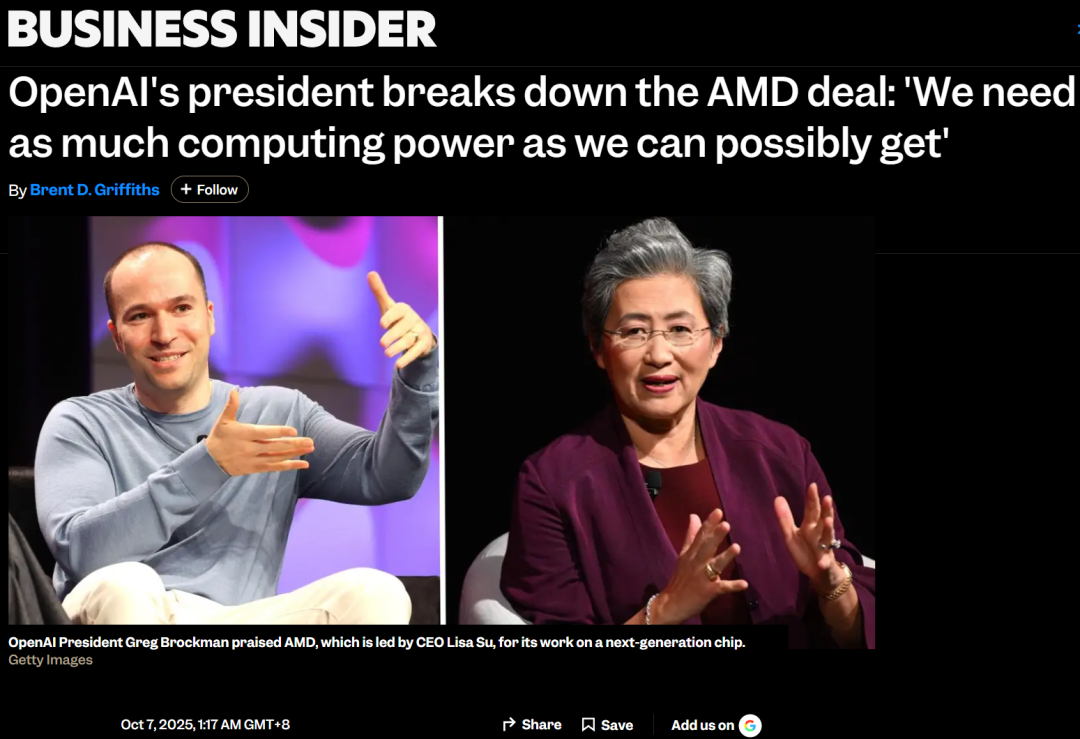

- OpenAI President Greg Brockman: "We need as much compute as we can get."

- Partnerships diversify hardware sources — including Broadcom, Microsoft, AMD.

Key Insight: AI infrastructure should never rely on a single supplier.

---

Pressures on NVIDIA’s Leadership

- Custom Chips: Cloud giants & AI labs develop their own accelerators.

- Capacity Constraints: Scarce advanced wafer fab capacity (TSMC).

- Ecosystem Moats: CUDA & NVIDIA’s toolkit remain dominant — but migration is possible.

AMD still lags in training workloads; however, inference presents competitive opportunities.

---

Risks for AMD

1. Deployment Goal: 6 GW Inference

- Requires large upgrades in datacenter power, cooling, interconnects.

- First 1 GW slated for late 2026 — ambitious timeline.

- Logistics & infrastructure challenges could disrupt schedules.

2. Manufacturing Constraints

- AMD relies on foundries like TSMC.

- Competes for capacity with Apple, NVIDIA, others.

- Yields, quality, and packaging issues may impact delivery.

3. Software Ecosystem Lag

- NVIDIA’s CUDA/cuDNN/NCCL deeply entrenched.

- AMD’s ROCm ecosystem lacks comparable maturity and developer adoption.

---

Valuation Bubble Risks

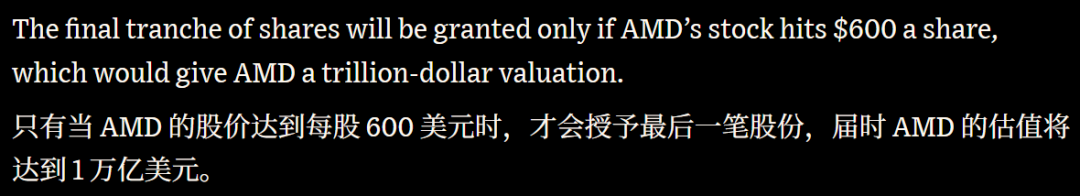

WSJ projects AMD could near $1 T market cap at $600/share — based on aggressive growth assumptions.

Downside Risks:

- Missing milestones limits equity release.

- Market revaluation could drop stock sharply.

- Competition could constrain growth outlook.

---

Three Potential Paths

Optimistic

- Smooth 1 GW deployment, faster scale-up

- Developer migration & open ecosystem adoption

- AI chip revenue share grows to 15–25% of total

- AMD becomes clear #2 in AI hardware

Neutral

- Deployment has delays

- Limited ecosystem migration

- AI chip valuation discounted

- Still better than current position

Pessimistic

- Major deployment failure

- OpenAI skips warrant exercise

- Competitor breakthroughs

- Market re-prices AMD lower

---

Strategic Takeaways

- For AMD: High-stakes gamble — core compute entry if successful, wasted effort if not.

- For OpenAI: Steps toward compute sovereignty and supply diversification.

- For Industry: Signals end of single-supplier dominance and rise of multi-architecture era.

Future Outlook: Coordinating hardware innovation with AI content/multiplatform strategies (like AiToEarn) could parallel AMD’s goals.

---

References

---

Bottom Line:

The AMD–OpenAI alliance is a calculated risk with the potential to disrupt AI hardware leadership. The next few years will reveal whether AMD can match execution to ambition — and whether diversified ecosystems in both compute and content can become the new norm.