OpenAI Aligns with Amazon, Microsoft Partners with Anthropic — In Silicon Valley, It's Interests Over Allies

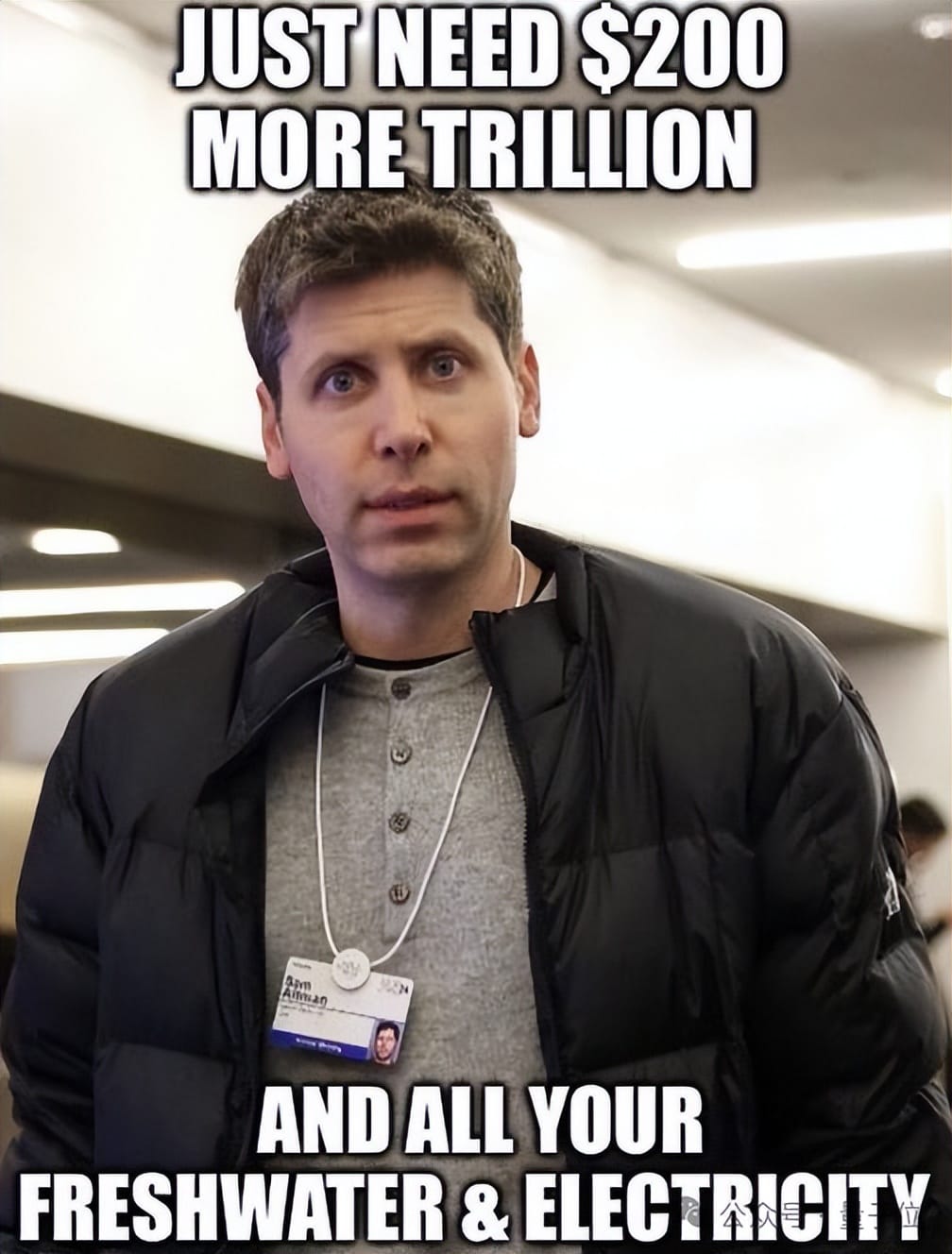

OpenAI’s $1.4 Trillion Compute Ambition Sparks Massive Cloud Spending

Amazon has become the first big winner from Sam Altman’s grand vision — securing a $38 billion mega-deal overnight.

For a company rumored to eventually debut in a $1 trillion+ IPO, such multi-billion-dollar compute contracts appear to be signed with zero hesitation.

> Altman buys GPUs as casually as collecting Pokémon…

---

Despite Huge Losses, Spending Continues

Just days ago, Microsoft revealed: OpenAI lost $11.5 billion last quarter.

Yet Altman pressed on — signing the $38B AWS deal without blinking.

When asked whether OpenAI could sustain the spend, Altman responded confidently on a podcast:

> Those making a fuss online about our compute spending… if they could buy OpenAI stock, they’d be rushing to do it.

---

Breaking Down the $38B Amazon Deal

Within a week of ending its exclusive cloud relationship with Microsoft, OpenAI:

- Partnered with Amazon in a $38B strategic cloud computing agreement.

- Entered one of the largest SaaS/cloud service contracts in history, according to analysts.

Market impact:

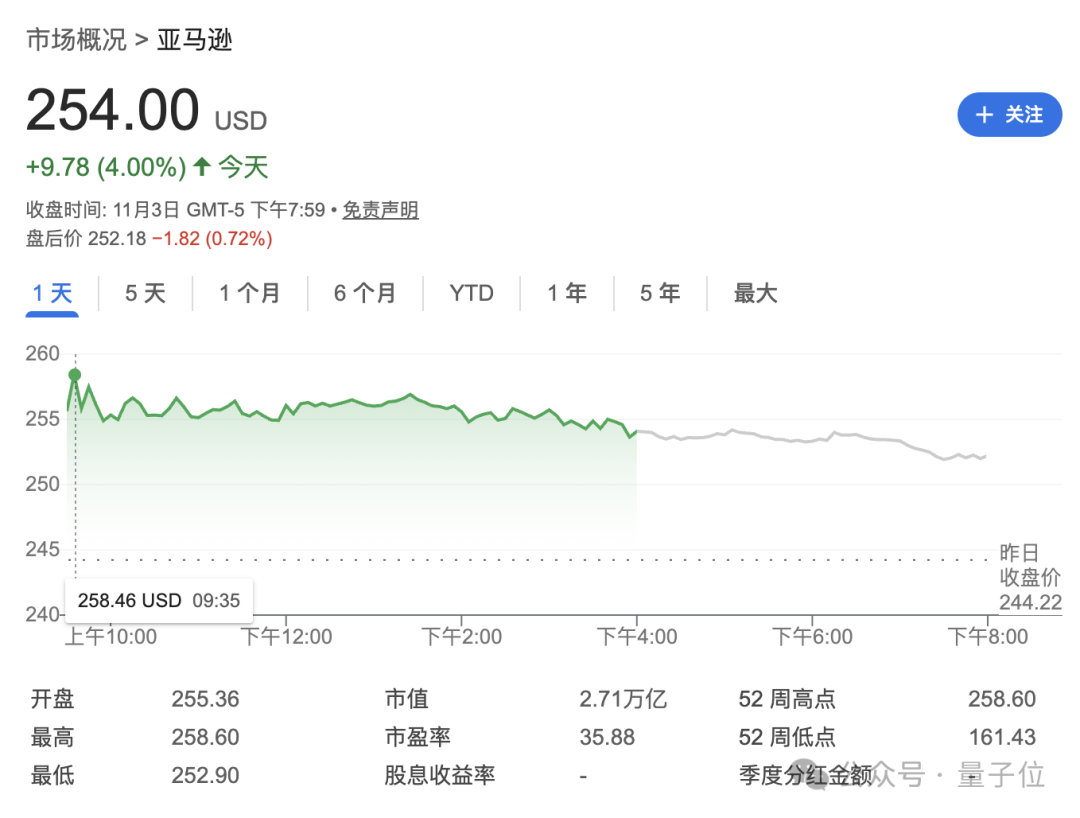

- Amazon stock: surged over 5% early trading, +$140B market cap — a new record.

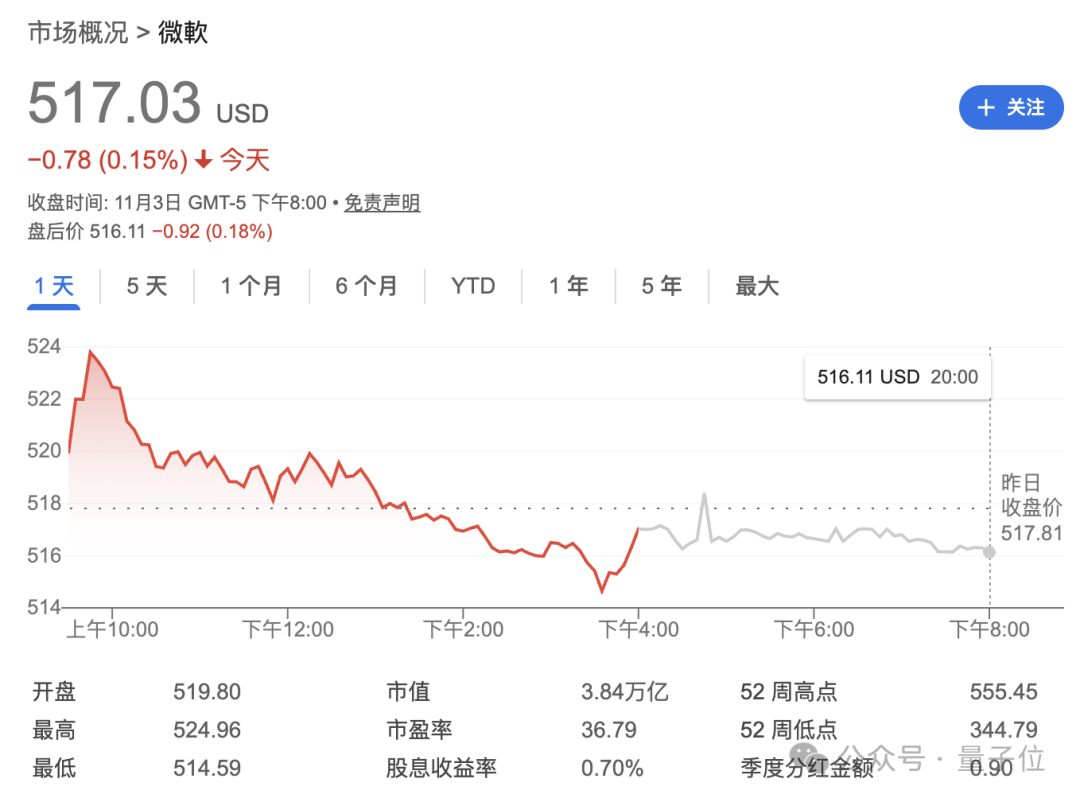

- Microsoft stock: dipped slightly.

---

AWS Benefits to OpenAI

According to official statements, OpenAI will receive:

- Full AWS compute access

- Hundreds of thousands of next-gen NVIDIA GPUs

- Tens of millions of CPUs

- Custom-built, ultra-high-spec compute infrastructure optimized for training and inference.

This system is built atop Amazon EC2 UltraServer, interconnecting NVIDIA GB200/GB300 GPUs over high-speed, near-zero-latency networks — capable of powering workloads from ChatGPT daily inference to frontier model training.

Altman noted:

> Frontier models need massive, stable compute. Partnering with AWS strengthens the global compute ecosystem and drives the next wave of AI breakthroughs.

---

Deployment Timeline

- AWS resources: Immediate availability

- Full deployment: End of 2026

- Reserved capacity: Through 2027+

Translation: $38B is just the opening bid.

AWS CEO Matt Garman added:

> As OpenAI pushes boundaries, AWS’s world-class infrastructure will be their foundation.

> Instant access to massive compute is where AWS excels.

---

Prior Collaborations

Earlier this year:

- OpenAI’s open-source model weights appeared on Amazon Bedrock.

- Quickly became one of Bedrock’s top model providers, used by thousands of businesses for agents, code gen, reasoning, and more.

---

The $1.4 Trillion Compute Empire Plan

Last Tuesday’s livestream headline:

OpenAI plans up to $1.4T investment building ~30 gigawatts of compute infrastructure.

Perspective:

- 1 GW ≈ nuclear plant output

- 30 GW ≈ electricity for 25M U.S. households

- Future ambition: add 1 GW compute per week.

---

Funding & Corporate Restructuring

With ARR under $20B, achieving that scale requires funding:

- ~$50B per gigawatt investment cost.

- OpenAI has transitioned to a public benefit corporation, enabling legal share issuance to raise capital.

---

End of Microsoft Exclusivity

Structural changes removed:

- Azure’s 6-year exclusivity

- Azure’s Right of First Refusal (ROFR)

Timeline:

- 2019–2024: Exclusive Azure agreement for all model work; Microsoft invested ~$13B.

- Growing compute needs → Azure no longer sufficient.

- ROFR replaced exclusivity.

- Now: No ROFR — OpenAI free to procure from any provider.

---

Oracle, SoftBank, Stargate & More

Even before Amazon:

- Deals: $250B Azure, $300B Oracle.

- Stargate super data center in collaboration with Oracle & SoftBank (self-build — long lead time).

---

AWS Playing Both Sides

Amazon also invested $4B in Anthropic last year:

Anthropic announced:

> AWS will be our core training partner, using Trainium and Inferentia chips for next-gen model training.

---

Microsoft’s Countermoves

- Integrated Anthropic’s Claude into Copilot — Office users can toggle between OpenAI or Anthropic models.

Corporate relationships are now overlapping “triangles” rather than simple partnerships.

---

For Creators: Infrastructure Wars = Opportunity

Massive AI compute moves highlight the need for scalable workflows.

AiToEarn官网 offers:

- Open-source, cross-platform AI content monetization

- Simultaneous publishing to Douyin, Kwai, WeChat, Bilibili, Xiaohongshu, Facebook, Instagram, LinkedIn, Threads, YouTube, Pinterest, X

- Analytics + AI模型排名 tracking

Much like AWS’s backbone for OpenAI, platforms like AiToEarn enable creators to scale reach and revenue.

---

Bezos and Amazon’s AI Catch-Up

AWS, pioneer in cloud computing, lagged in AI ecosystems:

- Microsoft: partnered early with OpenAI → Azure became an “AI-native cloud”

- Google: built full-stack AI in-house (TPUs, JAX, Vertex AI, Gemini)

- AWS: great in compute/storage, but incomplete AI toolkit.

---

Bezos’ Direct Push

CNBC reports Bezos asked:

> Why aren’t any AI companies using our cloud!!

- Frequent exec emails urging AI client acquisition

- Personally introduced startups to AWS

- Played a direct role in landing OpenAI’s $38B deal

While this may help AWS maintain #1 cloud share, the AI model race requires more effort.

---

References

- https://www.ft.com/content/74d79365-efdc-4446-b0ed-d53ad4b55f59

- https://openai.com/index/aws-and-openai-partnership/?utm_source=chatgpt.com

- https://www.theverge.com/2025/1/21/24349006/microsoft-openai-compute-partnership?utm_source=chatgpt.com

- https://news.mit.edu/2025/explained-generative-ai-environmental-impact-0117?utm_source=chatgpt.com

- https://www.bilibili.com/video/BV1r1yvByESw?share_source=copy_web

---

If you’d like, I can next create a visual timeline chart of OpenAI’s major cloud deals (Microsoft, Oracle, AWS) so your readers can quickly grasp the sequence — would you like me to prepare that?