OpenAI May Have Achieved the Fastest Cash Burn in History

OpenAI’s Escalating Inference Costs: A Financial Reality Check

Source: Xinzhiyuan Report

Editor: Peter

---

Executive Summary

Recently, OpenAI has been reported to face rapidly increasing inference costs.

As arguably the most cash-burning startup in history, the cost of running its large language models may be unsustainable under current revenue streams.

---

The Most Cash-Burning Startup in History

OpenAI is not a publicly listed company and thus has no obligation to disclose its revenue. However:

- Microsoft’s revenue-sharing agreement (20% cut from OpenAI’s total revenue)

- Azure spending disclosures for inference costs

Together allow for estimated financial tracking of OpenAI’s operations.

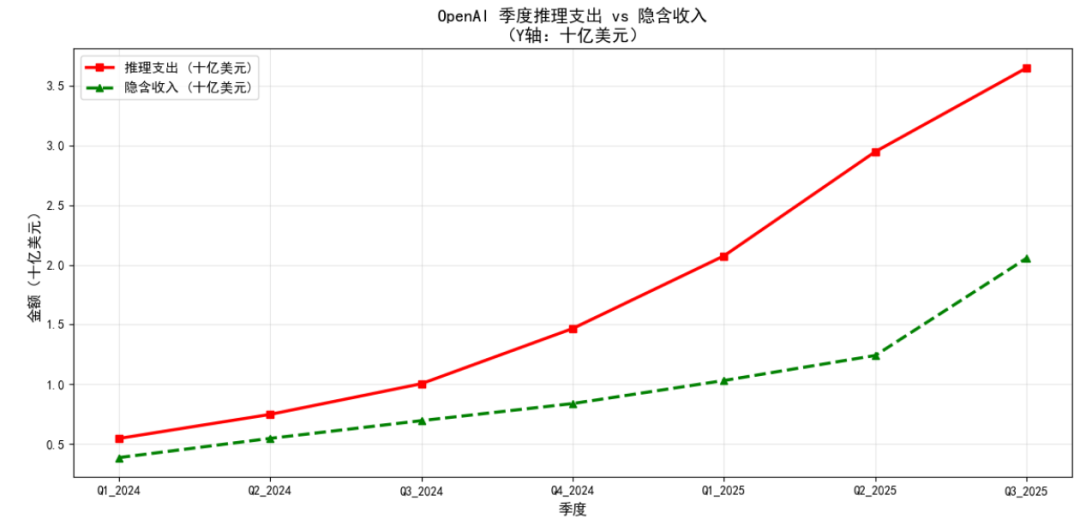

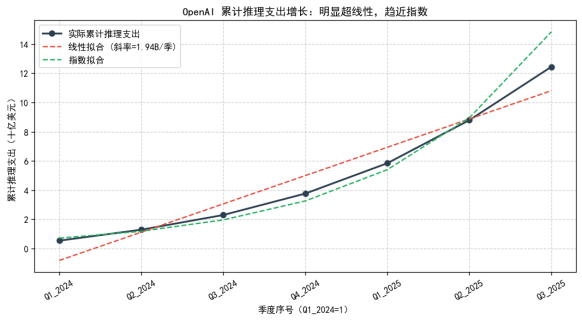

> Figure 1: Quarterly inference spending (red solid line) vs. implied revenue (green dashed line) from Q1 2024 to Q3 2025, extrapolated from Microsoft data.

Estimated OpenAI revenue and inference costs based on Microsoft data

---

Key Observations

- Q1 2024: Spending slightly higher than revenue.

- Q3 2025: Spending reached $3.65 billion, revenue only $2.06 billion.

- Cost-to-revenue ratio: ~$1.80 spent per $1 earned — losses worsening over time.

This widening cost–revenue scissor gap explains why OpenAI must continually raise external funding to sustain its operations.

---

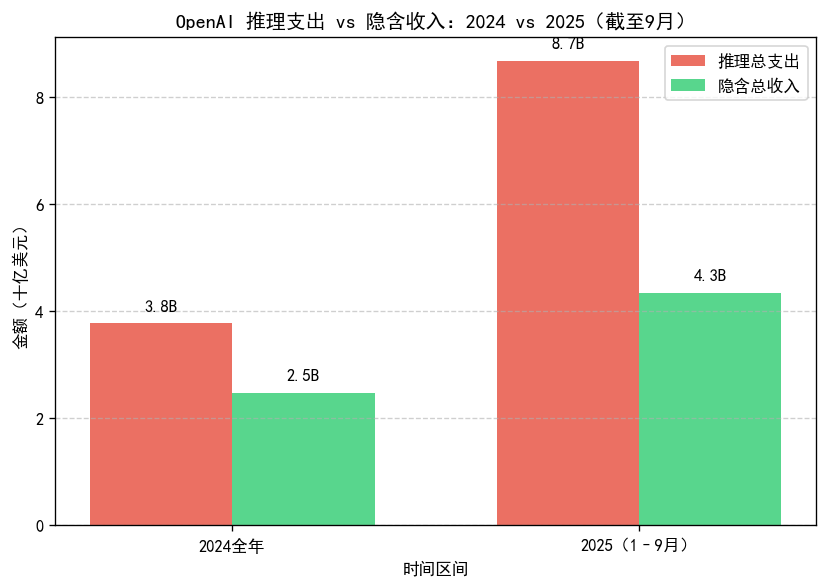

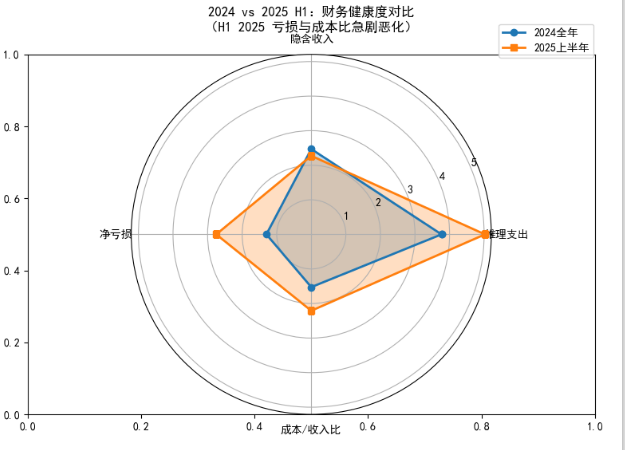

Annual Comparison: Costs vs. Revenue

- Nine months of 2025: Inference costs = $8.67 billion (2.3× 2024 total costs).

- Revenue grew only 75% (from $2.47 billion to $4.33 billion).

- Losses:

- 2024: $1.3 billion

- 2025 (first nine months): $4.34 billion

---

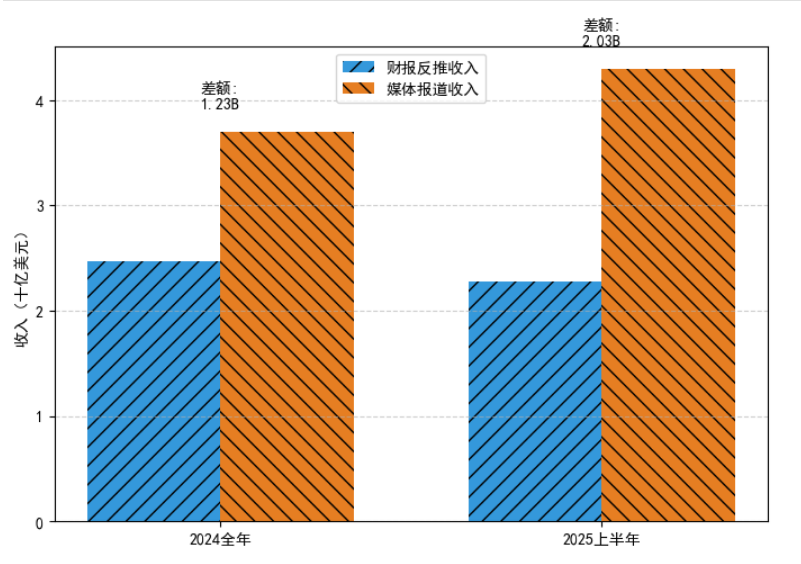

Reality vs. Media Reports

Microsoft’s financial disclosures show a marked difference from media revenue claims:

- 2024:

- Microsoft data: $2.47 billion

- Media: $3.7–4 billion (+50% overestimation)

- 2025 (H1):

- Microsoft data: $2.27 billion

- Media: $4.3 billion (double the implied figure)

This suggests a serious overestimation of OpenAI's growth narrative in the media and investor circles.

---

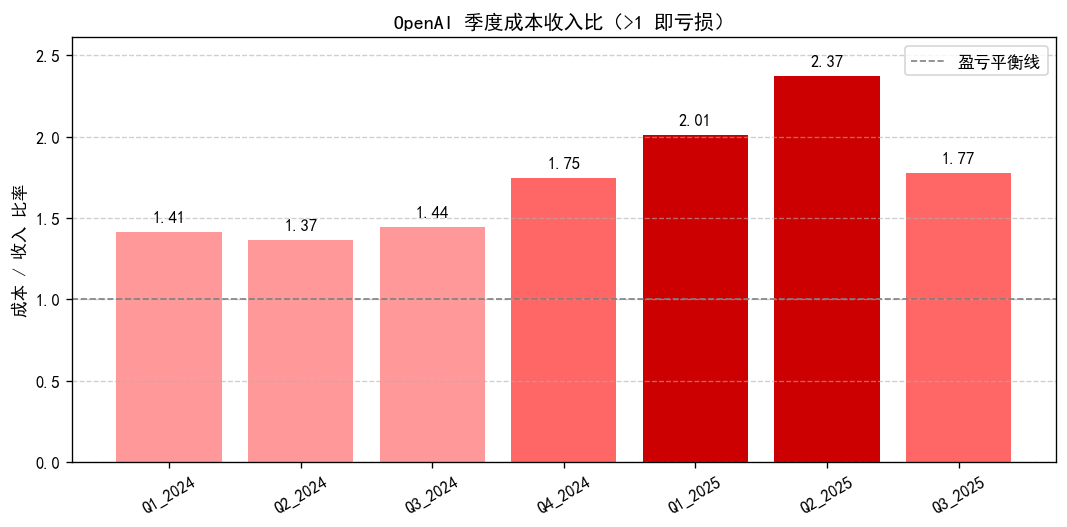

Spending $2 to Earn $1: Quarterly Breakdown

> Figure 4: OpenAI’s quarterly Cost/Revenue ratio — focused on inference only.

How to read it:

- > 1.0: Loss-making on inference.

- Higher ratios indicate deeper losses.

Notable Ratios in 2025

- Q1: 2.01 — spending twice the revenue.

- Q2: 2.37 — worst in history, “the more they sell, the more they lose.”

- Q3: 1.77 — still unprofitable, worse than any quarter in 2024.

---

Inference Trend Analysis

Curve fits reveal inference costs are growing exponentially, driven by increasing model sizes.

Projected 2025 full-year inference cost: $12–14 billion.

Revenue growth: linear only.

Without breakthroughs in efficiency or pricing redesign:

- OpenAI will remain reliant on capital injections

- Risks becoming a permanent cash black hole

- Revenue goals like $13 billion in 2025 are unrealistic (would require $9 billion in Q4 — vs. $2.35 billion actual Q3)

---

Critical Questions Ahead

- If OpenAI’s inference costs are this high, are profit margins viable for any leading-edge model developer?

- Can an industrial ecosystem around large models be built sustainably?

- Is there potential for a speculative bubble in generative AI economics?

Reference: https://www.wheresyoured.at/oai_docs/

---

Possible Paths to Sustainability

In response to rising costs across the AI sector, creators and developers are exploring more sustainable approaches:

Open-source global monetization platforms like AiToEarn offer:

- AI-powered content generation

- Cross-platform publishing (Douyin, Kwai, WeChat, Bilibili, Xiaohongshu, Facebook, Instagram, LinkedIn, Threads, YouTube, Pinterest, X)

- Analytics integration

- AI model ranking

By reducing cost dependence on centralized providers and diversifying revenue streams, AiToEarn provides a blueprint for turning AI creativity into sustainable income — potentially mitigating the risks currently faced by OpenAI.

---

Bottom line:

OpenAI’s current cost trajectory signals deep structural issues. Without drastic efficiency gains or a shift in monetization strategy, the gap between cost and revenue will continue to widen — turning even groundbreaking innovation into a financial liability.