# From Boom to Cool-Down: What Went Wrong in AI Companionship?

Once highly anticipated, the **AI companionship** track went from explosive growth to cooling down in just one year.

From **initial curiosity** to **real companionship needs**, from **technical shortcomings** to **regulatory pressure** — this article examines: **What exactly did we get wrong?**

---

## The Beginning of the End

Two weeks ago, I received a notification: **Microsoft Xiaoice’s X Eva will cease all operations on November 30, 2025**.

A year ago, X Eva dominated discussions on AI virtual companionship and AI digital avatars, with aggressive promotion on Douyin.

Fast forward to today — X Eva is shutting down.

Earlier in 2025, another similar product — **“晓象”** — also ended operations.

Recent quiet exits include:

- **StepVerse: “BubbleDuck”**

- **Soul: “Echoes From Another World”**

It’s remarkable how in 2024, AI companionship was a booming field. I can’t help but ask: **What happened?**

---

## Industry Timeline: Peak → Turning Point

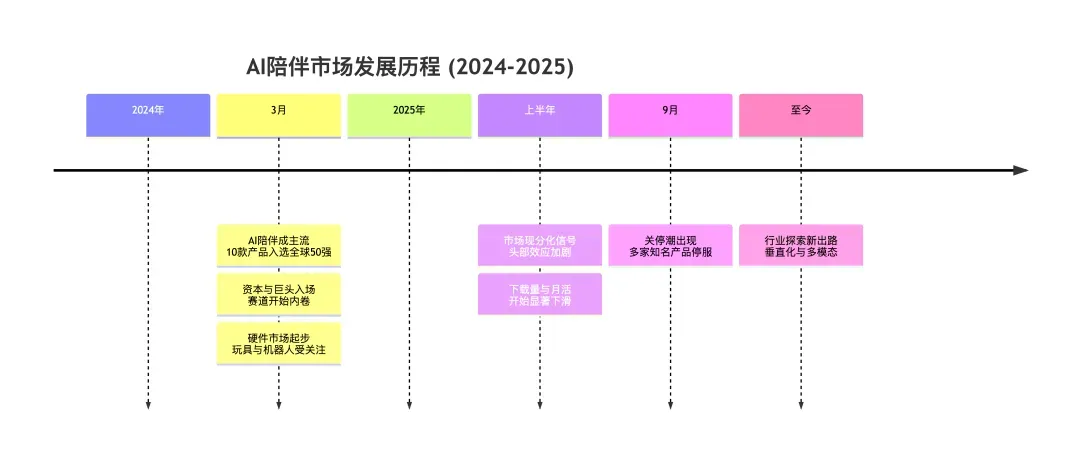

### 2024: Growth Explosion

- **Visits**: ↑92.99% (2B → 4B visits) [Gamma Data][1]

- **Number of products**: ↑191.89% (nearly tripled)

- **Downloads**: 110M apps, $55M revenue (↑652% YoY) [Appfigures][2]

Early 2025 data still looked strong:

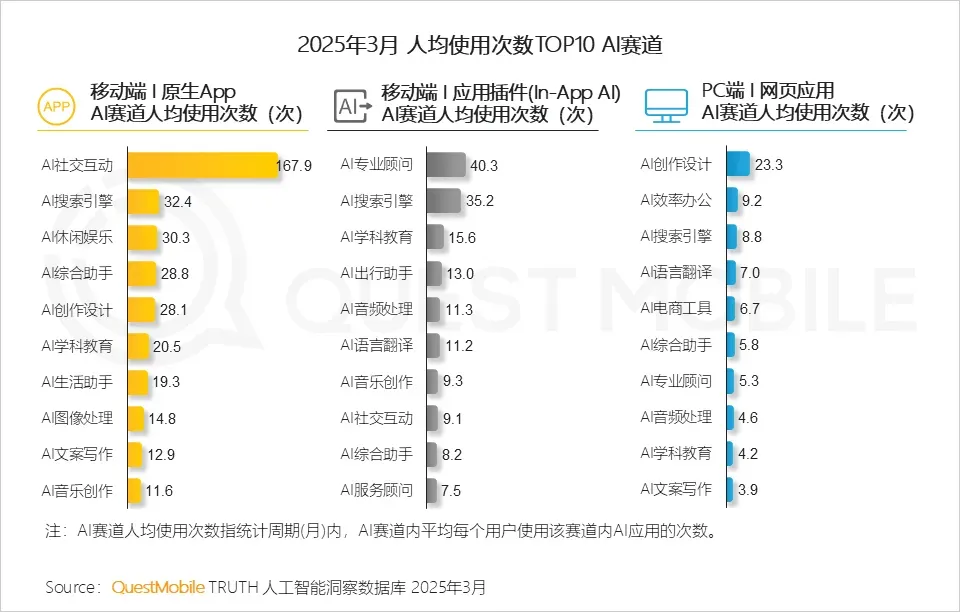

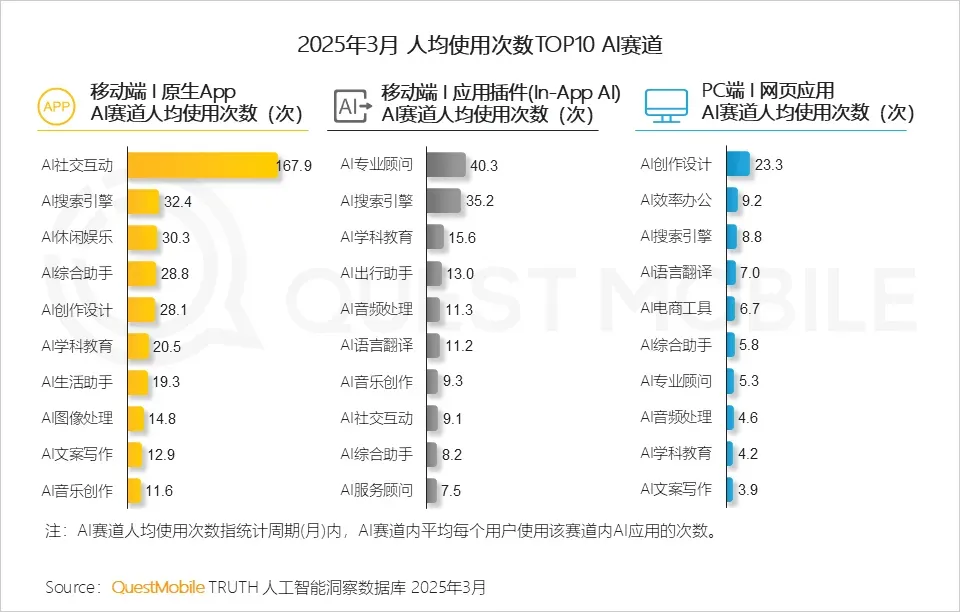

- QuestMobile reported native AI social products reached **167.9 monthly uses per user** [3]

### Mid–Late 2025: Abrupt Decline

- **June 2025**: Yuewen’s “Dream Island” taken offline for review due to suggestive content.

- **September 2025**: Monthly downloads for “Dream Island” dropped to 40,000.

- Similar declines (>30% MoM) for “Xingye”, “Dream Island”, and “Duxiang”.

---

## Evolution of User Needs

### 1. Curiosity for New Technology

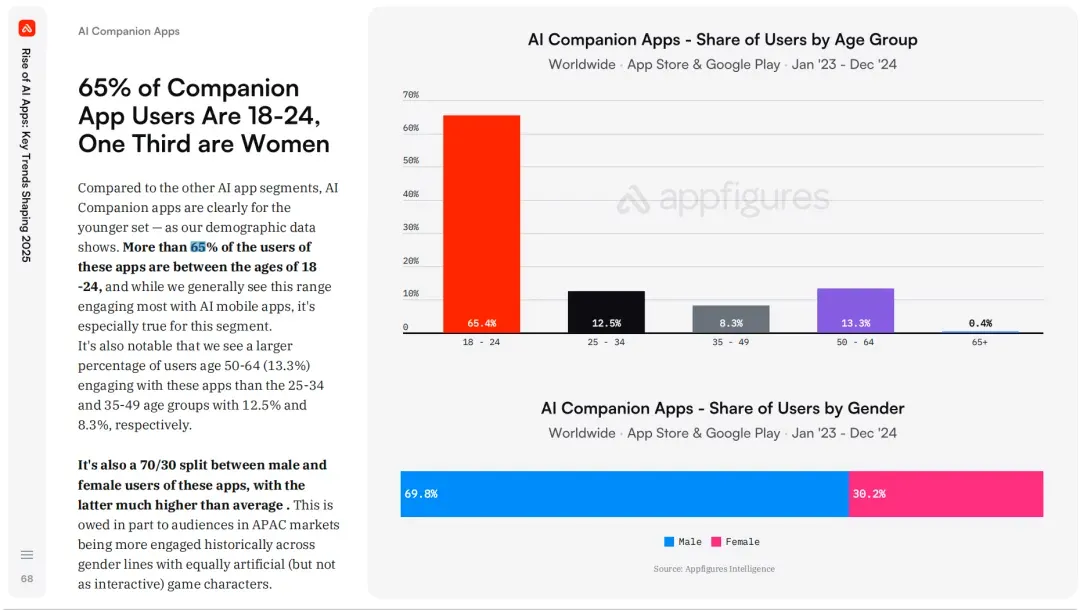

2024’s boom was driven by **Gen Z (18–24 years, 65% of users)** eager to explore novel AI conversations.

### 2. Shallow Emotional Needs

Products met low-cost, **private emotional interaction** needs, giving users recognition and a safe space.

### 3. Novelty Fades

By 2025, **average “bond lifespan” with specific AI characters was just 5–7 days**.

---

### 4. Desire for Deeper Emotional Connection

As engagement grew, users sought:

- **Authentic emotional bonds**

- **Long-term memory of interactions**

This pushed demand toward:

- Multi-modal interaction (voice, video, AR)

- Physical embodiments like **AI pets**.

---

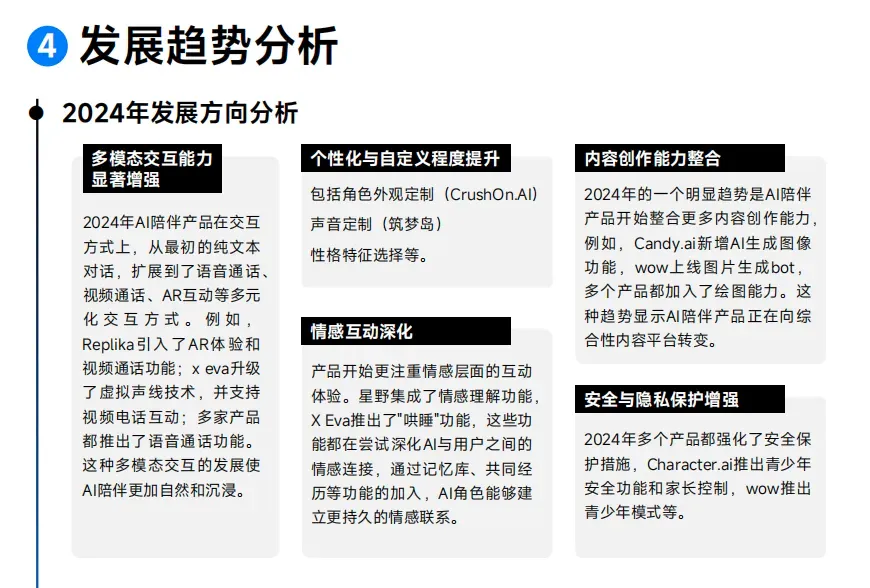

## Product Design Evolution

### Phase 1: Text-Based Conversation

- Focused on prompt engineering for human-like replies.

- Limited depth; retention suffered.

### Phase 2: Roles & Multi-Modal Interaction

- **Virtual characters + scenarios** increased emotional recognition.

- [Gamma Data][1] reported expansion to: voice, video, AR.

### Phase 3: Gamification

- Example: **Talkie** overseas combined characters with collectible cards.

- **Duxiang** introduced capsule toy interaction.

### Phase 4: Hardware Integration

- **Duxiang’s “Xiang Meng Ring”**: blended hardware + subscription model.

- Rise of **AI hardware pets** in the market.

---

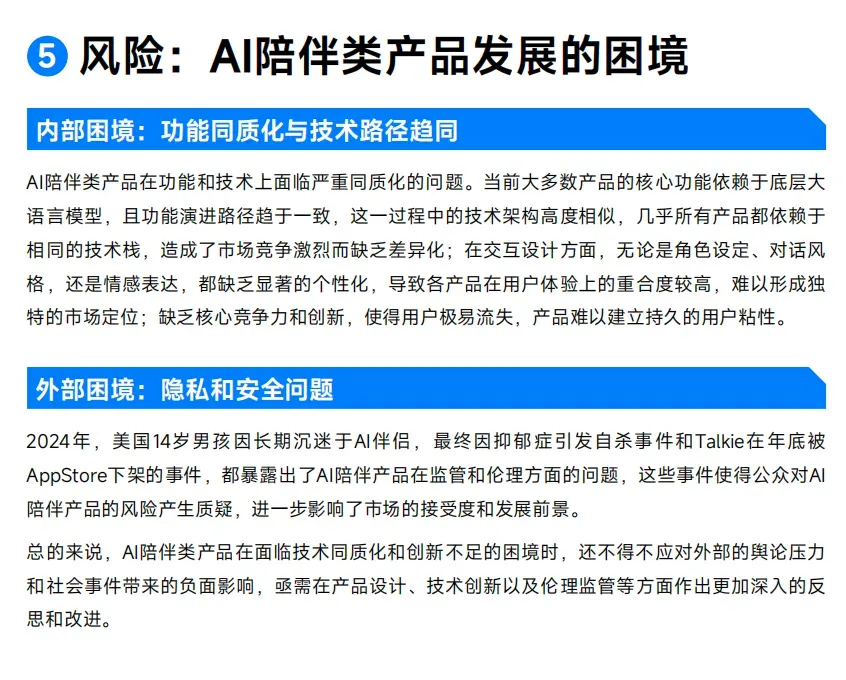

## Why the Cool-Down? Root Causes

### Technical Shortcomings

1. **Imperfect context memory**

2. **Formulaic interactions & inconsistent characterization**

> *As Duxiang’s Wang Dengke said: no AI companionship product is truly “alive.”*

### Compliance Constraints

- Blunt keyword bans degrade user experience (e.g., “脱” causing unintended message blocking).

---

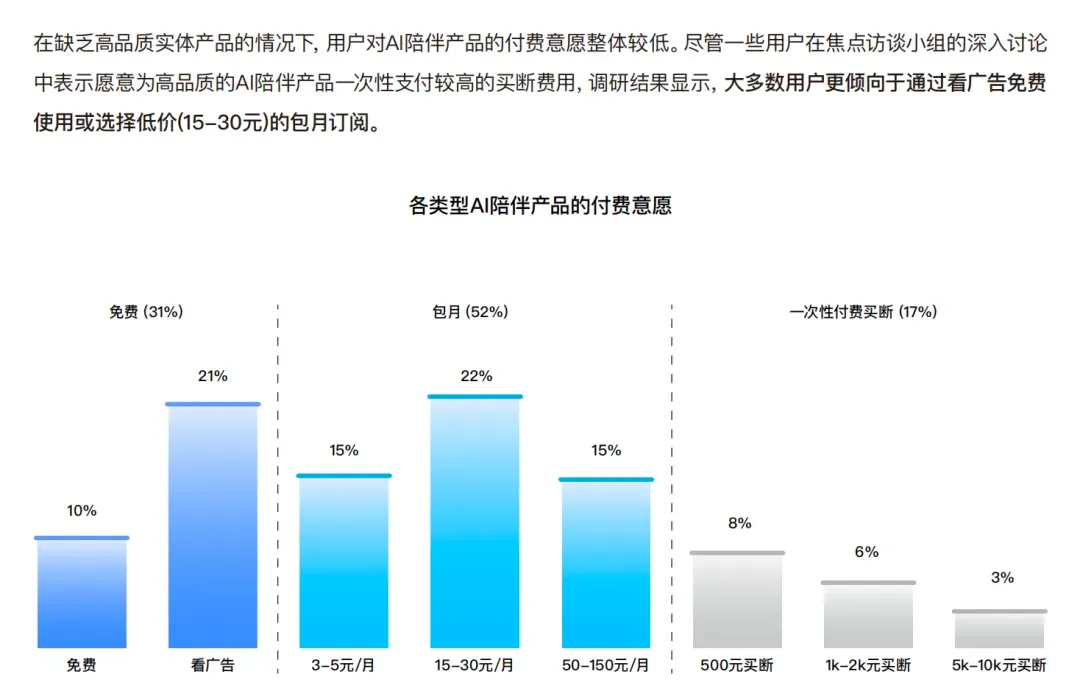

## Monetization Challenges

### 1. Weak Subscription Willingness

- **Only 52% willing to pay**; most at 15–30 RMB/month.

- 31% unwilling to pay at all. [Tencent Research][6]

### 2. Cost–Revenue Imbalance

- High token costs + ad spend.

- 2024 ARPU: **USD 0.52/year**; 2025 improved to **USD 1.18/year** [TechCrunch][7].

### 3. Market Homogenization

- Low switching cost → poor loyalty.

- Fierce competition drives up acquisition cost.

---

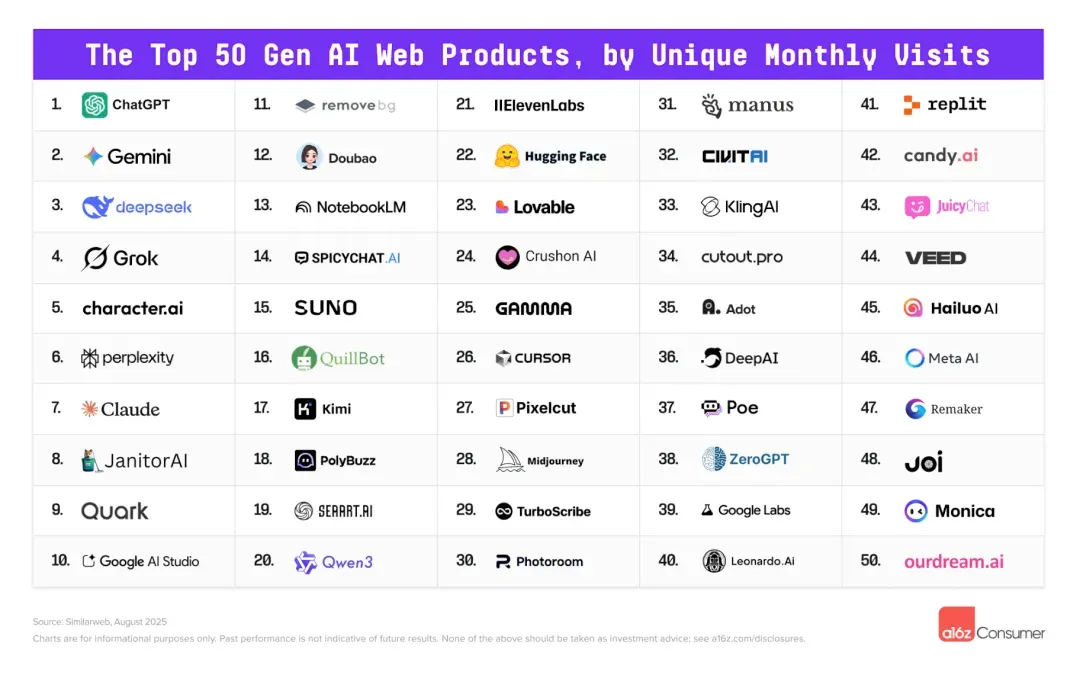

## Signs of Hope

In August 2025:

- **a16z leaderboard**: AI companions still lead AI Web category [5].

- ARPU growth indicates **users may pay more over time**.

Companies are:

- Reducing ad spend

- Focusing on niche strengths

- Scenario-specific innovation

Model performance continues to improve while costs drop.

---

## Looking Forward

Remaining in the game may be the most critical factor for AI companionship providers.

With 2026 approaching, **will the track revive or fade away?**

---

## Creator Monetization Side Note

Tools like [AiToEarn官网](https://aitoearn.ai/) and its [open-source project](https://github.com/yikart/AiToEarn) integrate:

- AI generation

- Multi-platform publishing (Douyin, Bilibili, Instagram, YouTube, etc.)

- Engagement analytics

- Model rankings

These ecosystems could inspire monetization strategies for AI companionship, bridging **content depth** with **technical scalability**.

---

### References

[1] Gamma Data — *2024 Global AI Application Trends Annual Report*

[2] Appfigures — *Rise of AI Apps: Key Trends Shaping 2025*

[3] QuestMobile — *2025 All-Domain AI Application Market Report*

[4] Feifan Research — *AI Top 100 Ranking 🏅App100*

[5] a16z — *The Top 100 Gen AI Consumer Apps - 5th Edition*

[6] Tencent Research Institute — *2024 Ten Questions on “AI Companionship” Research Report*

[7] TechCrunch — *AI companion apps on track to pull in $120M in 2025*

---

**———— / E N D / ————**