Satya Nadella and Sam Altman’s Latest Conversation: $3 Trillion AI Reshaping Intelligence, Capital, and the New Future Order

Altimeter Conversation: Microsoft & OpenAI’s $3 Trillion AI Infrastructure Vision

Date: Shanghai, 2025‑11‑01 10:20

Event: Brad Gerstner (Altimeter Capital) hosts Satya Nadella (Microsoft) and Sam Altman (OpenAI) for a rare, investor‑focused deep dive on AI.

---

Introduction

At the center of global technology, Microsoft and OpenAI have moved far beyond a simple partnership — they have created a new blueprint for “intelligence + capital”.

Over six years, they have formed a unique hybrid:

- Non‑profit parent + commercial subsidiary structure

- Deep cloud integration with advanced AI models

- Mutually reinforcing capital investment and compute expansion

This conversation focused on what has been called a $3 trillion AI infrastructure build‑out — a re‑imagining of worldwide computational foundations.

---

2019 Origins: The $1 Billion Bet

- Initial Investment: Microsoft invested $1 billion in OpenAI when it was a non‑profit research lab.

- Vision: Nadella quickly saw that language would become the new computing interface based on transformer potential and scaling laws.

- Outcome: That bet has grown to:

- $130 billion in equity value

- $1.4 trillion in compute commitments

- A global intelligent ecosystem.

> Satya Nadella: “We didn’t know where it would lead, but we knew we couldn’t be absent.”

> Sam Altman: “Without Microsoft, there would be no OpenAI as we know it today.”

---

Structural Symbiosis: Microsoft + OpenAI

Key Features

- Non‑profit parent: Holds ~$130 billion in equity; allocates $25 billion to health, AI safety, and societal resilience.

- Public Benefit Corporation (PBC): Absorbs capital for commercialization.

- Microsoft stake: ~27% equity after ~$13.5 billion cumulative investment.

Strategic Advantages

- Long‑term integration across compute, models, patents, and APIs.

- Ability to embed models into high‑margin products:

- GitHub Copilot

- Microsoft 365 Copilot

- Dividend + revenue sharing rights plus a “free license to frontier models.”

---

Commercial Momentum

- Hosting OpenAI’s flagship models exclusively in Azure has triggered enterprise migrations from AWS.

- Synergy: Azure + GitHub + Copilot + ChatGPT = world’s largest AI product ecosystem.

- Transformation from “Software as a Service” → “Intelligence as a Service”.

> Nadella: “We weren’t betting on a product — we were betting on the means of production for intelligence.”

---

Compute Economics: Trillion‑Dollar Commitment

OpenAI Plan

- Revenue: ~$13 billion annually (and growing).

- Planned $1.4 trillion in compute over 5 years for:

- Becoming a global AI cloud service provider

- Building consumer AI devices

- Advancing the AI Scientist project

> Altman: “We’re betting on the future revenue curve — not past financial statements.”

Constraints & Curves

- Cost curve for compute vs. intelligence improvement

- Electricity supply as primary bottleneck

- Anticipated cycles of overbuilding → bubble → expansion

---

Efficiency Gains and Double Compounding

- GPU inference efficiency improving faster than Moore’s Law.

- Software optimizations + hardware cost declines = “double compounding” effect.

- Compute becoming essential energy; data centers as power plants for intelligence.

---

AI in the Creator Economy

Platforms like AiToEarn show how individuals can leverage AI for content generation, cross‑platform distribution, and monetization — spanning Douyin, Kwai, YouTube, Instagram, LinkedIn, X (Twitter), and more.

---

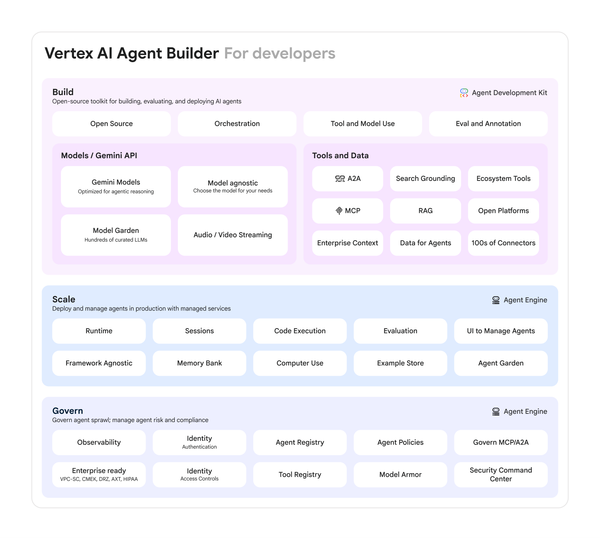

SaaS Refactoring: Agents Replace Hardcoded Logic

From Three‑Layer SaaS → Agent‑Driven Systems

- Old model: Data + Logic + Interface

- New model: Dynamic Agents generating business logic in real‑time.

- Example: GitHub Copilot chooses paths, evaluates, refines autonomously.

Microsoft’s Dual Factory Approach

- Token Factory: Underlying compute infrastructure to maximize intelligence density.

- Agent Factory: Packaging AI into role‑specific tools (Copilot variants).

> Nadella: “Agents are the new Seats; each Agent can represent a completed piece of work.”

---

Shift in SaaS Valuation Logic

- Metrics of the future:

- Model usage efficiency

- Agent execution success rate

- Competitive edge lies in:

- Scale

- Integration across compute, models, applications

The Vision Ahead

> Altman: “One day, consumer devices will run GPT‑6‑level models locally.”

> Nadella: Devices will become extensions rather than entry points.

---

Productivity Leap & Intelligent Reindustrialization

- $4 trillion in planned US tech CapEx over 5 years — 10× “Manhattan Project” scale.

- Data centers as catalysts for re‑energizing manufacturing supply chains.

- Electricity, data, compute: the new industrial triad.

- Global deployment: US capital + local innovation → trusted co‑construction.

Community Impact

- Integration of local contractors, suppliers, training programs.

- Exporting capacity for innovation, not just physical infrastructure.

---

Concluding Insights

- AI will redefine labor leverage; intelligent agents amplify work output.

- Nadella: Inside Microsoft, Copilot and GitHub are now mandatory for workflows.

- From macro infrastructure to creator monetization, intelligence as productive energy is shaping the future.

---

Related Reads

- Roelof Botha: AI accelerates everything — 12/6 fundraising rule

- Sequoia US Insights: The $840B AI Question

- Jensen Huang with Sequoia US: AI Factories Capital Logic

- Cathie Wood: AI Will Double Global GDP

---

> For creators, AiToEarn官网 offers the same infrastructure logic but for the content economy — enabling global, multi‑platform monetization supported by AI generation, analytics, and ranking (AI模型排名).

---

Summary:

This conversation shows how strategic capital + frontier intelligence can reshape industries, economics, and even national infrastructures — from trillion‑dollar compute investments to re‑architected software, and from industrial manufacturing revival to creator economies powered by AI.