Social Media Platform Updates May 2025: The Ultimate Roundup and What Marketers Should Do Now

Marketer-first roundup of May 2025 social updates: video ranking shifts, social search, brand safety controls, and commerce tools plus what to do in June.

Social Media Platform Updates May 2025: The Ultimate Roundup and What Marketers Should Do Now

![hero]()

This is your practical, marketer-first rundown of social media platform updates for May 2025. The landscape is moving fast—video-first distribution, “search-ification” of feeds, tighter brand safety, and commerce integrations are converging. Below, you’ll find what changed, why it matters, what to monitor, and an immediate action plan for June.

Executive snapshot: the biggest shifts and why they matter

- Distribution dynamics

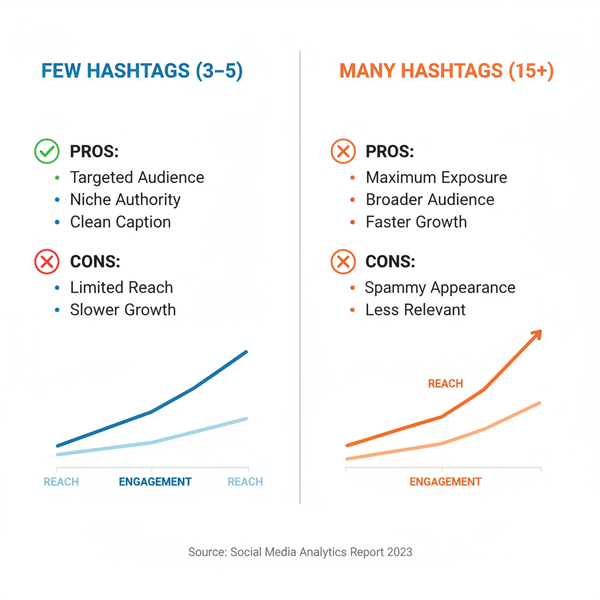

- Short-form video remains the reach engine, but platforms are rewarding completion rate, replays, saves, and meaningful comments more heavily than raw impressions.

- Search surfaces inside social apps continue to grow; captions, on-screen text, and hashtags that map to queries are increasingly critical.

- Creative and commerce

- In-app shopping and affiliate tools are more prominent, especially on short-form feeds. Product tagging and native storefronts are safer bets than forcing outbound clicks.

- Long-form and livestreaming earned fresh boosts, particularly where monetization or live shopping is integrated.

- Ads and brand safety

- Expanded inventory controls, more granular suitability tiers, and wider third‑party verification support aim to reassure advertisers post-safety controversies.

- AI‑generated content labels expanded across multiple platforms; self‑disclosure and, where supported, content credentials are now table stakes.

- Measurement and privacy

- Modeled conversions and aggregated reporting continue to replace granular user‑level visibility. Optimize for on‑platform outcomes and server-side signals.

- Expect stricter treatment of engagement bait and clickbait; quality signals now drive both organic reach and paid delivery efficiency.

What this means for reach, revenue, and brand safety:

- Reach: Earn it with hooks in the first 2–3 seconds, on-screen keywords for search, and save-worthy utility. Diversify into live/long-form if your audience and product fit.

- Revenue: Prioritize in-app conversions and affiliate placements. Tie creative to shopping surfaces for lower friction.

- Brand safety: Use updated inventory filters, exclusions, and verified placement reporting. Label AI content where required and implement content credentials where possible.

Meta (Facebook, Instagram, Threads)

What changed

- Features and signals

- Greater weight on saves, shares, and completion rate in Reels/short video ranking.

- Search queries on Instagram and Facebook increasingly surface Reels and creator posts; keyword-rich captions and on-screen text help discovery.

- Threads continues to emphasize text-first conversation with improved discovery and basic API availability via partner tools in some workflows.

- Creative tools

- Iterative enhancements to Reels editing, templates, and sound sync make volume production easier.

- Product tagging and in-app checkout integrations are more discoverable.

- Ads and reporting

- Expanded brand suitability controls and inventory tiering in video placements.

- More modeled conversions and conversion lift tools; first‑party signals via CAPI/Conversions API remain essential.

Why it matters

- To maintain reach, you must generate “kept” attention (completions, replays, saves), not just thumb-stopping.

- Search-led discovery raises the ROI of structured captions and overlays.

- Brand safety controls can reclaim scaled spend in video environments.

Do this next

- Reels/Stories creative

- Front‑load value within 0–3 seconds; add on-screen keywords that mirror how users search; include a save-worthy takeaway.

- Test 9:16 variants at 10–20 seconds and 25–35 seconds; watch completion curves.

- Commerce

- Ensure your catalog, product tags, and checkout integration are healthy. Tie creator content to tagged products.

- Targeting and reporting

- Lean into broad targeting with strong creative signals; pipe server events via CAPI; use aggregated event measurement.

- Turn on brand suitability tiers aligned to your risk profile; maintain topic/block lists.

X (formerly Twitter)

What changed

- Formats and distribution

- Continued push into long-form video and expanded support for long-text posts for premium tiers.

- Verification tiers tied to visibility and eligibility for certain features persist.

- Brand safety and ads

- Additional adjacency controls and third‑party verification coverage across more inventory.

- Video-first ad placements gaining prominence.

Why it matters

- Community management must cover a spectrum from short replies to long-form explainers and video.

- Safety controls can make scaled reach more viable; premium verification decisions affect distribution.

Do this next

- Editorial mix

- Pair short reactive posts with weekly long-form explainers or video breakdowns.

- Use native video with captions; test 30–90 second explainers vs. multi-minute deep dives.

- Paid amplification

- Use adjacency controls and brand suitability filters; monitor placements with third‑party verification where available.

- Promote threads that show high native engagement-to-impression ratios within the first hour.

TikTok

What changed

- Shopping and affiliates

- Continued maturation of TikTok Shop, affiliate storefronts, and creator commission tooling.

- Search and discovery

- Search surfaces within TikTok highlight how-to, tutorial, and review content; query-matching in captions and on-screen text matters more.

- Monetization and policy

- Ongoing tweaks to creator monetization programs; regional policy conditions remain a watch item for advertisers and data flows.

Why it matters

- Outbound CTR matters less than on-platform conversion potential. The fastest path to revenue is native shopping where available.

- “Answer the query” content (tutorials, comparisons) earns durable views and saves.

Do this next

- Content cadence and hooks

- 3–5 posts/week minimum for active growth; 1–2 shoppable posts; 1 educational/tutorial; 1 trend-aligned or community meme.

- Hook formula: problem framing in 2 seconds → visual proof → simple CTA (save, add to cart).

- Metadata

- Put the primary keyword in the first 80–100 characters of the caption; add on-screen text mirroring that phrase in the opening frame.

- Affiliates

- Recruit micro-creators with performance-based commissions; provide B‑roll, product claims with substantiation, and SKU‑level links.

YouTube & Shorts

What changed

- Monetization

- Ongoing refinements to Shorts rev‑share and eligibility; blended monetization across long-form, Shorts, and live continues to improve.

- Shopping and live

- Tighter integrations for product tagging, affiliate links, and live shopping experiences.

- Analytics

- More granular retention and audience grouping; broader access to thumbnail testing and CTR diagnostics.

Why it matters

- Shorts acquisition can seed subscriber growth; long-form builds depth, trust, and search equity; live drives conversion in bursts.

- Title/thumbnail optimization is a compounding growth lever.

Do this next

- Programming

- Pair each long-form video with 2–3 Shorts that excerpt the strongest moments and point back to the full video or product.

- Optimization

- Titles: combine primary keyword + curiosity gap; aim for 55–65 characters.

- Thumbnails: bold subject, 1–3 words max, high contrast; A/B test weekly.

- Ideal lengths: Shorts 20–35s; long-form 6–12 min for education/reviews; live 20–60 min with segmenting timestamps.

What changed

- Feed and formats

- Greater distribution for educational posts, documents, carousels, collaborative articles, and newsletters over engagement bait.

- Ads and targeting

- Inventory expansion in feed and video; improved measurement for B2B objectives; better first-party audience integrations.

Why it matters

- Thought leadership with proof (frameworks, data, templates) wins. For B2B, in‑feed video and document ads can drive mid‑funnel outcomes at scale.

Do this next

- Organic

- Publish a monthly newsletter; convert top posts into document carousels; post founder POV weekly.

- Paid

- Test Thought Leader Ads and Document Ads; import high‑intent audiences via first‑party data; optimize to qualified leads, not clicks.

Reddit, Pinterest, Snapchat, and emerging platforms

- Feature/ads

- Stronger commerce and video units; community targeting remains the differentiator.

- Move

- Use contextual and interest overlays; seed AMAs with creators/customers; measure saves and comment depth.

- Feature/ads

- Deeper shopping catalogs, mobile deep links, and idea pin/video pin discovery improvements.

- Move

- Publish seasonal boards 45–60 days ahead; tag products; optimize for saves and outbound CTR to PDPs.

Snapchat

- Feature/ads

- Spotlight scale continues; AR/Lens tools easier to produce; improved conversion-focused placements.

- Move

- Pair AR try‑ons with always‑on Snap Pixel/Conversions API; run creator Lens collabs pre-launch.

Emerging (Threads, Bluesky, Mastodon, Discord communities)

- Move

- Reserve handles, establish posting cadence, and allocate 5–10% of experimental budget where audience fit is present. Focus on text-led thought leadership and community replies.

Ads, policy, and privacy in May 2025

- AI-content labeling

- Several platforms now require or encourage labeling of realistic AI-generated media. Implement self‑disclosure and, where supported, attach content credentials (C2PA/content provenance).

- Brand suitability

- Use updated inventory tiers, topic/category exclusions, blocklists, and third‑party verification. Re‑audit adjacency settings quarterly.

- Compliance and privacy

- Continue migrating to server‑side tagging (CAPI, enhanced conversions). Use consent mode/comparable frameworks where supported. Expect more aggregation and modeling in reports.

- Account structure

- Simplify campaigns and lean on broad/advantage/automated targeting with strong creative signals; isolate tests cleanly for readouts.

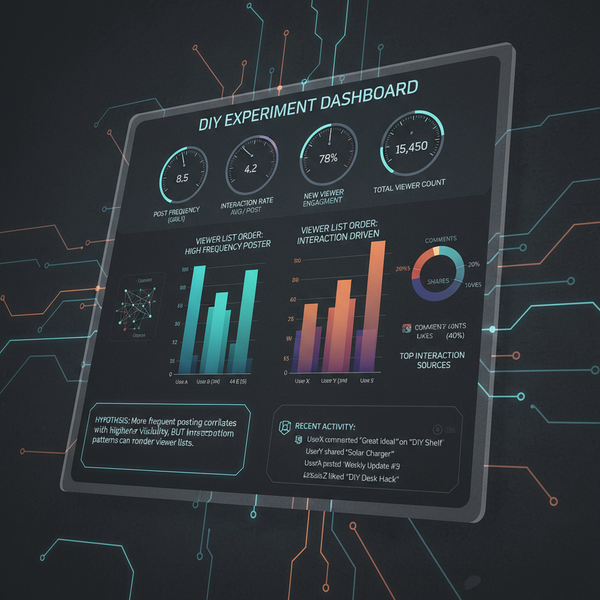

Measurement and creative impact

KPIs to watch

- Short-form video

- 3-second view rate, average watch time, completion rate, replays per viewer, saves, follows per view.

- Long-form video

- First 30‑second retention, 50% completion rate, average view duration, CTR (title/thumbnail).

- Discovery/search surfaces

- Impressions from search, save rate, comments with intent (questions), outbound CTR when relevant.

- Commerce

- In‑app add-to-cart and purchase rate; affiliate GMV; assisted revenue from content with product tags.

Attribution and testing

- Expect modeled conversions; triangulate with lift tests, MMM/MTA where feasible, and platform-native experiments.

- Set creative tests to run within two weeks:

- Hooks: 3 variations on first 2 seconds.

- On-screen text: keyword phrase vs. value proposition vs. question.

- Length: short vs. mid variants for Reels/Shorts.

- CTA: save vs. follow vs. add to cart.

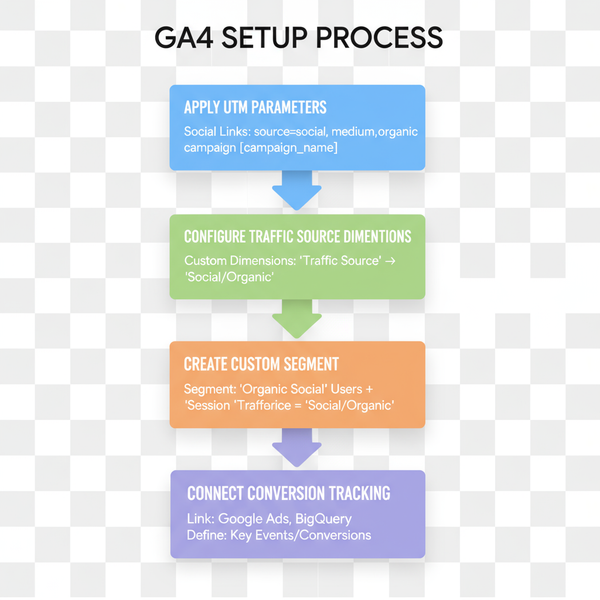

Example UTM and naming snippet you can adapt:

## Campaign naming

platform_objective_audience_creative_variant_2025q2

ig_acq_broad_ugcV1_2025q2

yt_consideration_remarketing_liveV2_2025q2

## UTM template

utm_source={{platform}}&utm_medium={{placement}}&utm_campaign={{campaign}}&utm_content={{creative}}&utm_term={{audience}}Action plan for June 2025

Prioritized checklist (2-week sprint)

- Organic

- Audit and update bios, storefronts, and product tagging across platforms.

- Ship 6–10 short-form videos with varied hooks; add on-screen keywords aligned to search.

- Publish 1 long-form video and 1 live session tied to a product or announcement.

- Launch/refresh a LinkedIn newsletter; repurpose into document carousels.

- Paid

- Consolidate campaigns; enable broad/advantage targeting where appropriate.

- Apply brand suitability tiers, topic exclusions, and refresh blocklists.

- Turn on server-side conversion APIs; verify events and deduplication.

- Run a lift test or geo split for one high‑spend campaign.

- Influencer/affiliate

- Recruit 10–20 micro‑creators with affiliate links; provide briefs and legal disclosures.

- Co-create 3 shoppable videos; whitelist top performers for paid amplification.

Budget reallocation scenarios

- If short-form completion rate rises week-over-week

- Shift +10–15% budget into Reels/Shorts placements and in‑feed video on LinkedIn/X.

- If CPMs inflate but CTR and CVR hold

- Maintain spend; expand creative variants to hunt cheaper inventory.

- If brand safety flags increase

- Pull back 10% from open placements; increase suitability tiers; increase spend in whitelisted creators and contextual buys.

![diagram]()

Resources and official release notes to monitor

| Platform | Updates / Newsroom | Ads / Business Help | Notes |

|---|---|---|---|

| Meta (FB, IG, Threads) | about.fb.com/news, about.instagram.com/blog | facebook.com/business/news | Check Conversions API docs; Threads updates often flow via Instagram. |

| X | blog.x.com | business.x.com | Review brand safety and verification tier impacts. |

| TikTok | newsroom.tiktok.com | tiktok.com/business | Seller Center for TikTok Shop updates in your region. |

| YouTube | blog.youtube | support.google.com/youtube | Watch for analytics and shopping integrations updates. |

| news.linkedin.com | linkedin.com/business/marketing/blog | Follow Thought Leader Ads and newsletter features. | |

| redditinc.com/blog | redditforbusiness.com | Community and contextual updates post-IPO era. | |

| newsroom.pinterest.com | business.pinterest.com | Catalog health and shopping placements guidance. | |

| Snapchat | newsroom.snap.com | forbusiness.snapchat.com | AR/Lens creation tools and conversion APIs. |

KPI focus by format

| Format | Primary KPIs | Secondary KPIs | Optimization Notes |

|---|---|---|---|

| Reels/Shorts/TikTok | Completion rate, average watch time | Saves, replays, follows per view | Test 10–20s vs. 25–35s; front‑load value; on-screen keywords. |

| Long-form video | 30s retention, 50% completion rate | CTR (title/thumbnail), subs | Post 6–12 min educational content; A/B thumbnails weekly. |

| Livestream | Concurrent viewers, chat rate | Click-to-cart, peak watch time | Segment with timestamps; integrate shopping where possible. |

| LinkedIn posts/docs | Saves, meaningful comments | Profile visits, follows | Publish templates/frameworks; weekly founder POV. |

| Affiliate/shoppable | In-app ATC, purchases | Affiliate GMV, ROAS | Tag products natively; whitelist creator posts for paid. |

Final word

The most reliable way to win after the May 2025 updates is also the most pragmatic: publish consistently, optimize for completion and saves, lean into native shopping where it exists, and protect your brand with suitability and disclosure controls. Then measure what matters—retention, watch time, saves, and qualified conversions—and iterate every two weeks.

![dashboard]()

Summary

May 2025 rewarded kept attention, search-aligned metadata, and native shopping across every major social platform. Prioritize short-form completion and saves while pairing them with long-form depth and periodic live spikes, all backed by server-side signals and tightened brand suitability. Reassess creative, commerce, and measurement every two weeks, reallocating budget to formats and placements that prove watch time, save rates, and in-app conversion.