Top Social Media Platforms With the Most Users in 2024

Discover the top social media platforms in 2024 ranked by monthly active users, with insights on growth trends, demographics, and engagement strategies.

Understanding the Most Popular Social Media Platforms in 2024

In the fast-changing digital landscape, staying informed about the social media with the most users is essential for marketers, creators, and brands aiming to maximize reach. Knowing which networks dominate in monthly active users (MAUs) in 2024 can guide you toward the right channels for content distribution, customer engagement, and advertising success.

This guide explores the top social media platforms by user count, examines their global influence, highlights growth trends, and offers actionable insights for leveraging each network effectively.

---

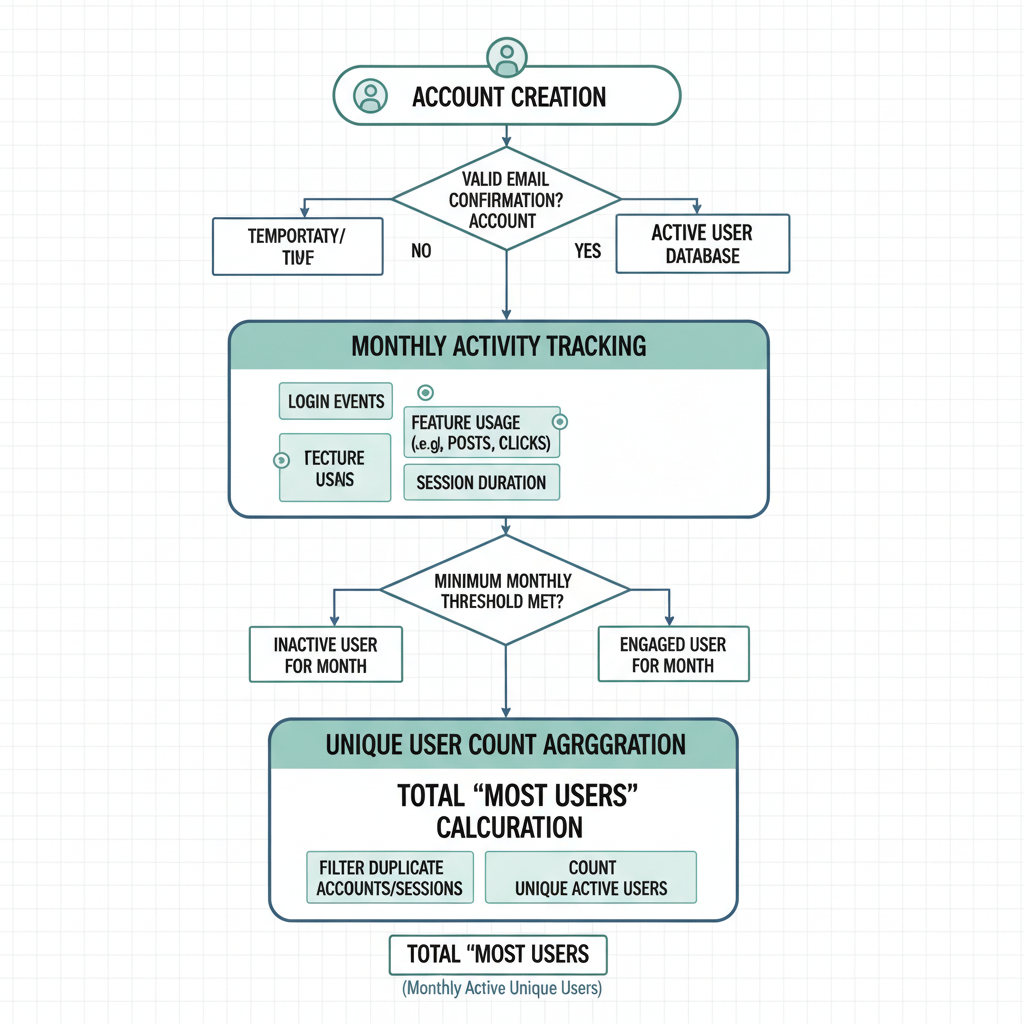

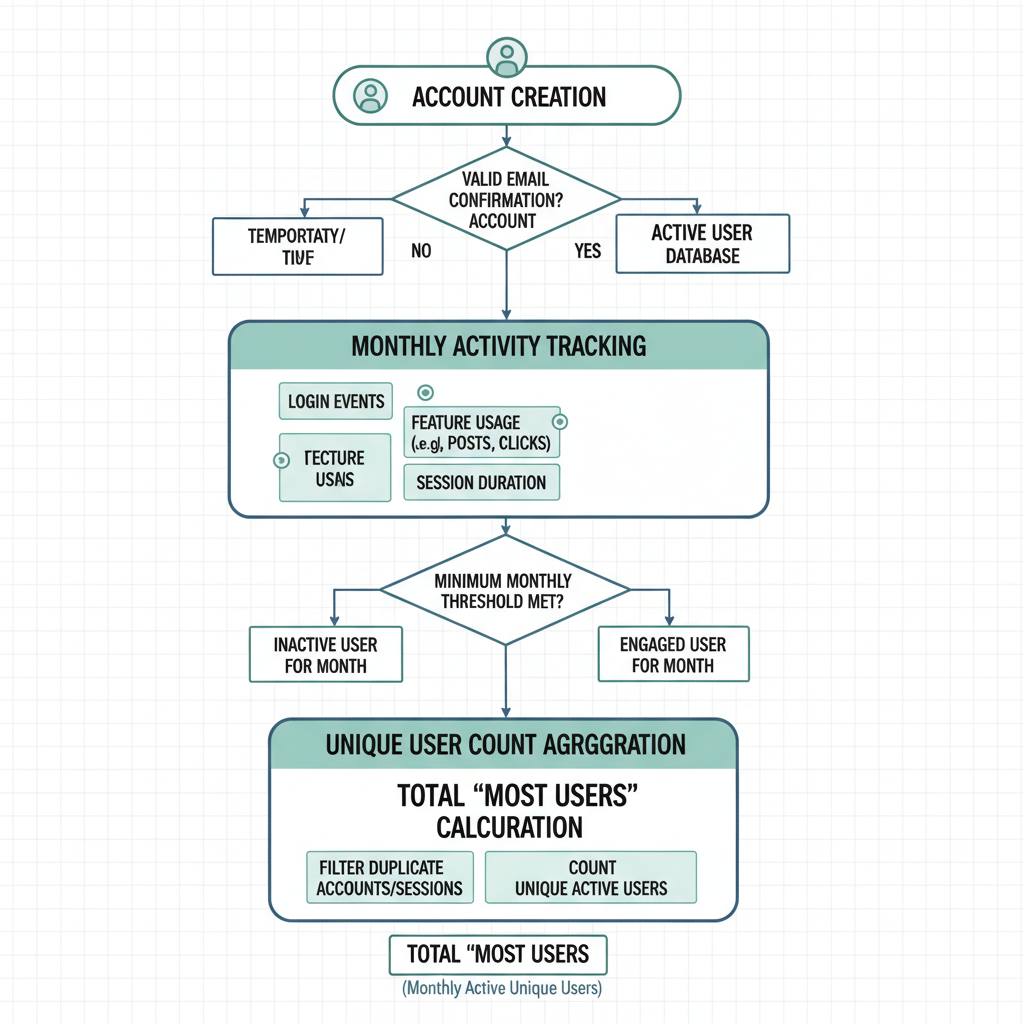

What Does "Most Users" Mean?

When we talk about the “most users” in social media, we’re referring to Monthly Active Users (MAUs)—the count of unique individuals engaging with a platform at least once within a 30‑day period.

Key Data Sources:

- Company quarterly reports

- Market research (Statista, DataReportal)

- Independent analytics publications

MAUs give a level playing field for comparing platforms that have different formats, engagement styles, and geographic penetration.

---

Top Social Media Platforms by User Count (2024)

Here’s the current global ranking by MAUs:

| Rank | Platform | Monthly Active Users (MAUs) | Primary Content Type |

|---|---|---|---|

| 1 | 3.05 billion | Social networking | |

| 2 | YouTube | 2.70 billion | Video sharing |

| 3 | 2.50 billion | Messaging | |

| 4 | 2.35 billion | Visual sharing | |

| 5 | TikTok | 1.20 billion | Short-form video |

| 6 | 1.32 billion | Multi-purpose | |

| 7 | Telegram | 900 million | Messaging |

| 8 | Snapchat | 750 million | Multimedia messaging |

---

Platform-by-Platform Deep Dive

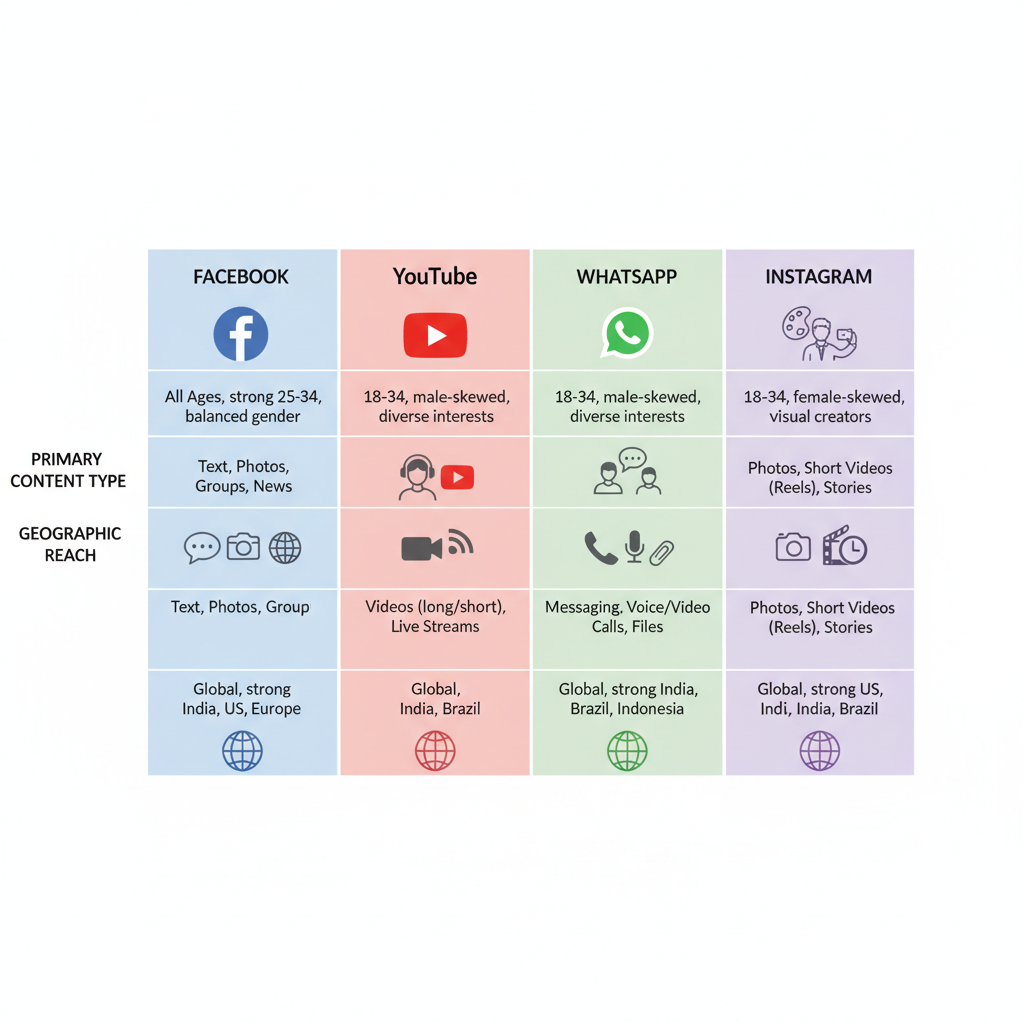

Facebook: Still the Giant

Despite being over two decades old, Facebook retains the largest user base globally.

User Base & Demographics:

- 3.05 billion MAUs

- Most popular among 25‑54 age groups

- Strong in India, Indonesia, Philippines

Trends:

- Integration with Instagram and WhatsApp

- Expansion of video content and Marketplace

- Niche groups for targeted community building

---

YouTube: The Global Video Hub

YouTube, with 2.70 billion MAUs, ranks second and serves as the world’s primary video search engine.

Video Trends:

- Average watch session: 40 minutes

- Appeals to all age ranges

- Content ranges from quick tips to feature-length films

---

WhatsApp: Messaging Without Borders

WhatsApp’s 2.50 billion users make it the leading OTT messaging app.

Highlights:

- Leader in India, Brazil, most of Europe

- Personal and business communication

- End‑to‑end encryption for privacy

---

Instagram: Visual Influence

With 2.35 billion MAUs, Instagram concentrates on photos, Stories, Reels, and in‑app shopping.

Usage Trends:

- Reels driving video engagement

- Shoppable posts enable direct purchases

- Heaviest usage among 18‑34 year olds

---

TikTok: Viral Short-Form Video

TikTok’s 1.20 billion MAUs show strong Gen Z and millennial engagement.

Key Points:

- Discovery through algorithm-driven feeds

- Huge viral potential for micro‑content

- Ad formats integrated into native experience

---

WeChat: The Chinese Super App

WeChat’s 1.32 billion MAUs dominate in China.

Functions:

- Messaging, payments, mini‑apps, shopping

- Brands use official accounts and e‑commerce

- Operates within Chinese regulatory framework

---

Telegram: Privacy-Focused Messaging

Telegram appeals to its 900 million MAUs with privacy and scalability.

Features:

- Large groups and broadcast channels

- Cross-device synchronization

- Popular with public communities and creators

---

Snapchat: Youth-Driven Interaction

Snapchat serves 750 million MAUs with ephemeral messaging and AR.

Engagement:

- Core audience 13‑24 years old

- Branded content via Discover

- Advanced AR lenses for interactive ads

---

Growth Rates & Engagement Stats

Recent performance metrics show different trajectories:

| Platform | Year-over-Year Growth (MAUs) | Average Daily Usage Time (minutes) |

|---|---|---|

| TikTok | +11% | 95 |

| +5% | 62 | |

| Telegram | +16% | 28 |

| +2% | 33 | |

| +4% | 38 |

---

Regional Differences & Emerging Platforms

Regional leaders vary widely:

- China: WeChat, Douyin

- Russia/Eastern Europe: VKontakte, Telegram

- Japan: LINE for messaging

- Southeast Asia: TikTok and Facebook co‑lead

Upcoming challengers include BeReal for authentic sharing and Lemon8 blending lifestyle content with commerce.

---

Tips for Brands & Creators

- Match Platform to Audience – Choose networks based on demographic fit.

- Diversify Formats – Cross‑post and repurpose content creatively.

- Use Built-In Tools – Leverage native ad managers and analytics.

- Stay Consistent – Regular interaction boosts visibility.

- Measure & Adapt – Let performance data guide strategy.

---

Predictions for Future User Trends

The social media with the most users will likely evolve as:

- AI enhances personalization

- Short‑form video consumption increases

- Privacy‑first platforms expand

- E‑commerce merges further with social

- Age-based platform preferences shift

Expect Facebook and YouTube to maintain numerical dominance, while TikTok and newer entrants drive cultural trends. Messaging platforms will become even more central to everyday communication.

---

By aligning your marketing or content strategy with where billions already spend their daily screen time, you can ride the wave of engagement instead of chasing it. Start optimizing your presence on the platforms that matter most in 2024—and stay ready to pivot as new leaders emerge.