Increase Profits Using Tabs Revenue Automation

Discover how tabs revenue automation streamlines billing, subscriptions, integrations, and reporting to boost efficiency and maximize profits.

Increase Profits Using Tabs Revenue Automation

In the modern marketplace, tabs revenue automation is rapidly becoming an essential strategy for companies aiming to optimize financial operations and boost profits. By using intelligent software to consolidate revenue data, automate invoicing, manage subscriptions, and streamline payment processes, organizations can reduce manual workloads and increase efficiency across all revenue streams. This article covers what tabs revenue automation is, the challenges it solves, integration methods, setup processes, and strategies for ongoing optimization.

---

What is Tabs Revenue Automation?

Tabs revenue automation is an advanced financial technology solution that automates revenue management tasks such as billing, invoicing, subscription tracking, and reporting. Unlike conventional accounting software, tabs-based systems offer an intuitive tabbed interface, allowing quick navigation between key financial categories, enhancing workflow efficiency.

Core Features

- Tabbed Navigation – Organized views for invoices, subscriptions, payments, and reports.

- Automated Invoicing – Generates and dispatches invoices automatically based on specific triggers.

- Subscription Management – Handles contract renewals, upgrades, downgrades, and cancellations.

- Integrated Payment Processing – Enables secure payments with automated transaction reconciliation.

- Real-time Reporting – Provides instant insights into revenue performance and trends.

- ERP/CRM Integration – Connects with enterprise platforms for a cohesive financial management system.

---

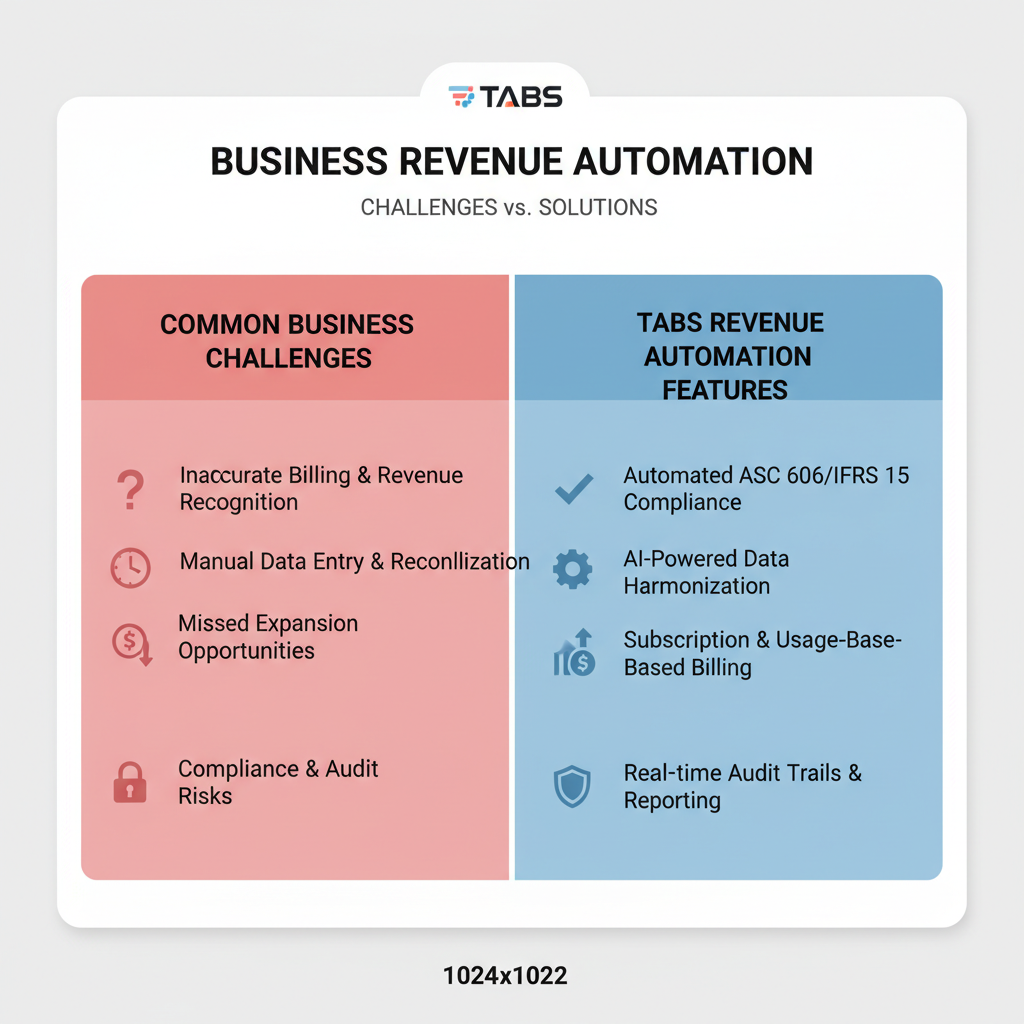

Common Business Challenges Solved

Manual revenue handling often leads to inefficiencies and costly errors. Tabs revenue automation effectively tackles these issues:

- Delayed Invoicing – Ensures invoices are dispatched promptly.

- Human Error – Minimizes data-entry mistakes in billing and reporting.

- Cash Flow Uncertainty – Offers real-time tracking for better forecasting.

- Subscription Churn – Reduces attrition through automated renewal reminders.

- Fragmented Data Sources – Consolidates disparate streams into one accessible interface.

---

Integration Options with ERP/CRM Systems

A seamless integration between tabs revenue automation and existing ERP or CRM systems is crucial for unified data management and consistent operations.

Common Integration Models

- Direct API Connection – Allows real-time exchange of invoice, payment, and reporting data.

- Middleware Bridge – Utilizes dedicated tools to link separate platforms.

- Plugin or Module Add-ons – Provides ready-made integration for popular CRMs (e.g., Salesforce) or ERPs (e.g., SAP).

Key Factors for Integration

- Data Security – Employ encrypted data transfers to protect financial information.

- Field Mapping – Ensure accurate alignment between database fields in connected systems.

- Sync Frequency – Select real-time or scheduled synchronization based on operational needs.

| Integration Model | Pros | Cons |

|---|---|---|

| Direct API | Fast, real-time, robust | Requires technical expertise |

| Middleware | Flexible, versatile | Extra cost, potential latency |

| Add-on Modules | Easy to deploy | Vendor lock-in |

---

Step-by-Step Setup Process

To implement tabs revenue automation successfully, follow this structured approach:

- Requirement Analysis – Outline workflows to automate, integrations needed, and compliance requirements.

- Select a Solution – Choose a platform tailored to industry specifics and transaction volumes.

- System Configuration – Set invoice templates, define subscription parameters, and map necessary integrations.

- Data Migration – Import existing customer records and historical invoicing data.

- Testing – Conduct trial runs for invoicing, billing, and reporting functionalities.

- Training – Equip staff with skills to navigate the tabbed interface and handle exceptions.

- Deployment – Launch in the live environment while monitoring key performance indicators (KPIs).

- Continuous Improvement – Update automation rules based on metrics and team feedback.

---

Key Automation Workflows

Tabs revenue automation supports a variety of streamlined workflows:

- Invoicing Automation – Dispatch invoices automatically after project completion or subscription renewal.

- Subscription Billing – Manage recurring payments at specified intervals and handle prorated charges.

- Revenue Reporting – Deliver real-time analytics for data-driven decision-making.

- Payment Reconciliation – Automatically match payments to corresponding invoices.

- Reminder Notifications – Alert customers of pending renewals or overdue amounts.

---

Benefits: Time Savings, Accuracy, Cash Flow Improvement

Businesses adopting tabs revenue automation typically realize these gains:

- Time Savings – Frees employees from repetitive tasks, enabling focus on growth-oriented initiatives.

- Improved Accuracy – Reduces billing errors and ensures consistent revenue tracking.

- Enhanced Cash Flow – Speeds up invoicing and payment cycles, improving liquidity.

- Customer Satisfaction – Offers a smoother billing experience that strengthens client relationships.

---

Case Study Examples

SaaS Company

A subscription-based software provider integrated tabs revenue automation to oversee thousands of accounts. Late payments decreased by 25%, and billing time was cut in half.

Manufacturing Firm

By connecting revenue automation with ERP systems, the company gained real-time insights into product revenues, enabling smarter inventory and production scheduling.

Online Retailer

Automation reduced order-to-cash timelines by 30%, significantly improving available cash reserves.

---

Tips for Optimizing Automated Revenue Processes

- Audit Automation Rules Regularly – Keep systems aligned with evolving business needs.

- Utilize Real-time Dashboards – Quickly identify revenue patterns and anomalies.

- Personalize Customer Communication – Tailor invoices and reminders for improved engagement.

- Integrate Business Intelligence Tools – Gain deeper analytics into automated processes.

- Maintain Manual Override Options – Ensure flexibility in exceptional scenarios.

---

Compliance and Data Security Considerations

Revenue automation demands strict attention to regulatory and security standards.

Compliance

- Follow IFRS or GAAP guidelines for accurate revenue recognition.

- Ensure compliance with region-specific tax rules.

Security

- Employ data encryption for both storage and transfer.

- Implement role-based access controls to safeguard sensitive information.

- Schedule penetration testing to uncover vulnerabilities.

---

Future Trends in Revenue Automation Technology

Emerging innovations are set to enhance tabs revenue automation:

- AI-Powered Forecasting – Machine learning models to predict future revenue patterns.

- Blockchain Billing – Immutable transaction records guaranteeing transparency.

- Voice-Activated Interfaces – Hands-free control over tabbed systems.

- Hyper-Personalized Workflow – Customized billing experiences per customer profile.

---

Summary and Next Steps

Tabs revenue automation is a powerful driver of operational efficiency, accuracy, and profitability. By integrating with ERP and CRM ecosystems, optimizing workflows, and safeguarding compliance, businesses can streamline financial management while positioning themselves for scalable growth.

Ready to transform your revenue processes? Explore tabs revenue automation solutions today and start reaping the benefits of faster cycles, reduced errors, and improved customer satisfaction.