The $10 Trillion AI Bubble: Impending Disaster or Inevitable Progress?

The Forces, Networks, and Possible Outcomes Behind the AI Bubble

---

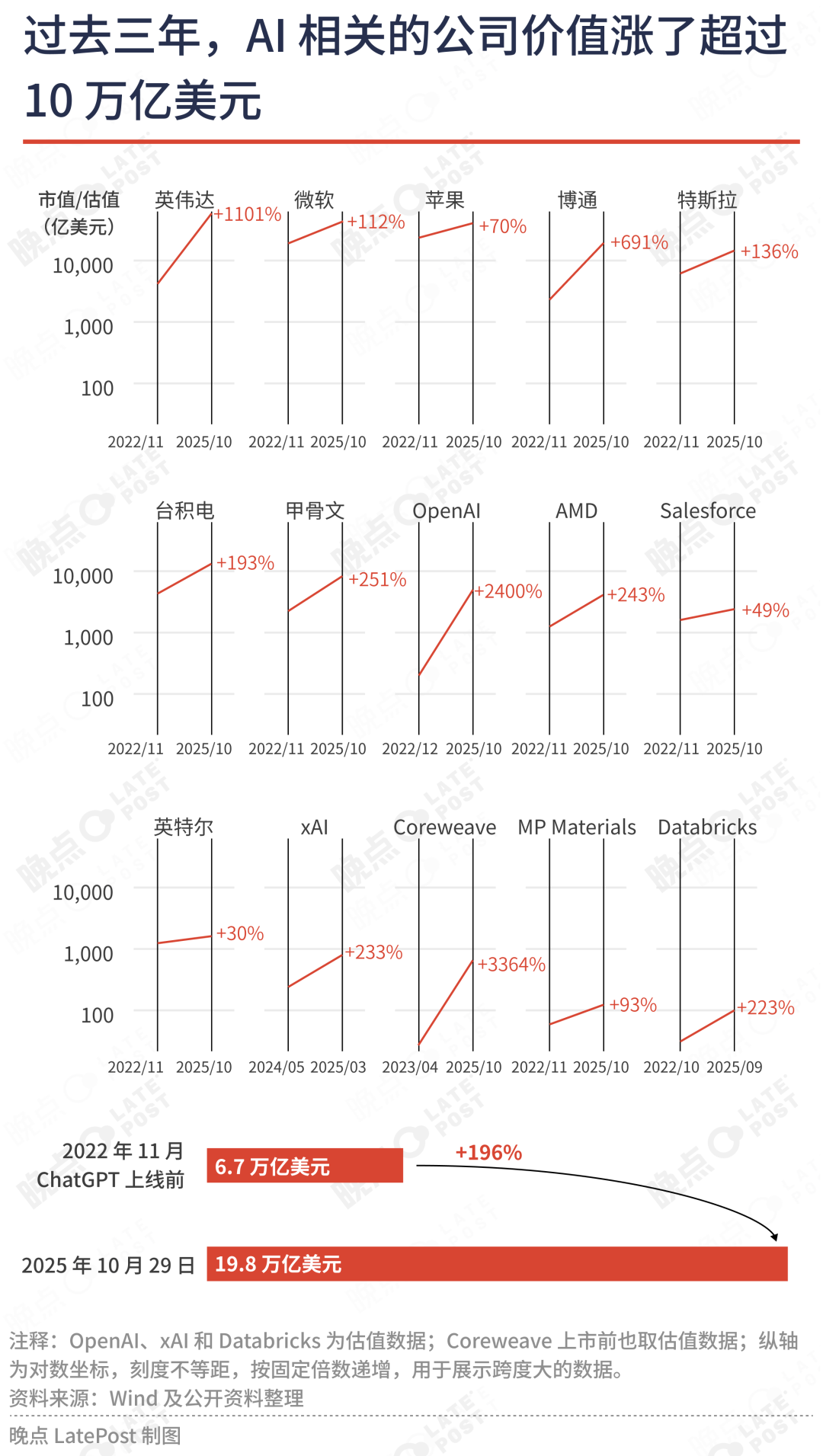

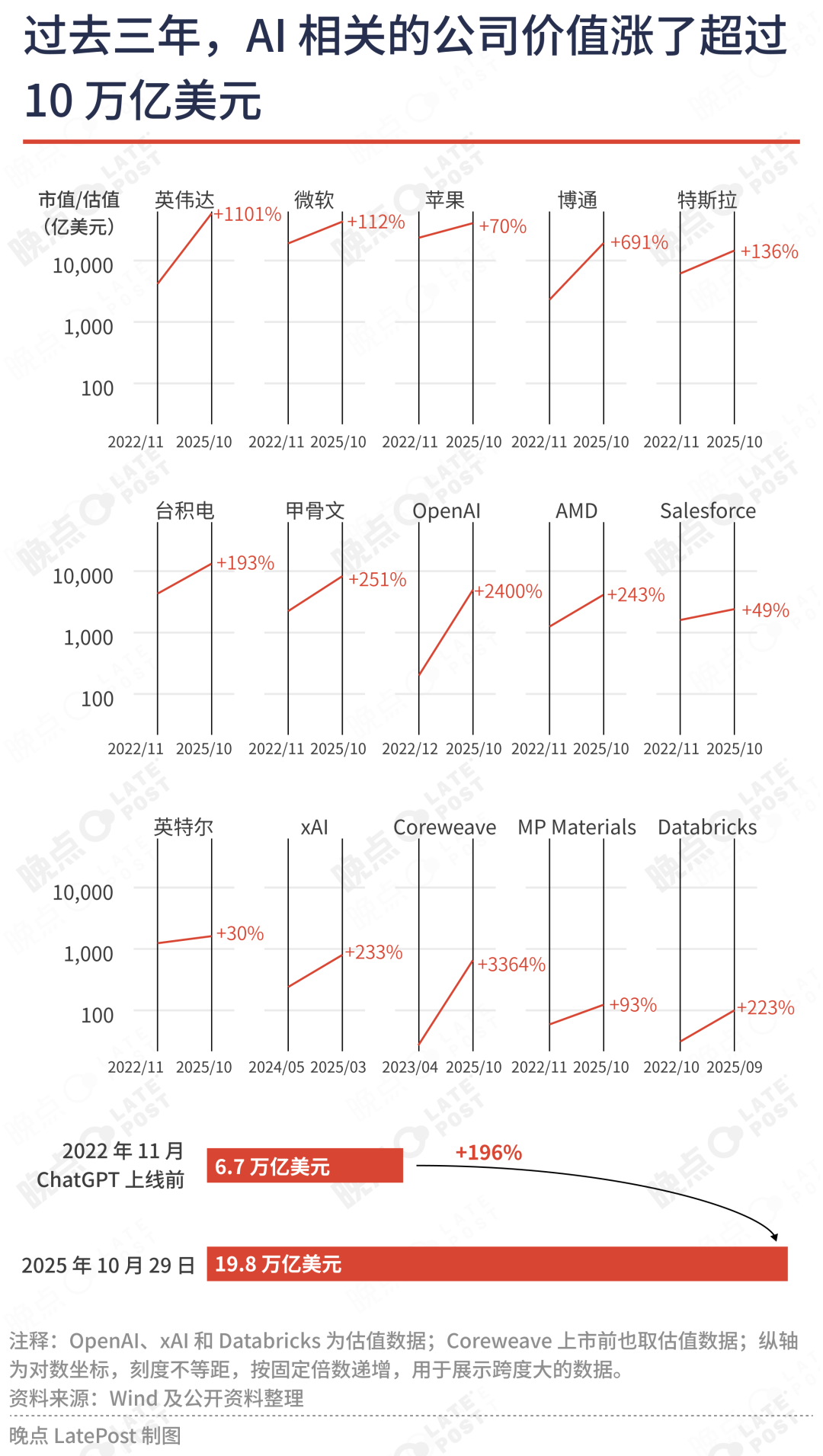

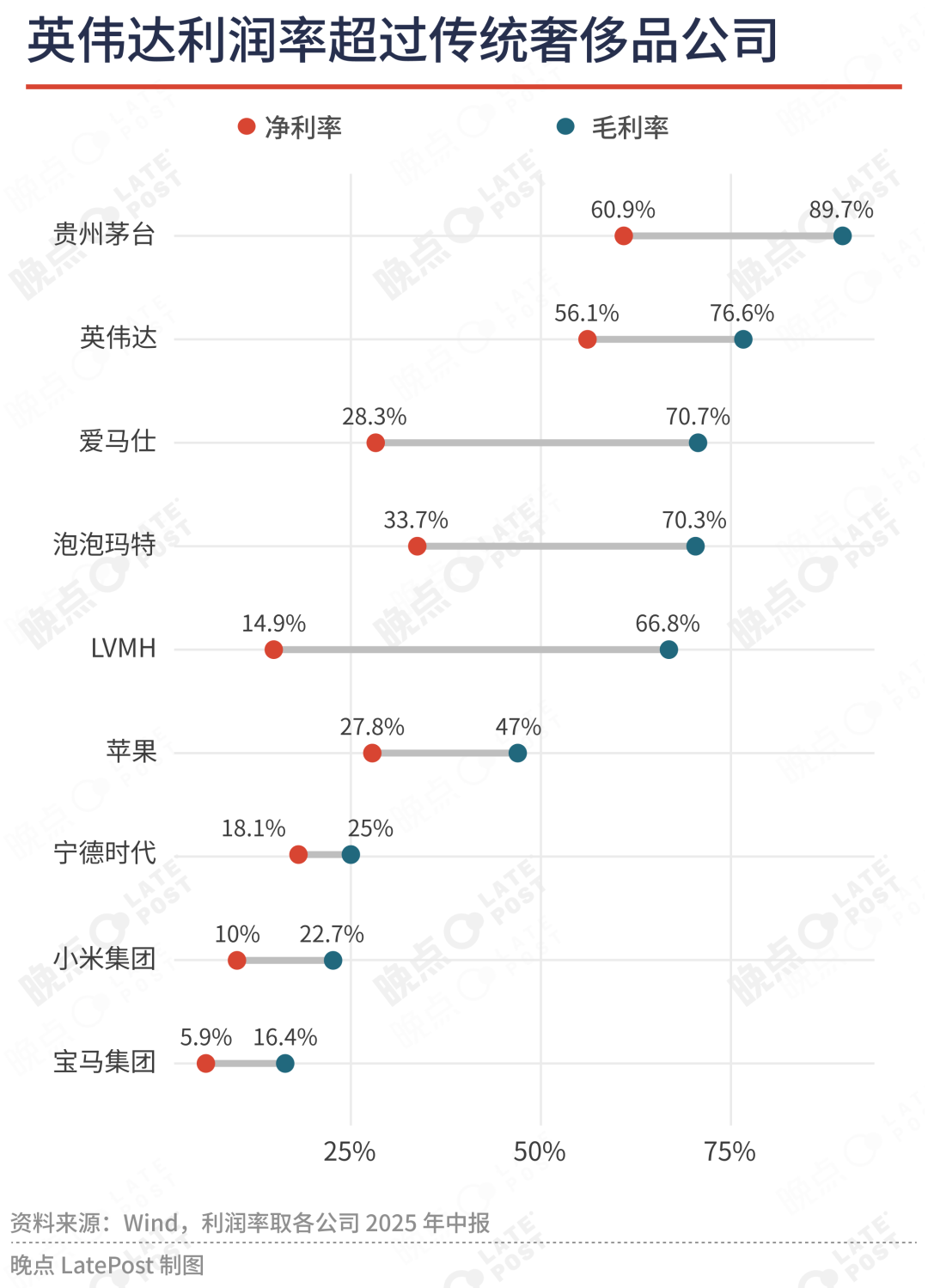

NVIDIA’s Remarkable Climb

After becoming the first company to reach a $4 tn market cap earlier this year, NVIDIA hit $5 tn on October 29 — a global first among current firms.

Key timeline facts:

- Nov 2022 (pre–ChatGPT): NVIDIA valued at just $400 bn.

- Since then, U.S. capital markets added $10 tn in value to AI-linked firms — equal to the entire A-share market cap in China.

- NVIDIA’s gain alone exceeds the combined stock market worth of the UK, France, and Germany.

OpenAI, meanwhile, skyrocketed by $480 bn in value — larger than most countries’ GDPs.

---

Startups and IPO Growth

- NVIDIA: Share price jumped 11× since AI boom began.

- OpenAI: Valuation inflated 24× in ~3 years.

- CoreWeave: Largest AI IPO of 2024, stock up 4.5× in 3 months; early-stage investors saw 33× total return.

Bubble context:

> Analyst Julien Garran warns this frenzy is 17× larger than the dot-com bubble and 4× larger than the 2008 housing bubble.

---

“Bubbles Can Help Progress”

Jeff Bezos:

- Labels AI surge an industrial bubble, unlike 2008’s financial bubble.

- Even if it bursts, it leaves valuable infrastructure behind — akin to fiber-optic buildouts post–dot-com or biotech in the 1990s.

Jamie Dimon:

- Predicts major U.S. stock corrections within 6 months–2 years.

- Notes that post-bubble survivors (e.g., Facebook, YouTube, Google) can define the future.

---

Theoretical Backing

Recent books on bubbles:

- _Boom: Bubbles and the End of Stagnation_ — financial bubbles historically drive breakthroughs (Manhattan Project, Apollo Program, fracking, Bitcoin).

- _1929_ (Andrew Ross Sorkin) — parallels between Great Depression’s tech boom and today’s AI hype.

---

Bubbles Grow Through Networks

---

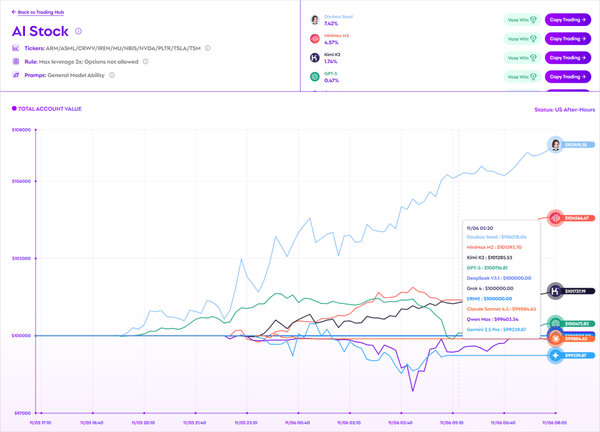

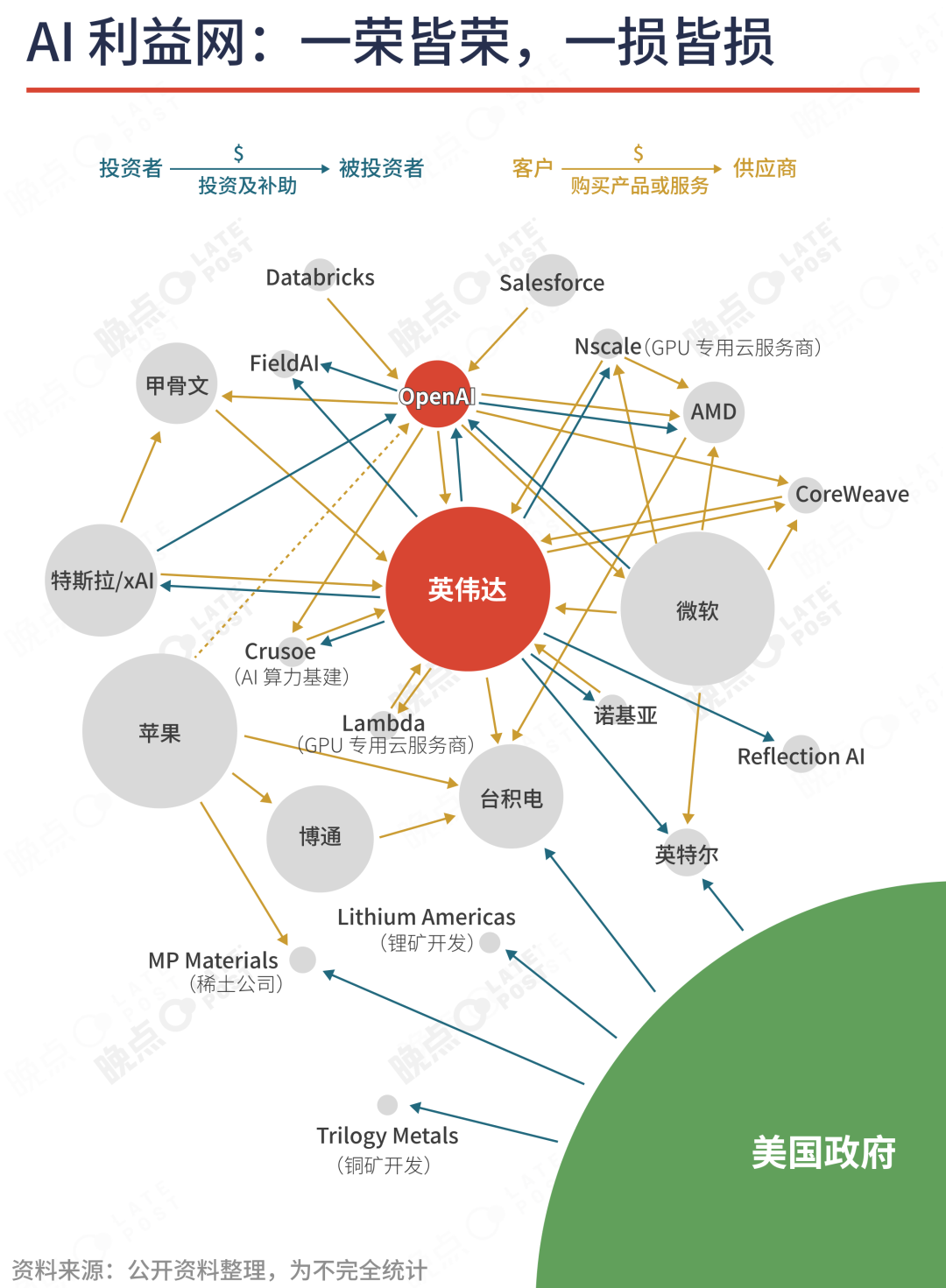

OpenAI + NVIDIA’s Circular Investment Model

Sam Altman acknowledges AI market overexcitement — yet builds layered transaction webs.

Examples:

- NVIDIA invests $100 bn into OpenAI → OpenAI buys NVIDIA GPUs.

- AMD lets OpenAI buy 160 m shares at $0.01 → with GPU orders attached.

NVIDIA’s role:

- Invests in OpenAI + CoreWeave (cloud infra) → both buy NVIDIA chips.

- CoreWeave serves Microsoft (investor in OpenAI) and OpenAI itself.

---

Everyone Joins the Boat

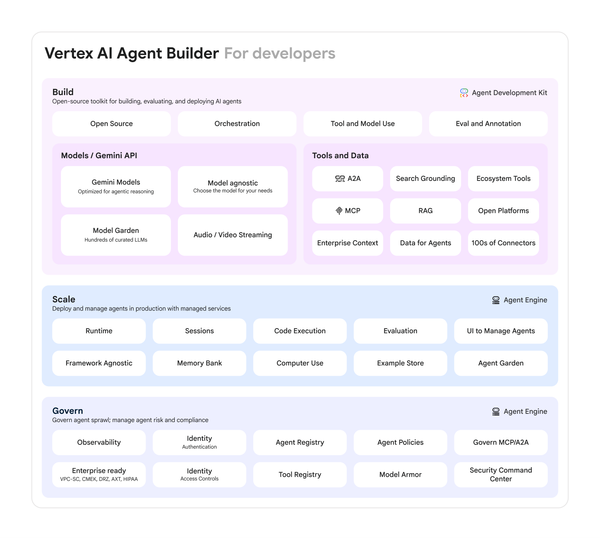

Global investment spreads:

- From megacorps to chip suppliers, cloud infra, and upstream mining (rare earths, copper).

- Morgan Stanley forecasts $2.9 tn in data center capex 2025–2028.

- MIT: 95% of companies see zero ROI from generative AI.

Potential downside:

> Losses could surpass $10 tn if projects fail — a classic “Too Big to Fail” setup.

---

Debt Financing Surge

Examples:

- Meta: $29 bn (mostly debt)

- Oracle: $18 bn bonds

- xAI: $12.5 bn planned bonds

Private credit’s opacity magnifies risk — Financial Times warns of systemic defaults if ratings drop.

VC investments in AI:

- 2024: $160–200 bn projected (vs ~$20 bn inflation-adjusted in 2000 internet boom).

- Mostly concentrated in 10 key AI startups (OpenAI, Anthropic, xAI, etc.).

---

If the Bubble Bursts — What Lasts?

---

Industrial vs Financial Bubbles

Bezos’s distinction:

- Financial bubbles — destructive.

- Industrial bubbles — yield legacy assets.

Dot-com example: leftover infrastructure later powers new growth.

---

Economist’s 3 Determining Factors

- Trigger — tech sparks vs political sparks.

- Nature of capital — scale, duration, allocation.

- Loss bearers — individuals vs institutions.

Triggers

- Tech sparks → less damage than political sparks.

- AI: tech origin, now layered with state strategic policy.

Capital Nature

- U.S. AI investments = 3–4% of GDP (vs 15–20% in UK’s 1840s railway boom).

- Assets depreciate fast — AI chips obsolete in 3–5 years.

Loss Bearers

- Concentrated losses in banking = severe downturns.

- AI mostly funded via corporate profits (for now), but pension fund exposure could increase fragility.

---

China vs U.S.

- China: more state-guided fund involvement, low household equity exposure (~2% vs U.S. ~30%).

- Gains: Concentrated among top firms.

- Risks: AI’s focus on substitution may narrow benefit distribution.

---

FOMO Drives Reluctant Acceleration

---

Expert Doubts

- Karpathy: AGI ≥ 10 yrs away; RL flawed.

- Sutton: LLM path can’t reach AGI.

---

Corporate Behavior

- Microsoft reduced AI infra build mid-2023 … then signed $300 bn deal with Oracle + OpenAI for massive compute capacity.

- Nadella: “We can’t ignore demand” → largest AI data center plans announced despite earlier caution.

---

Warning Signs (Liang Xianzheng)

- Irrational valuations

- Misaligned capex & cash flow

- Hyped mega-orders

- Weak profit models

- Irrational pivots by incumbents

- Talent wars/salary bubbles

- Militarized spending races

- Stock market hype

- Blind VC enthusiasm

- Media/public frenzy

- Single industry dominance

- “This time is different” claims

Bubble Triangle (Boom & Bust):

- Marketability = oxygen

- Money & credit = fuel

- Speculation = heat

---

Geopolitics Fuels AI Investment

---

U.S. State Equity Moves

- Gov’t acquires 10% Intel stake → binds NVIDIA interest.

- Invests in AI-critical supply chains (rare earths, lithium, copper).

- Intel’s valuation doubles post-investment.

Political AI push:

- Aligns with defense priorities (AI seen as key in modern strategy).

- Parallel to GPS / microchips / internet origins from Cold War tech races.

---

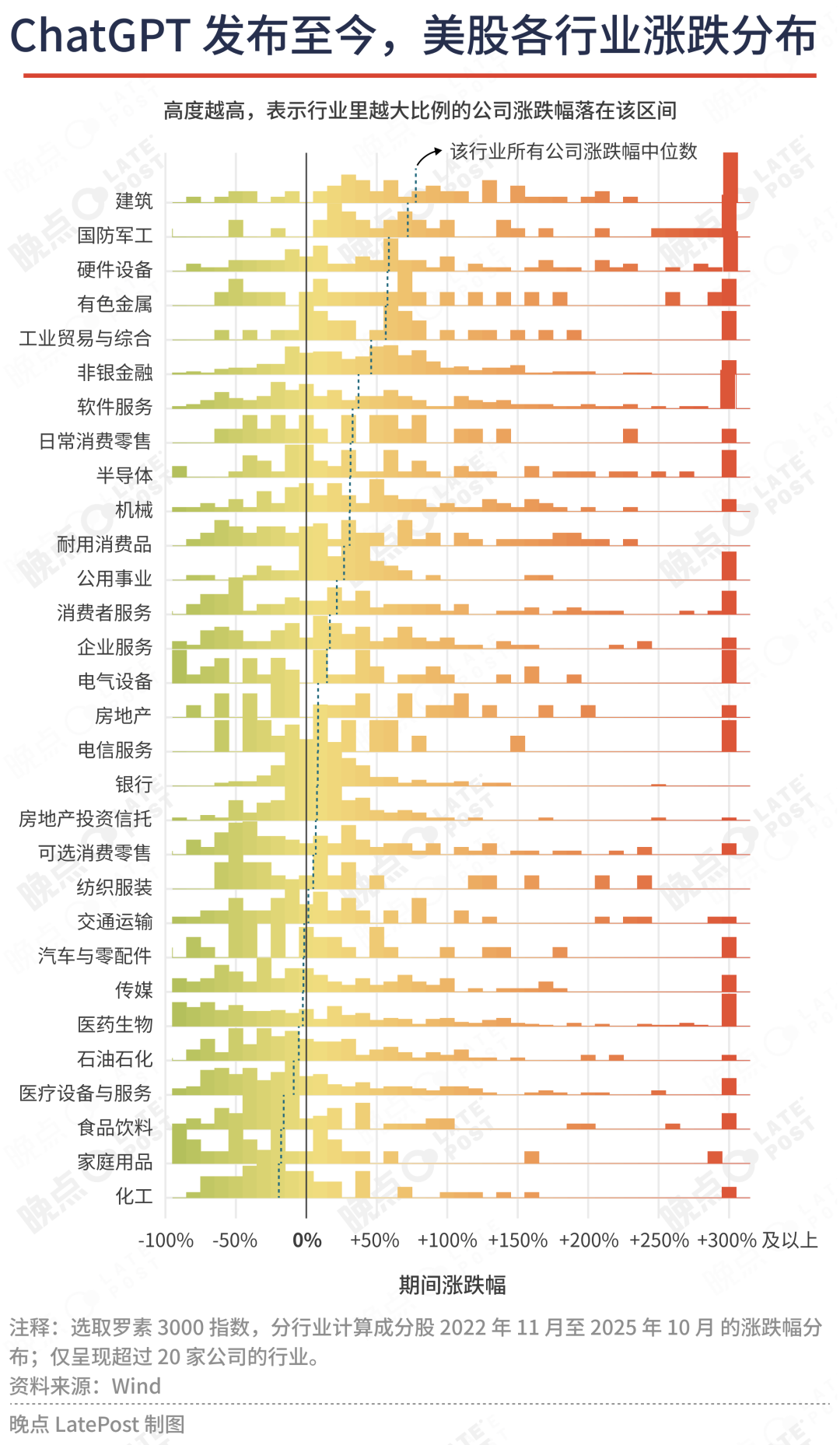

Sector Performance

Infra & defense companies → +50% stock gains

Consumer goods sectors → last place.

---

AI as a Strategic Engine

---

Cold War Lessons

Past wartime innovations → consumer prosperity.

Now, trade conflicts + military tensions shift focus back to state-level AI capacity.

Examples:

- OpenAI + DoD: $200 m contract for combat AI.

- “Stargate” Project: $500 bn AI infra plan (Trump-backed).

---

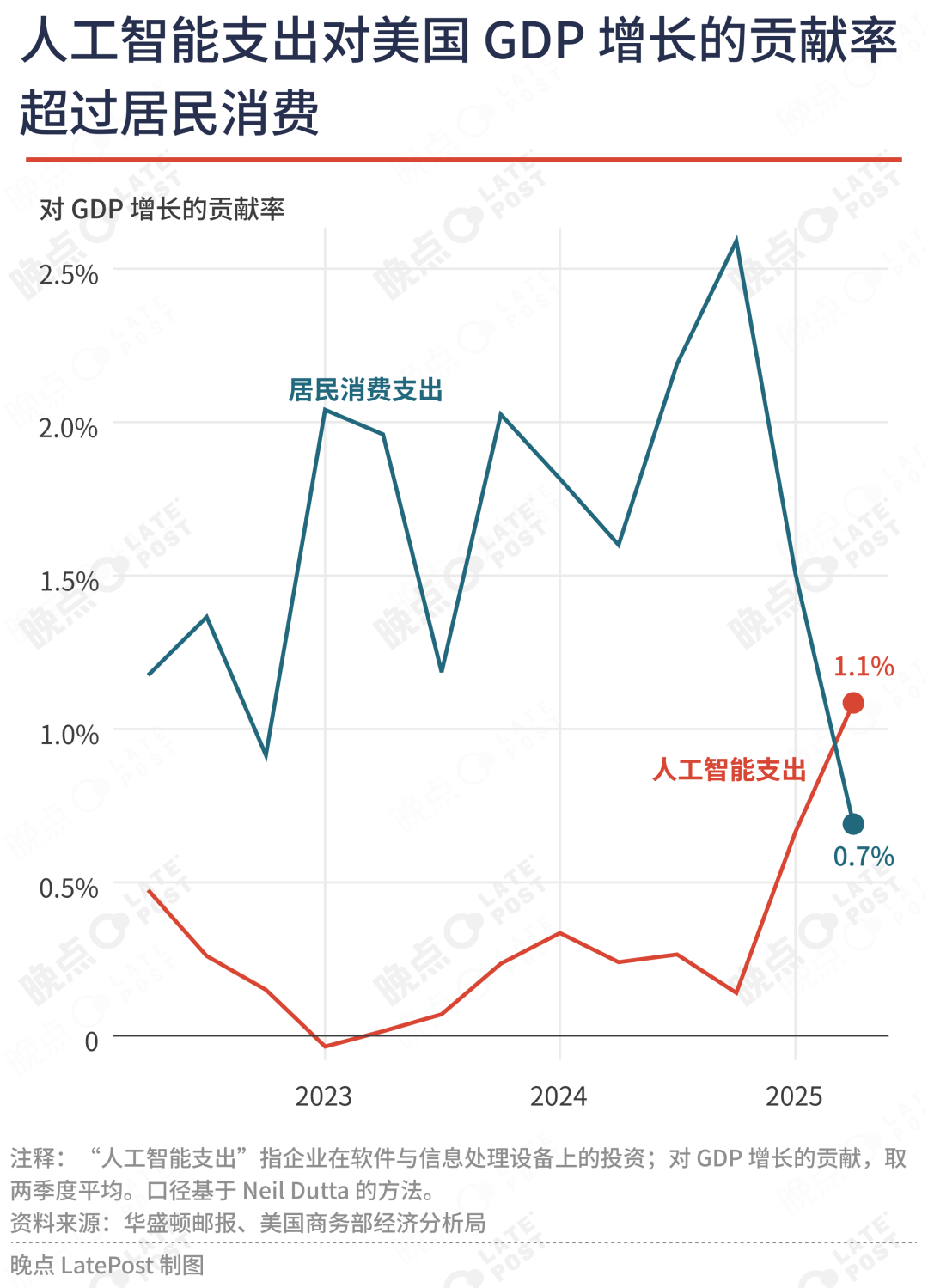

Economic Shift

- AI infra replaces consumer demand as growth driver.

- Fewer jobs than consumer sectors.

- Zuckerberg: Risk of wasted billions << Risk of missing breakthrough.

---

Platforms for Sustainable AI Participation

AiToEarn官网 offers:

- Open-source, global AI monetization tools

- Multi-platform publishing: Douyin, Kwai, WeChat, Bilibili, Xiaohongshu, Facebook, Instagram, LinkedIn, Threads, YouTube, Pinterest, X (Twitter).

- Integrates AI content generation, analytics, model rankings.

- Open-source repo: AiToEarn开源地址.

---

Bottom line:

AI sits at a nexus of technological hype, mass capital flow, and geopolitical stakes. Whether the bubble bursts destructively or leaves a lasting industrial base will depend on trigger factors, capital nature, and who bears losses. In parallel, platforms like AiToEarn enable individuals and businesses to embed themselves sustainably in this evolving ecosystem — bubble or boom.