The Capital Market Is Wary of Designer Toys

Why Has No “Disney” Emerged in the Designer Toy Industry Yet?

---

Recent Market Moves

- TOP TOY has officially filed for listing on the Hong Kong Stock Exchange.

- July 2025: Series A funding led by Temasek raised USD 59.43M at a valuation of USD 1.3B (~HKD 10.2B).

- In comparison, POP MART once hit a HKD 400B market cap.

---

POP MART’s Q3 2025 Earnings Snapshot

- Revenue up 245%–250% YoY.

- Overseas growth: 365%–370% YoY.

- Share price fell 8.08% on announcement day and continued for 5 days.

- October 23: Largest single-day drop since April (-9%).

- Market cap shrank to HKD 312.1B within two months.

---

Contradiction in the Market

- Consumers: New releases in secondary markets sell out instantly; resale prices often multiple times retail.

- Capital Markets: Leading firms post strong earnings but face stock declines; new IPOs struggle to gain high valuations.

- Others: CARD游 and 52TOYS remain at prospectus stage.

---

1. What Is the Capital Market Worried About?

Growth Data (China)

From 2020–2024: RMB 22.9B → RMB 76.3B (CAGR 35.1%)

2025E: RMB 87.7B.

Drivers:

- Gen Z dominance (>40% market share, “self-exclusive” consumption habits).

- Category diversification — blind boxes (28%), plush toys (+1289% in 2024 revenue via LABUBU).

- Wider age appeal — age 30–45 spends 40% more per order than Gen Z.

---

Capital’s Cooling Sentiment

- Heavy reliance on short-lifecycle IPs due to emotional consumption trends.

- Uncertainty in IP longevity: Trends change quickly; high aesthetic fatigue risk.

Case Study:

- In POP MART’s H1 2025 proprietary products, THE MONSTERS delivered RMB 4.814B revenue.

- Premium willingness for top IPs declined from 3–5× retail → <1.5×.

- LABUBU secondary-market hype cooled drastically within weeks.

---

2. Rising New Brands Splitting the Market

Competitive Landscape — Blind Box Industry Tiers

- First Tier: POP MART — dominant IPs (MOLLY, SKULLPANDA, THE MONSTERS).

- Second Tier: MINISO (TOP TOY).

- Third Tier: Alpha Group, Gao Le Shares, Yuanlong Yatu, Le Zi Tiancheng Culture.

Third-tier brands face:

- IP barriers

- Distribution disadvantages

- → Financing enthusiasm cooled; only two primary market financing rounds in 2024.

---

3. Global Expansion: Shine & Shadows

H1 2025 Overseas Revenue (POP MART):

- Asia-Pacific: RMB 2.85B (+257.8% YoY)

- Americas: RMB 2.26B (+1142.3% YoY)

- Europe & others: RMB 480M (+729.2% YoY)

Overseas revenue = 40% of POP MART’s total.

TOP TOY overseas share grew from 0.6% (2024-end) → 3.9% (H1 2025).

Risk: Most brands replicate domestic playbook abroad without deep local cultural integration.

---

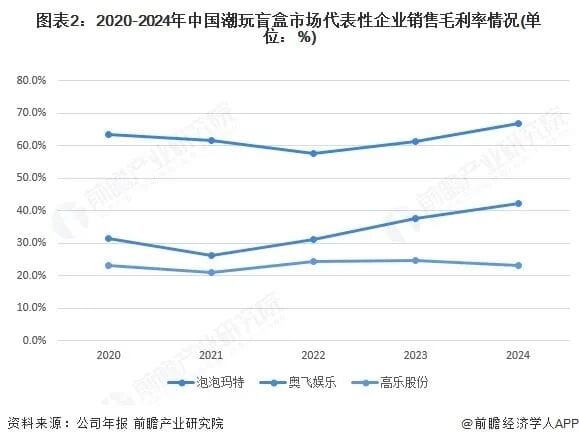

4. High Gross Margins — Double-Edged Sword?

Margin Trends

- POP MART: 57.5% (2022) → 66.8% (2024) → 70.3% (H1 2025)

- Kayou: 71.3% (2024)

- TOP TOY: ~20–32% (2022–2024)

---

Why so high?

- IP premium potential via emotional resonance & scarcity.

- Low material costs (most cost in IP licensing).

- Full supply chain control by leading brands.

---

Structural Weakness:

- TOP TOY heavy reliance on licensed IPs (<0.4% revenue from proprietary IP in 2024).

- Licensing fees rising: RMB 178M (2022) → RMB 421M (2024).

- POP MART avoids licensing cost, but faces “blockbuster external IP” threats (e.g., Nezha 2 at RMB 300M sales in one month).

---

5. Why Hasn't a “Disney” Emerged Yet?

Disney at a Glance:

- Market cap: USD 211.5B (4× POP MART)

- H1 2025 revenue: USD 47.2B (~RMB 338B)

- Net profit: RMB 61.1B (13× POP MART’s)

---

Disney’s Evergreen “Story-IP-Merchandise” Loop

- Immersive experiences: resorts, parks — 59%+ profits.

- Merchandise matrix: 22,000 SKUs integrate IP into daily life.

- Streaming platforms: incubate and monetize IP direct-to-consumer.

---

Designer Toy Bottleneck:

- Most brands lack narrative depth; focus on aesthetics + marketing traffic.

- POP MART exploring animation (Labubu and Friends) but retail sales remain ≈95% of revenue.

---

Global Context:

- China IP consumption penetration: ~53–56%

- Japan: 11× higher

- US: 50× higher

---

6. Conclusion — Moving from Traffic to Story

In today’s competitive landscape, deep narrative building and cultural resonance are key to sustaining IP value.

Platforms like AiToEarn官网 offer:

- AI-generated content creation

- Cross-platform publishing (Douyin, Kwai, WeChat, Bilibili, Xiaohongshu, Facebook, Instagram, LinkedIn, Threads, YouTube, Pinterest, X)

- Performance analytics & AI model ranking

For designer toy brands, integrating such tech-driven storytelling tools could help bridge the gap toward a “Disney-like” unfading IP ecosystem.

---

---

Final Note:

To truly become the “Disney” of designer toys, brands must evolve beyond short-term hype to create multi-generational IP universes with storytelling, immersive experiences, and diversified monetization channels. AI-powered content ecosystems may well be part of that future.