# Global Storage Price Surge: How AI Is Reshaping Tech Hardware Costs

It’s that time of the year again when tech companies release their annual financial reports.

This year, beyond the usual revenue figures, there’s a **clear and unanimous warning** in forward-looking statements across the industry:

> ***Due to rising global storage industry costs, product prices will go up next year.***

*Image|GIGAZINE*

---

## The Scope of the Price Hike

This isn’t just about phones or PCs anymore:

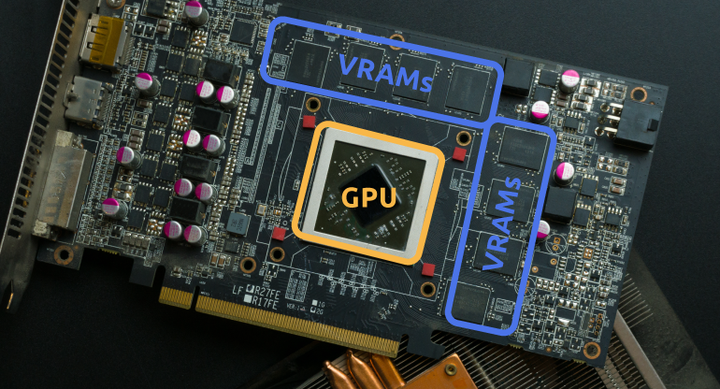

- **Upstream GPU and board manufacturers** are also feeling the effects.

- The **DIY PC community** faces particularly bad news.

### Transition Years Compounded by Higher Costs

2025–2026 is already set to be a transition point for semiconductor manufacturing:

- **CPU/GPU process nodes** shifting from *3nm* to *2nm*.

- Now, add rising memory costs — making PC building **prohibitively expensive**.

---

## "Buy RAM, Get the Computer for Free"

With today’s inflated memory prices, buying a **Mac Studio with 512GB of RAM** feels absurd:

- **The M3 Ultra processor, chassis, Thunderbolt 5 controller, and even storage are practically free** compared to the RAM cost.

*Literal “buy RAM, get the computer free” scenario.*

---

## Storage Price Hikes Are Unavoidable

### Previous Analysis

Earlier articles have detailed the reasons behind recent **coordinated price increases** across smartphone SKUs, RAM modules, and SSDs.

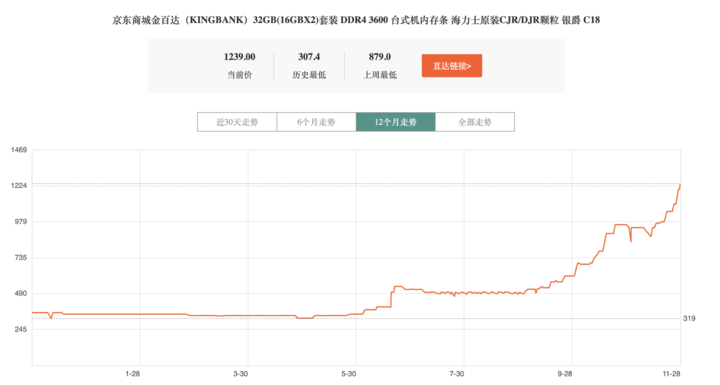

**What’s new:** The **magnitude and speed** of these hikes is unprecedented.

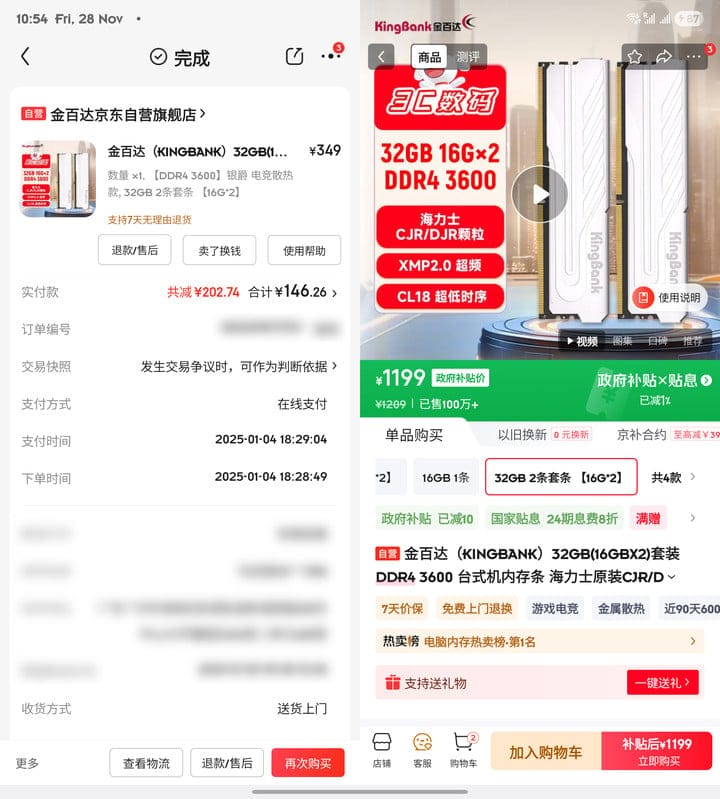

Example from personal experience:

- **Jan 2025:** KingBank DDR4 3600 dual 16GB kit — ¥349

- **Now:** **Triple the price**

---

### AI as the Catalyst

AI infrastructure growth is the **primary driver**:

- **OpenAI’s "Stargate" $3 trillion plan**

- New data center expansions from Microsoft, Amazon, Apple

- All require **enterprise-grade High Bandwidth Memory (HBM)**

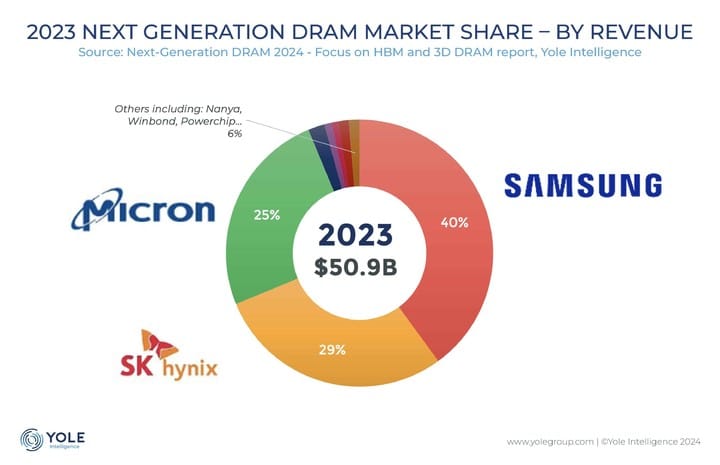

Only **three global companies** can mass-produce DRAM/HBM:

**Samsung, SK Hynix, Micron** — controlling about **95% of the market**

---

### Strategic Shift of Capacity

Rather than create *fake shortages*:

- **Redirecting production** to enterprise-level products

- Higher profit margins over consumer goods

Historic example: 2018 SK Hynix Wuxi plant fire = **instant price spikes**

Now, shortages extend to **GDDR6 and GDDR7** for GPUs.

---

### NVIDIA's Rumored Response

Leak suggests NVIDIA may:

- Sell **only GPU cores**

- Let board makers like ASUS, Gigabyte, Colorful source RAM themselves

Business logic: frees up NVIDIA’s memory supply for **high-end AI products**.

---

## The Wider Impact

This situation is affecting:

- **PC OEMs**

- DIY enthusiasts

- The **mobile phone industry** — another major DRAM consumer

Memory prices are spiking **100%–200% in a single month**:

---

## Mobile Market Outlook

### DRAM Contract Price Trends

TrendForce report shows:

- **Q4 DRAM prices up 75% YoY**

- NAND Flash also climbing

Projected by 2026:

- **Mobile BOM costs +5%–7%**, possibly nearing +10%

Example:

A RMB 5,499 phone with RAM + storage as 15% of BOM:

- Flash prices doubling = +RMB 500–700 retail increase.

---

### The End of the High-Spec Midrange

RMB 3k–4k smartphones with **24GB RAM + 1TB storage**?

**Likely gone for good.**

---

## Processor Battleground

- 2026: Mobile processors shift from 3nm to 2nm

- TSMC’s 2nm debut customer may be **OpenAI**, not Apple

- **AI now competes with consumers for processors**

Likely consensus by 2026 among smartphone brands:

- **Feature cuts for mid-low end**

- **Price hikes for mid-high end**

---

## Exceptions to the Surge

Some brands are more insulated:

- **Huawei**: One-year supplier contracts mitigate price shocks

- **Samsung**: In-house memory supply = smaller price rises (~$50 for S26 series)

- **Apple**: Less protection due to supply monopoly dynamics

---

## AI Platforms for Content Creators

Platforms like [AiToEarn官网](https://aitoearn.ai):

- **Generate, publish, monetize AI-powered content**

- Post across major channels: Douyin, WeChat, Bilibili, YouTube, Instagram, LinkedIn, X (Twitter)

- Integrated **analytics** and **AI model rankings** ([AI模型排名](https://rank.aitoearn.ai))

These tools enable creators to **adapt quickly** to tech market disruptions.

---

## iPhone 18 Series Price Outlook

Rumors:

- All models: **12GB RAM** for Apple Intelligence

Price drivers:

1. **2nm process cost hike**

2. **5nm pricing increase** for R&D offset (affecting A20 Pro)

**Projected price increase:** ~RMB 1,000

---

## Software Optimization Era

Reduced RAM in mainstream models (12GB from 16GB):

- Greater need for **system optimization**

- Software slimming becomes critical

---

## A New Kind of Price Cycle

**Key point:**

- DRAM price hikes in late 2025 are driven by **external demand capture** by AI and data centers.

- **Different cycle** than traditional tech market shifts.

---

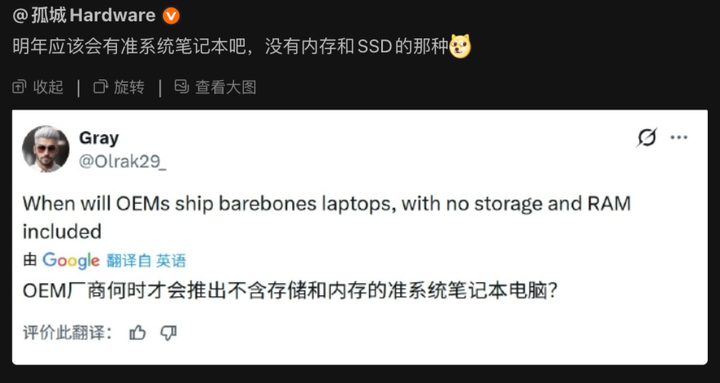

### Impact on PC Sector

- Heavy DDR4/DDR5 reliance

- Uneven margins

- Possible rise of **barebone laptops** requiring user-supplied RAM/storage

---

## Final Thoughts

AI workloads are **reshaping hardware demand** across all devices.

Open-source monetization platforms like [AiToEarn官网](https://aitoearn.ai) give creators tools to:

- Align with evolving market trends

- Efficiently produce and distribute content

- Turn digital expertise into income

In a world of volatile hardware prices, creative adaptability is the best hedge.