The new Aito M7 — Everyone says it's expensive, yet everyone’s buying it

AITO Really Sells Better When It’s Expensive

Under the article “Official Site Crashes! New AITO M7 Presale Starting at 288,000 RMB, 100,000 Orders Within 1 Hour,” by Dongchehui, nearly 200 comments appeared — most of them skeptical.

- Many readers thought AITO was crazy: with the price rising to 288,000 RMB during presale, who would buy?

- Some swore they would cancel their orders unless the launch price dropped by 50,000 RMB.

When the new AITO M7 was released, the price did drop — 10,000 RMB below the presale figure — but it was still around 20,000 RMB higher than the 2024 M7 model.

Despite all the price complaints, buyers still rushed to place orders.

On October 29, HarmonyOS Intelligent Mobility announced that from launch to exceeding 20,000 deliveries took only 36 days.

Even more impressive, this was achieved under production constraints. Only in November would monthly output climb to 20,000–30,000 units.

> In today’s cutthroat automotive market, a price hike is often seen as suicidal.

> Yet the AITO M7 managed to increase sales while raising prices.

Competitors may well be asking themselves: why?

---

The Most Cost-Effective AITO

Price vs. Product Strength

The headline price increase is misleading — the new M7’s upgrades easily justify the bump.

Key Upgrades

- Space Experience

- Old complaint: Interior space didn’t match its length (>5 m), and the third row was useless.

- Wheelbase grew from 2,820 mm to 3,030 mm (+21 cm), improving cabin space.

- Six-seat version: third-row legroom is now 810 mm — comfortable for adults on short trips.

- Customers often say: “Spacious, feels like the AITO M9.”

- Exterior Design

- Styling now leans toward high-end AITO M8.

- Closed grille, lower intake, paddle-style headlights match M8’s features.

- Smoother lines, semi-hidden door handles, roof racks, lidar — unified design.

- Rear through-light bar simplified for a more refined look.

▲ 2024 AITO M7

▲ 2026 AITO M7

- New colors: Coral Red, Island Blue, Warm Cloud White — appealing to younger buyers.

▲ AITO M7 Island Blue

- Interior Luxury & Tech

- Larger central display with narrower bezels.

- New 17.3-inch rear entertainment screen meets family demand.

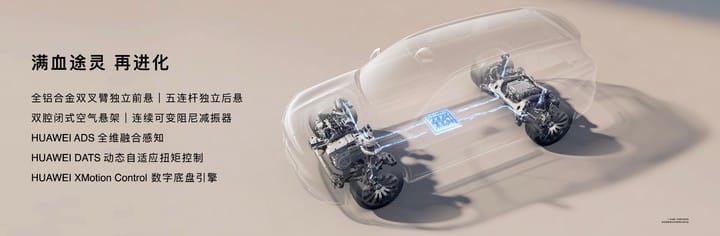

- Mechanical & Driving Performance

- Front suspension: upgraded from MacPherson to double wishbone independent.

- Huawei TorqueLing platform + ADS fusion perception + DATS torque control

- More stable handling at high speeds and over bumps.

- Smart Driving

- Huawei QianKun ADS 4 system.

- Debuts in-cabin laser vision Limera — pushes ADAS to new heights.

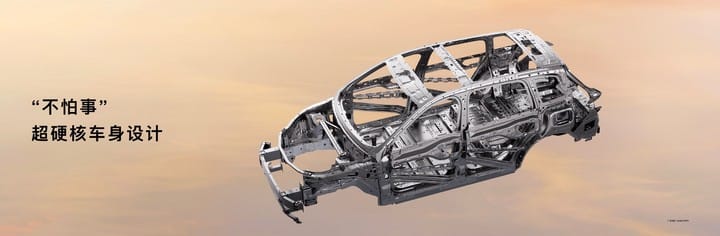

- Passive Safety

- Cabin: submarine-grade hot-formed steel (2000 MPa tensile strength).

- Aluminum crash beams front/rear.

- Ten-grid side reinforcement — safety needs no further explanation.

---

Bottom line:

Within a 300,000 RMB budget, the new M7 delivers almost the same core experience as the 400,000 RMB M8 or even 500,000 RMB M9.

Some premium features (e.g., power doors, privacy sound shields) are less critical when the price gap is 100,000 RMB.

---

Selling to People Who “Don’t Buy New Energy Vehicles”

Different Target Audience

AITO isn’t directly competing with other NEV brands — much of its sales volume comes from customers traditionally resistant to EVs.

- NEV penetration in China’s 300,000 RMB segment:

- 2023: 18%

- 2025 (est.): 47%

- Family SUVs take a big share.

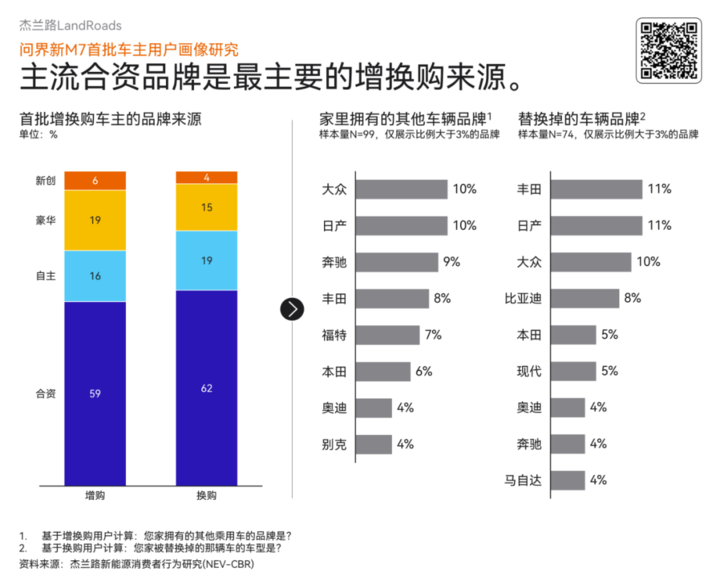

- GEARANDROAD survey:

- Among first buyers of new AITO models, 60%–70% were replacements or additional purchases.

- Almost all replaced cars were internal combustion.

Brand Matters

In the past, before NEVs surged, this segment was dominated by:

- BBA (BMW, Benz, Audi)

- Toyota, Volkswagen

As joint ventures weakened, Tesla, AITO, Li Auto, and Xiaomi took over.

- Tech-focused buyers → Tesla

- Design/emotion-focused → Xiaomi

- Hesitant about pure EVs → AITO

---

A Master of Industry Integration

Historical Context

- 2022: Li Auto expanded lineup (L7, L8, L9).

- Previous-gen AITO M7 launched with Huawei’s brand halo + HarmonyOS cockpit.

- Fastest domestic NEV to exceed 10,000 monthly deliveries.

▲ First-gen AITO M7

Li Auto CEO Li Xiang admitted:

> In Q3 2022, the AITO M7 almost crushed the Li ONE. Huawei’s capabilities caused our sales to collapse, forcing early discontinuation and >1B RMB losses.

First-Gen M7 Shortcomings

- Rapid release sacrificed refinement.

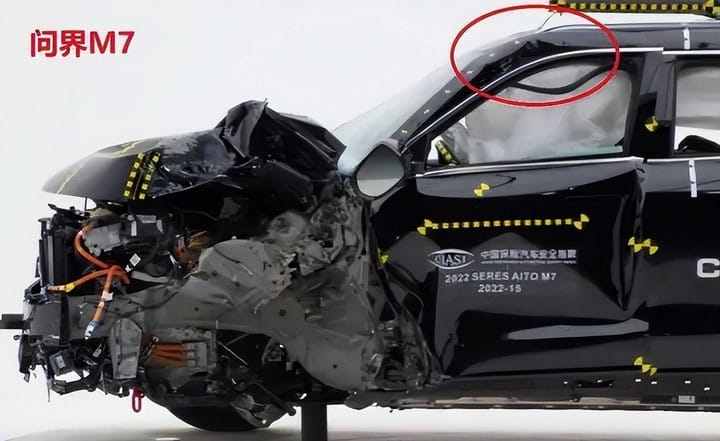

- Example: C-IASI crash test — “Good” rating for structural integrity, weaker than cheaper competitors.

---

Rapid Iteration

Huawei’s principles:

- Keep main product lines well-defined.

- Identify issues quickly.

- Iterate at industry-leading speed.

For the M7:

- Richard Yu approved 500M RMB investment + 6 months development.

- Upgraded HarmonyOS to 2.0.

- ADS expanded to nationwide urban NCA.

Result: Breakout success of the second-gen M7.

---

Strategic Tri-Level Lineup

- M7 → 300,000 RMB segment

- M8 → 400,000 RMB segment

- M9 → 500,000 RMB flagship

Mutually reinforcing rather than cannibalizing sales.

---

Why High Price + High Volume Works

Compared to earlier M7 models, the current version is fundamentally different — apart from the name.

- In a market stuck in a “low price war,” Wenjie offers an evolving, beyond-expectations experience.

- Learned from Li Auto, fixed issues, leveraged Huawei’s premium positioning.

- Appeals to non-price-sensitive customers.

---

Industry Takeaway

Sustainable success in automotive now depends on:

- Consistent, iterative upgrades

- Strategic market positioning

- Bridging gaps between tech innovation and customer sentiment

For creators, analysts, and media professionals covering this space, tools like:

… enable:

- AI-assisted content generation

- Multi-platform publishing

- Analytics & monetization

Helping ensure insights on fast-moving markets reach their full audience potential.