The “O Chain” Has Formed, and Nvidia Is Just One Link

Staying Close to OpenAI: Profits, Influence, and the Rise of the “Open Chain”

Staying close to OpenAI comes with significant rewards—and the reinvention of long-established companies is proving it.

Reposted from Face AI

---

OpenAI DevDay 2025: A Showcase of Scale

OpenAI’s third annual developer conference, DevDay 2025, took place in San Francisco.

CEO Sam Altman shared striking milestones:

- 800 million weekly active ChatGPT users

- 4+ million platform developers

- 6 billion API tokens processed per minute

Behind these numbers is the “Altman Effect”—the power of OpenAI announcements to send related company stocks soaring.

---

Stock Rally Highlights

- AMD: +30% at open, closed up 23.71%

- Figma: Peaked +16%, closed +7.4%

- Coursera: Intraday +8.4%

- HubSpot: +11%

- Salesforce: +4.2%

- Expedia & TripAdvisor: Each +7%+

- Mattel: +6%, after announcing collaboration on Sora 2

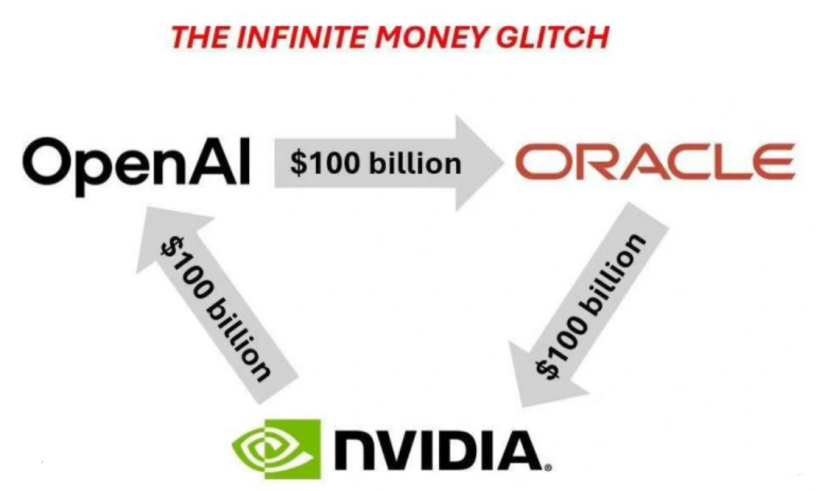

Such market reactions recall earlier events—like Oracle’s $300B OpenAI contract, which sent its stock up 36% in one day.

---

01. Birth of the “Open Chain”

Much like Apple’s “Fruit Chain” of suppliers, OpenAI has quietly built the “Open Chain”—a layered network of value-sharing partners:

Layers of the Open Chain:

- Direct partners – AMD, Oracle (tech suppliers)

- Ecosystem integration – Figma, HubSpot, Salesforce

- Indirect beneficiaries – cloud services, compute infrastructure

The chain is expanding:

- NVIDIA: $100B investment, millions of GPUs for OpenAI data centers—phased with each 1GW capacity milestone

- Samsung Electronics & SK Hynix: Joined October 1, part of $500B Stargate project

Software side growth:

- Launch of Apps SDK

- Enables in-chat service triggers (e.g., Spotify playlists, Zillow real estate search)

- First-wave merchants: Booking.com, Canva, Coursera, Expedia, Spotify, Zillow

---

Independent Creator Angle

Platforms like AiToEarn官网 bring Open Chain-style advantages to individual creators:

- AI-driven content generation

- Multi-platform publishing: Douyin, Kwai, WeChat, Bilibili, Xiaohongshu, Facebook, Instagram, LinkedIn, Threads, YouTube, Pinterest, X (Twitter)

- Integrated analytics and AI model rankings

---

Case Studies: AMD & Oracle

AMD's 6 GW Compute Power Deal (Oct 6)

- +23% stock surge

- Ripple effect to partners:

- Tongfu Microelectronics (AMD CPU/GPU packaging & testing)

- Shenghong Technology (advanced PCB tech)

Oracle in Fiscal 2024

- Annual growth: 6% (below expectations)

- Major breakout came via OpenAI contract—mirrored AMD’s sudden price leap.

Endorsement Effect

OpenAI partnerships attract competitors, similar to Apple supply chain dynamics—entry into the chain ensures strategic positioning in AI’s ecosystem.

---

02. OpenAI’s Capital Magnetism

Key financial developments in 2025:

- $100B investment pledge from NVIDIA

- $50B+ raised via loans and venture capital

- Plan for tens of billions more via infrastructure debt issuance

- October 2: $6.5B secondary stock sale → valuation = $500B

Vision drives funding:

- AGI mission and consumer products like Sora 2 fueling imagination

- Altman’s future-oriented narratives (“zero-person companies”) sustain market excitement.

---

Sora 2: Demand Surge

- Invite-only, 1M downloads in first week (> ChatGPT’s debut)

- Enormous compute needs—video generation far more resource-intensive than images

- Upstream certainty for GPU and cloud providers

Parallel for Creators:

Platforms like AiToEarn官网 allow AI content monetization across multiple channels, leveraging distribution networks much like Open Chain participants.

---

03. Demand-Side Supply Chain Control

OpenAI operates a “demand controls supply” model, anchored in scarce compute resources.

By holding the largest demand, OpenAI can:

- Negotiate orders-for-equity

- Reshape upstream/downstream structures

Not Seeking a Super App

Altman’s DevDay quote:

> “Our goal is not to make a super app, but to build a truly powerful AI super system.”

---

Risks & Bubble Concerns

- Closed capital loops (e.g., OpenAI ↔ NVIDIA ↔ Oracle) could collapse if AI hype fades

- AMD example: 6 GW GPU deployment + warrant grant (up to 10% AMD equity)

- Potential fallout:

- Devalued equity holdings

- Risky consortium collateral

- Plummeting supplier shares

---

Independent Strategy

Creators and smaller firms should take note:

- Diversify involvement across ecosystems

- Avoid overdependence on single supply chains

- Use open-source, cross-platform tools such as AiToEarn (官网, AI模型排名) for resilience

---

[](https://mp.weixin.qq.com/s?__biz=MzkyNjU2ODM2NQ==&mid=2247618902&idx=1&sn=7e9f8a5662155b89e5b4c8b51602a59d&scene=21#wechat_redirect)

[](https://mp.weixin.qq.com/s?__biz=MzkyNjU2ODM2NQ==&mid=2247618885&idx=1&sn=7b3d9ce6ecadb22bb07261a291520297&scene=21#wechat_redirect)

---

Tap the “heart” icon before you leave.

---

Final Insight

Whether reading, creating, or sharing, tools like AiToEarn官网 empower creators to:

- Publish to multiple platforms simultaneously

- Track performance

- Maximize monetization of AI-powered content through analytics and rankings

In the AI era, linking yourself to high-value ecosystems—whether corporate “chains” or open-source networks—is the best strategy for growth.