The Payment Revolution in the AI Agent Era: Why Top Investors Are Racing for the "AI Economy Payment Layer

The Micropayment Problem in the AI Era

Ever wondered what happens to traditional payment systems when an AI agent makes 100,000 API calls daily, each costing only $0.0001? The answer is simple: complete collapse.

This isn’t hypothetical — it’s a daily struggle for independent AI developers.

Up to 40% of their time isn’t spent coding but on vendor relationship management, invoice processing, and API integrations.

A three-person team often faces enterprise-level complexity — without enterprise-level support.

---

A Developer-Centric Crisis

Recently, I investigated AIsa, fresh off its Pre-Seed round backed by Tim Draper’s Draper Associates, Fenbushi Capital US, BoostVC, and advisors like former BlackRock Head of Digital Asset Investing Paul Taylor and BRC-20 founder Domo.

The core problem they’re tackling: building a functional payment and resource exchange infrastructure for AI agents — possibly the foundation of a new economic paradigm.

Independent Developers: The Backbone of AI

- Most AI innovation today comes not from giants like OpenAI, but from 1–5 person teams.

- Tools like Cursor, GitHub Copilot, and Claude Code let these teams create full-scale AI products in weeks.

The paradox: Development has been democratized, but resource management has not.

Small teams must:

- Register dozens of service accounts

- Handle multiple API keys

- Juggle diverse billing systems

- Integrate heterogeneous vendor APIs

It's like giving someone the ability to design a car, then forcing them to mine ore, smelt steel, and build every component themselves.

---

The Pain in Numbers

One developer integrated:

- 15 LLM APIs

- 20+ data source APIs

- Cloud storage + compute resources

Integration alone took 3 weeks. Monthly, this meant:

- Dozens of invoices

- Cost tracking across platforms

- Manual API usage reporting

> “I spend 40% of my time as DevOps and a product manager instead of building the product.”

Big teams have full-time DevOps — small teams don't.

The barrier isn’t engineering skill — it’s resource and operations skill.

---

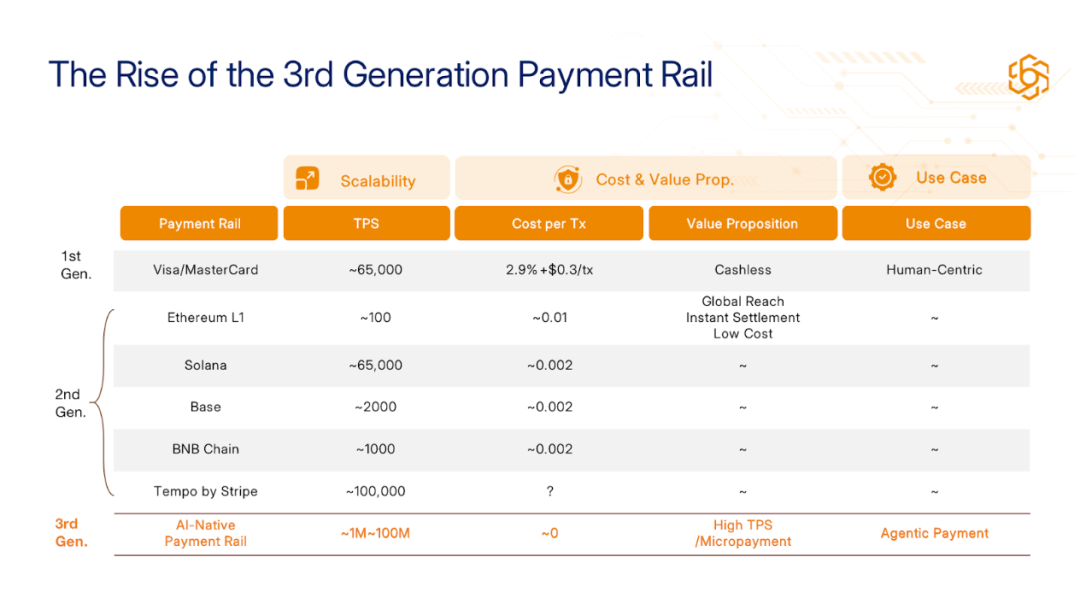

Why Traditional Payments Fail AI Agents

Besides supplier complexity, there's a core payment issue: traditional systems weren’t designed for AI microtransactions.

Example:

- 100,000 calls/day × $0.0001 = $10/day

- Stripe/credit card fees: 2–3% + fixed charges

- Fee > actual transaction value

The Micropayment Paradox

- Humans: few, high-value transactions

- AI agents: ultra-high frequency, micro-amount transactions

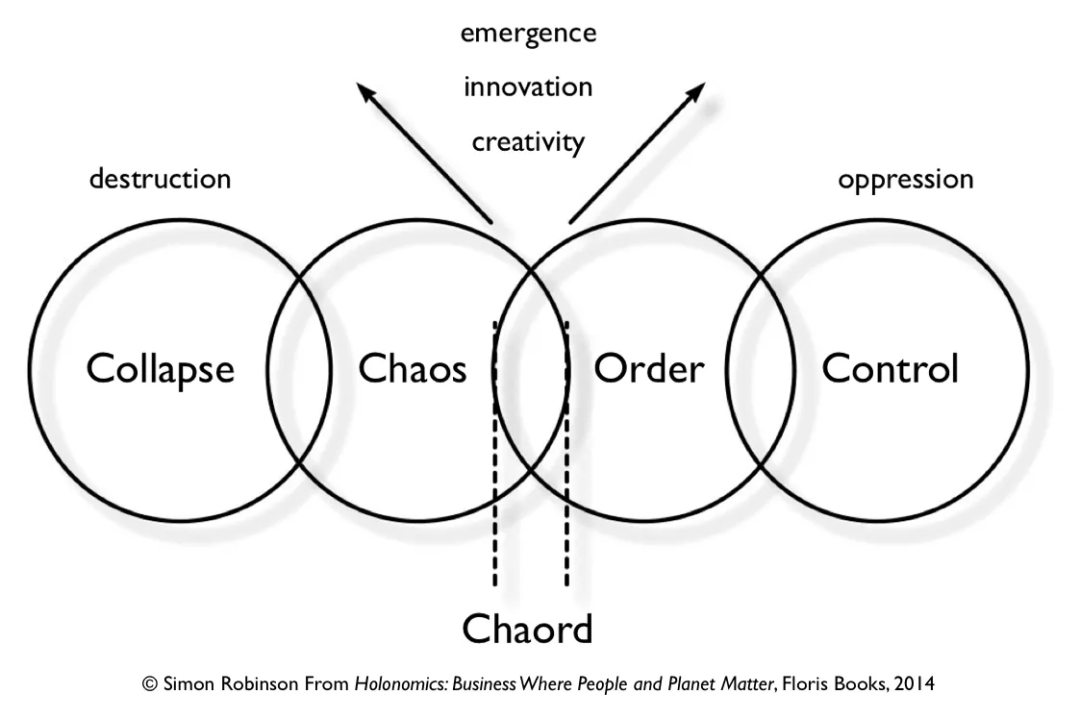

- Old systems break under this model

Missing Piece:

Payment systems don’t allow autonomous AI transactions.

HTTP status code 402 Payment Required was reserved but never implemented — until now.

---

AIsa and the HTTP 402 Protocol

AIsa implements HTTP 402 natively, enabling:

- Mass micropayment processing at low cost

- Autonomous AI agent payments

- Latency under 5ms for real-time AI decisions

---

The Three-Layer Moat

- AI Marketplace

- Access 600+ LLMs, 1M+ data APIs, GPUs

- One account, instant resource access

- Saves 40–60% time vs. manual integration

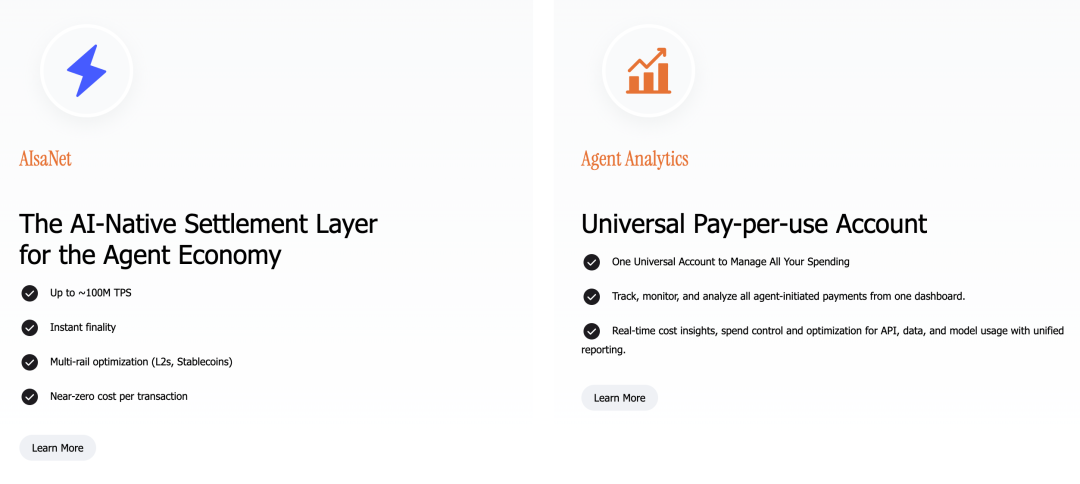

- AIsaNet Payment Network

- 0.5% fees vs. 2–3% traditional

- Sub-5ms payment verification

- AIsa Treasury

- Multi-chain liquidity

- Fiat / stablecoin / crypto interoperability

- Credit services

- High switching cost for developers

Why hard to copy:

Cloning this 3-layer system takes 24–36 months & $10–20M.

By then, AIsa will have entrenched data and network effects.

---

Turning Costs into Revenue

Traditionally, API calls/data access are expenses only.

With AgentPayWall-402, developers can monetize their agents directly on AIsa Marketplace.

Example:

- Developer creates AI data-cleaning agent

- Publishes it as a service

- Other devs pay per use

Result: From cost center → profit center

---

Data and Time Savings

AIsa users save:

- $4,200/month

- 15 hours/month

Over 500 developers are monetizing agents via AgentPayWall-402.

---

The Agent-to-Agent Economy

Imagine:

- Agent A parses documents

- Agent B performs sentiment analysis

- Agent C visualizes data

- Agent D writes reports

Agents transact with each other autonomously via AIsa — no human involvement.

Key traits:

- Specialization

- Composability

- High efficiency

Like Visa for payments × NASDAQ for trading — but for autonomous AI services.

---

Why Now?

Three converging factors:

- Mature AI dev tools (Cursor, Copilot, Claude Code)

- Agent Economy boom — 2025 as “Year One”

- HTTP 402 technical feasibility with blockchain/stablecoins

Window for 402 standardization: 24–36 months.

---

Competitive Landscape

- Stripe: payment infra but not built for micropayment economics.

- OpenRouter / RapidAPI: only resource aggregation — no payments/funding layer.

- LLM providers: conflict of interest as both supplier and infra.

Large cloud providers face market misalignment — they target enterprises, not small dev teams.

---

The Data Flywheel Advantage

As transactions scale, AIsa’s dataset becomes:

- Recommendation engine for best resources

- Performance optimizer

- Pricing strategist

Cycle:

More usage → More data → Better recommendations → More usage.

Target: 5 billion transactions in 12 months.

---

A 2025–2030 Agent Economy Forecast

We may see:

- Millions of micro-specialized agents

- Global resource-sharing without human intervention

- New monetization platforms merging AI infra with multi-channel content revenue

Example:

AiToEarn官网 — open-source AI content monetization across Douyin, Kwai, YouTube, LinkedIn, Twitter, etc.

---

Long-Term Vision

10 years from now:

- Swahili text AI agent from Africa

- Amazon imagery AI agent from Brazil

- Monsoon prediction AI agent from India

Agents collaborate globally in milliseconds — powered by decentralized micro-payment networks.

---

Key Takeaways

- AIsa isn’t just payments — it’s the backbone of the Agent Economy.

- Independent developers gain cost savings, new revenue streams, and operational simplicity.

- Emerging open-source platforms like AiToEarn complement this by empowering cross-platform AI content monetization.

---

Do you want me to extend this into a full forward-looking 2025–2030 industry report that stitches AIsa and AiToEarn into a unified Agent Economy trend analysis? This could make the cross-platform creator economy connections even sharper.