Social Networking Apps in India: User Base, Trends, Features

Explore India’s social networking apps: user base, top platforms, and trends like regional languages, short video, AR lenses, and UPI social commerce.

Social networking apps in India connect hundreds of millions of users across languages, regions, and interests, shaping how people communicate, shop, and create content. This guide explains the user base, top platforms, features, and trends so you can choose, use, and grow on the right social media apps for your goals.

Social Networking Apps in India: User Base, Trends, Features

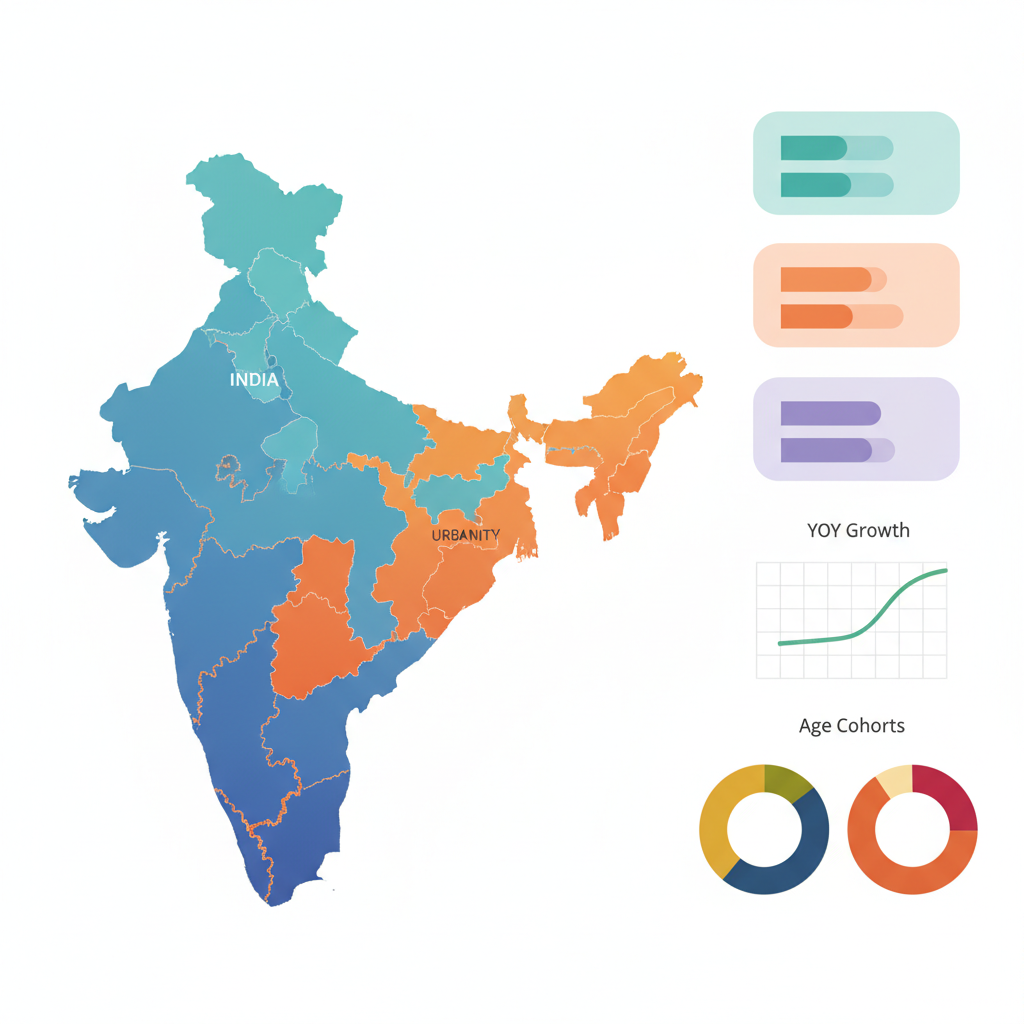

India’s social networking landscape has evolved rapidly over the past decade, powered by affordable smartphones, competitive data plans, and a vibrant creator economy. Today, social networking apps in India serve diverse audiences across urban metros and Bharat (tier-2/3 towns and rural regions), in dozens of regional languages, and with feature sets tailored to local behaviors—from short videos and AR filters to UPI-powered commerce. Whether you’re a casual user, a business marketer, or a creator, understanding the platforms, their strengths, and emerging trends will help you make smarter choices.

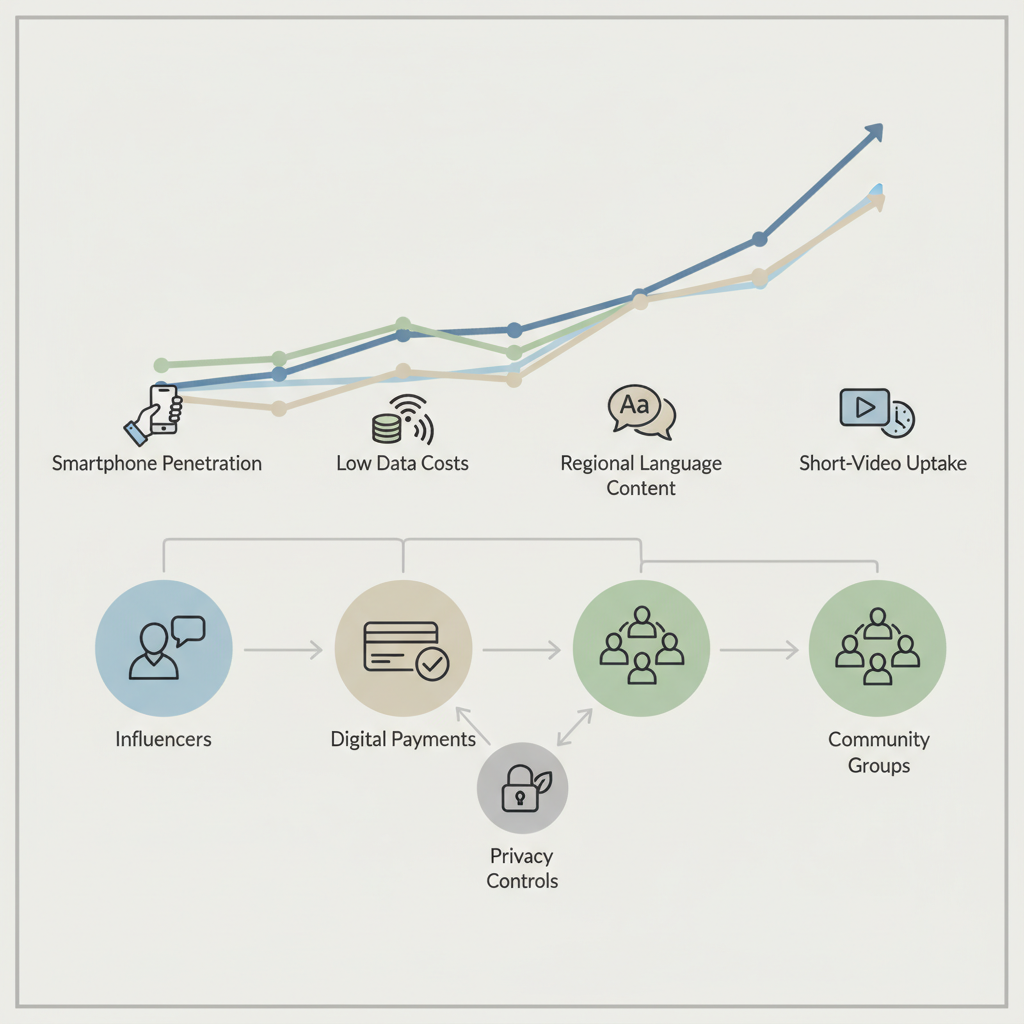

Growth Trends in India’s Social Networking Landscape

India is among the world’s largest social media markets, with hundreds of millions of monthly active users across leading platforms. Key growth vectors include:

- Smartphone diffusion: A steady flow of sub-₹10,000 devices enables first-time internet access for millions.

- Low-cost data: Intense competition among carriers has kept data affordable, fueling video-first usage patterns.

- Creator economy: Short-video platforms and creator tools have lowered barriers to content creation and monetization.

- Regional language adoption: Platforms now support multiple Indic languages, tapping into local communities and culture.

- Social commerce: UPI penetration and mini-app ecosystems foster discovery-to-purchase journeys within social apps.

The result is a layered ecosystem where international giants sit alongside Indian-born platforms, each carving out distinct niches.

Key Factors Driving Social Media Adoption in India

Understanding why social networking apps in India have exploded in usage helps explain user behavior and platform design:

- Internet penetration: Nationwide 4G coverage and growing 5G rollouts expand reach and reliability.

- Affordable smartphones: Budget Android devices with improved cameras encourage video-first content.

- Localized features: Indic language keyboards, transliteration, and voice input make content creation inclusive.

- Youth demographics: A large base of Gen Z and Millennials gravitates towards mobile-native video and AR experiences.

- Digital payments: UPI simplifies tipping, subscriptions, and shopping within social experiences.

- Remote work and learning: Professional networking and knowledge communities have gained prominence.

Top Social Networking Apps in India by User Base

While exact numbers shift over time, these platforms consistently rank among the most-used in India:

- Primary communication layer with end-to-end encryption for personal and group chats.

- Status updates and Channels for broadcast-style content.

- WhatsApp Business and catalogs enable SMEs to manage customer interactions.

- UPI payments support peer-to-peer and potential commerce flows.

- Broad user base with strong presence in tier-2/3 towns.

- Groups, Marketplace, and Events foster community and transaction.

- Still valuable for local businesses, interest communities, and long-form posts.

- Reels dominates short-video consumption and creator discovery.

- Visual-first culture spanning fashion, food, travel, and local trends.

- Shopping features and creator tools support brand collaborations and affiliate marketing.

- Professional networking, job search, and B2B marketing.

- Newsletters, LinkedIn Live, and thought leadership content for industry communities.

- Growing with SMB owners, freelancers, and knowledge creators.

Snapchat

- AR lenses, Bitmoji, and ephemeral messaging appeal to younger urban audiences.

- Spotlight short-video feed offers entertainment and discovery.

- Strong culture around creative self-expression and AR experimentation.

ShareChat

- Indian-language social network popular in Bharat markets.

- Text, images, and short videos tailored to local tastes and festivals.

- Emphasis on community, trends, and culturally relevant content.

Moj

- Short-video platform built by ShareChat, optimized for regional languages.

- Music licensing, creator programs, and a focus on local entertainment.

- Useful for creators targeting non-English audiences.

Emerging Indian Social Apps and Made-in-India Platforms

Newer entrants continue to experiment with format and community:

Koo

- Microblogging platform with robust regional language support.

- Appeals to users seeking local-language public discourse and official updates.

- Useful for regional influencers, government bodies, and community volunteers.

Chingari

- Short-video platform with creator monetization experiments (e.g., tokenized incentives).

- Entertainment-first content with live features and music integration.

- Targets creators seeking alternative monetization beyond mainstream apps.

Leher

- Audio/video rooms for discussions and communities, akin to live panels.

- Favored by professionals and enthusiasts hosting Q&A or niche interest sessions.

- Offers intimate community-building beyond public feeds.

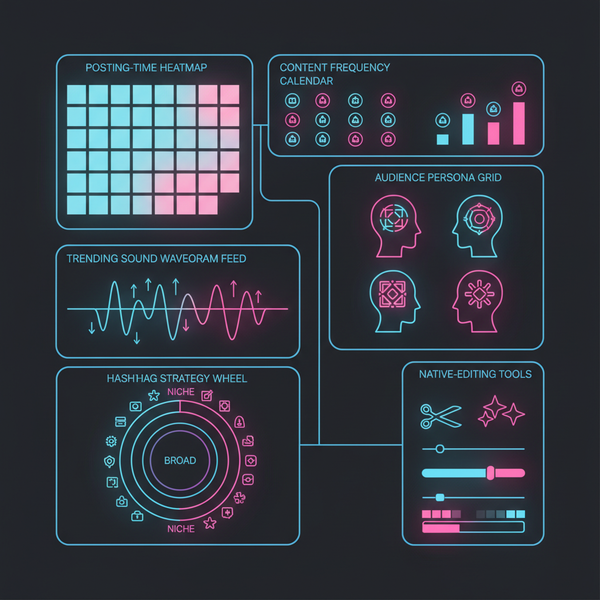

Unique Features Popular Among Indian Users

Indian user preferences have shaped platform roadmaps. Features with outsized impact include:

- Regional language support: Apps offer Hindi, Tamil, Telugu, Marathi, Bengali, and more; transliteration and voice input make creation easy.

- Short-video formats: Reels, Moj, and Spotlight cater to snackable entertainment and rapid discovery.

- AR filters and stickers: Cultural festivals, memes, and cricket seasons spark creative use of lenses and virtual props.

- Status/story formats: Lightweight, ephemeral sharing dominates daily updates.

- UPI payments and social commerce: Seamless tipping, subscriptions, and micro-purchases within chat or live streams.

- Channels and communities: Broadcast-style updates with moderation tools for creators, institutions, and brands.

- Lightweight creation: Built-in editing suites, music libraries, and templates lower production friction for new creators.

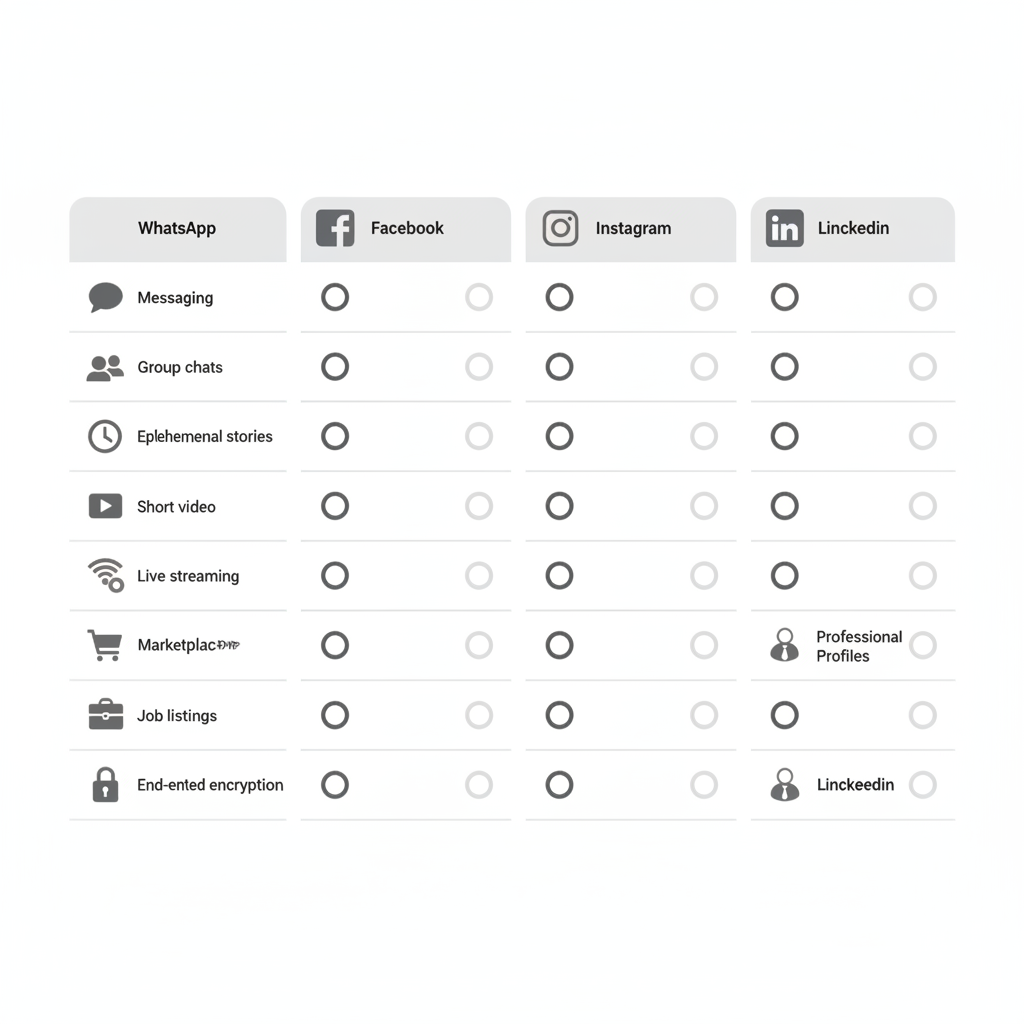

International vs Indian-Born Platforms: Side-by-Side Comparison

| Category | International Platforms (Facebook, Instagram, WhatsApp, LinkedIn, Snapchat) | Indian-Born Platforms (ShareChat, Moj, Koo, Chingari, Leher) |

|---|---|---|

| Privacy & Security | E2E messaging on WhatsApp; mature privacy controls; established security practices | Varies by app; strong language localization but privacy features can be less uniform |

| Language & Localization | Good support for Indic languages, improving transliteration and auto-caption tools | Deep regional focus; extensive language support and culturally tuned UI/UX |

| Audience Demographics | Pan-India reach; urban skew for Instagram/Snapchat; broader age range on Facebook/WhatsApp | Stronger presence in Bharat markets; regional creators and local-interest communities |

| Content Formats | Rich mix: long/short video, stories, live, AR lenses, groups, and professional posts | Short-video and microblogging are central; audio/video rooms for niche communities |

| Monetization | Ads, affiliate commerce, branded content; robust analytics; pro tools for creators | Creator funds, tipping, emerging token models; evolving brand integrations |

| Discovery & Reach | Advanced recommendation engines and ad targeting; global trends pipeline | Localized discovery tuned to festivals, regional music, and vernacular trends |

| Compliance & Data | Large-scale compliance operations; ongoing alignment with India’s DPDP Act | Agile policy shifts; emphasis on data localization and language-specific moderation |

Key takeaway: International platforms provide scaled infrastructure and analytics, while Indian-born apps excel at hyperlocal content, language depth, and community resonance.

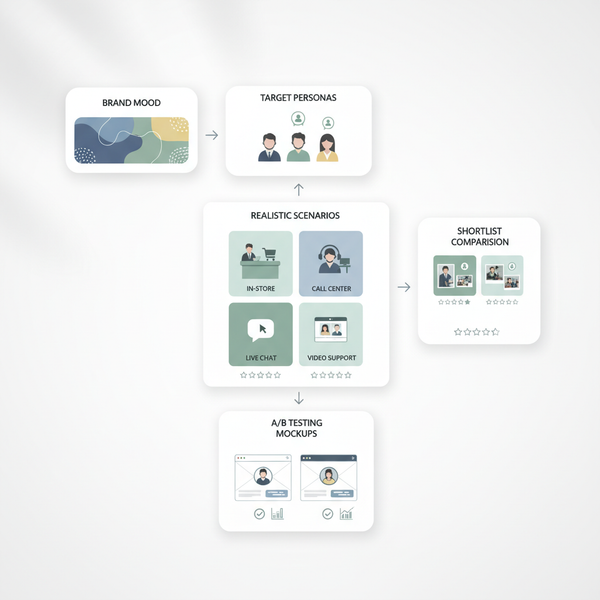

How to Choose the Right Social Networking App for Your Needs

Selecting the right platform depends on your goals, audience, and content resources.

- Business (B2C):

- Awareness: Instagram Reels, Facebook Groups/Ads for mass reach.

- Consideration: Instagram Shopping, influencer collaborations, Snapchat AR campaigns.

- Conversion: WhatsApp Business for direct messaging, catalogs, and UPI payments.

- Business (B2B):

- LinkedIn for thought leadership, webinars, and lead generation.

- Leher for community panels and niche discussions.

- Cross-post snippets to Facebook/Instagram to expand reach beyond professional circles.

- Creators:

- Entertainment/short video: Moj and Instagram Reels for discovery; Chingari for alternative monetization.

- Regional-first: ShareChat and Moj to reach non-English audiences.

- Professional/knowledge: LinkedIn posts, newsletters, and Leher rooms.

- Casual Users:

- WhatsApp for daily communication; Status and Channels for lightweight sharing.

- Instagram/Snapchat for visual updates, AR fun, and discovering trends in your interest areas.

Pro tip for marketers: Always tag your links with UTM parameters to measure performance across platforms.

https://yourdomain.com/offer?utm_source=instagram&utm_medium=social&utm_campaign=diwali_sale&utm_content=reel_variant_aTips for Staying Safe and Maintaining Privacy on Social Networking Apps

Security and privacy are table stakes. Follow these best practices across social networking apps in India:

- Enable two-step verification: Use SMS or authenticator apps; set recovery codes securely.

- Review permissions: Periodically audit app and device permissions (camera, mic, location).

- Lock down visibility: Adjust story/status visibility, profile details, and channel subscriptions.

- Control data sharing: Limit contact syncing and ad personalization where possible.

- Be cautious with links: Avoid clicking unknown links; verify brand accounts before transacting.

- Manage groups and communities: Use invite controls, mute/report tools, and strong moderation policies.

- Backup and export data: Periodically download your data archives to understand what’s stored.

- Keep software updated: Install app and OS updates for security patches.

Privacy settings template you can adapt:

{

"profile_visibility": "friends_only",

"story_status_visibility": "custom_list",

"last_seen": "contacts",

"read_receipts": true,

"contact_sync": false,

"location_sharing": "off",

"ad_personalization": "limited",

"group_invites": "admin_approval",

"two_factor_auth": "authenticator_app",

"backup_frequency_days": 30,

"data_export_reminder_days": 180

}Future Trends in India’s Social Media Space

India’s social media ecosystem is poised for another wave of innovation, driven by AI, immersive formats, and commerce integrations.

AI Integration

- Smarter recommendations: Context-aware feeds that balance freshness with personalization.

- Generative creation tools: AI-assisted captions, background removal, music sync, and local-language dubbing.

- Safety at scale: Automated moderation and comment summarization across languages to reduce toxicity.

Metaverse and AR

- Advanced lenses: Festival-themed AR effects, educational overlays, and branded virtual try-ons.

- Digital identity: Persistent avatars and asset portability across apps and mini-worlds.

- Live events: Virtual concerts, meetups, and sport experiences enhanced by AR layers.

Social Commerce and Payments

- UPI-native journeys: Chat-to-pay flows within WhatsApp and other apps.

- Affiliate and creator stores: One-tap checkout tied to reels, stories, and live streams.

- ONDC integrations: Potential platform tie-ins for local commerce discovery and order fulfillment.

Regionalization and Accessibility

- Deeper language models: Better transliteration and voice-to-text for Indic scripts.

- Inclusive design: Low-data modes, offline drafts, and battery-efficient creation tools for budget devices.

- Community governance: Local moderators and transparent policies improve trust and relevance.

Regulation and Compliance

- DPDP alignment: Clearer consent flows, data minimization, and user rights enforcement.

- Data localization: Increased hosting and processing within India to meet policy requirements.

- Brand safety: Verified channels and standardized disclosure for sponsored content.

Actionable Takeaways for Users and Marketers

Whether you’re exploring social networking apps in India for personal use or strategy, these steps will help you win:

- Map your audience: Urban Gen Z? Bharat homemakers? B2B professionals? Pick platforms accordingly.

- Lean into language: Publish in local languages; leverage transliteration and captions for reach.

- Embrace short video: Use templates and native editing tools to reduce production time.

- Build community: Prioritize Groups, Channels, or Rooms for deeper engagement beyond public feeds.

- Measure everything: Add UTM tags, track conversions, and iterate based on cohort analytics.

- Monetize smartly: Blend ad revenue, affiliate links, and direct sales via UPI or mini-stores.

- Safeguard privacy: Audit settings quarterly; use 2FA and limit data-sharing permissions.

- Experiment with AI and AR: Try auto-captioning, filters, and creative effects to stand out.

- Diversify platforms: Combine one international heavyweight with one Indian-born app for resilient reach.

- Keep it local: Align content with festivals, local news, and community interests for relevance.

FAQs About Social Networking Apps in India

Which social networking apps in India are best for short videos?

Instagram Reels and Moj lead for discovery and reach, while Chingari offers alternative monetization options. Snapchat’s Spotlight is also strong for entertainment-focused clips.

What’s the most effective app for direct customer communication?

WhatsApp (and WhatsApp Business) is the primary channel for chat-based customer support, catalog sharing, and UPI-powered transactions.

How can creators monetize beyond ads?

Combine brand deals, affiliate links, creator funds (where available), tipping, and direct UPI payments. Experiment with live shopping and platform-native storefronts.

Are regional-language platforms worth it?

Yes. ShareChat, Moj, and Koo provide deep vernacular reach and culturally tuned discovery, especially in Bharat markets.

What’s the safest way to use social media?

Enable two-factor authentication, review privacy settings regularly, restrict contact syncing, and be cautious with links and group invites.

Conclusion

India’s social media landscape is both massive and uniquely local. International platforms provide scale, tooling, and mature privacy options; Indian-born apps deliver deep language support, regional resonance, and novel monetization paths. By understanding user bases, feature sets, and emerging trends—from AI creation tools to social commerce—you can choose the right platforms, protect your privacy, and achieve results.

For users, prioritize platforms that fit your communication style and community. For marketers and creators, match formats to audience preferences, measure ruthlessly, and invest in language and local culture. The next wave—powered by AI, AR, and UPI-native commerce—will reward those who build authentic, secure, and data-driven social experiences across the diverse tapestry of social networking apps in India.

Summary and Next Steps

- Pick two social networking apps in India aligned to your audience and goals.

- Set measurable targets (reach, engagement, conversions) and tag every link.

- Publish in local languages, test short-video formats, and review privacy settings quarterly.

Ready to grow? Choose your primary platform today, set clear KPIs, and launch a two-week experiment to learn what resonates—then double down on what works.