Translate the following blog post title into English, concise and natural. Return plain text only without quotes. 胡泳:会计造假、举债扩张,我们正目睹一场人工智能泡沬吗?丨大声思考

Michael Burry’s Warning: Is AI Entering Bubble Territory?

Michael Burry — famed for predicting the 2008 subprime mortgage crisis — has turned his bearish eye toward artificial intelligence (AI). He has made large bets that the current AI boom will eventually collapse, signalling his belief that we are in bubble territory.

On October 31, 2025, Burry posted on X:

> “Sometimes you can see the bubble. Sometimes you can act on it. And sometimes, the only winning move is not to play.”

Burry has 1.6 million followers.

---

1. The “Bubble” Call Revisited

Over the past six weeks, Burry has returned to social media to outline a bearish view on hyperscale data centers and AI stocks.

Key developments:

- Initially appeared to lose his short bet against Nvidia, later recovered.

- Instead of celebrating, he closed his hedge fund, appointed a successor, and launched a newsletter: Cassandra Unchained.

- First article published November 24: Primary Signs of a Bubble: Supply-Side Gluttony — compares the 1990s internet rush to the current AI surge.

Analogy: Last era’s pick-and-shovel supplier = Cisco

Today’s equivalent = Nvidia

AI-generated image: Jensen Huang selling shovels to Elon Musk, Satya Nadella, and other tech moguls.

---

2. Key Concern: Hidden Costs & Accounting Practices

Both Michael Burry and Warren Buffett are investing legends — but with opposing approaches:

- Buffett: Long $4B in Alphabet (Google)

- Burry: Short over $1B in Nvidia and Palantir via put options

Why Palantir?

Likely due to high valuation.

Why Nvidia?

More complex: hyperscale cloud companies have invested hundreds of billions in Nvidia GPUs.

OpenAI Stargate Phase I data center, Abilene, USA — Source: OpenAI

Accounting Red Flag

- Typical accounting spreads GPU costs over 5–6 years.

- Nvidia’s product cycle: new architecture every 1–2 years, now closer to 1 year.

- Longer depreciation schedules make profits look better than they are.

Burry’s accusation: Nvidia and its customers may be inflating profits through favorable depreciation timelines.

Nvidia disputes this:

- CFO Colette Kress: GPUs retain durability via CUDA ecosystem.

- CEO Jensen Huang: AI benefits everyone — from startups to Meta.

---

3. Valuation Milestone

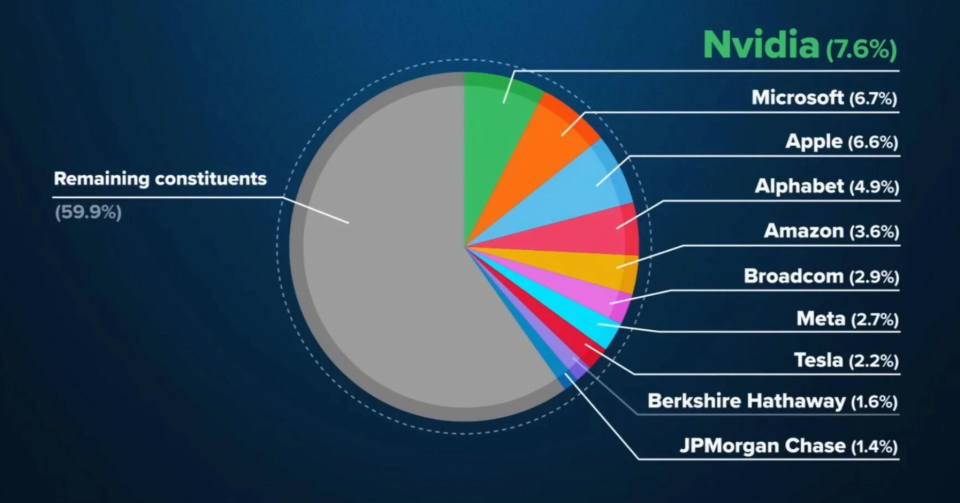

- October 29, 2025: Nvidia hits $5T valuation — first public company at that mark.

- +$1T in 4 months.

- World Bank: exceeds GDP of all nations except US & China.

---

4. AI Boom Context

- Major tech giants increasing AI capex, most benefiting Nvidia.

- Kress: Sales by Dec 2026 could exceed $500B — more than triple FY2025 revenue ($130B).

- Competitive threats emerging: Google TPU chips, trained Gemini 3 entirely on TPUs.

Google CEO Sundar Pichai selling shovels to Mark Zuckerberg — AI-generated image.

Alphabet’s market cap surged to nearly $4T on TPU momentum.

---

5. Cyclical Financing: Inflating the Balloon

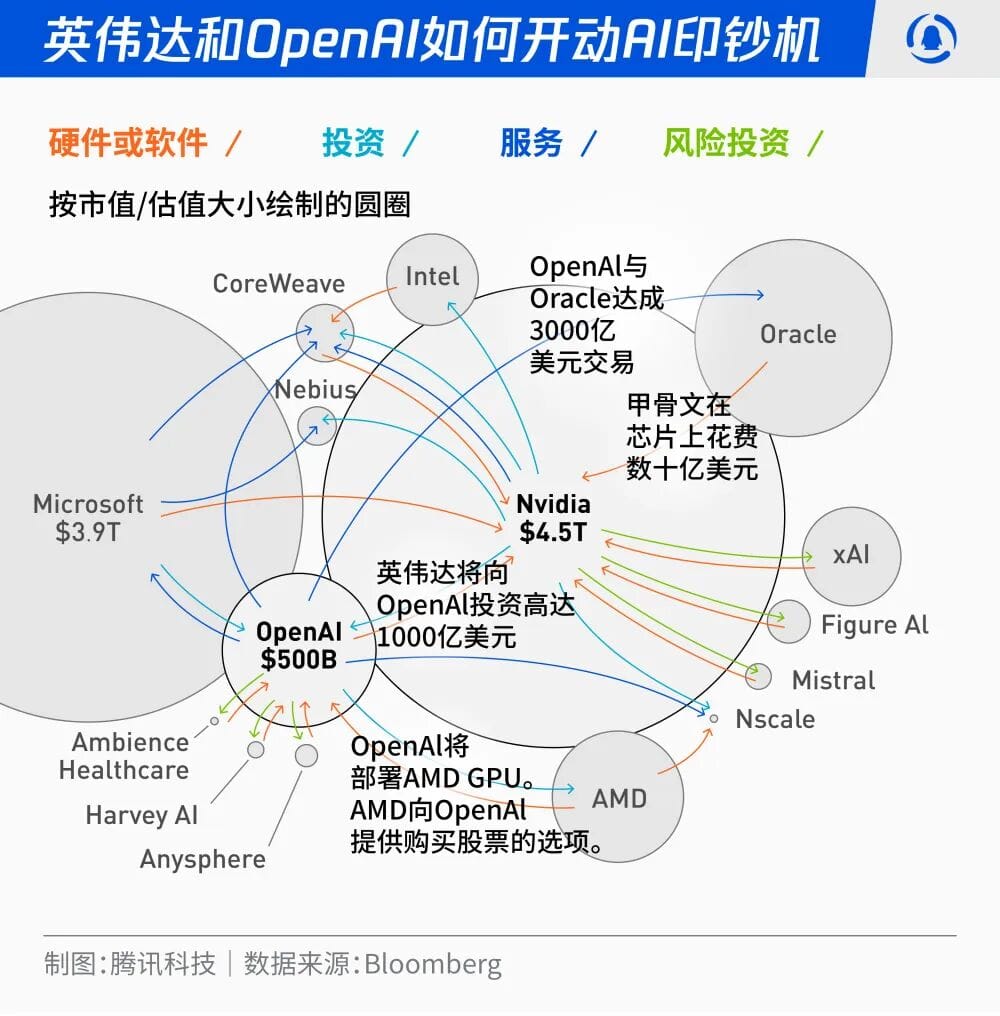

Nvidia invests in AI companies that then buy its chips:

- Sept 2025: $100B pledged to OpenAI

- Nov 2025: $10B to Anthropic

Effect: Self-funding growth by financing customers.

Oracle’s Debt Risk

- $96B total debt via bonds & loans to support OpenAI cloud capacity.

- Interest costs could consume most of Oracle’s $3B quarterly profit.

- Chain risk: OpenAI slowdown → Oracle payment risk → Nvidia exposure.

---

6. Debt-Powered Expansion

AI capex is now partly funded by external debt:

- Meta: $27B private debt for Hyperion data center.

- Microsoft: $100B AI investment fund — debt financed.

- OpenAI & AMD: “equity-for-orders” deals.

Capex growth forecast:

2026: +30% YoY to $500B (vs 10% previously projected)

Concerns:

- Off-balance-sheet debt (SPVs) at Meta & xAI resembles Enron-era risks.

- Free cash flow at Amazon, Google, Meta, Microsoft showing signs of strain.

- By 2028: global datacenter spend may hit $3T — much via borrowing.

---

7. Systemic Risk & Market Concentration

- AI sector accounts for 80% of 2025 US stock gains.

- AI-related companies: 165% return over ~3 years (vs S&P 500 avg +68%).

- Market cap concentration: Nvidia, Google, Microsoft, Apple, Amazon = 30% of S&P 500.

Economist Jason Furman: Without AI capex, US GDP growth would be 0.1% annualized.

---

8. Bubble or Fundamentals?

Risks:

- Over-reliance on few companies & unproven tech ROI.

- AI-washing = companies adding “AI” label for valuation boosts.

Strengths:

- Robust balance sheets & healthy margins.

- AI revenue momentum — monetizing during buildout.

- Real demand: datacenter utilization ~80% vs internet bubble’s 7%.

---

9. The Road Ahead

AI is a general-purpose technology comparable to electricity in transformative potential:

- Productivity gains

- New industries in health, education, robotics

- Integration with quantum computing

Volatility is inevitable — history shows disruptive tech sees bubbles before stabilization.

---

10. Recommended Reading

-  AI in the Age of Change

-  Hu Yong | Why AI Might Make You Less Intelligent

-  Tian Yuandong | Large Models & World Compression

---

11. Tools for the AI Creator Economy

Platforms like AiToEarn官网 enable AI content generation, multi-platform publishing, and analytics — spanning Douyin, Kwai, WeChat, Bilibili, Facebook, Instagram, LinkedIn, YouTube, Pinterest, and X.

Such tools help ensure:

- Sustainable revenue from AI creativity.

- Human oversight to avoid cognitive skill erosion.

- Diversification beyond speculative AI investment.

---

Summary Table: AI Bubble Signals vs Fundamentals

| Bubble Signals | Fundamental Strengths |

|---------------------------------------------|----------------------------------------------|

| Excessive valuations | Strong cash flow and margins |

| Cyclical financing & debt buildup | Monetization during buildout |

| AI-washing hype | Tangible infrastructure & high utilization |

| Market over-concentration | Multiple revenue streams & enterprise base |

---

Would you like me to also create a one-page infographic from this rewritten article, so the key risks and fundamentals are visualized for quick reference? That would make this markdown even more engaging.