Translate the following blog post title into English, concise and natural. Return plain text only without quotes. 红杉合伙人敲响 8,400 亿的回报警钟,David Cahn 给 AI 初创公司的几个建议

Linkloud 引言

红杉资本合伙人 David Cahn 是全球顶尖的 AI 投资人之一,曾在 Coatue 任职期间主导过 Notion 和 Hugging Face 的投资,加入红杉后又相继布局了 Clay、Juicebox、Sesame 等非常火爆的 AI 公司。

继去年以“AI's $600B Question“震动硅谷后,他此次带着升级版的“8,400 亿美元账单”回归。本期 20VC 播客中,他将从宏观到微观解析物理基建引发的“股权解除”风险、23 岁 AI 原生代的人才重构,以及国防科技作为下一个变革前夜的崛起。希望能为大家带来帮助,Enjoy!

已经很久没有一场对话能够像本期 20VC 的播客中,红杉资本合伙人 David Cahn 与 Harry Stebbings 的交流这样,如此精准地捕捉到时代的脉搏。

一、AI 时代被低估的物理属性

- 德州的沙漠与空运的电工

去年夏天,大家的目光几乎都盯着计算模型、参数规模和数据质量。那是一个属于“Bit”的夏天,讨论都飘在云端,好像 AI 只是一场纯粹的软件革命。

但 David 当时提了一个听起来很复古、甚至反直觉的观点:人们严重低估了数据中心的物理属性。他认为,未来的竞争核心会回归到最基础的工业要素——钢铁、服务器和电力。

如今,这个预测不仅成真了,激烈程度甚至超乎想象。

如果深入 AI 建设一线,去德克萨斯州的沙漠里和工人们聊聊,会发现硅谷的精英叙事和物理世界的现实差距巨大。David 在一线看到:为了抢夺有限的电力接入,科技公司像打仗一样,直接用飞机把电工空运到现场。为了抢熟练工人,大家已经完全不计成本。

- 发电机:比 H100 更稀缺的硬通货

更紧迫的是缺发电设备。在这个疯狂的建设周期里,发电机这种工业时代的产物,突然变得比 H100 芯片还稀缺。顶级供应商的产能早就卖光了,订单甚至排到了 2030 年。

这意味着,如果现在才想建数据中心,有钱也没用,未来五六年甚至根本搞不到最基础的电力保障。

这种对物理资源的争抢,正在重塑整个行业的竞争格局。

- 当“千兆瓦”取代“美元”

这也带来了一个大变化:衡量标准变了。以前 Sam Altman 这种 CEO 谈 AI 基建,单位是“美元”。而在过去这一年,单位悄悄变成了“千兆瓦(Gigawatts)”。

这不只是换个词,而是标志着 AI 经济从金融主导转向了物理资源主导。在这个新世界里,手里有几十亿美元现金当然好,但如果没有锁定的千兆瓦电力配额,那些钱就是一堆废纸。

逻辑很简单:GDP 本质上更擅长统计物理产出,而不是虚拟服务。

二、8,400 亿美元算力账单下的供应链护城河

- 膨胀的账单:从 6,000 亿到 8,400 亿美元

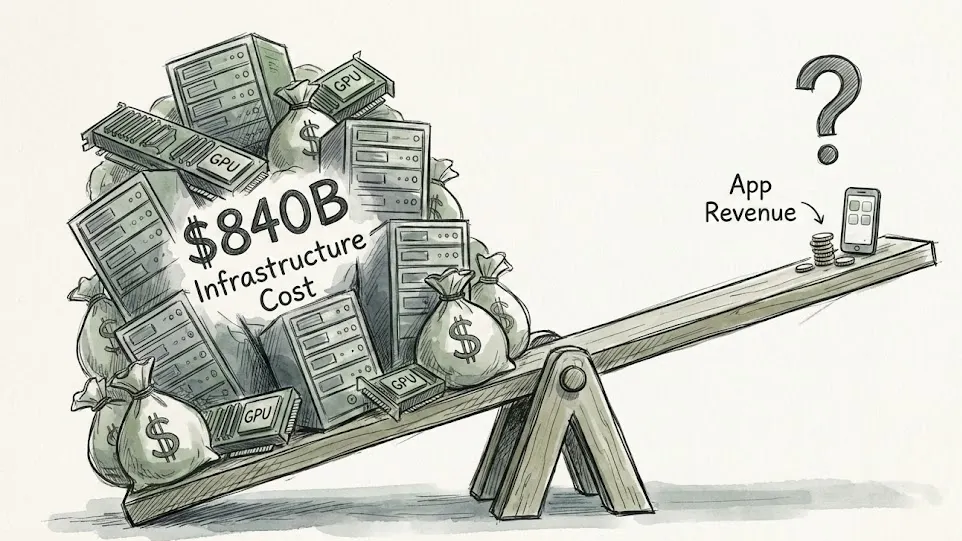

去年,David 抛出了“AI's $600B Question“ 的问题并引发了巨大讨论。

逻辑很简单:如果全行业买 Nvidia 芯片花了 1,500 亿美元,算上数据中心配套,总投入就是 3,000 亿美元。为了回本并赚到钱(比如 50% 毛利),行业得创造 6,000 亿美元的终端收入。

一年过去,到了 2025 年夏天,这笔账已经涨到了 8,400 亿美元。好消息是,增长虽然快,但没到失控的程度。坏消息是,核心隐患还在:客户的客户,到底健不健康?

这是悬在行业头顶最大的问号。钱是花出去了,但因为建设有滞后,算力还没真正到位,收入端也就迟迟没法验证。

2. Construction Itself Is the Moat

The complexity of the construction process has become a new variable.

In the AI era, the ability to build is itself becoming a moat. In the past, people thought that as long as you had money, a data center could be built in two years. But in reality, when all major global companies are competing at the same time for the same resources to do the same thing, the difficulty rises geometrically.

This is not something Meta or Google can simply solve by throwing money at it. To truly understand the situation, investors cannot rely solely on financial reports — they need deep supply chain tracking capabilities.

You have to dig down into the capillaries of the operation — find out who they’re calling, which vendor contractors are buying generators from, and where the copper wires for the transformers are sourced. Only by tracing this long and fragile supply chain to its end can you see the full truth at the core of AI.

---

3. The Commodity Trap and Disappearing Monopoly Profits

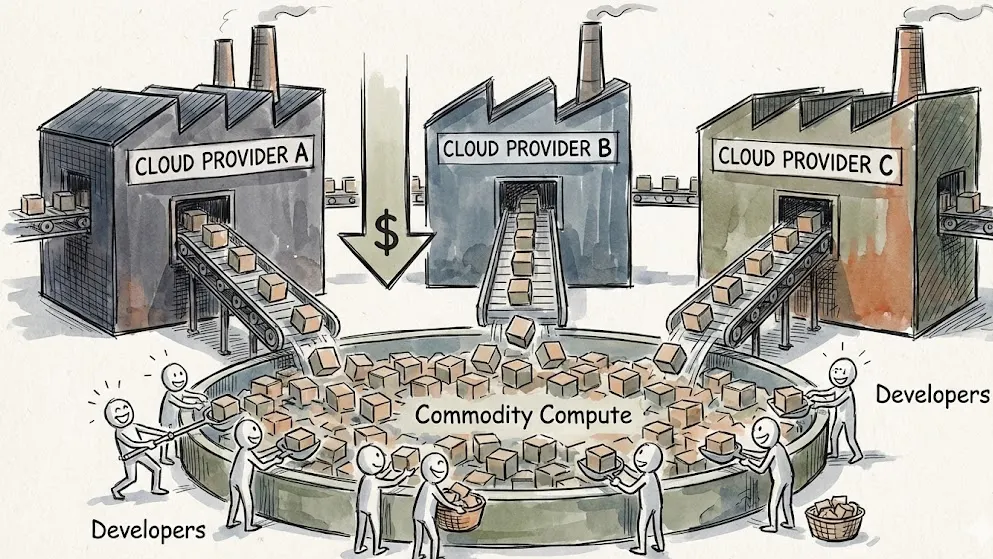

1. Compute Power Becomes a “Commodity”: The Producer’s Dilemma

Analyzing winners and losers in the AI wave is more akin to studying the dynamics between commodities and monopolies.

Consumers benefit from an oversupply of compute power, but producers may face hard times. The reason is simple — producing compute power is essentially turning into a commodity business.

Imagine you start an oil company with the best team and most efficient technology in the world. But if global oil producers are all expanding aggressively, flooding the market with crude oil, falling prices will inevitably destroy profit margins.

In commodity industries, a company’s fate is often beyond its control, rising and falling with market supply-demand fluctuations.

Currently, cloud service providers and compute power suppliers are exactly in this position.

For compute power consumers — e.g., companies buying electricity and chips to train AI models or create applications — this is great news. If overheated investment leads to compute overcapacity and price collapse, application companies’ costs will drop sharply, boosting gross margin naturally.

Therefore, long-term investment value lies in “non-commodity businesses” (those consuming resources and creating unique, defensible value), rather than “commodity businesses” that only provide infrastructure.

---

2. Real Monopolies Are Quietly Forming

There is a huge misconception: people tend to project today’s tech giants’ monopoly positions onto AI’s future.

We are in an unusual “gilded age” — the Magnificent 7 tech companies occupy 40% of the S&P 500 index market cap, printing cash at a staggering pace. This creates the illusion that all tech businesses ultimately become monopolies.

But history teaches us to be wary of such straight-line thinking. When Google was founded, few thought search could become a monopoly; when YouTube was sold for $1.65 billion, people thought it was overpriced, never imagining its current scale; similarly, when AWS launched the cloud era, few realized it was a trillion-dollar market.

Real monopolies often form quietly in plain sight, without attracting much attention. Only in a low-competition environment can early movers patiently build defensible moats.

---

4. Lessons for Entrepreneurs: Beware the Growth Illusion

In a vast and uncertain environment, what should entrepreneurs in the eye of the storm do?

1. From T2D3 to the “0 to 100M Club”

First, the yardstick for growth speed has changed. In the golden era of SaaS, VCs loved to talk about “T2D3” (triple growth for two years, then double growth for three years).

In the AI era, this standard is too slow. It has been replaced by the “0 to 100 Million Club” — companies that go from zero directly to $100M in revenue.

Companies like Harvey, Glean, Clay, and Juicebox demonstrate that in an internet-connected world hungry for AI, if you create a product with extremely strong product-market fit, market explosion can be astonishingly fast.

In this era, $2M ARR could be reached in just ten days. This is not a bubble illusion, but a concentrated release of previously suppressed demand.

---

2. Don’t Be Fooled by Overnight Success — Scars Are the Real Moat

However, this doesn’t mean success comes instantly. Many companies that appear to rise overnight actually endured long, obscure exploration periods.

Juicebox’s team spent three years building a music app for campuses, experiencing countless failures and pivots before finding the right direction. Clay, after raising Series A from Sequoia, spent three to four years in uncertainty before settling on its current product shape.

These “scars” are an entrepreneur’s most valuable asset.

---

In fact, this blend of deep capability-building and patient iteration is also why platforms such as AiToEarn官网 are intriguing for today’s AI creators. AiToEarn is an open-source global AI content monetization platform that lets creators use AI to generate, publish, and monetize content across multiple major platforms simultaneously — from Douyin, Kwai, WeChat, Bilibili, and Rednote to Facebook, Instagram, LinkedIn, Threads, YouTube, Pinterest, and X. By connecting AI content generation tools, cross-platform publishing, analytics, and model ranking (AI模型排名), it helps creators not only grow fast but also build lasting moats in the competitive AI economy.

Founders Who Have Experienced Pain Understand How Hard PMF Is

Founders who have endured setbacks and understand the difficulty of achieving Product-Market Fit often possess far more resilience than those who have had smooth sailing, raising vast amounts of capital off a PPT alone. The greatest companies in history were rarely built in just twelve months.

---

3. Beware of False Prosperity — Any Number Multiplied by Zero Is Still Zero

Don’t believe in so-called “kingmakers.”

In the venture capital world, there’s a persistent myth: if Sequoia or another top-tier VC invests in a company, it’s destined to be a winner. But capital is just fuel — it can’t create the engine. Too much money too soon is often not a guarantee of success but a catalyst for failure.

If a company raises huge funds before establishing a solid revenue foundation, arrogance can creep in — the “we’ve already won” mindset. This mental trap masks deep product and organizational problems until a crisis erupts.

The most dangerous group may not be founders, but employees who join after the company hits a billion-dollar valuation. They often mistakenly believe the ship has reached a safe harbor.

This is where basic math applies: any number multiplied by zero equals zero.

No matter the rate of growth, momentum, or valuation, if aggressive expansion burns through cash, or excessive leverage causes collapse during market turbulence, the result is still zero.

Momentum can distort reality, making us believe bull markets last forever. As a founder steering the ship, one must remain sober-minded: expand boldly when tailwinds are strong, but always ensure you avoid the “return to zero” trap.

---

V. How Far Is AGI?

1. The Clash Between Radical and Calm

“How far away is AGI?” is perhaps the most divisive question in today’s tech market.

A curious phenomenon: in the cafeterias of top AI labs, listening to young researchers chatting, you might think AGI will arrive tomorrow morning. In these circles, “countdown” predictions have become a badge of status — the shorter the timeline you claim, the more visionary or informed you seem. This “it’s almost here” mood drifts through cafés in the Bay Area.

But compare this exuberance with the caution from the “godfather” figures who pioneered current AI paradigms, such as Richard Sutton, Andrej Karpathy, and Ilya Sutskever — all of whom have spent decades in the field. They tend to predict true AGI might still be 20 or even 30 years away.

Ilya Sutskever even remarked that “pretraining is dead,” hinting that our current trajectory may have hit a ceiling. To cross the chasm from large models to true agents, we might need an entirely new paradigm. This realism from the inventors themselves stands in stark contrast to newcomers’ blind optimism.

This mismatch in time perception is one of the market’s most underestimated risks. If the entire financial system prices and invests based on “AGI is imminent” and the reality is a 20-year wait, the resulting shock could be massive.

---

2. Value Will Flow to the Masses, Not Just Giants

This does not mean AI’s value is illusory. As Masayoshi Son noted, AI could impact 5% of global GDP — an astronomical figure.

However, McKinsey reports that only 1% of global GDP consists of “economic profit” above the cost of capital. This means that most value created by AI will not settle in the vaults of giants. Competition will drive it toward lower prices and better services for everyday consumers and workers.

This may be the most heartwarming takeaway here: despite discussions of hundreds of billions in capital battles, cutthroat compute competition, and bubble risks — in the end, technology’s progress should benefit everyone.

---

VI. Talent Building: An Underrated New “Moat”

1. Age 23: AI’s “Golden Generation”

One question worth pondering: pouring massive resources into engineering teams does not guarantee proportional output. Excess resources can dilute focus and reduce efficiency.

In today’s market, maintaining hunger and high efficiency matters far more than the size of your budget.

Many companies severely underestimate the value of 23- and 24-year-olds — especially in AI. David interviews 200 to 300 fresh graduates every year, not only to hire but to learn from them.

These young talents have perspectives the previous generation never had: they started using ChatGPT at age 18, while seasoned professionals had no such experience. This is a crucial blind spot.

ChatGPT has existed for only five years, meaning no one on earth has more than five years of hands-on AI experience. Whether you’re a rookie or an industry veteran, in the realm of generative AI we are all essentially at the same starting line.

In a fast-changing market that demands rapid learning, the adaptability and native perspectives of young people are uniquely valuable.

For those navigating this rapidly shifting AI landscape, platforms like AiToEarn官网 are emerging as tools to bridge generational perspectives. AiToEarn, an open-source global AI content monetization platform, helps creators harness AI to generate, publish, and earn across multiple major platforms from Douyin and Kwai to YouTube and X (Twitter). By connecting AI content generation, cross-platform publishing, analytics, and model ranking, it offers a practical pathway for individuals and teams to turn AI-driven creativity into sustainable economic value — benefiting newcomers and veterans alike.

十年前做软件,高级工程师靠着架构和代码的积累,确实能碾压初级工程师,那时的剧本是“雇专家省培训”。但在 AI 创业的新剧本里,真正的“前线力量”是那些 23、24、25 岁的 AI 通才。他们是真正的 AI-Native,对技术充满了最纯粹的热情。

- 可见风险 vs. 隐藏风险

招聘本质上就是在做权衡。大家都想要“免费午餐”,但现实决策里,没有任何交易是完美的。Sequoia 内部常聊到一个核心概念:隐藏风险(Hidden Risk)和可见风险(Visible Risk)的较量。

招一个 23 岁的年轻人,风险显而易见:心智可能还不够成熟,也没啥工作经验。这些是摆在桌面上的“可见风险”。

相比之下,招一位履历完美的资深人士,看起来似乎没毛病,安全感拉满。但这往往掩盖了更致命的“隐藏风险”:他们可能已经没那么拼命了,可能根本不是真正的 AI-Native,甚至他们高昂的薪水本身,就是一种容易被忽视的风险。

- 哪怕随大流更安全,也要拥抱“可见风险”

人类的本能是随大流,喜欢抱团,这其实是对“隐藏风险”的偏好——好像只要风险埋在地下、大家都没看见,心里就是安全的。但对于想突破的投资人和创业者,更明智的做法是去承担那些“我知道我在承担”的可见风险。

在招聘时,不招 23 岁年轻人的理由通常超级明显。但如果支持他们的理由够硬,能盖过经验的不足,那这种可见风险就值得冒。这种风险观点的转变,正是适应 AI 快速变革时代的关键思维。

七、职业选择:失效的“模仿算法”与心态重构

- 以前好用的“模仿算法”,现在失灵了

对刚毕业的年轻人来说,选职业永远是个难题。大家做决定时有个通病,可以称为“模仿算法” 。

逻辑特别简单:看看上一届最聪明的人去哪了,我也去哪。而上一届的人,又是跟着上上一届学的。

过去很长一段时间,这招挺好使。比如 2010 年代初,Google 这些大厂增长了 10 倍甚至 25 倍,跟着大家去绝对没错;后来 Palantir 火了,跟风去也是对的。

但现在,一旦出现剧烈的新变量,这套老算法就崩了。AI 就是那个巨大的新变量。世界运行规则变了,预测模型也得更新。

这就导致“模仿算法”失效了:你的学长学姐在做决定时,还没见过现在的 AI,也不懂生成式 AI 的潜力。如果现在还盲目照搬老路——比如去传统的投行或咨询——而不考虑 AI 这个变量,职业生涯很可能会跑偏。

- “索取”还是“贡献”?

在职业选择的底层逻辑上,可以把人分为两类:

-

绝大多数人(超过 90%)其实是“索取者”,找工作时想的是:“我能得到什么?”——不管是学技能、攒人脉还是当跳板。

-

只有极少数人(不到 10% 甚至 1%)是“贡献者”,他们会问:“我能贡献什么?”。

正是这群人推动了硅谷发展。资本主义有个好处:贡献越大,回报通常也越大。那些在伟大创业公司之间流转、持续创造价值的人,就是典型的“贡献者”。

但是不管选哪种心态,关键是一定要把 AI 这个变量算进去。

十年前加入创业公司,初级工程师得熬个 5 到 10 年才能真正派上用场;但现在,AI 抹平了经验差距,年轻人和所有人在同一起跑线,能更快地产生影响力。