Using AI to “Unlock” the Financial Market Black Box: How Microsoft Research Asia Built an Order-Level Simulation Engine

AI for Finance: Building Deterministic Market Simulation with Foundation Models & Agents

In the era of large AI models and intelligent Agents, the financial industry is undergoing a profound transformation — from investment decision-making to market simulation. At the AICon Global Artificial Intelligence Development and Application Conference, Liu Weiqing, Principal Researcher at Microsoft Research Asia’s Machine Learning Group, presented:

> MarS: A Financial Market Simulation Engine Driven by Generative Foundation Models

Their work focuses on leveraging order-level native financial data and an automated iterative Agent workflow to achieve high-fidelity market simulations and efficient decision optimization.

---

Why MSRA Invests in AI for Finance

Nine years ago — around the time of AlphaGo’s debut — MSRA launched the AI for Industry initiative to apply AI across high-impact domains. Finance became a focal area for several reasons:

- Gap Between Theory and Practice: Algorithms in academic papers often fail to reflect real-world constraints.

- Need for Tools & Frameworks: A tool-driven approach ensures research outcomes match operational performance.

- Absence of Suitable Open-Source Solutions: Motivated the creation of Qlib, evolving from supervised learning to reinforcement learning, meta learning, and now Agent-based automated workflows.

---

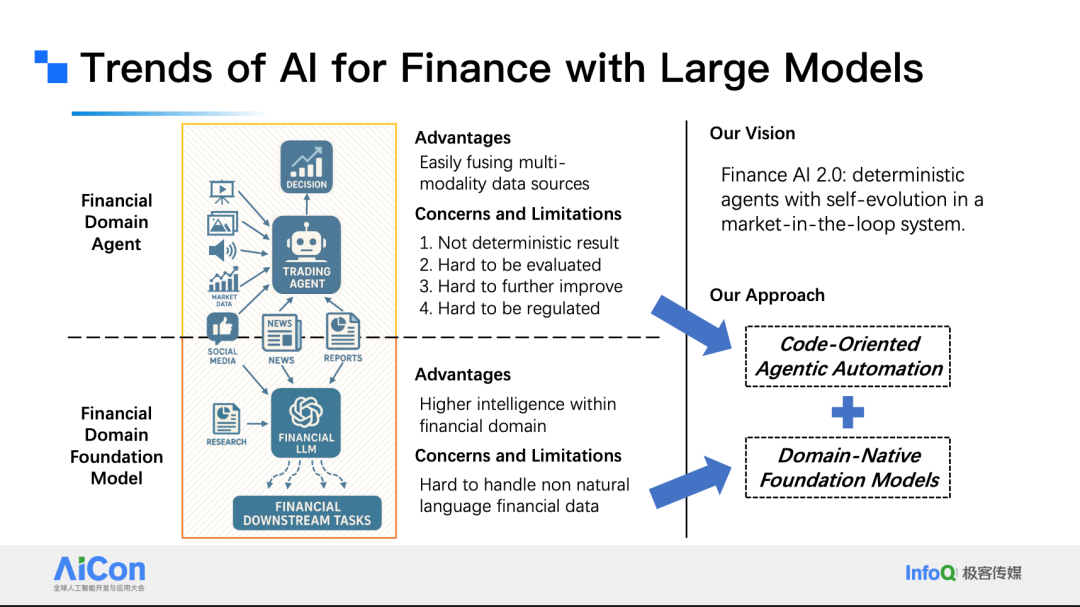

Large Models, Domain Data & Decision Certainty

Challenges in Financial AI

- Financial data is structured, domain-specific, and often non-linguistic, making it ill-suited to pure NLP fine-tuning.

- LLM-based decision Agents tend to be non-deterministic — unacceptable in finance, where identical inputs must yield identical outputs.

MSRA’s Goal: Build relatively deterministic Agents capable of self-iteration while integrating finance-specific evaluation metrics.

---

Approach Overview

Two Key Efforts:

- Foundation Model — Trained using domain-native data.

- Iterative Agent Workflow — Code-driven automation for stronger determinism.

---

Modeling Native Financial Data

Order-Level Market Data

- Captures microstructure beyond price-level trends.

- Exhibits scaling law effects similar to LLMs.

Outcome

- Realistic, controllable order-generation model.

- A digital twin financial market platform enabling dynamic, scenario-based evaluation.

---

Agent-Based Automated Iteration

Using Code as the core:

- Model-generated code is directly executable.

- Training scripts can be produced to build deep models, integrated back into the workflow.

- Iterations proceed until optimal reproducible results are achieved.

---

Quant Research Automation: Qlib + R&D-Agent

Components

- Qlib — Open-source quantitative research platform.

- R&D-Agent — Automates iterative workflows.

Two Agent Roles

- Research Agent — Generates high-quality strategies and ideas.

- Development Agent — Implements and optimizes engineering execution.

Feedback Loops:

- Engineering feedback — Bugs, training time, resource usage.

- Performance feedback — Strategy effectiveness, model metrics.

---

Results in Quantitative Research

- Fully automated 52 iterations in ~18 hours.

- Surpassed expert-designed baselines in four evaluation metrics.

---

Large Market Model (LMM)

Traditional Approach Limitations

- Relies on abstract features/factors, missing hidden market information.

- Treats market as a black box.

LMM Approach

- Models each market order at finest granularity.

- Converts order data into video-like sequences for CV-based modeling.

---

Model Training & Scaling Laws

- Tokenization of individual orders.

- Orders aggregated into minute-level groups.

- Transformer architecture shows clear scaling law effects.

---

Applications Beyond Next-Token Prediction

- Predictive simulations at order level.

- Monte Carlo-style rollouts for future indicator forecasting.

- Superior minute-level predictions compared to supervised baselines.

---

Deployment Challenges & Efficiency Optimization

Main Bottleneck:

- Order-by-order auto-regression slows generation.

Solution:

- Optimized modeling reduced rollout time from 15 minutes to ~1 minute, paving the way for real-world use.

---

Digital Twin Market Simulation

Advantages Over Traditional Models

- Simulates order-level behavior, not just prices.

- Enables study of rare/high-risk events (e.g., “Golden Finger” incident).

---

Interactive & Controllable Interfaces

- Order Interaction Interface: Submit orders & observe impact.

- Scenario Control Interface: Generate market conditions (bull/bear) on demand.

Platform: MarS System — merges LMM with interfaces, allowing Agent-based multi-round optimization.

---

Order Generation Model Types

- Order-Group (Minute-Level) Generation

- Order-Level Generation

Combined, these achieve:

- Scenario fitting

- Real-time user interaction response

---

Natural Language Control Signals

- User describes target scenario (e.g., downturn).

- System generates code to locate historical patterns and guide future order flow simulation.

---

Validating Generated Data

- Measured with 11 financial indicators → strong statistical alignment with real markets.

- Macro-level formula (√q / v) emerges from micro-simulation, even without direct training on it.

---

Broader Applications & Integration

While targeted at finance, this world-model + iterative Agent paradigm applies to:

- Healthcare

- Industrial optimization

- Creative industries

Example: AiToEarn官网 — integrates AI model generation, cross-platform publishing, analytics, and monetization.

---

References

- Qlib: https://github.com/microsoft/qlib

- R&D-Agent: https://github.com/microsoft/rd-Agent

- MarS: https://github.com/microsoft/mars

---

Would you like me to also create a clean visual diagram summarizing the Foundation Model + Agent Workflow architecture so readers grasp the workflow faster? That could significantly improve readability and retention.