Using VC Strategies for Angel Investing: Li Zhu’s Early-Stage Investment Code

Focusing on the Track: Doubling Down on Investment & Management

> “Among Inno Angel’s investments, three became unicorns in 2024. In 2025, Megvii Technology and YouAI Zhihhe filed prospectuses with the Hong Kong Exchange. We already have eight companies that completed share restructuring, with another 12 preparing to file. In 2026, we expect that number to double,” — Li Zhu, Founder of Inno Fund.

Over 12 years of steadfast angel investing, Li Zhu has transitioned from a “scatter-shot” approach to a high-conviction VC-style strategy — focusing deeply on tech sectors, investing decisively, and taking larger positions.

At DEMOCHINA, four of the top ten startups were Inno-backed, with Jinghua Secret Computing winning DEMOGOD of the Year.

---

Strategic Shift Since 2019

Key Changes

- Sector Focus: Narrowed exclusively to technology after a five-year review.

- Fund Structuring:

- Angel Fund: Deals < ¥15 M RMB

- Sci-Tech Fund: Deals > ¥30 M RMB

- Investment Size: First-round stakes now 10–20%, over 20% for incubations.

- Portfolio Management: Digitized oversight, active post-investment involvement.

> "We’re neither purely VC nor purely seed. Call us ‘large angel, small A-round’,” — Li Zhu.

---

Larger Bets, Higher Standards

- Equity Goal: 10–20% per round, 20%+ for incubated projects.

- Selective Targets: Companies capable of hitting ≥ ¥30B RMB valuations.

- High-Concentration Strategy: “Eggs in one basket” only if confident in the industry and leaders.

- Valuation Ceiling: Pre-investment threshold of ¥1 B RMB.

---

Inno’s 3 Core Investment Filters

- Macro Direction — Aligned with market & societal trends.

- Team — Proven credentials and execution capability.

- Scarcity — Unique tech/product advantages.

---

Exit & Follow-On Strategy

- Primary Market Focus: Selling to CVCs, financial institutions.

- Retention: Keep 2–3% equity post-IPO prep.

- Follow-On Funds: Buying old shares ready for exit.

---

Reasons for Big Checks

- Rising personnel and R&D costs for hard tech.

- Higher entry valuations (¥200–300M RMB pre).

- Access to top-tier deals requires ≥ ¥20–30M RMB.

- Intensive DD warrants significant stake.

---

Project Sourcing "Net"

- Tsinghua University connection:

- Scholarships, course sponsorships, alumni tracking.

- 30–40% portfolio from Tsinghua alumni.

- Other Elite Schools: PKU, SJTU, Fudan, HUST, Westlake, etc.

- VC Ties: LP base includes Sequoia China, IDG Capital. Quarterly or monthly exchanges.

- Partner Networks: Industry LPs like Beijing Electronics Holdings provide orders & referrals.

---

Digital Management System — Inno’s Secret Weapon

- Real-time fund & portfolio tracking.

- Financial/operational uploads every period.

- Instant LP access to DD data.

- Valuation trend analysis — exit on plateaus.

- Transparent profit-sharing: 70% to team, 30% to management.

---

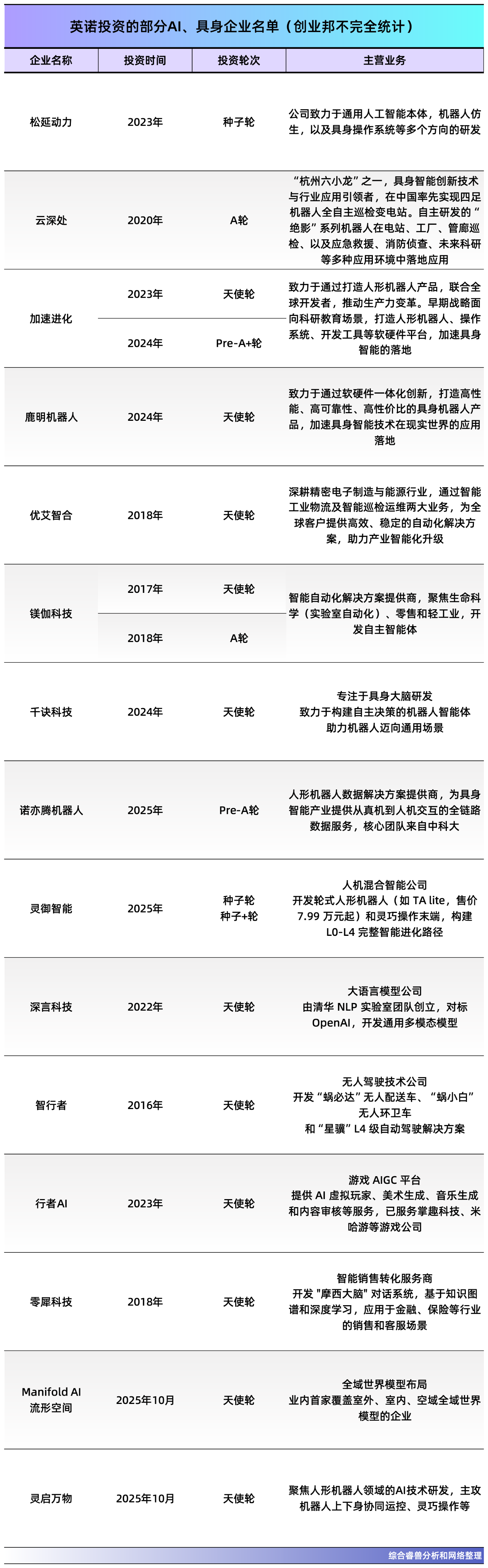

AI & Embodied Intelligence Focus

Key Approach:

- Embodied Intelligence First — Skip foundation models dominated by big tech.

- Invest in motion control, robot “brains,” data security, and training paradigms.

- Early bets on leading humanoid robot firms, e.g., Accelerated Evolution, Songyan Dynamics, Tiangong.

Robotics & AI Strategy:

- No Foundation LLMs — Avoid direct competition with tech giants.

- Specialized Tracks — e.g., data synthesis, encryption security.

- Training Paradigms — Simulation, imitation learning, world models.

> "Embodied intelligence space suits startups — big companies see slower scaling here, so it’s friendlier to entrepreneurs."

---

Market Potential

- Goldman Sachs: ¥1 T market in 5 years; ¥10 T in ~20 years.

- Supports 100+ companies valued > ¥100 B.

---

Fund Management Rules

- Sci-Tech Innovation Fund: ~¥1.5 B max per phase, 3-year deployment.

- Angel Fund: Max ¥500 M per phase, 2–3 year deployment.

- Avoid oversizing to protect returns.

---

Brand Structure

- Inno Angel Fund — foundational, ≤ ¥500 M per phase.

- Inno Sci-Tech Fund — flagship, ¥1–1.5 B per phase.

---

Angel Investment “Three Ones” Rule

- Valuation ≤ ¥100 M

- First financing round

- ≤ ¥10 M investment

---

Decision & Execution Discipline

- Collective partner decision-making.

- Monthly Exit Week review.

- All approving partners meet founders.

- Weekly project approval meetings.

---

Post-Investment Priorities

- Talent recruitment.

- Follow-on financing support.

- Industry scenario creation for deployment.

---

Track Record

> Profit Ratio: 2/3+ of projects profitable — VC-level performance.

> DPI Targets:

> - ≤ ¥500 M fund: DPI ≥ 1 in 6 years

> - ¥1–1.5 B fund: DPI ≥ 1 in 7 years

---

Long-Term Lessons from Li Zhu

- Use own capital early for trial & error.

- Build and share within a strong team.

- Stay curious; value discovery requires constant learning.

---

Ecosystem Synergy with AI Content Monetization

Tools like AiToEarn官网 parallel Inno’s connected investment ecosystem by enabling:

- AI content generation

- Multi-platform publishing (Douyin, Kwai, WeChat, Bilibili, Xiaohongshu, Facebook, Instagram, LinkedIn, Threads, YouTube, Pinterest, X)

- Analytics + AI model ranking (AI模型排名)

- Streamlined revenue monetization across channels

---

Would you like me to prepare a short, investor-friendly LP briefing based on this improved Markdown, to highlight Inno’s differentiators and track record in a half-page format? That would make this content faster to digest for potential partners.