Valuation Tops $200B as Cursor’s New Funding Goes Viral — Founder Reveals Growth and Hiring Secrets: Two-Day Onsite Trial, Hands-On with Cursor Codebase

🚀 The Global Highest Valuation for an AI Programming Company Just Got Refreshed

One of the hottest names in the AI programming world, Cursor (by Anysphere), has once again redefined industry expectations — its latest valuation has soared to $29.3 B USD (≈ ¥207.9 B RMB).

📈 Series D Funding Milestone

On November 13, Anysphere announced the completion of a $2.3 B USD Series D round (≈ ¥163 B RMB).

- Previous valuation (June 2025): $9.9 B USD

- Current valuation (Nov 2025): $29.3 B USD (~3× growth)

Key investors:

- New: NVIDIA, Google, Coatue

- Existing: Accel, Thrive, a16z, DST

- Series D lead: Accel & Coatue

CEO Michael Truell told CNBC:

> “Our focus right now is on growing the company and the team. We have a lot to accomplish before considering something like an IPO.”

---

1️⃣ Two and a Half Years Since Launch — Cursor’s Valuation Skyrockets

Cursor launched quietly in 2023 as a native AI IDE.

- Minimal marketing, huge viral growth

- Among the fastest-growing SaaS products globally

Emerging trend leveraged: Vibe Coding — developers converse with AI, which handles code generation, modification, and refactoring.

- Powered by dual-engine architecture: Cursor × Composer

- Composer is a code-specialized model (Cursor’s "brain")

- IDE architecture rewritten for context memory, multi-language support, and speed

Commercial impact (2 years in):

- 💰 Annual Recurring Revenue (ARR): >$500 M USD

- 👤 Daily Active Users: >1 M

- 📈 Paid subscribers: 360,000

- 🏢 Enterprise clients: 50,000

- 🌍 Adopted by over half of Fortune 500

Why the Growth Flywheel Works

- Freemium model lowers entry barrier

- Strong community ecosystem

- Solves key pain points: talent shortages, cost pressures, legacy system constraints, repetitive debugging

---

💸 Capital Momentum

Funding timeline:

- Jul 2024 — $60 M USD

- Dec 2024 (Series B) — $105 M USD

- May 2025 (Series C) — $900 M USD

- Nov 2025 (Series D) — $2.3 B USD

Valuation: $2.6 B → $29.3 B in < 12 months.

Notable industry story:

- OpenAI reportedly led Seed round

- Attempted acquisitions twice (offers exceeded $10 B)

- Anysphere refused exclusive model agreement

---

🌐 Industry Parallels — The AiToEarn Example

Platforms like AiToEarn官网 showcase another AI-driven growth model:

- Open-source global AI content monetization

- Multi-platform publishing: Douyin, Kwai, WeChat, YouTube, Instagram, X (Twitter), etc.

- Integrated AI generation, analytics, and model rankings (AI模型排名)

---

⚠️ Challenges Ahead

Risks:

- Heavy dependence on foundational models (OpenAI, Anthropic) & VS Code ecosystem

- Possible “single API change” disruption risk

- Pressure from rising open-source large models

Strategic response:

- Deep integration into enterprise R&D workflows

- Coverage from testing → DevOps → observability → data feedback loops

- Building a full-chain integration moat

---

2️⃣ a16z Podcast — Cursor’s Founding Story

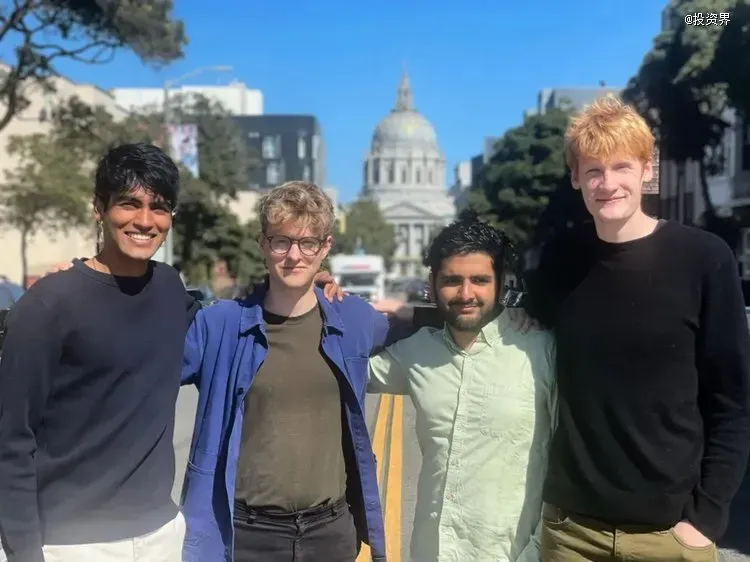

Image source: Anysphere — From left to right: Aman Sanger, Arvid Lunnemark, Sualeh Asif, Michael Truell

Highlights from the interview:

- Pivot from 3D robot CAD automation to AI programming

- Chose VS Code over building a new IDE to leverage developer habits

- Built the functional IDE in 2 weeks despite resource constraints

- Grew organically without marketing spend

- Managed infrastructure bottlenecks during hypergrowth

Industry view: Software engineering moving from “writing code” → “judging code correctness”, redefining engineers as decision-makers.

---

📌 Key Lessons from the Pivot

- CAD project failed due to data scarcity & skill mismatch

- Team’s deep coding background made programming a natural target

- Early decisions focused on workflow-level tooling, not just models

---

🛠️ Scaling Challenges

- API traffic at double-digit % of cloud provider’s revenue

- Diversified model suppliers, built in-house inference/training systems

- Rewrote infrastructure for stability under growth pressures

---

🔍 Product Strategy: Focus Before Expansion

Why VS Code & not CLI/IntelliJ:

- Intentional “own-the-surface” approach in early phase

- Plan to move into model layer later, only after workflow dominance

- Belief in switching barriers, but also in the power of compelling tools

---

☁️ Infrastructure Philosophy

Multi-cloud from day one:

- Using Databricks, Snowflake, AWS, GCP, Azure, PlanetScale

- Learned the hard way about database scaling (sharding required)

- PlanetScale migration solved critical bottlenecks

---

📦 Multi-Product Roadmap

Current wedge: Editor pane for daily coding work

Expansion logic:

- Editor changes → team collaboration transformation

- AI collaboration tools for review, communication, and management

- Goal: become complete AI coding service provider

---

💼 Hiring Practices — Two-Day Trial

Process:

- Conventional coding interview

- 2-day on-site trial on real Cursor codebase

- Technical signals: solving complete tasks, proactive behavior, product sense

- Cultural fit: mutual interest in working together

- Side benefit: candidates preview real work life

Unique aspect: Still used even at 200+ team size

---

🤝 Acquisition Strategy — Talent First

- Bold M&A moves for strategic hires

- Example: Supermaven acquisition (team led by TabNine founder Jacob)

- Use acquisitions to accelerate product roadmap & team density

---

🔮 The Automation Question

Will Cursor be automated out of existence?

- Truell’s view: Far from full automation of software development

- Current stage = “iPod moment” → next leap = “iPhone moment”

- Survival depends on continuous innovation

---

📢 Closing Thoughts

Cursor’s journey shows:

- 🔹 Strong scenario–product fit fuels growth

- 🔹 Infrastructure & strategic talent acquisition underpin scaling

- 🔹 Multi-product & multi-platform thinking is the next frontier

Parallel for creators:

Platforms like AiToEarn官网 enable similar leverage in content industries — integrating generation, publishing, analytics, and monetization across major channels, reflecting the same principle: own the workflow, build the moat, innovate continuously.