# **Brother Yong’s Live-Stream: From Entrepreneurial Dreams to Bankruptcy Chronicles**

In the live-stream **“Brother Yong Talks Restaurant Entrepreneurship”**, what was meant to be a guide for starting a business with co‑host insights has instead evolved into a series of laugh‑out‑loud **“bankruptcy chronicles.”**

This long‑form piece takes you inside the absurd world of these so‑called **“Entrepreneurial Immortals”** — exposing flow‑chasing scams, misplaced confidence, and the pitfalls behind the **“County Middle‑Class Bankruptcy Four‑Piece Set.”**

It shows that sometimes the **most expensive tuition** is paid to “teachers” you’ve never even met.

---

## **If You Think Life Is Hard…**

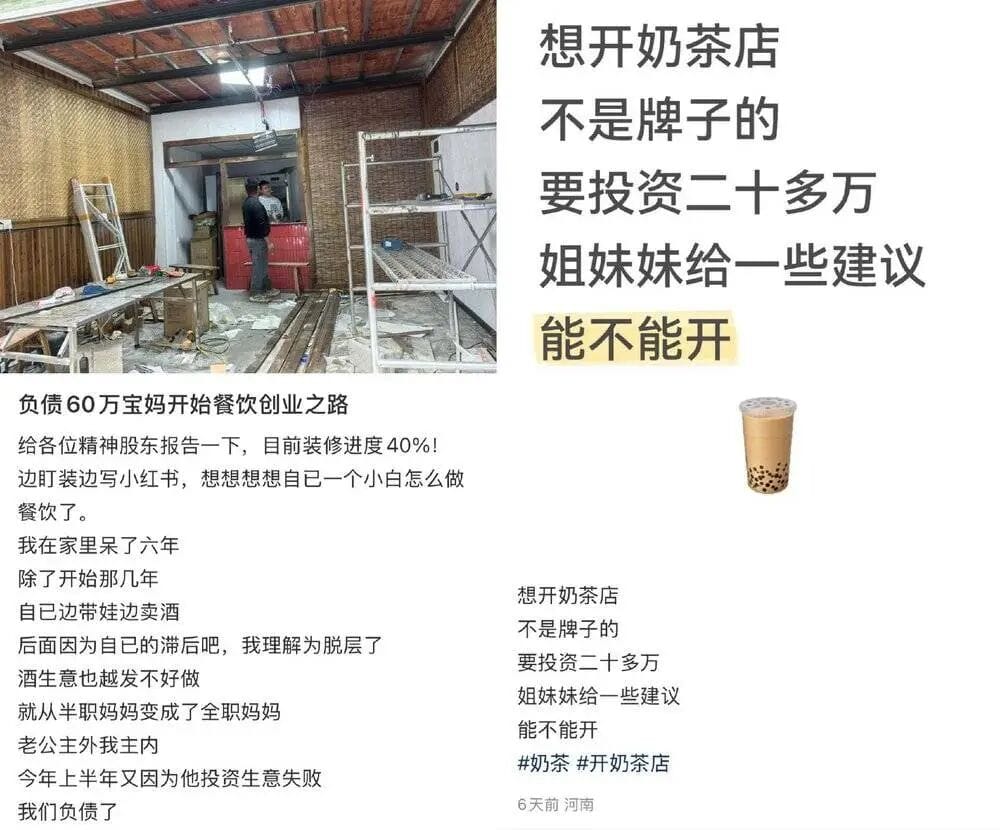

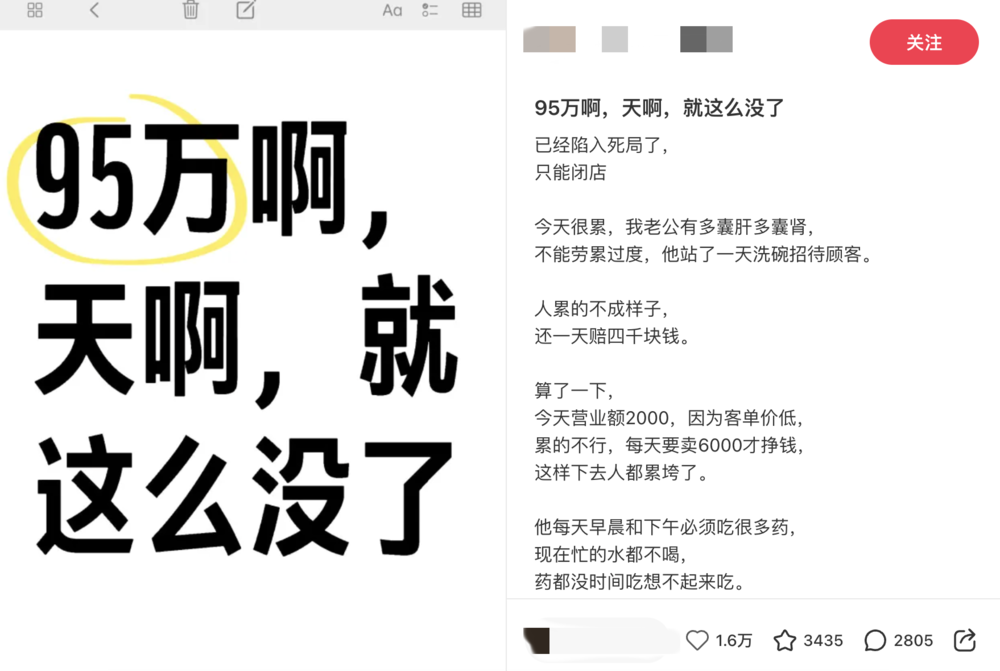

Consider those lone warriors out there starting businesses while already burdened with heavy debt.

Across the country, you’ll find “wise spirits” of entrepreneurship who would rather take on hundreds of thousands in liabilities than work for someone else — even if it means opening a **knockoff milk tea shop right next to a famous franchise**.

In their minds? Beat Mixue, topple Luckin.

After watching their video diaries, many realise how **happy and simple** earning a monthly salary really is.

For young people, these livestreamed “co‑host chats” have become **stress‑relief entertainment**. One episode after work can feel like a comedy show.

---

## **01 — The Comedy of Entrepreneurship**

### From Consulting to Comedy

**@Brother Yong Talks Restaurant Entrepreneurship** began as a paid consulting program for aspiring business owners.

It has morphed into a viral variety show where **Brother Yong debunks risky ventures** and stops people from diving blind into doomed projects.

### Why the Audience Loves It

- Milk tea and burger shops are scam hotspots nationwide.

- The pattern is uncanny:

1. **Join a franchise**

2. **Splurge on renovations**

3. **Grand opening fanfare**

4. **Call Brother Yong for help**

5. **Close up shop within a month**

6. **List equipment for sale second‑hand**

Losses are eye‑watering — but to viewers, it’s oddly captivating.

---

### Common Scam Schools in Brother Yong’s Room

#### **1. The Loan‑Leverage School**

> *“When no one supports my dream, I’ll take a loan to reach the heavens.”*

- Many blow through savings, plus loans, **starting already in debt**.

- Example: A divorced mother borrowed ¥70,000 to open a “Chinese medicine milk tea” shop, losing ¥160/day, with no market research.

Even worse — she combined two products no demographic wanted:

- Young people: avoid herbal brews

- Elderly: avoid milk tea

---

#### **2. Fast Recruitment Burger Trap**

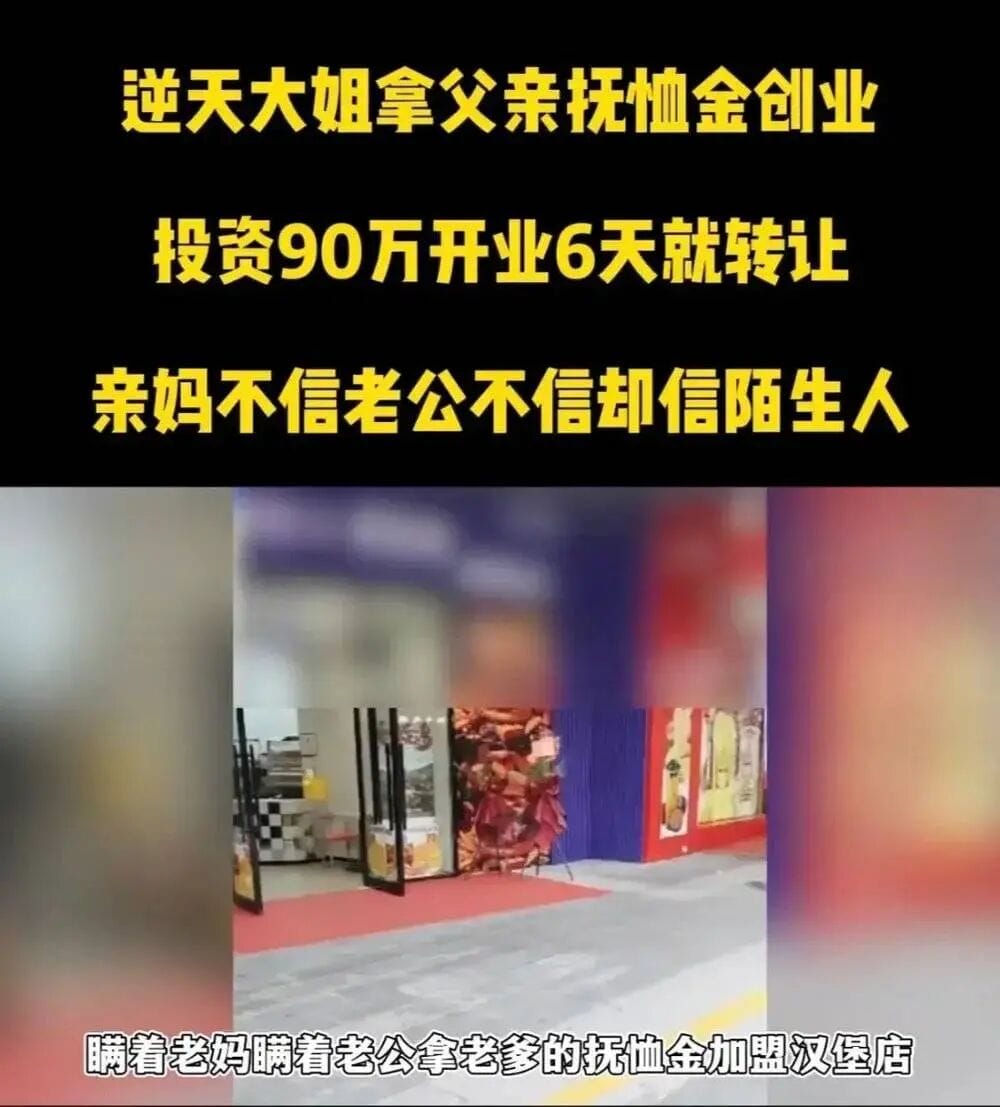

- A woman in Ningxia secretly spent ¥900,000 in six days.

- Bought **local agency rights** from a scheme promising future profit shares.

- HQ was **just an office showroom**, no real store existed.

- Even rent transfer scam added ¥30,000 in losses.

---

#### **3. Nine‑Story Demon Tower (Milk Tea Fortress)**

- Shanxi man built a **six‑floor milk tea stronghold** for ¥1 million.

- Daily revenue: ¥800

- Daily payroll: ¥900

- Original dream: franchise Mixue

- Actual outcome: tricked into a “subsidiary brand” with no market.

---

#### **4. Catch Up with the UK, Surpass the US**

- Belief that an unknown chain will beat **Luckin, Mixue, McDonald’s, and KFC**.

- Invests ¥450,000 in “Fourth‑Generation Burgers” — a made‑up concept pushed by recruiters.

---

## **Pilgrimage by Netizens**

Fans now visit these failed shop locations for fun, turning some into **tourist check‑in spots**.

Absurd cases include:

- A grilled sausage shop with billion‑yuan dreams.

- A ¥1.6 million unknown coffee brand collapse.

- Can‑packaged milk tea store in a dead mall.

---

## **02 — Wise Immortals**

### Brother Yong’s Diagnostic Formula:

> “Where’s your shop? How much did it cost? Did you visit HQ? Any real stores there? Nope? Foot traffic? None? Close it. Fire extra staff. Sue for refund. Goodbye.”

---

### The “Middle‑Aged Bankruptcy Quartet”

1. Burgers

2. Milk tea

3. Coffee

4. Baked goods

These sectors are **dominated by household names**, leaving no space for off‑brands.

Recruitment traps follow fixed patterns: intercept prospective franchisees, push “sub‑brands,” and trick with fake site inspections.

---

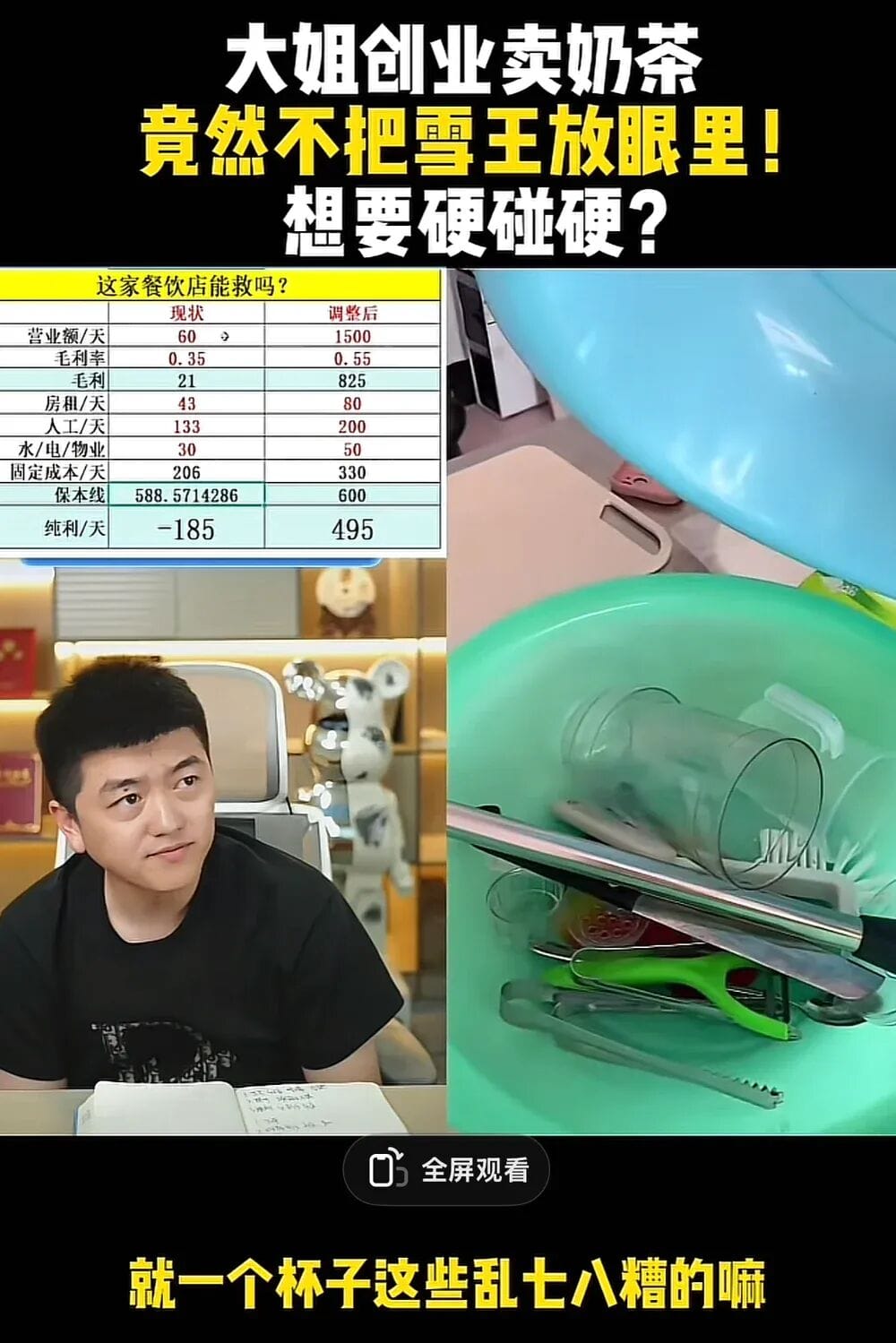

### Case Highlight: Foot‑Basin Juice Shop

- County town in Jiangxi

- Shop next to **Mixue Bingcheng**

- Daily turnover: ¥50

- Equipment stored in plastic foot basins — yet she believed she’d beat Mixue.

---

### Case Highlight: “Nezha x Drink” Milk Tea IP Trap

- ¥400,000 invested

- HQ only showed a showroom

- Location: deserted mall

- Concept based solely on outdated IP hype

---

## **03 — Economic Boom Legacy & The Fast‑Franchise Chain**

### How Fast‑Franchise Companies Operate:

- Intercept real brand traffic via search ads

- Claim saturation & sell fictitious sub‑brands

- Guarantee profits & manipulate urgency to close deals

- Stack charges: Franchise fee → Agency fee → Renovation → Inflated rent transfers

---

### Why Small‑Brand Franchises Fail:

- Market monopoly by giants

- Algorithms pushing unrealistic “be your own boss” dreams

- Overstaffing for vanity

- Refusal to pivot to working concepts (like breakfast at school gates)

---

**Key Insight:** Ordinary people cannot manage wealth beyond their own cognitive capacity.

---

## **Tools for Smarter Ventures**

For those considering entrepreneurship or documenting these cultural phenomena:

Platforms like **[AiToEarn官网](https://aitoearn.ai/)** provide **AI‑powered, multi‑platform publishing & analytics** — turning content (even cautionary tales) into sustainable streams without falling into physical business traps.

---

## **Conclusion**

Social media’s constant **FOMO** fuels risky ventures.

Every day, another shop hangs a **“For Transfer”** sign.

The wiser choice — online or offline — is to **research, verify, and diversify** before betting everything.

---

**———— / E N D / ————**