What Is CFBR Meaning and Uses in Business and Finance

Learn the different meanings of CFBR in business and finance, from cash flow break-even ratio to customer feedback review and social media usage.

Understanding CFBR: Meaning and Uses in Business and Finance

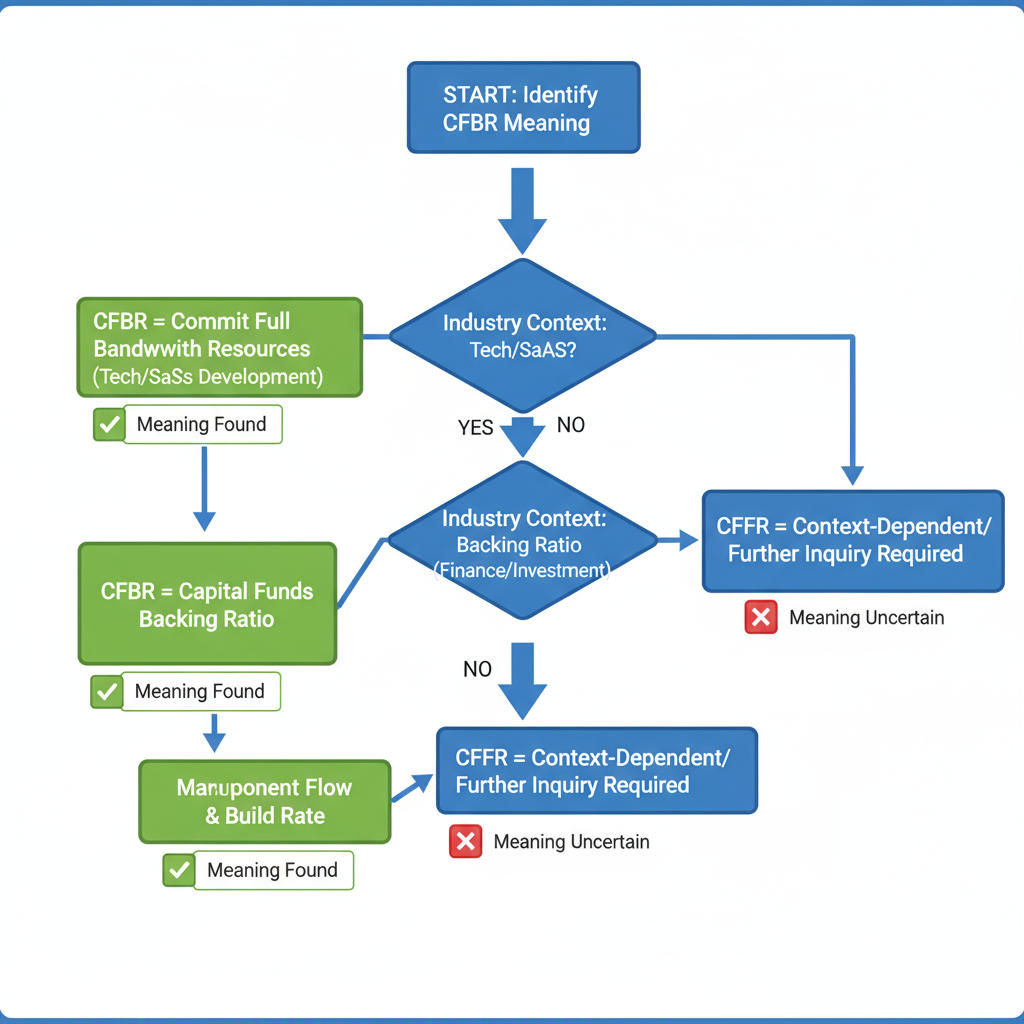

In today’s competitive and jargon-rich environment, acronyms like CFBR often appear in financial reports, marketing decks, or social media strategies. If you have ever paused to ask "What is CFBR in business contexts?", you’re in good company. This guide dives into the multiple meanings of CFBR, their origins, and how to use each interpretation to enhance decision-making in business and finance.

---

Multiple Interpretations of CFBR

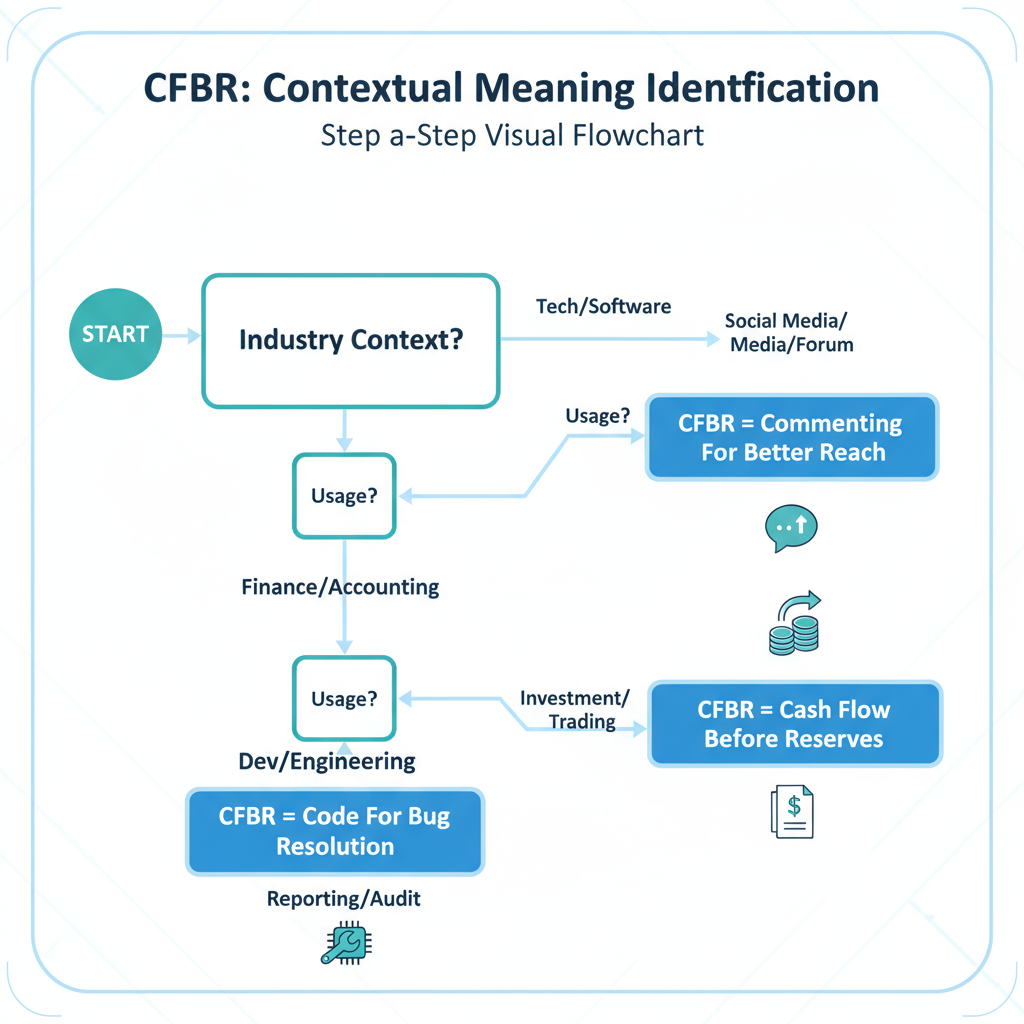

CFBR holds different meanings depending on the industry or scenario. The most common interpretations include:

- Customer Feedback and Business Review – Used in customer success, marketing, and operations for performance evaluation.

- Cash Flow Break-even Ratio – In corporate finance, a metric marking the point where cash inflows equal cash outflows.

- Close Friends Best Responders – Social media slang for highly engaged followers.

Correctly identifying the intended definition depends on context and surrounding cues.

---

Industry Context: Pinpointing the Right Meaning

The industry or team using CFBR often reveals its meaning:

- Finance / Business Analysis: Most likely Cash Flow Break-even Ratio.

- Customer Experience Teams: Typically Customer Feedback and Business Review.

- Social Media & Online Communities: Often Close Friends Best Responders.

Clues include accompanying metrics, platform references, and the sender’s role.

---

Origin and Usage Across Sectors

- Cash Flow Break-even Ratio: Originated in corporate finance for liquidity threshold analysis.

- Customer Feedback and Business Review: Emerged with CRM adoption and systematic performance reviews.

- Close Friends Best Responders: Developed organically among social media users to describe loyal, interactive followers.

---

CFBR in Finance: Definition and Calculation

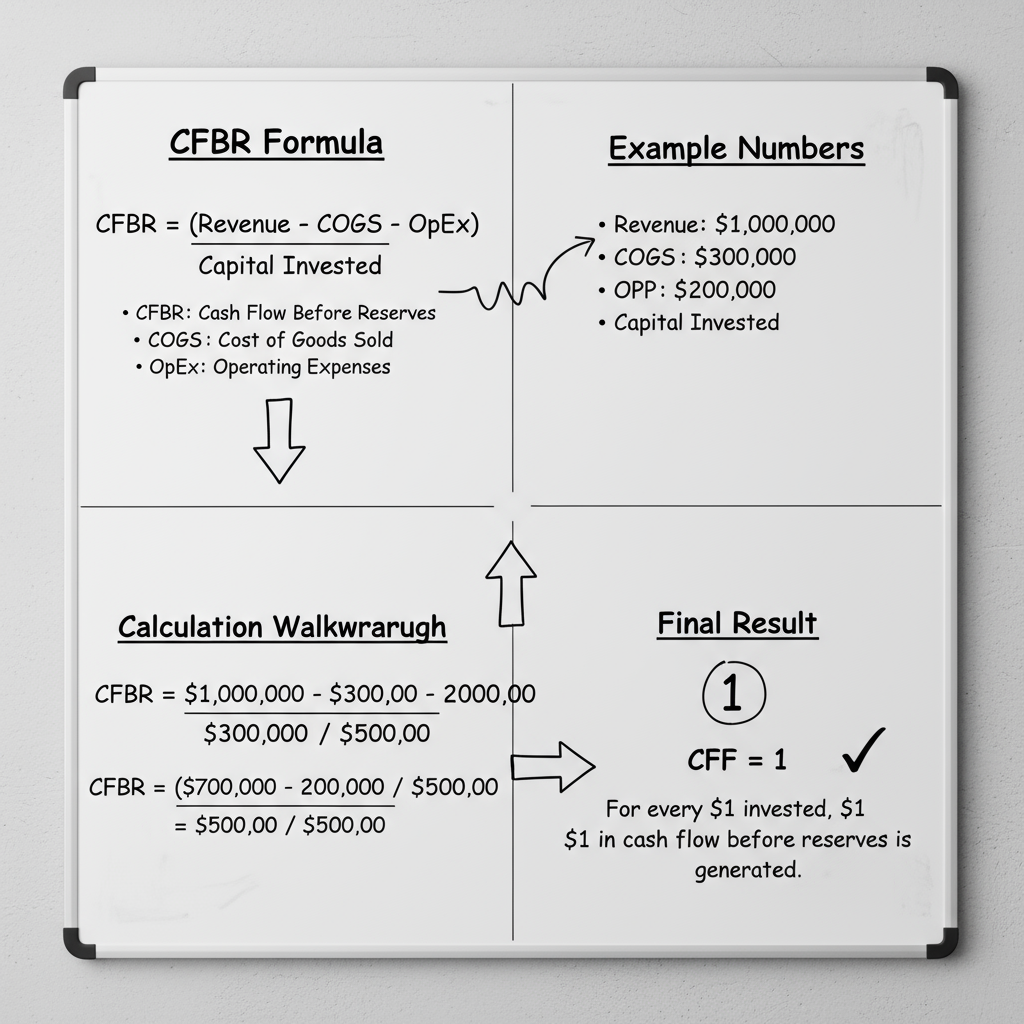

In finance, CFBR stands for Cash Flow Break-even Ratio, which measures when operating cash inflows match operating cash outflows.

Formula

CFBR = Fixed Cash Costs / (Cash Inflows per Unit - Variable Cash Costs per Unit)Where:

- Fixed Cash Costs – e.g., rent, permanent staff salaries.

- Variable Cash Costs per Unit – Costs linked to each unit produced.

- Cash Inflows per Unit – Revenue per sold unit.

---

Example Calculation

If:

- Fixed Cash Costs = $50,000

- Variable Cash Costs per unit = $20

- Cash Inflows per unit = $50

Then:

CFBR Units = 50,000 / (50 - 20) = 50,000 / 30 = 1,667 unitsResult: The company must sell 1,667 units to achieve cash flow break-even.

---

Why It Matters in Finance

Grasping CFBR enables finance teams to:

- Pinpoint sales targets for positive cash flow.

- Adjust pricing and reduce costs effectively.

- Safeguard liquidity in fluctuating markets.

---

CFBR in Social Media and Digital Communities

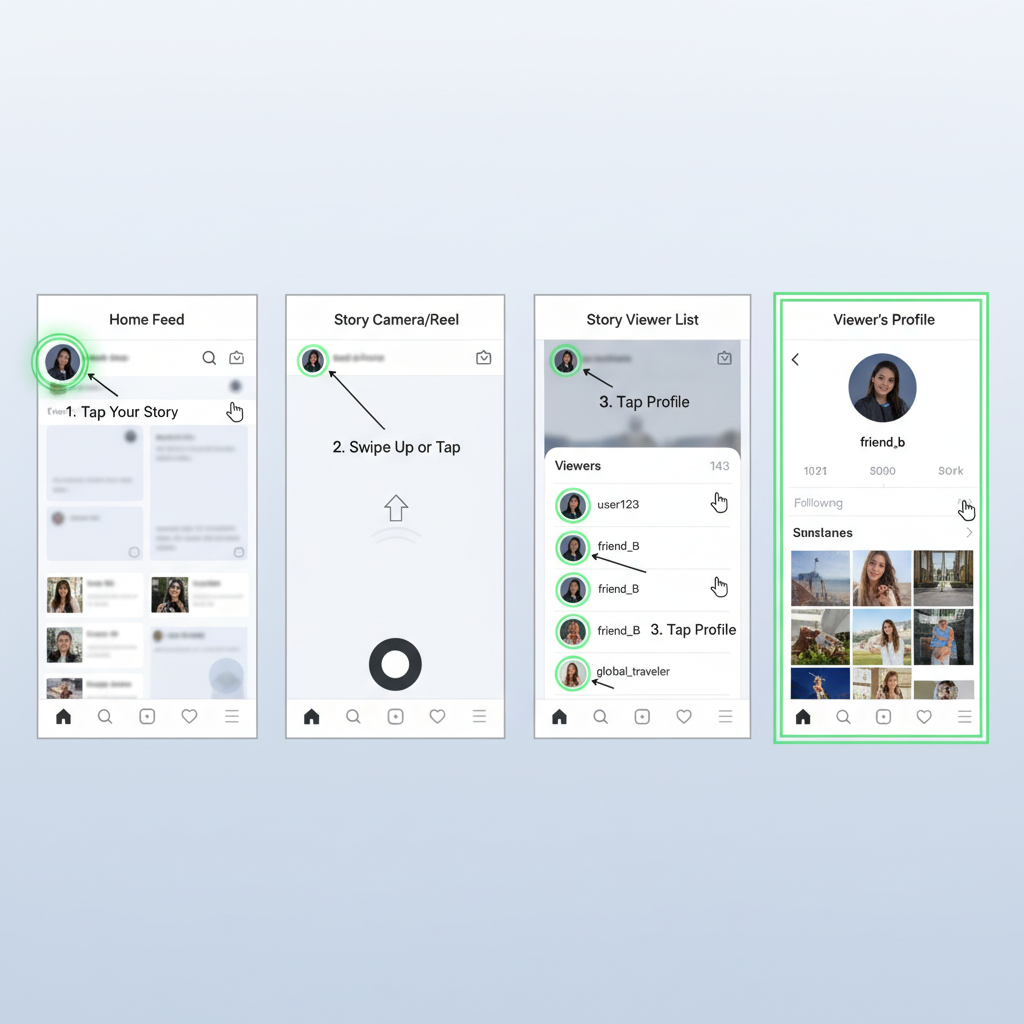

In social contexts, CFBR means Close Friends Best Responders — followers who frequently like, share, and comment on your content.

Benefits include:

- Identifying loyal advocates or potential micro-influencers.

- Streamlining high-value engagement strategies.

- Fostering strong community bonds.

---

Customer Feedback and Business Review Interpretation

As Customer Feedback and Business Review, CFBR is part of operational excellence and retention strategies.

Typical steps:

- Review KPIs and operational metrics.

- Analyze survey results and qualitative feedback.

- Plan improvement initiatives for the next review cycle.

---

Importance of Understanding CFBR in Business Decision-Making

Correctly interpreting CFBR helps:

- Reduce costly miscommunication.

- Align KPIs with strategic objectives.

- Apply the right metric for actionable insights.

In finance, misreading CFBR risks liquidity mismanagement. In marketing, it can derail customer engagement plans.

---

Practical CFBR Applications

Finance:

A startup sets sales targets using CFBR (Cash Flow Break-even Ratio) to ensure it covers operating expenses each month.

Customer Relations:

A SaaS provider holds quarterly CFBR meetings (Customer Feedback and Business Review) to identify product improvements.

Social Media:

A lifestyle brand rewards its CFBR group (Close Friends Best Responders) with exclusive previews to maintain loyalty.

---

Step-by-Step Guide to Improving CFBR Metrics

For Cash Flow Break-even Ratio:

- Collect accurate fixed and variable cost data.

- Apply the formula to find current break-even.

- Reduce overhead or unit costs where possible.

- Increase per-unit revenue through pricing or upselling.

- Reassess monthly to track improvement.

For Customer Feedback and Business Review:

- Aggregate customer feedback from all channels.

- Detect recurring issues or suggestions.

- Implement targeted solutions.

- Measure results before the next review.

---

Common Mistakes or Misconceptions About CFBR

- Assuming a universal definition without checking context.

- Confusing with accounting profit break-even, which focuses on net income instead of liquidity.

- Overlooking qualitative input in customer feedback reviews.

---

Tools and Resources for Tracking or Learning CFBR

| CFBR Meaning | Tools | Purpose |

|---|---|---|

| Cash Flow Break-even Ratio | Excel, QuickBooks, FreshBooks | Financial modeling and liquidity monitoring |

| Customer Feedback and Business Review | SurveyMonkey, HubSpot, Zendesk | Collecting and analyzing customer data |

| Close Friends Best Responders | Instagram Insights, Hootsuite | Measuring engagement and audience trends |

---

Summary: Key Takeaways

- CFBR meanings vary: confirm the usage context.

- Finance: Critical liquidity metric (Cash Flow Break-even Ratio).

- Operations & CX: Process for feedback and review (Customer Feedback and Business Review).

- Social Media: Engagement group (Close Friends Best Responders).

- Correct usage of CFBR strengthens planning, communication, and performance.

---

Mastering the nuances of what is CFBR equips you to interpret communications accurately and act decisively. Whether you are refining a financial model, conducting a customer review, or building social engagement, applying the right CFBR framework can deliver measurable results. Start integrating CFBR insights into your strategy today to enhance clarity and impact.