Where Are AI-Native Startups Spending Their Money on AI Products?

The Shift from Consumer → Professional Users → Enterprise

AI is reshaping skills, tasks, and team structures — and the impact differs sharply between large corporations and startups.

- Large enterprises: Incremental efficiency gains within existing workflows.

- Startups: Birth of truly AI-native companies built on next-generation software.

---

What Defines This New Generation of Software?

Recently, a16z partnered with Mercury to analyze real financial spending data (June–August 2025) from Mercury’s 200,000+ startup customers.

The goal: Identify the Top 50 AI application-layer companies, ranked not by web visits, but by actual cash flow.

> Mercury is a fintech provider of startup-focused banking, credit cards, and financial tools.

Why this matters:

- Compute infra vendors reveal what startups are building.

- This list reveals how AI is actually deployed in products and workflows, and where early-stage companies are willing to pay.

- Patterns match survey data: AI budgets are rising, with higher ROI than traditional tools.

Categories represented:

- Vibe Coding platforms

- Creative tools

- Customer service solutions

This supports a core AI thesis: AI expands niche expertise into company-wide capabilities — today, everyone can be a creator.

---

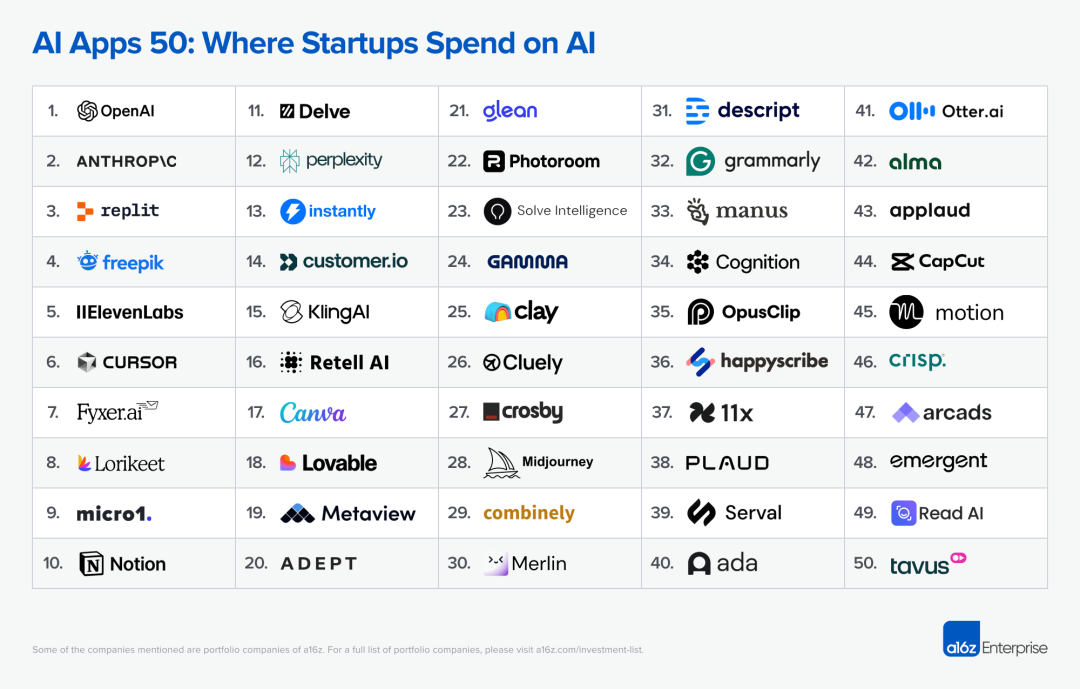

📊 The "Top 50 AI Applications" List

Exclusions:

- Cloud service resellers (Azure, etc.)

- GPU providers (Coreweave, etc.)

- Infrastructure tools

- (Google Cloud + Gemini spending combined due to inseparable data)

Data scope:

- Transactions via Mercury: ACH, wire transfers, and IO card spending.

- Excludes non-Mercury card use and personal accounts.

---

Key Observations

1️⃣ Horizontal Applications Dominate (60%)

Horizontal = usable by anyone, across roles. Vertical = specific professional niches.

Top horizontal category:

- General-purpose LLM assistants:

- OpenAI (#1)

- Anthropic (#2)

- Perplexity (#12)

- Merlin AI (#30)

Document-centric LLM platforms:

- Notion (#10)

- Manus (#33)

Why market is unsettled:

- No clear single leader yet.

- Likely multi-interface / multi-model usage depending on task.

---

Other horizontal strongholds:

Meeting support tools (transcription + productivity):

- Fyxer (#7)

- Happyscribe (#36)

- Plaude (#38)

- Otter AI (#41)

- Read AI (#49)

- Cluely (#26, real-time feedback)

Creative tools: Now cross-functional — marketing, design, product teams all use them.

Vibe Coding: AI app creation for engineers & non-engineers, now reaching enterprise scale.

---

💡 Platform Highlight:

AiToEarn — an open-source global AI content monetization platform enabling:

- AI content creation

- Cross-platform publishing (Douyin, Kwai, WeChat, Bilibili, Xiaohongshu, FB, IG, LinkedIn, Threads, YouTube, Pinterest, X/Twitter)

- Analytics

- AI model rankings (View rankings)

Docs: AiToEarn Documentation

---

2️⃣ Creative Tools: Largest Single Category (10/50)

Leaders:

- Freepik (#4, all-in-one suite)

- ElevenLabs (#5, text-to-speech)

Image tools: Canva, Photoroom, Midjourney

Video tools: Descript, Opus Clip, Capcut

Emerging avatar tools: Arcads (#47), Tavus (#50)

---

3️⃣ Vertical Applications: Augment vs Replace Humans

Two pathways:

- Augment – AI removes repetition, humans focus on value-add

- Replace – AI acts as full-time “employee”

Current status:

- 12 augment-focused

- 5 “AI employee” models:

- Crosby Legal (#27)

- Cognition (#34)

- 11x (#37)

- Serval (#39)

- Alma (#42)

Vertical categories:

- Customer Service: Lorikeet (#8), Customer.io (#14), Ada (#40), Crisp (#46)

- Sales / GTM: Instantly (#13), Clay (#25), 11x (#37)

- Recruitment / HR: Micro1 (#9), Metaview (#19), Applaud (#43)

- Ops / Compliance: Delve (#11), Combinely (#29)

---

4️⃣ Vibe Coding Moves Into Enterprise

Companies: Replit, Cursor, Lovable, Emergent

Revenue contrast:

- Replit (#3): Enterprise-grade autonomous agents + full dev stack (DB, auth, secure publishing, enterprise controls)

- Lovable: Fast UI generation, consumer-friendly focus → lower revenue in B2B

Implication: Enterprise buyers value end-to-end capabilities + control.

---

5️⃣ Product Migration: Consumer → Enterprise

Nearly 70% of ranked companies start with individual adoption, then expand to teams.

Examples:

- Cluely (#26)

- Midjourney (#28)

For model providers:

- OpenAI shifted in one year from 75% consumer revenue to ~50/50 split.

Impact:

Enterprise adoption cycles now take 1–2 years, not decades.

---

---

🚀 Strategic Takeaway

Consumer-grade AI is already enterprise-capable.

Platforms like AiToEarn官网 unify creation → publishing → monetization for both personal and corporate users, bridging gaps between consumer enthusiasm and enterprise-scale execution.

Supported platforms: Douyin, Kwai, WeChat, Bilibili, Xiaohongshu, Facebook, Instagram, LinkedIn, Threads, YouTube, Pinterest, X (Twitter).

---

❤️ Click “Heart” before you go.

---

Final Note

In the age of AI-driven creativity, ecosystems like AiToEarn shorten the path from idea → audience → revenue by integrating:

- AI content generation tools

- Multi-platform publishing pipelines

- Analytics

- Model ranking (View rankings)

---

Would you like me to also create an executive summary table comparing Horizontal vs Vertical market segments for faster reading? That could make this research more actionable.