Why AI Is Not Yet a Bubble — Four-Part Series | 42 Scriptures AI Newsletter

AI Newsletter #2 — Unicorn Fal’s Rise, AI Bubble Debate, Pricing Strategies & Growth Power Law

Curated from 200+ overseas articles and 100+ podcast episodes — this is the second issue of the AI Newsletter.

We’ve launched a dedicated site for subscribers: 42chapter.substack.com, for those who prefer the web version.

---

📋 Contents

- $100M ARR in 1 Year — The keys to Fal’s explosive success

- Is AI a bubble yet? — Why Coatue says “not yet”

- Pricing for AI products — Lessons from 250 companies

- Growth Power Law — Insights from Sandy Diao

---

1. Fal’s Journey to $100M ARR in 12 Months

In October, Fal announced $250M funding led by Sequoia and KP with a valuation topping $4B.

Fal operates an "AI generative media cloud" — optimized APIs for image, video, and audio models — acting as both premium broker and accelerator.

Results: ARR grew from $2M → $100M in one year with under 50 employees.

---

Strategic Pivot

- Origin: Initially a data-processing product competing with Databricks/Snowflake.

- Trigger: Stable Diffusion demand surge + GPU shortage → massive waiting lists.

- Investor prompt: Which product gets to $1M ARR faster? Which gets to $10M faster? → pivoted to inference optimization.

---

Choosing Generative Media over LLMs

Despite LLM hype, Fal chose image/video inference, reasoning:

- Avoid giant competition risk (e.g., Google offering LLM inference for free).

- New market creation vs. cannibalizing existing revenue streams.

- SOTA shelf life is short (3–4 months) → advantage erodes quickly.

---

Aggregation Flywheel

Fal integrates 600+ models with deep optimization:

- Attract developers with best performance APIs.

- Draw models seeking distribution to this large developer base.

Accidentally sparked when introducing Chinese model Kling to Western devs → models flocked in.

---

GTM: PLG + Sales Loop

- Self-service signup & pay-as-you-go.

- Identify whales by spend threshold (e.g., $300/day).

- Enterprise conversion via Sales + annual contract incentives.

---

Authentic Brand Marketing

- GPU Rich / Poor hats — became event hits.

- Live speed deployments of new models — high dev respect.

---

Next Opportunities

- Scale AI for media — shared, labeled datasets.

- RL frameworks for video model reward functions.

- Vertical ad solutions — niche industry targeting.

Refs:

---

2. AI Bubble? Coatue’s Analysis

Michael Burry’s portfolio shift (puts on NVIDIA/Palantir worth $1B) reignited bubble fears. Surveys show 54% of fund managers think AI is in bubble stage.

---

Coatue’s View: Not Yet

Definition: asset prices >> intrinsic value, driven by speculation.

Doubts vs. Responses:

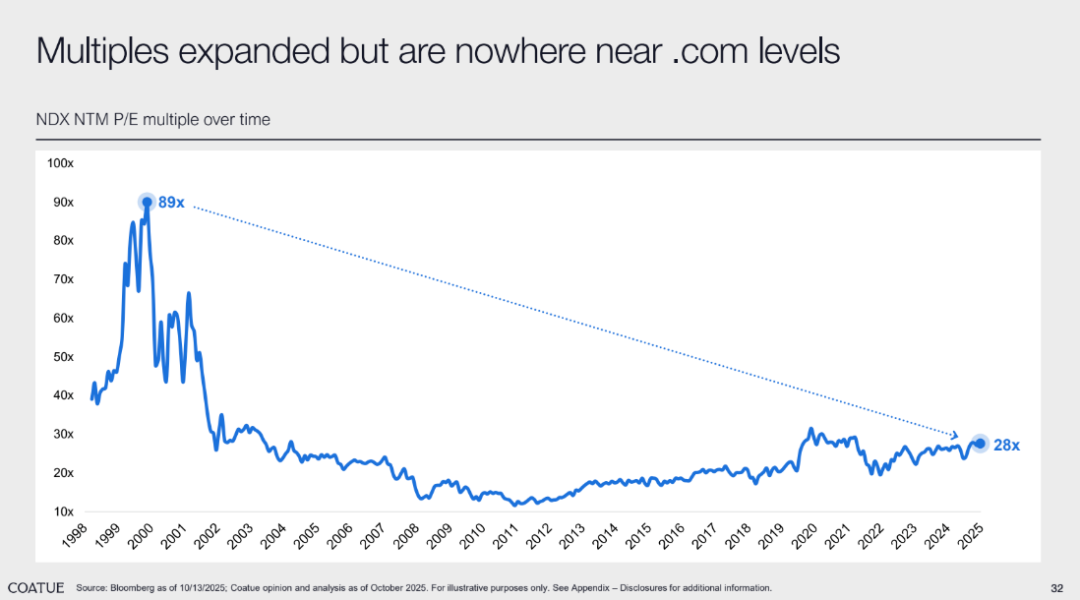

- Valuations: Nasdaq 100 forward P/E now 28× — far from 2000’s 89×.

- Concentration: Today’s giants are diversified multi-sector vs. mono-line in 2000.

- CapEx: 46% of cash flow vs. 75% in 2000 — funded internally.

- Funding loops: Not new — watch scale.

- Low enterprise adoption/profitability: Infra needs time; consumer side strong (ChatGPT MAU vs. tech history).

---

Demand & Profit Trajectory

- AI revenues could grow 10× in 5–10 years → $1.9T by 2035.

- ROIC projected +20% (mature cloud levels).

- Odds: >2/3 market remains strong.

Refs:

Coatue Update | Economic Times on Burry

---

3. Pricing AI Products — Madhavan’s Framework

Experience: 250+ companies, 30 unicorns.

---

Stage-based Focus

Early stage: Keep pricing simple + story-driven (e.g., Superhuman’s $1/day for 4h/week gain).

Scaling: Negotiation tactics:

- Give to get — trade discounts for value audit reports.

- Make client self-convince — collaborative ROI model.

- Options over single plan — Good / Better / Best.

Concession pattern: Decreasing sizes signal near-bottom limits.

---

POC Best Practices

- Charge for POCs to filter leads.

- Tell clients POC fee ≠ future contract value.

- Avoid fixed pricing upfront — give ranges linked to ROI.

---

Pricing Quadrants

By Value Attribution Difficulty × AI Autonomy:

- Pay-per-use for infra AI.

- Seat-based SaaS for low-autonomy, hard-to-attribute.

- Sub + usage for AI Copilots (low autonomy, easy attribution).

- Performance-based for AI Agents (high autonomy, easy attribution).

Pitfalls:

- Giving away high-value features.

- Too slow price iteration vs. AI’s pace.

- Targeting churn-prone customers.

Ref:

---

4. Growth Power Law — Sandy Diao Insights

---

Data-Inspired, Not Data-Driven

Context matters — friction can filter high-intent users (e.g., Descript’s desktop app vs. low-intent web visitors).

---

Channel Focus

80% of growth from 1–2 channels — find and scale Unfair Advantages (e.g., content created by users → affiliate program).

---

Position Broad, Acquire Narrow

Horizontal brand, vertical landing pages for specific tasks/scenarios → feed broad homepage conversions.

---

Early Growth Hiring

Embed growth before PMF — even <10-person teams.

Only must-have trait: hands-on drive.

Ref:

---

💡 Closing Thought

Pricing power, channel focus, and authentic market engagement will be key in translating AI innovation into sustainable business.

Platforms like AiToEarn官网 integrate AI content generation, multi-platform publishing (Douyin, Kwai, WeChat, Bilibili, Xiaohongshu, FB, IG, LinkedIn, Threads, YouTube, Pinterest, X/Twitter), analytics, and model rankings (AI模型排名) — helping creators and builders commercialize AI output efficiently.

---

More Reading: