8 Products with Annual Revenue Growth Over 100 Million — Who Wins the Biggest Overseas “Bonus” in 2025?

Is the Future of the Casual Market a Battle Between Turkey and China?

Cover image generated by AI

Produced by|White Whale Overseas Editorial Department

---

Introduction

Gaming media Gamigion recently published a chart (based on AppMagic data) showing encouraging growth:

At least 8 overseas casual mobile games saw year-on-year revenue growth exceeding USD 10 million in 2025, accounting for about half the list.

However, after confirming with AppMagic, we found the comparison was actually full-year 2024 vs. the first nine months of 2025 — meaning the full-year 2025 growth may be even higher.

Image source: Gamigion

To obtain more reasonable statistics, we collaborated with AppMagic to analyze revenue changes among domestic casual game developers over the past year.

---

Defining Our Analysis

Scope & Category Rules

- "Casual games" here refers to tracks with strong performance this year and high domestic developer participation — including hybrid casual, match-3, and merge games.

- Simulation management and social party games are excluded.

- Data timeframe: We compared Q1–Q3 2025 vs Q1–Q3 2024 to avoid fluctuations observed in October 2025.

- Benchmark:

- Selected Top 18 casual products by growth in 2025 Q1–Q3, based on USD 15 million (approx. RMB 107 million) minimum year-on-year growth.

---

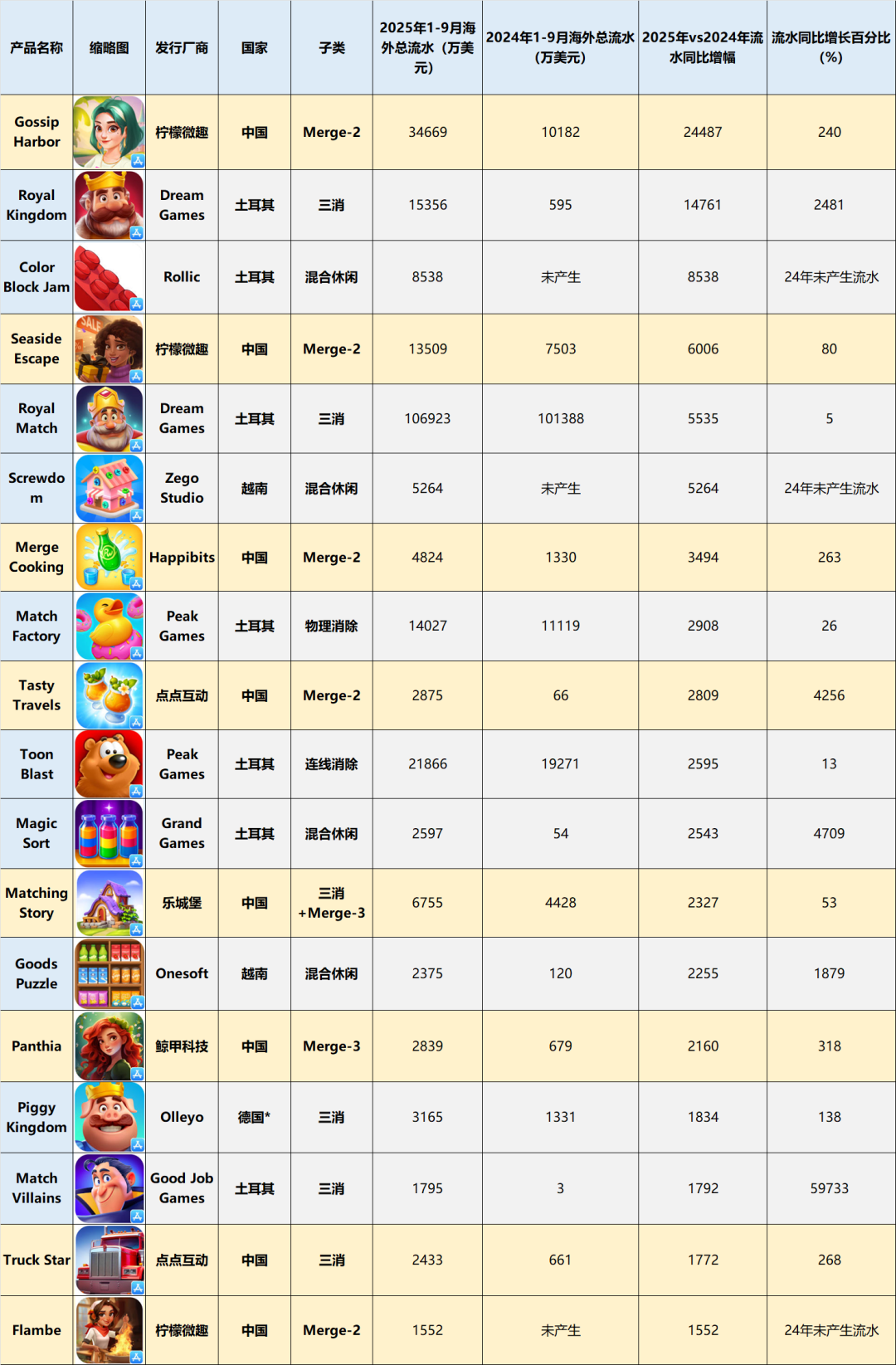

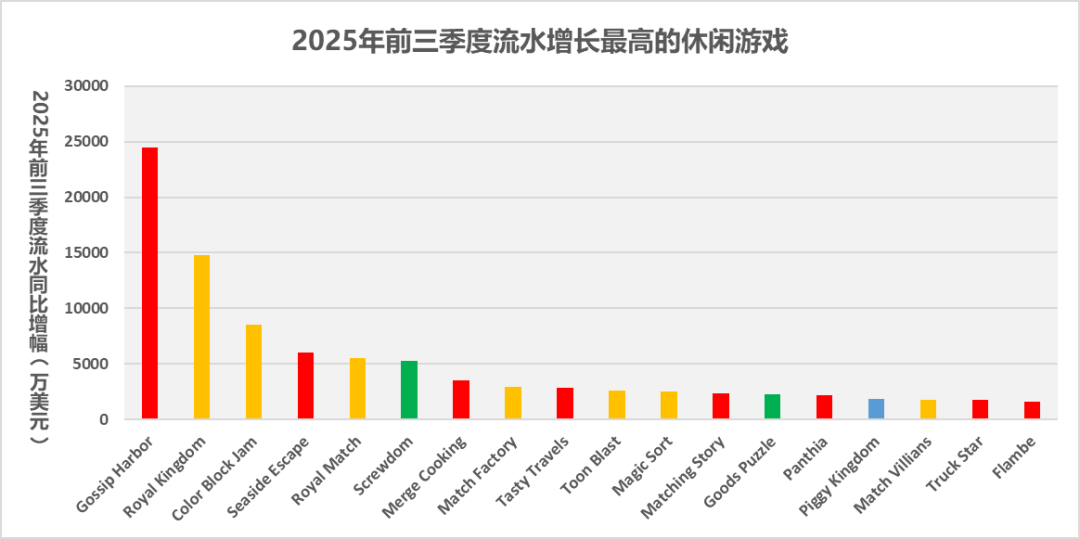

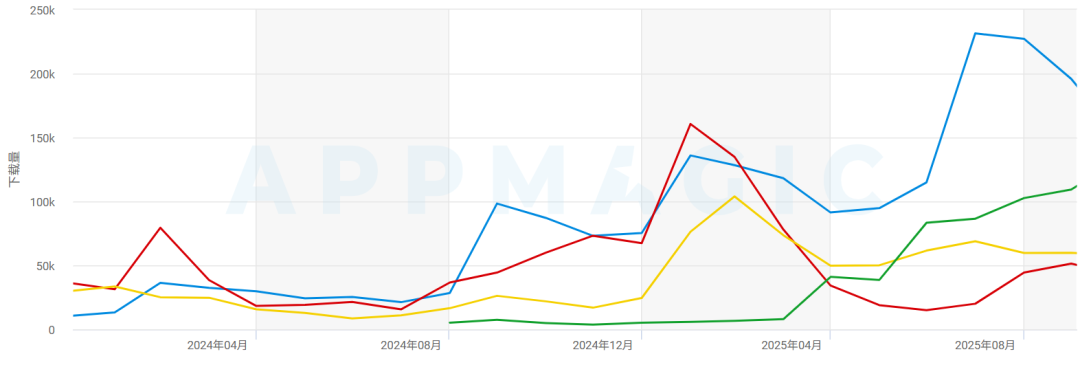

In the 2025 Q1–Q3 global game revenue growth chart,

8 products are by domestic developers (yellow). Olleyo is likely backed by a Chinese firm.

Source: AppMagic

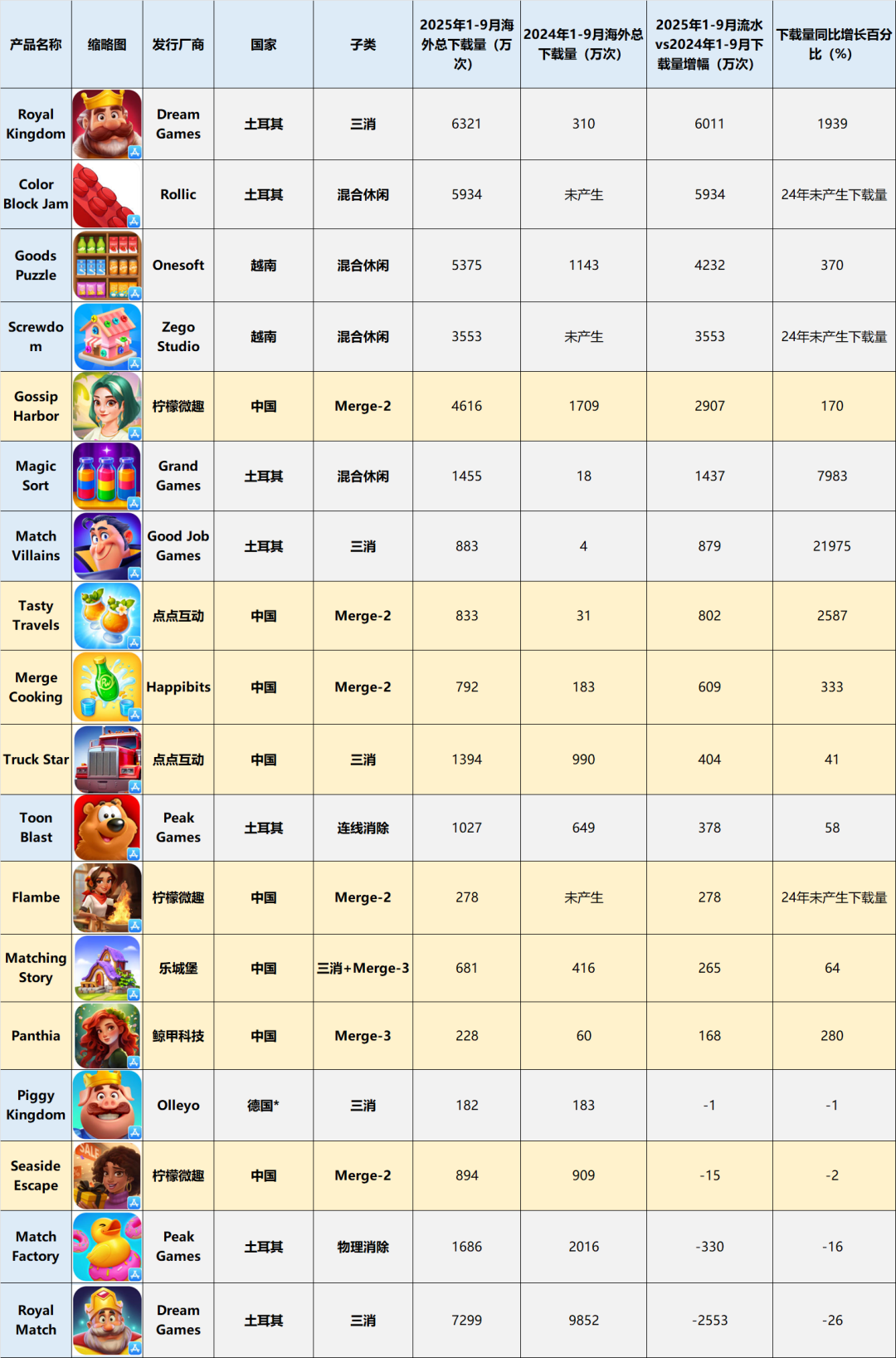

Most domestic titles did not gain over 10 million downloads,

except Gossip Harbor (+29.07M downloads).

Source: AppMagic

Growth-chart games mostly originate from China (red) or Turkey (yellow).

Source: AppMagic

Most successful games launched Nov 2021–July 2024.

Sources: data.ai, AppMagic

---

Key Observations

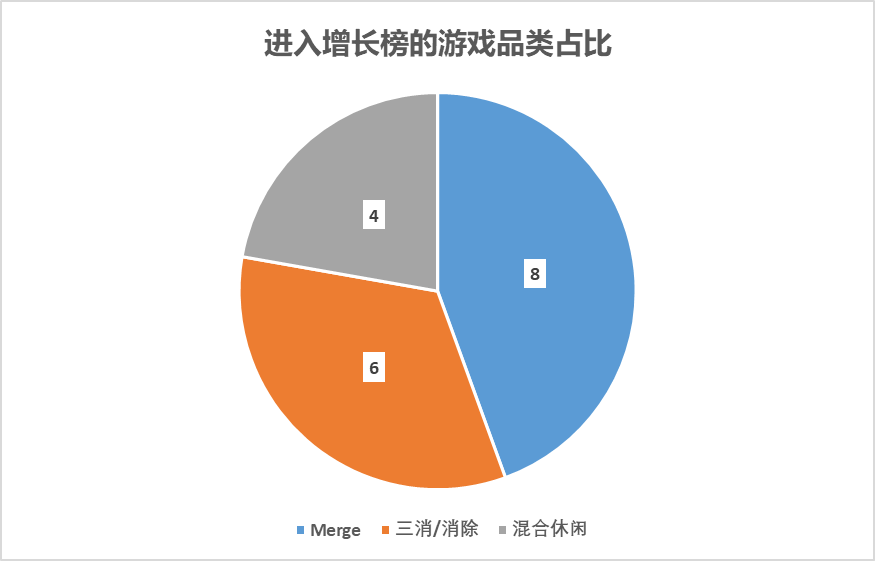

1. Merge Games Lead Growth Over Hybrid Casual

Merge, Match-3, and Hybrid casual are all represented,

but Merge is the most numerous. Source: Diandian Data

Revenue growth: Match-3 (blue) and Merge (orange) dominate,

Hybrid casual trails, except Color Block Jam.

Source: AppMagic

Top Performers (Q1–Q3 2025):

- Gossip Harbor (Merge) — +USD 100M+ growth (#1)

- Royal Kingdom (Match-3) — +USD 100M+ growth (#4)

- Color Block Jam (Hybrid) — ~USD 85M growth (#3)

---

Regional Developer Trends

Chinese vs Turkish vs Vietnamese

- Chinese: Focus on Match-3 & Merge. Heavy-game studios like DianDian Interactive entering casual market.

- Vietnamese: Specialize in hybrid casual.

- Turkish: Strong across all genres.

Leaderboard Breakdown:

- China: 8 titles

- Turkey: 7 titles

- Vietnam: 2 titles

- Germany-listed Olleyo: likely Chinese-backed.

---

3. Western Developers Cooling Off

Big names like King, Playrix, and Metacore — famous for Match-3/Merge — have no entries in the growth leaderboard.

Suggests:

- Existing hits have plateaued.

- New titles haven't scaled successfully.

---

4. Fine-Tuning Takes 1–2 Years

Most top-growing games scaled 1–4 years after launch.

Only Goods Puzzle launched in 2025 and grew fast.

Casual games require ~1–2 years optimization before revenue spikes.

---

5. "Low Downloads, High Revenue" Phase

Revenue growth often outpaces download growth.

Example:

- Gossip Harbor: +29M downloads

- Seaside Escape: downloads declined, yet revenue rose.

This points to:

- Better conversion of paying users.

- Reactivation of lapsed players as key growth drivers.

---

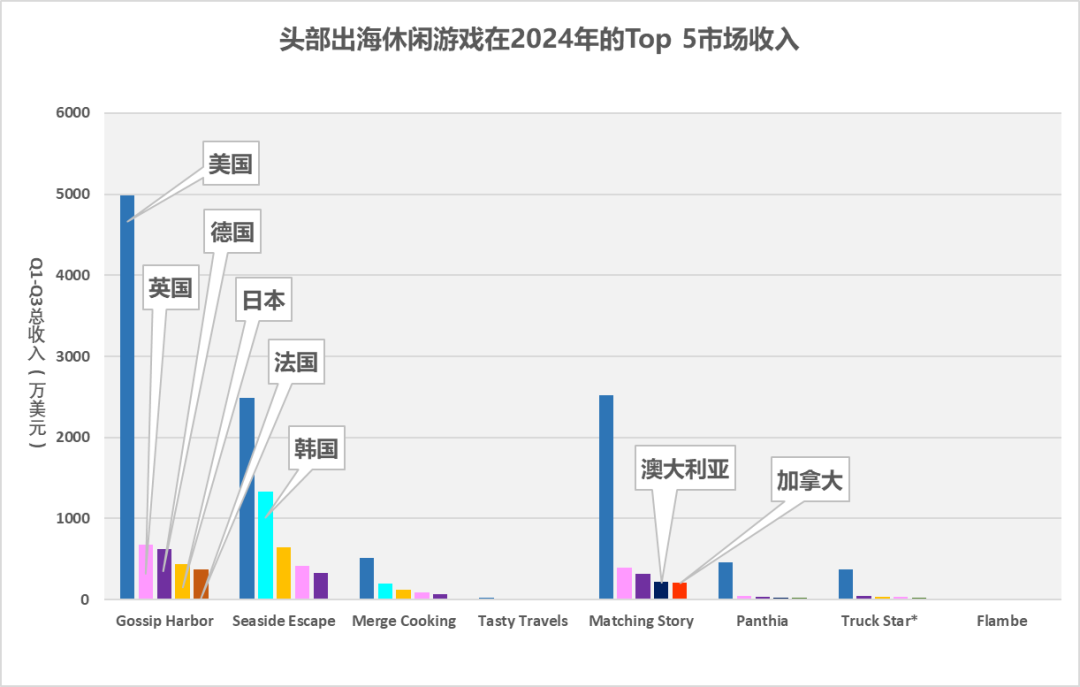

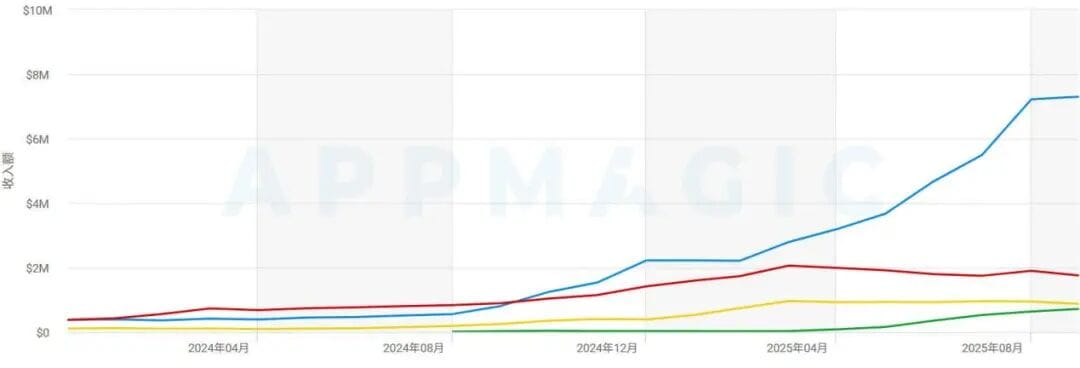

Cracking the Japanese Market

Japan is now Top 3 market for many outbound casual games in 2025,

a shift from 2024 when it ranked lower.

Top Revenue-Growth Titles with Japan in Top 3:

- Gossip Harbor

- Seaside Escape

- Merge Cooking

- Tasty Travels

Gossip Harbor reached over USD 7.3M/month in Japan by Sept 2025.

Source: AppMagic

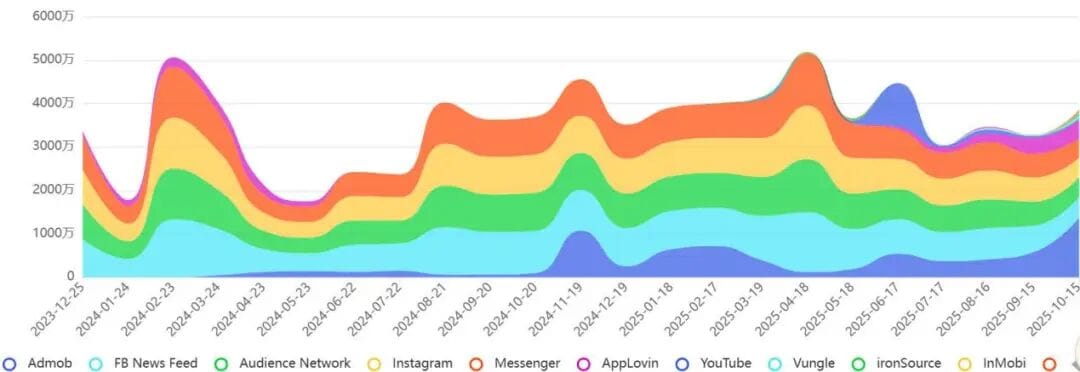

Japan downloads spiked in 2025 — Gossip Harbor led the way.

Source: AppMagic

---

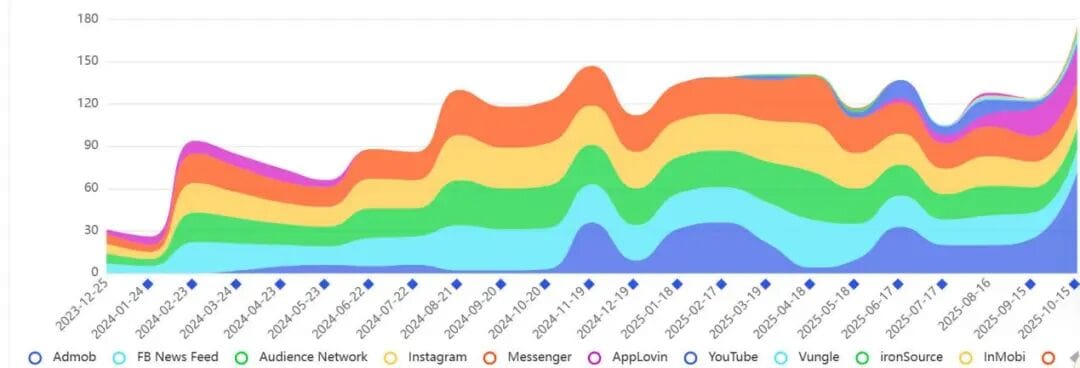

Ad Strategy in Japan

- High emotional impact creatives work best.

- Example: "tragic" 3D animation of a lonely girl needing rescue.

- All ads free from obvious AI-generated traces.

- Peak impressions exceeded 50M.

High impressions despite limited creatives.

Source: Guangdada

Cute characters + emotional narratives resonate in Japan.

Image: Guangdada

---

Addressing Ad Misrepresentation

Localized creatives clearly show authentic gameplay to build trust.

Localized ad clarifies content authenticity | Facebook

---

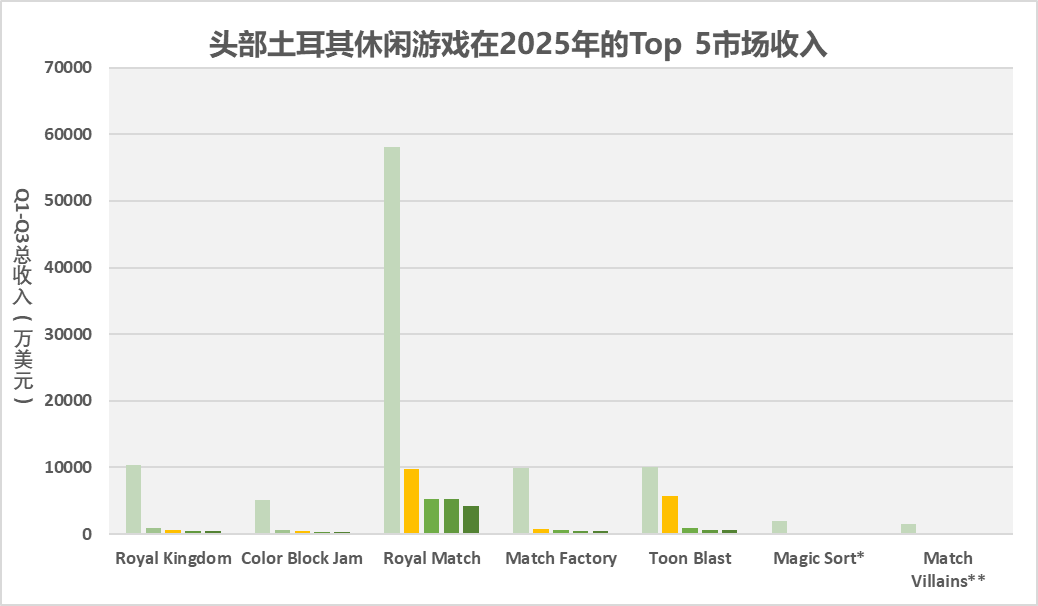

Turkish Studios: Consistent New Hits

Turkish hits like Royal Match cultivated Japan early — now many new titles appear:

- Match-3: Royal Kingdom, Match Villains

- Hybrid casual: Color Block Jam

Strength: Turkey sustains output across all genres with high-quality new releases.

---

Hybrid Casual Success Case: Color Block Jam

- Core mechanic: simple sliding puzzle ("Huarong Dao" style)

- Leveraged numerical balancing to sustain engagement & monetization

- Smooth difficulty progression encourages natural spending/ad viewing

Chinese developers often focus on theme variation but may need stronger numerical design expertise.

---

Final Thoughts

2025 Casual Gaming Battlefront:

- China: Operational excellence in specific tracks/markets.

- Turkey: Mature, industrialized casual development — broad genre coverage.

Challenge for Chinese developers:

Shift from "going global" to building sustainable innovation capacity — blending creative originality with numerical design expertise.

---

Data Sources

SimilarWeb, Diandian Data, Semrush, Guangdada, AppMagic, and other third-party platforms.

Figures are indicative and may differ from actual values.

---

Platforms Empowering Global Expansion

Tools like AiToEarn官网 offer:

- AI-generated content creation

- Cross-platform publishing (Douyin, Kwai, WeChat, Bilibili, Rednote, Facebook, Instagram, LinkedIn, Threads, YouTube, Pinterest, X)

- Analytics & AI model rankings (AI模型排名)

- Open-source ecosystem for efficient global launches

By reducing friction between production and distribution, such platforms mirror the operational efficiency seen in top-performing game studios.