Huawei, Alibaba, and Tesla’s Business Decisions All Follow This Theory

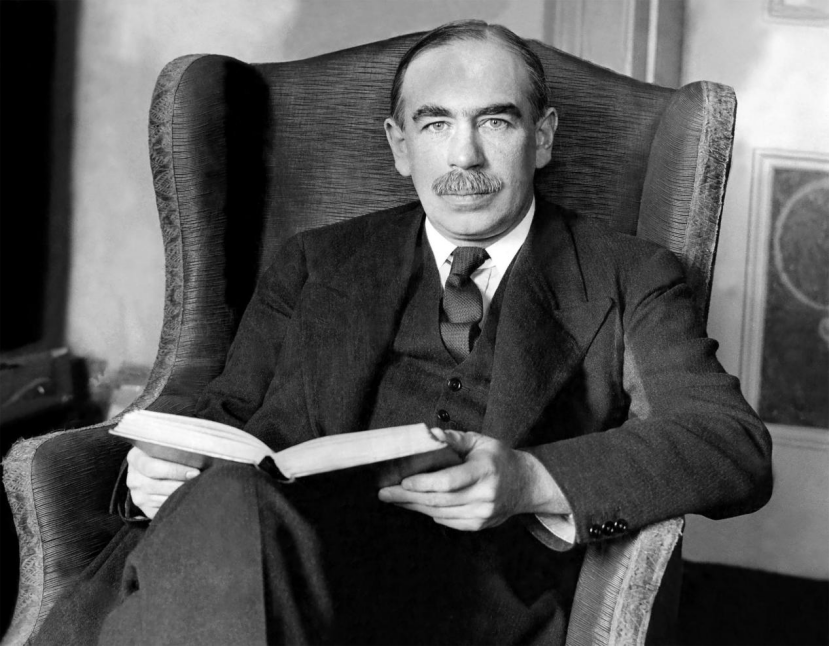

John Maynard Keynes: Guiding Star of 20th-Century Economics

In the history of 20th-century economic thought, John Maynard Keynes stood as the guiding star.

He overturned the assumptions of classical economics and ushered in a new era in macroeconomics.

Many assume Keynes’s theories apply only to governments and macroeconomic policy, but his core insights also offer profound guidance for corporate strategic decision-making.

John Maynard Keynes

One of the most influential economists of the 20th century, hailed as the “Father of Macroeconomics.”

---

Keynes's Breakthrough Ideas

- Rejected the classical belief that “supply automatically creates demand.”

- Emphasized effective demand as the true determinant of economic output.

- Advocated government intervention to stimulate demand during slumps, magnifying impact via the investment multiplier effect.

- Highlighted market psychology and uncertainty — “animal spirits” influence economic behavior beyond rational calculation.

Key Takeaway for Decision-Makers: Read trends, follow them, and sometimes shape them — guiding these “animal spirits” in markets and industries.

These concepts are vividly seen today in companies like Huawei, Alibaba, Tesla, and Baodao Eyeglasses.

---

1. Huawei

Investing Ahead of the Curve: The Corporate Multiplier Effect

Huawei’s strategic R&D spending exemplifies Keynes’s investment multiplier effect.

Case Highlights

- Early Commitment to 5G: Invested tens of billions of RMB over a decade — before commercialization, despite uncertain market potential.

- Countercyclical Strategy: Increased R&D spending above 20% of revenue during technological embargoes.

Keynesian Insights Applied

- Foresight Aligned with Trend: Recognized digital infrastructure as a driver of future global growth.

- Multiplier Impact:

- Upstream: Boosted chip design/manufacturing industries (e.g., Qualcomm, TSMC).

- Horizontal: Stimulated niche sectors — RF components, optical modules, antennas.

- Downstream: Empowered applications like mobile payments, short video, and IoT.

Result: Created technological supply that generated vast new market demand — Keynesianism in action at the corporate scale.

---

2. Alibaba

Aligning Supply with Effective Demand via Big Data

Keynes taught that effective demand determines output. Alibaba perfected this principle through data-driven manufacturing.

Rhino Factory Example

- Intelligent manufacturing platform using data from 700M active consumers (search terms, carts, purchases, reviews).

- Uses AI and deep learning to forecast demand.

- Reduced apparel production cycle from months to 3 days, cutting surplus inventory rates from 30%+.

Why It’s Keynesian

- Moves from “blind production” to real-time demand portrait.

- Predicts exact quantities, timing, and locations for product demand.

- Turns production into a precise, data-based response — avoiding resource waste.

---

Modern Parallel in Content Creation

Platforms like AiToEarn embody the same principle in the digital creator economy. AiToEarn:

- Generates AI content.

- Publishes across major platforms (Douyin, WeChat, Bilibili, YouTube, Instagram, X, etc.).

- Integrates analytics and model rankings for optimal reach and monetization.

Explore:

---

3. Tesla

Creating Demand through Disruptive Innovation

Advanced strategies don’t just meet demand — they create it.

Model 3 Launch

- Affordable mass-market EV ($35,000 price target, 345 km range).

- Eliminated range anxiety, added autonomous driving, OTA updates.

- Leveraged EV subsidy policies (e.g., US federal $7,500 tax credit).

Impact

- 240,000 units delivered in 2018.

- Boosted global EV penetration from 1.5% to 2.5%.

- Triggered an industry-wide multiplier effect — batteries, charging networks, smart driving systems.

Lesson: Disruptive products can ignite “animal spirits” and build entirely new markets.

---

4. Baodao Eyeglasses

Navigating Cycles through Risk Control

Keynes also stressed uncertainty management. Baodao Eyeglasses responded to economic and competitive pressures via deep service enhancement.

Strategy

- Lifetime digital eye-health profiles for every customer.

- Personalized re-exam reminders and ongoing health consultations.

- Transforming single purchases into lifelong service relationships.

Benefits

- Stable membership base cushions against downturns.

- Customer loyalty becomes a hedge against macroeconomic risk.

Result: Steady, long-term growth through resilience and service value — key Keynesian risk control principles.

---

5. Keynes: Master of Theory and Practice

Keynes wasn’t just a theorist — he was a successful investor.

Investment Wisdom

After the 1929 crash:

- Saw undervalued quality assets others missed.

- Bought and held superior investments long-term.

- Balanced fundamental analysis with awareness of market sentiment.

Quote:

> “The essence of investing is this: for genuinely superior things, even if the market doesn’t currently recognize them, hold onto them permanently.”

---

Legacy and Modern Application

Keynes’s mindset — proactively confronting uncertainty, discerning trends, and shaping the future — transcends economics textbooks.

His ideas inspire:

- Governments

- Corporations

- Investors

- Creators

In today’s AI-driven digital economy, platforms like AiToEarn官网 empower creators to:

- Diversify income streams.

- Reduce dependency on fleeting trends.

- Build sustainable value — echoing Keynes’s vision that shaping demand ensures long-term prosperity.

---

Final Thought:

In volatile markets, actively shaping outcomes beats passive adaptation. Keynes’s most valuable legacy may be this: true prosperity begins with the courage and wisdom to create demand.

---

Would you like me to also create a one-page diagram summarizing the corporate applications of Keynesian concepts so readers have a quick visual reference? That could make your piece even more engaging.