Is the U.S. SaaS IPO Market Really Recovering? Five Key Metrics to Watch

Linkloud IPO Insights — 2025 Market Overview

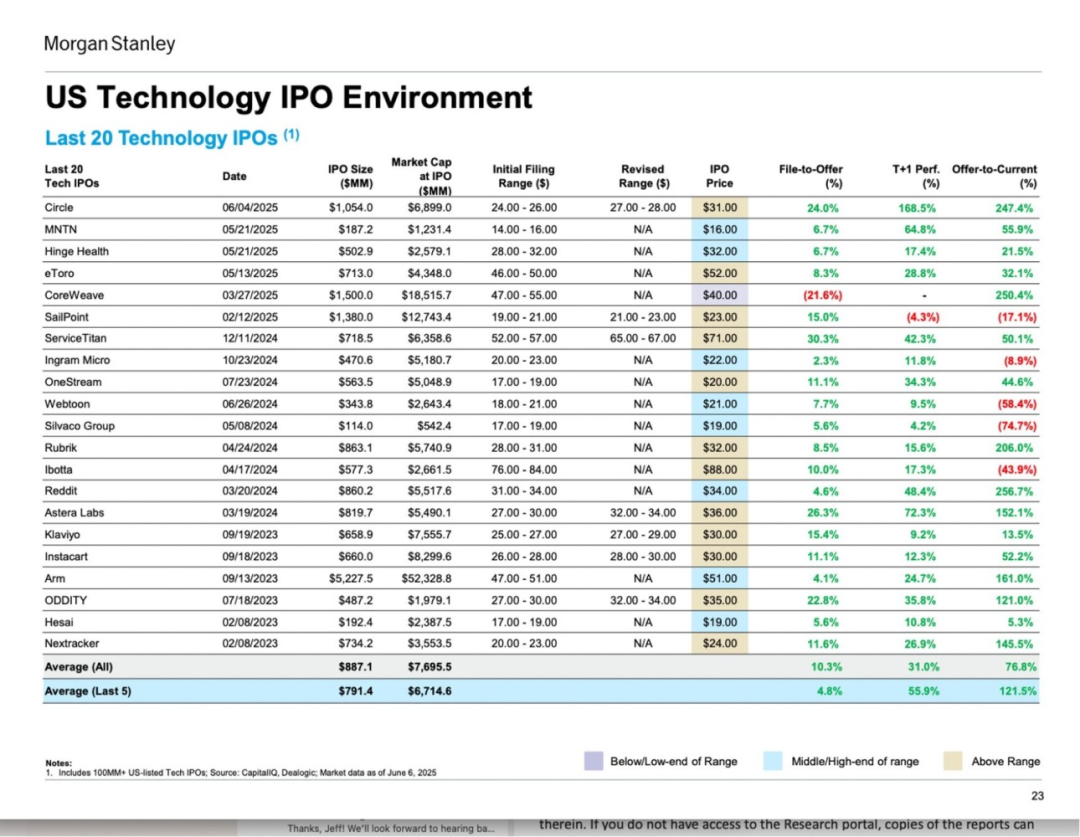

In 2025’s sizzling IPO market, the biggest deals are not necessarily delivering the biggest returns.

Example: Reddit’s $860M IPO yielded an astonishing 256% return — far ahead of giant ARM’s $5.2B deal, which returned “just” 161%.

This Great IPO Awakening has opened a decisive window for high-growth SaaS companies, especially those in Series C and beyond.

This summary distills analysis from SaaStr founder Jason Lemkin, exploring:

- Key forces driving the IPO revival

- Lessons from SaaS IPOs like ServiceTitan, Rubrik, and OneStream

- Five core pre-IPO metrics every SaaS founder should master

---

For complete details, see the full original article.

---

The IPO Window Is Wide Open

After years of inactivity, the secondary market for tech has reignited. Extraordinary returns have caught the attention of founders, CFOs, and investors.

---

1. Data Revealing the Market Shift

Circle, a stablecoin issuance platform, rose 247% post-IPO.

- Filed range: $24–26

- Final price: $31 — beating expectations

Latest 20 tech IPOs data:

- Day-1 average gain: 31%

- Average return to date: 76.8%

- Latest five IPOs average return: 121.5%

---

2. Forces Driving the IPO Revival

Market Timing Matters

Morgan Stanley shows half of the latest 20 tech IPOs occurred in 2025, many in the past few months — reflecting a giant shift in market demand.

Size Matters — But Bigger Isn’t Always Better

- Average IPO size: $887M

- Smaller deals often outperform:

- Reddit: $860M → 256% ROI

- ARM: $5.2B → 161% ROI

---

3. SaaS Opportunities Ahead

Revenue Multiples Are Back

- Example: ServiceTitan IPO valuation at 52–57x revenue

- Premium valuations favor recurring revenue + predictable growth

Pricing Above Filing Ranges

- SailPoint: Filed $19–21 → Priced at $23

- Indicates strong market demand beyond banker hype

---

What This Means for SaaS Companies

For Series C+ with High Growth:

- IPO window likely lasts 12–18 months

- ARR > $100M & growth > 30% → evaluate IPO readiness now

For Early-Stage:

- Align strategy to long-term valuation drivers

- Focus on predictable revenue & scalability

---

Content Strategy Tie-In:

Platforms like AiToEarn help SaaS founders publish investor materials and thought leadership cross-platform — streamlining multi-channel reach on Douyin, Kwai, WeChat, Bilibili, Facebook, Instagram, LinkedIn, Threads, YouTube, Pinterest, X (Twitter), and more.

---

Warning Signs to Watch

Not all IPOs succeed:

- CoreWeave: -21.6% pre-to-post listing drop

- SailPoint: Current returns negative

Excluding outliers:

- Average Day-1 gain: 10.3% — suggests rational pricing

---

In-Depth Snapshot — Recent B2B IPOs

ServiceTitan (Dec 11, 2024)

- $718M IPO, Filed $52–57 → Priced $71

- +50.1% over IPO price

- Lesson: Vertical SaaS can win big with deep workflow coverage

CoreWeave (Mar 27, 2025)

- $1.5B IPO, Filed $47–55 → Priced $40

- +250.4% rise

- Lesson: AI infra can command huge premiums — but pricing discipline matters

SailPoint (Feb 12, 2025)

- $1.38B IPO, Filed $19–21 → Priced $23

- -17.1% drop

- Lesson: Even must-have sectors face execution risks

Rubrik (Apr 24, 2024)

- $863M IPO, Filed $28–31 → Priced $32

- +206% rise

- Lesson: Data + AI = premium valuation

MNTN (May 21, 2025)

- $187M IPO, Filed $14–16 → Priced $16

- +55.9% rise

- Lesson: CTV ad tech benefiting from budget migration

Hinge Health (May 21, 2025)

- $503M IPO, Filed $28–32 → Priced $32

- +21.5% rise

- Lesson: Digital health ROI for employers is a strong selling point

OneStream (July 23, 2024)

- $563M IPO, Filed $17–19 → Priced $20

- +44.6% rise

- Lesson: CFO tooling remains in demand

---

5 Key Pre-IPO Metrics for B2B SaaS

- Revenue Quality Score

- 85%+ recurring revenue

- NDR > 110%

- Predictability commands premium pricing

- Scale Efficiency Ratio

- Growth rate ÷ burn rate > 2.0

- Proves scaling without overspending

- Market Penetration Velocity

- >40% of growth from existing customers

- “Land and expand” strategy builds moats

- Profit Margin Trajectory

- Clear 20%+ operating margin target in 2–3 years

- Gross margin > 70%, improving unit economics

- Category Leadership Indicators

- Top 3 in segment

- Defensible differentiation + pricing power

---

Strategic Playbook for SaaS IPOs

- Choose a North Star metric from the five above and optimize relentlessly

- Embed AI capabilities into core products

- Demonstrate leadership via market share growth

- Articulate a profitability path to >20% margins

- Time entry to IPO market — early advantage matters

- Target measurable ROI use cases

---

Final Takeaway:

The 2025 IPO market rewards strong fundamentals + alignment with growth megatrends.

B2B SaaS founders should combine disciplined execution with savvy market timing — and leverage platforms like AiToEarn官网 for AI-driven content generation and category leadership in the run-up to going public.