South Korea Becomes a Hotspot for US AI

Recently, the U.S. Has Been Aggressively Building AI Industry Footprint in Japan and South Korea

---

October: South Korea Became the Hottest AI Battleground

First, let’s look at the timeline:

October 1 — Sam Altman flew to Seoul, signed the South Korea agreement for the Stargate Project at the Blue House: $500 billion investment, two data centers, and 900,000 DRAM wafers per month.

October 18 — Donald Trump played seven hours of golf in Florida with five major South Korean conglomerate leaders: Samsung’s Lee Jae-yong, SK’s Chey Tae-won, Hyundai’s Chung Eui-sun, LG’s Koo Kwang-mo, Hanwha’s Kim Dong-gwan. The discussion centered on $350 billion in investments and tariffs.

October 23 — OpenAI released the Korea AI Economic Blueprint, a 48-page report directly offering South Korea policy suggestions for AI industry development.

October 24 — Anthropic announced its Seoul office, timing closely after OpenAI’s release.

October 29–30 — Trump visited South Korea to attend the APEC summit.

South Korean President Lee Jae-myung is reportedly considering a major surprise for Trump.

> One month, three waves of visitors, one shared goal: the 90% of global High Bandwidth Memory (HBM) capacity controlled by Samsung and SK Hynix.

---

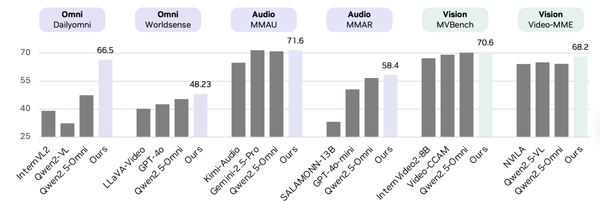

Understanding HBM’s Role in the Supply Chain

High Bandwidth Memory (HBM) stacks multiple DRAM chips vertically, linked through Through-Silicon Vias (TSV), enabling data transfer speeds dozens of times faster than traditional memory.

Micron’s HBM schematic.

For large AI model training and inference, the bottleneck is not raw compute power but data movement speed. If a GPU can calculate fast but cannot be fed data quickly enough, it stalls — this is called the memory wall.

Currently, the most advanced HBM3e can reach bandwidth up to 1.2TB/s — more than 10× DDR5.

NVIDIA’s H100 GPUs use HBM3, each paired with 80GB HBM. Without it, the H100 would just be a pile of transistors.

Global HBM production is dominated by:

- SK Hynix — 50%

- Samsung — 30%

- Micron — 10%

Combined, the two Korean companies hold about 80% of capacity; factoring in their lead in HBM3e mass production, the effective control approaches 90%.

Samsung (left), SK Hynix (right).

---

South Korea controls:

- 73% of the global DRAM market

- 51% of the NAND flash memory market

Moreover, Korean firms hold key patents in advanced packaging technologies like 3D vertical stacking and Processing-in-Memory (PIM) — methods competitors cannot replicate in the short term.

Semiconductors account for nearly 20% of South Korea’s GDP; semiconductor exports in 2024 reached $141.9 billion, up 43.9% year-on-year.

South Korea is the sixth-largest semiconductor exporter globally, but in memory chips it holds an absolute lead — 56.9% global market share.

---

OpenAI’s Economic Blueprint for Korea

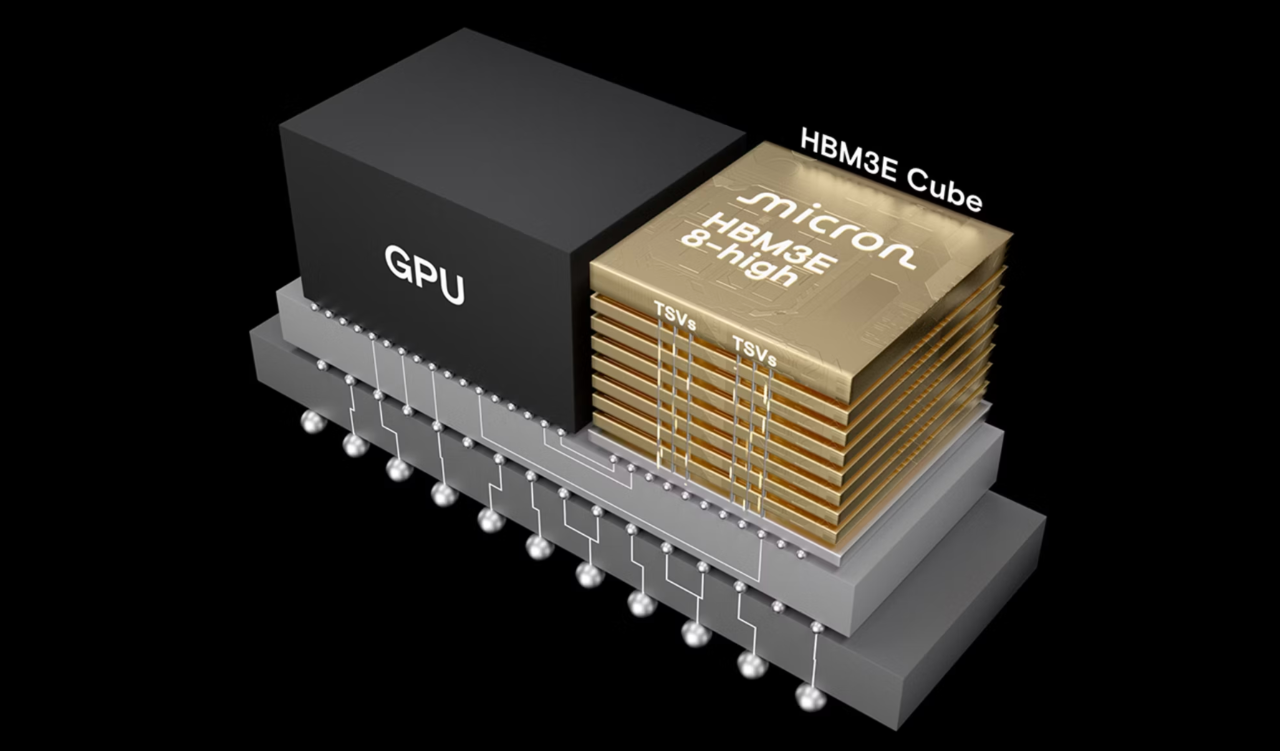

On October 1, Sam Altman met with President Lee Jae-myung, Samsung Chairman Lee Jae-yong, and SK Chairman Chey Tae-won.

Sam Altman with President Lee Jae-myung.

The trilateral meeting resulted in immediate agreement:

- Two 20MW data centers: one in Pohang (Samsung), one in Jeollanam-do (SK Hynix), with plans for future expansion.

- Monthly supply of 900,000 DRAM wafers from Samsung and SK Hynix.

For perspective: current global HBM capacity is around 400,000 wafers per month. OpenAI’s deal would require South Korea to more than double global HBM output.

The order value exceeds $72 billion.

Following the signing:

- Samsung’s stock hit its highest point since January 2021.

- SK Hynix shot up to its highest level since 2025.

---

In this unfolding U.S.–Korea AI and semiconductor partnership, control over high-bandwidth memory appears to be the strategic lever. For creators, analysts, and journalists tracking such developments, producing timely multi-platform content is increasingly valuable. Tools like AiToEarn官网 — an open-source global AI content monetization platform — now make it possible to generate, publish, and earn from AI-assisted articles across major platforms simultaneously, from Douyin and Bilibili to YouTube and LinkedIn. By uniting AI generation, cross-platform publishing, analytics, and model ranking, AiToEarn empowers professionals to turn complex industry insights like these into monetizable content efficiently.

Two Companies Add $37 Billion in Market Value Within 24 Hours; KOSPI Breaks 3,500 and Hits All-Time High of 4,032.68

_Screenshot taken October 27, 2025, 2:54 PM — South Korean stock market reaches new highs_

---

October 23: OpenAI Releases Korea AI Economic Blueprint

The 48-page report outlines a dual-track strategy: Establish sovereign AI capabilities (foundation models, infrastructure, data governance, GPU supply) while deepening collaboration with companies such as OpenAI to access cutting-edge technologies.

OpenAI’s Economic Blueprint: Korea

---

Economic Outlook in the Blueprint

- Productivity Impact: Bank of Korea predicts AI could increase total factor productivity by 3.2% and raise potential GDP growth by up to 12.6%.

- Healthcare AI Market: From $377 million in 2023 to $6.67 billion in 2030, CAGR 50.8%.

- AI Smart Factory Market: From $154.9 billion to $726.4 billion.

- AI-driven Memory Chip Market: Expected growth 24%.

- Government Commitment: Public-private investment pledge of ₩150 trillion (over $115 billion).

---

OpenAI’s Local Expansion

- May 26, 2025: Announcement of Korea corporate entity.

- September 10, 2025: Seoul office officially opens — OpenAI’s third office in Asia (after Tokyo and Singapore).

- September 29, 2025: Kim Kyung-hoon appointed first Korea GM — formerly GM at Google Korea.

User and Market Data:

- Korea is the world’s second-largest paid ChatGPT subscription market (after the U.S.).

- Weekly active users YoY ↑ 4×, paid subscribers ↑ 3×.

- API usage ranks in the global top ten.

Key Partnership:

- OpenAI partners with Kakao to integrate ChatGPT into KakaoTalk, which has 50 million users and 97% market share in Korea’s instant messaging sector.

- September 23: GPT-5 integration into KakaoTalk announced.

Academic Collaboration:

- September: MOU signed with Seoul National University to establish Korea’s first OpenAI-partnered AI-native campus.

---

Anthropic’s Timeline

One day after OpenAI released its blueprint:

- October 24: Anthropic announces Seoul office — its third APAC office following Tokyo (June) and Bangalore (October 7). Strategic entry reflects Korea’s advanced AI adoption.

- Comment from Paul Smith, Chief Commercial Officer: Korean companies are among the world’s most advanced Claude users, particularly in complex programming and enterprise applications.

- Usage Data:

- Korea ranked top 5 globally in Claude usage (total and per capita).

- A Korean software engineer is the world’s number one Claude Code user.

- Over the past four months, weekly active users of Claude Code in Korea grew 6×.

---

As AI adoption accelerates across Korea’s economy — from healthcare to manufacturing to enterprise software — the concurrent expansion of OpenAI and Anthropic shows the strategic importance of the Korean market in the global AI ecosystem. Alongside these industry giants, open-source platforms such as AiToEarn官网 are emerging to help creators harness AI for content generation, multi-platform publishing, and monetization. AiToEarn enables simultaneous distribution to major platforms like Douyin, Kwai, Bilibili, Instagram, YouTube, and X, while integrating analytics and AI model rankings, offering creators an efficient path to monetize AI-powered creativity.

Would you like me to create a comparison chart of OpenAI and Anthropic’s expansion strategies in Korea to visualize their differences and overlaps?

https://www.anthropic.com/news/seoul-becomes-third-anthropic-office-in-asia-pacific

Anthropic’s Early Presence in South Korea

On August 13–14, 2023, SK Telecom invested USD 100 million in Anthropic, becoming a strategic partner.

The two companies jointly developed a multilingual large model for the telecommunications industry, supporting Korean, English, German, Japanese, Arabic, and Spanish.

As a result, SK Telecom’s customer service quality improved by 34%.

Local application case:

South Korean company Law&Company developed the SuperLawyer AI legal assistant based on Claude, improving lawyer efficiency by 1.7 times.

92.5% of users saved time, and 46.8% saved more than 30 minutes per hour.

Within the first 100 days, the platform attracted 4,300 users with a conversion rate of 49.4%.

Anthropic plans to build a full local team in Seoul and is recruiting a South Korea Country Manager.

They have also launched the Claude for Startups program, providing technical resources and API credits to Korean VCs and startups.

---

Trump’s Deal: USD 350 Billion Investment for Tariff Reduction

On October 18, at the Trump International Golf Club in West Palm Beach, Florida, Donald Trump played golf for 7 hours, from 9:15 a.m. to 4:42 p.m.

Those playing alongside Trump were five chaebol leaders from South Korea: Samsung’s Lee Jae-yong, SK’s Chey Tae-won, Hyundai’s Chung Eui-sun, LG’s Koo Kwang-mo, and Hanwha’s Kim Dong-kwan.

This meeting was arranged by SoftBank’s Masayoshi Son, with a discussion agenda covering U.S. investment, tariff negotiations, the Stargate project, and supply chain cooperation.

> Core deal framework:

> South Korea commits USD 350 billion in investments in the U.S., in exchange for a tariff reduction from 25% to 15%.

The investment structure is still under negotiation: proportion of cash vs. financing, foreign exchange market stability, and possible currency swap arrangements.

Details will be finalized during Trump’s visit to South Korea on October 29–30.

Lee Jae-myung (left), Donald Trump (right)

---

Trump’s October Visit Agenda

Trump arrives in South Korea on October 29 to attend the Gyeongju APEC Summit.

> Official schedule:

> - Bilateral summit with Lee Jae-myung on Oct 29

> - Keynote speech at the APEC CEO Summit luncheon

APEC CEO Summit participants:

NVIDIA CEO Jensen Huang, OpenAI CEO Sam Altman, AWS CEO Matt Garman — plus the leaders of Korea’s five major chaebols, totaling around 1,700 executives.

The summit themes — "Bridge, Business, Beyond" — will in practice be a concentrated showcase of AI and semiconductor cooperation.

---

South Korean Corporations’ Investment Commitments in the U.S.

- Samsung: USD 37 billion chip foundry in Taylor, Texas, and an additional USD 17 billion semiconductor plant in Austin.

- SK Hynix: USD 3.9 billion advanced chip packaging plant in West Lafayette, Indiana, focusing on HBM, aiming for mass production by 2028; secured USD 450 million in U.S. government subsidies.

- Hyundai Motor Group: USD 26 billion investment in the U.S., with a goal of producing over 80% of locally sold vehicles within the country.

---

U.S. Policy Tools

In August 2025, the Trump administration revoked exemptions allowing Samsung and SK Hynix to use U.S. technology in their China operations.

Announced a 100% tariff on imported semiconductors, with exemptions for companies building plants in the U.S.

---

South Korea’s Strength: Policy, Investment, R&D

South Korean government’s AI strategic target: By 2027, rank among the world’s top 3 AI powers.

Investment:

- Government pledge: KRW 150 trillion (over USD 115 billion) through public-private cooperation.

- 2025 AI budget: KRW 1.8 trillion (USD 1.28 billion), a rise from 2024.

- Korean companies committed USD 48.9 billion in AI development by 2027.

K-Semiconductor Strategy:

USD 450 billion investment by 2030 to build a global semiconductor supply chain.

---

Broader Implications for AI Ecosystem

South Korea’s push to become a top AI nation aligns with its aggressive semiconductor expansion and global partnerships with entities like Anthropic. As AI models and semiconductor technologies converge, platforms that facilitate AI content development and monetization could see significant growth.

For example, AiToEarn官网 is an open-source global AI content monetization platform that helps creators use AI to generate, publish, and earn from multi-platform content. It enables seamless publishing to major platforms including Douyin, Kwai, WeChat, Bilibili, Rednote, Facebook, Instagram, LinkedIn, Threads, YouTube, Pinterest, and X (Twitter), while integrating creation tools, analytics, and model rankings. In a rapidly evolving AI landscape, such tools may complement national strategies by empowering individual and enterprise-level AI adoption efficiently.

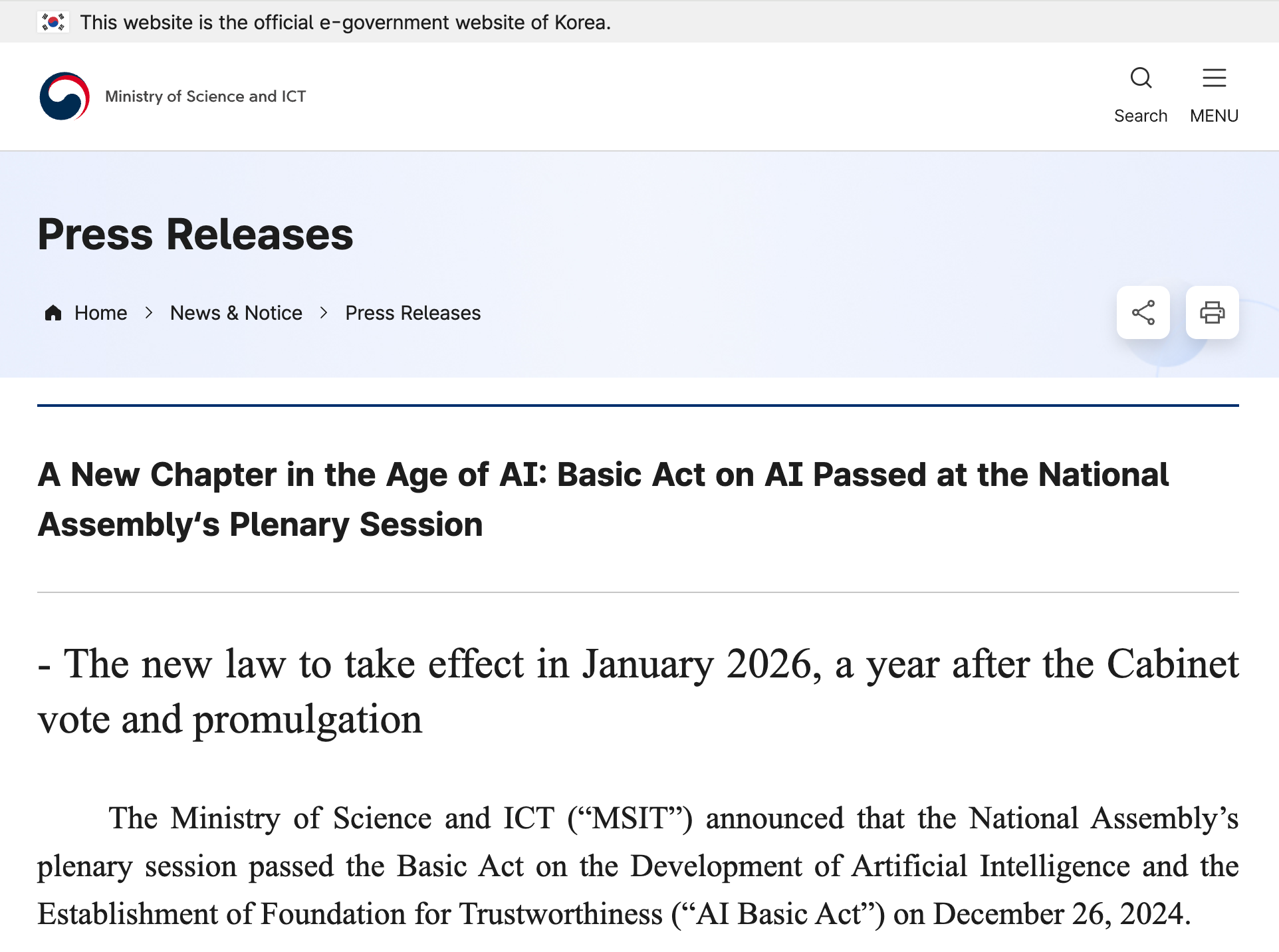

Legislation

In December 2024, South Korea passed the AI Basic Act (인공지능 기본법), which will take effect in January 2026, making it the first country in the Asia-Pacific region and the second in the world—after the EU—to formulate comprehensive AI regulatory legislation.

The act establishes:

- A National AI Commission

- An AI Safety Institute

- A National AI Computing Center

It also imposes transparency obligations for high-impact AI systems and generative AI.

---

Research & Development

According to Stanford's Global AI Vibrancy Tool, South Korea ranked 7th among 36 countries in 2024, up from 14th in 2017.

AI Patent Applications

In 2023, South Korea registered 17.3 AI patents per 100,000 people, ranking first globally, ahead of Luxembourg (15.3), China (6.1), and the US (5.2).

KAIST ranked 5th globally (4th in Asia) in the number of top AI conference papers between 2020–2024, behind only Peking University, Carnegie Mellon University, Tsinghua University, and Shanghai Jiao Tong University.

---

Sovereign AI Program

The government has selected five consortia for sovereign AI development: Naver, LG AI Research, SK Telecom, NCSoft, and Upstage.

Objective: Develop domestic models achieving 95% of frontier model performance (e.g., ChatGPT).

Investment: KRW 100 billion (≈ USD 72 million).

---

AI Market & Infrastructure

The South Korean AI market is projected to grow from USD 3.12 billion in 2024 to USD 30 billion in 2033, with a CAGR of 26.6%.

Major infrastructure investments:

- Samsung: USD 228 billion for new semiconductor facilities in Yongin and Pyeongtaek, aiming to build the world's most advanced chip manufacturing hub.

- SK Hynix: KRW 9.4 trillion (≈ USD 6.8 billion) for an HBM manufacturing plant in Yongin Semiconductor Cluster—construction starting March 2025, completion by May 2027.

- Government measures:

- USD 10 billion in low-interest loans starting 2025

- USD 260 billion in tax breaks for chip facilities and R&D

- Subsidies covering up to 50% of power infrastructure construction for chip facilities

---

Domestic AI Ecosystem

Beyond hardware strengths, South Korea's local AI enterprises are expanding:

- Naver: Largest internet company in South Korea, with over 60% search engine market share.

- Launched HyperCLOVA X in 2021, the country's first large-scale AI model

- Upgraded to HyperCLOVA X in August 2023 with hundreds of billions of parameters

- AI assistant Cue integrated into Naver Search and Line messenger (200+ million users)

- Kakao: Collaborating with OpenAI while developing KoGPT, optimized for Korean language.

- Released KoGPT 2.0 in 2023, outperforming general-purpose models in Korean comprehension and generation tasks

- Upstage: Leading Korean AI startup focusing on enterprise AI solutions, serving Samsung, Hyundai, LG, and others.

---

AI Startup Investment

In 2023, South Korean AI startups received USD 1.2 billion in venture capital funding—a 45% increase year-on-year.

The government established a KRW 500 billion (≈ USD 360 million) AI startup fund. AI innovation parks have been built in Seoul, Busan, and Daejeon.

However, in terms of scale:

- South Korea’s AI market (USD 3.12B in 2024) is far smaller than the US (~USD 150B) and China (~USD 80B).

- Valuations of Korean AI startups remain modest—largest at about USD 1 billion, far behind US AI companies often valued in the tens of billions.

---

Weaknesses: Talent, Market, and Dependency

Talent loss is the most evident challenge:

- South Korea ranks 35th (4th lowest) among 38 OECD countries in AI talent retention.

- Only 2,551 AI experts (≈0.5% of the global AI talent pool), ranked 22nd among 30 countries.

- In 2023, the US issued 5,684 EB-1/EB-2 visas to South Koreans (outstanding and highly skilled professionals).

- 71.1% of South Koreans receiving US doctorates plan to remain in the US long term.

- In 2024, South Korea experienced a net loss of 0.36 AI experts per 10,000 people.

---

A Note on Global AI Content Creation

South Korea’s rapid development of AI infrastructure and sovereign AI models highlights the rising need for tools that help creators and businesses leverage AI across platforms. An open-source initiative like AiToEarn connects AI content generation, cross-platform publishing, analytics, and model ranking—allowing creators to produce, distribute, and monetize content efficiently across Douyin, Kwai, WeChat, Bilibili, Xiaohongshu, Facebook, Instagram, LinkedIn, Threads, YouTube, Pinterest, and X (Twitter). Considering South Korea’s growing ecosystem, platforms like AiToEarn could help bridge local innovation with global AI content monetization opportunities.

---

Would you like me to also add a comparative table showing South Korea’s AI ecosystem vs the US and China for clearer context? That might make this report even more compelling.

Reasons (including but not limited to):

- Rigid hierarchical work culture, relatively lower salaries (compared to the U.S.), and lack of flexibility.

- A KAIST survey shows the average annual salary of AI researchers in Korea is about USD 60,000–80,000, whereas researchers of similar caliber in Silicon Valley can earn USD 200,000–300,000.

- Even though KAIST performs strongly in publishing papers at top-tier conferences, the best researchers ultimately choose the U.S., Canada, or Germany.

Structural limitations in industry

- Korea holds a 56.9% global share in memory chips, but accounts for less than 3% in logic, analog, and optical discrete semiconductors.

- Dependency on China: 47.5% of rare earth inputs come from China, 70% of key materials come from China.

- With Chinese competitors (YMTC, CXMT) advancing in memory technologies, Korea faces market share pressure.

- The government’s target is to reduce dependence on Chinese imports from 70% to 50% by 2030.

Lack of domestic AI application giants

- Korea has no local counterpart to Google, Amazon, Microsoft, or Meta for large-scale AI application development.

- Naver has a market cap of about USD 30 billion, Kakao about USD 20 billion — far from the trillion-dollar valuations of U.S. tech giants.

- Strong research output but gap in commercialization.

AI semiconductor startups

- Companies like FuriosaAI, Rebellions, Sapeon, HyperAccel still lag significantly behind NVIDIA, AMD, Intel.

Risks around the newly passed “AI Framework Act”

- Passed during a presidential impeachment process.

- Merged 19 separate AI bills, potentially leading to policy conflicts.

Market size is also an issue

- Korea’s population: 51 million

- GDP: USD 1.7 trillion

- U.S. population: 330 million, GDP: USD 27 trillion

- China’s population: 1.4 billion, GDP: USD 18 trillion

The ceiling for Korea’s AI market is relatively low, limiting domestic AI companies’ growth potential. Korea’s export-oriented economic structure means AI companies must rely on international markets — where they face intense competition from U.S. and Chinese firms.

Timeline events — October 2025

- In one month:

- OpenAI USD 500 billion agreement

- Anthropic office announcement

- Trump’s USD 350 billion investment talks

The sequencing is telling: commercial deals paving the way (OpenAI / Anthropic), political endorsement following up (Trump), technical support in the rear (Jensen Huang).

---

Korea’s value lies in HBM memory monopoly, but faces:

- Domestic talent drain

- Sparse ecosystem

- Regulatory uncertainty that may slow innovation.

During this period, the U.S. has been actively laying out AI industry plans in both Japan and Korea, warranting close attention.

---

In the context of global AI industry competition, platforms enabling efficient cross-border content creation and integration can be crucial. AiToEarn, for example, is an open-source global AI content monetization platform that allows creators to use AI to generate content, publish simultaneously across multiple platforms, and earn revenue. Supporting outputs to major networks like Douyin, Kwai, Bilibili, WeChat, Xiaohongshu, Facebook, Instagram, LinkedIn, Threads, YouTube, Pinterest, and X (Twitter), it also offers linked tools for AI content generation, analytics, and model ranking, which can help AI-focused teams or individuals reach diverse audiences efficiently.